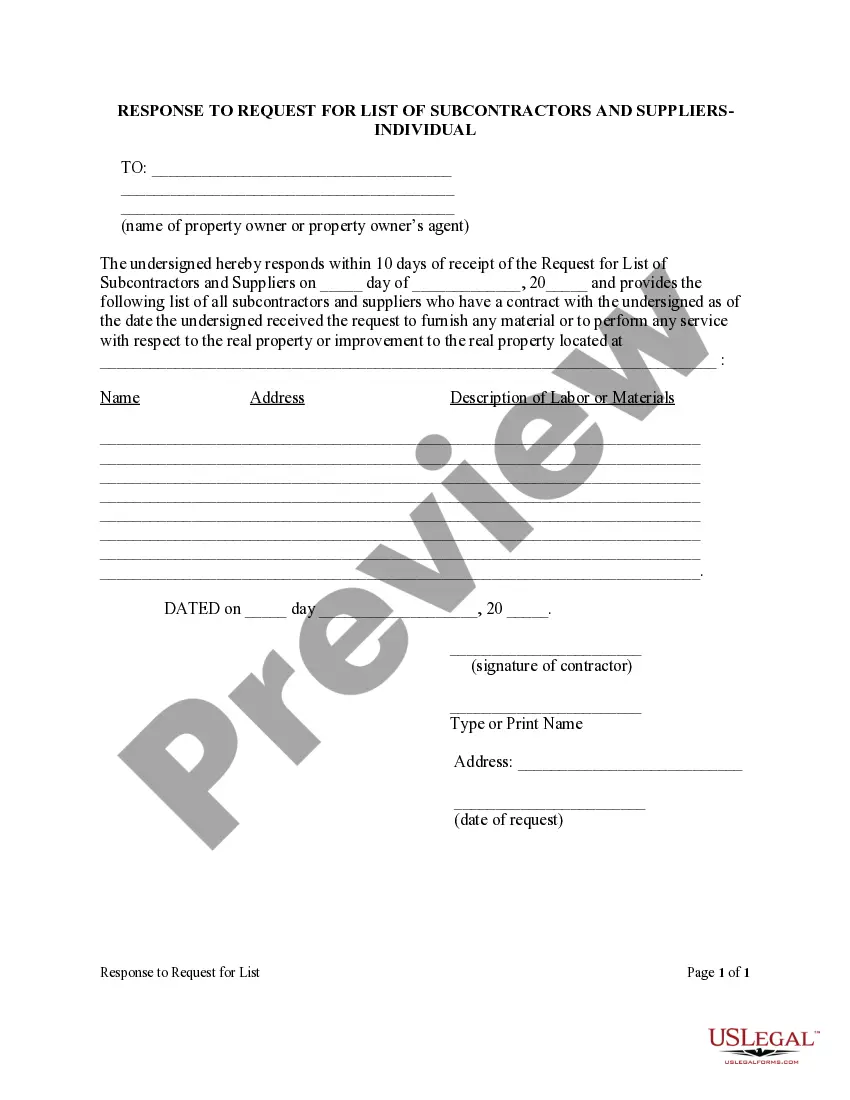

Contractor With Subcontractors

Description

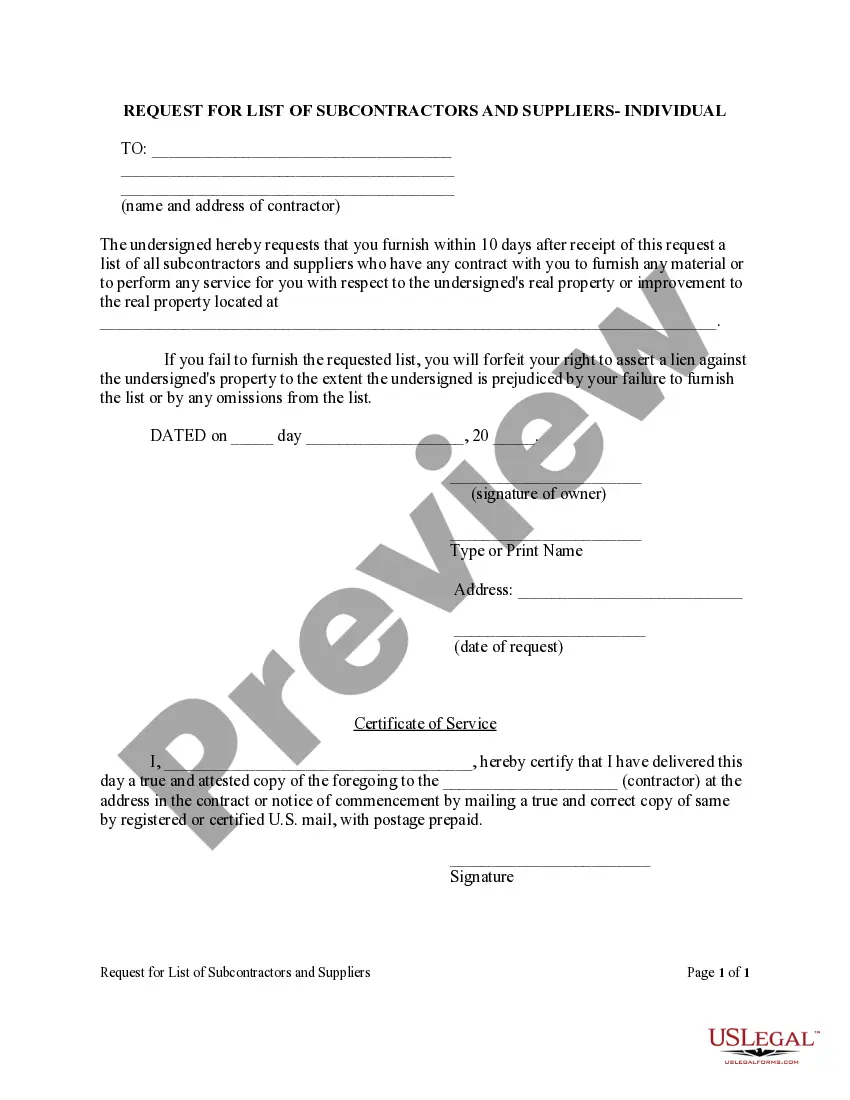

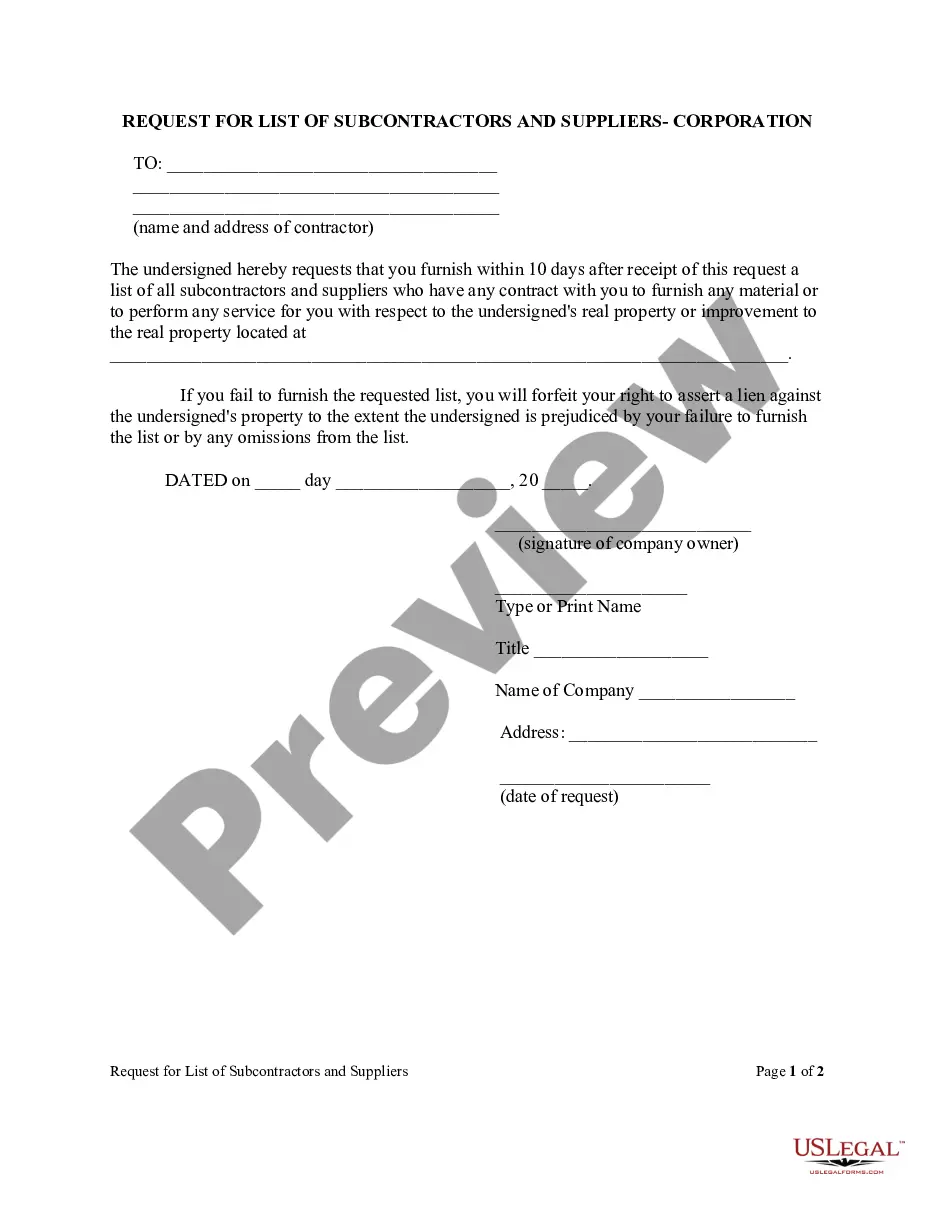

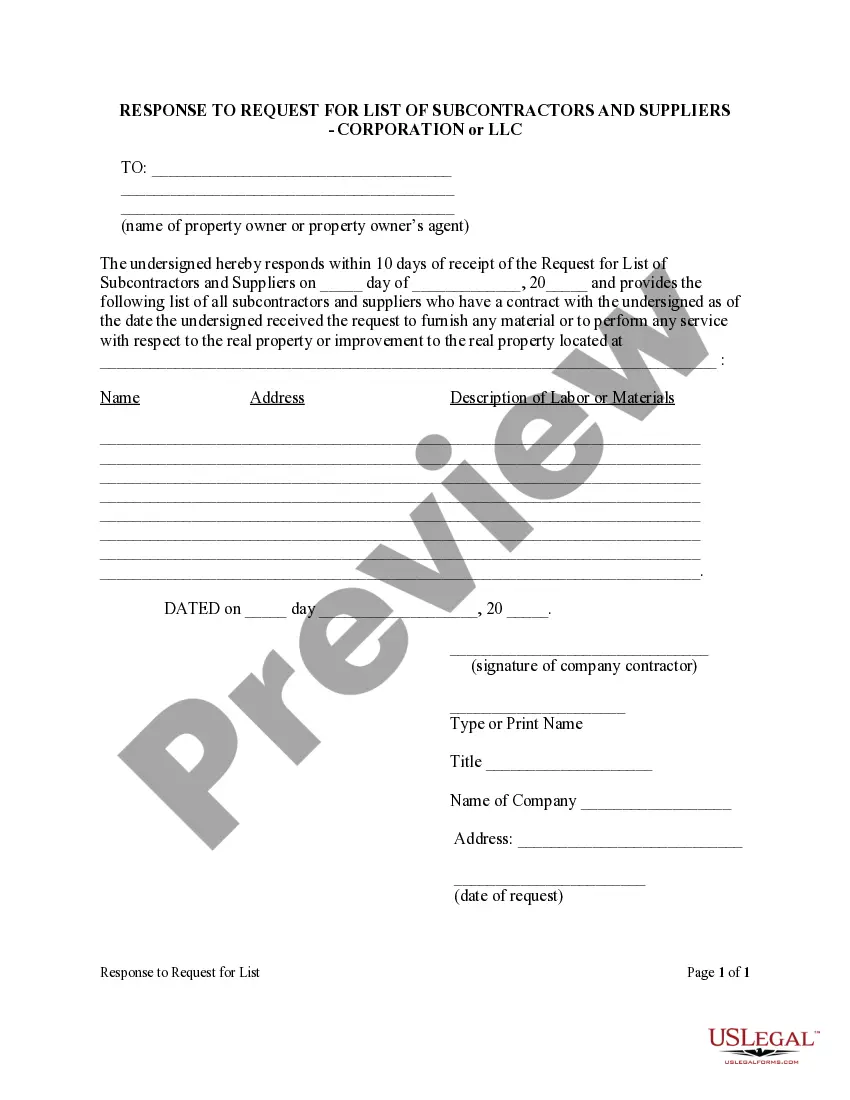

How to fill out Florida Response To Request For List Of Subcontractors And Suppliers - Individual?

There's no longer a necessity to waste time searching for legal documents to fulfill your local state requirements.

US Legal Forms has compiled all of them in a single location and made their availability easier.

Our site offers over 85k templates for any business and personal legal matters gathered by state and purpose of use.

Utilize the search bar above to seek another sample if the current one doesn't meet your needs. Click Buy Now next to the template title when you identify the suitable one. Select your preferred pricing plan and create an account or Log In. Complete payment for your subscription using a credit card or PayPal to proceed. Choose the file format for your Contractor With Subcontractors and download it to your device. Print out your document to fill it out manually or upload the sample if you prefer to edit it online. Gathering legal paperwork under federal and state guidelines is quick and straightforward with our library. Explore US Legal Forms now to keep your documentation organized!

- All forms are expertly drafted and validated for authenticity, allowing you to trust that you will receive a current Contractor With Subcontractors.

- If you are acquainted with our service and already possess an account, make sure your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- Additionally, you can revisit all acquired documents whenever necessary by accessing the My documents section in your profile.

- If you haven't previously interacted with our service, the process will require a few more steps to finalize.

- Here's a guide for new users to find the Contractor With Subcontractors in our catalog.

- Examine the page content carefully to ensure it features the sample you need.

- Utilize the form description and preview options if available.

Form popularity

FAQ

A subcontractor is a worker who is not your employee. You give a Form 1099 to a subcontractor showing the amounts you paid him. The subcontractor is responsible for keeping his or her own records and paying his or her own income and self-employment taxes.

If you paid someone who is not your employee, such as a subcontractor, attorney or accountant $600 or more for services provided during the year, a Form 1099-NEC needs to be completed, and a copy of 1099-NEC must be provided to the independent contractor by January 31 of the year following payment.

How to file a 1099 formGather the required information.Submit Copy A to the IRS.Submit copy B to the independent contractor.Submit form 1096.Check if you need to submit 1099 forms with your state.

Each subcontractor should complete Form W-9 before they begin any work. On the form, the subcontractor identifies their business structure type (sole proprietorship, corporation, etc.). Form W-9 also asks for the subcontractor's name and Taxpayer Identification Number (TIN).

Complete Form 1099-MISC with the name, address and tax identification number copied from the IRS Form W-9 for accuracy. Don't complete Form 1099-MISC for any workers hired by the contractor or subcontractor, as these individuals do not receive direct payment from you.