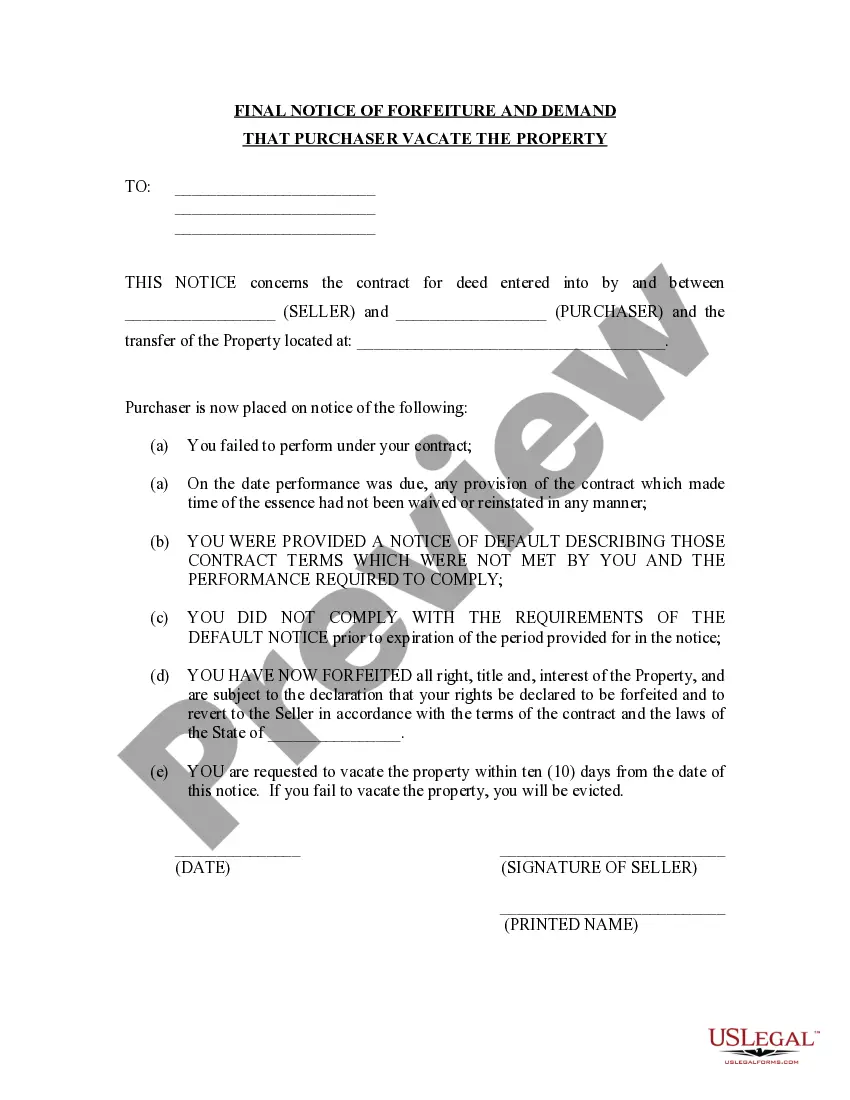

Land Contract Forfeiture Form With Two Points

Description

How to fill out Florida Final Notice Of Forfeiture And Request To Vacate Property Under Contract For Deed?

Drafting legal paperwork from scratch can often be intimidating. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re looking for a an easier and more affordable way of creating Land Contract Forfeiture Form With Two Points or any other forms without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online collection of more than 85,000 up-to-date legal documents addresses virtually every element of your financial, legal, and personal affairs. With just a few clicks, you can quickly get state- and county-compliant templates diligently put together for you by our legal professionals.

Use our website whenever you need a trusted and reliable services through which you can quickly locate and download the Land Contract Forfeiture Form With Two Points. If you’re not new to our services and have previously set up an account with us, simply log in to your account, select the form and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No problem. It takes minutes to set it up and navigate the catalog. But before jumping directly to downloading Land Contract Forfeiture Form With Two Points, follow these recommendations:

- Review the document preview and descriptions to make sure you are on the the form you are searching for.

- Make sure the form you choose complies with the requirements of your state and county.

- Choose the right subscription option to get the Land Contract Forfeiture Form With Two Points.

- Download the file. Then complete, sign, and print it out.

US Legal Forms has a good reputation and over 25 years of expertise. Join us today and turn form execution into something easy and streamlined!

Form popularity

FAQ

First, the seller must serve a written notice of the forfeiture upon the buyer. Unless the land contract provides for a longer time, the buyer has 15 days after being served with the notice of forfeiture to cure the default (paying the amount that is past due). MCL 600.5728.

The whole foreclosure process typically takes a minimum of 12 months from filing the lawsuit to expiration of the redemption period.

In forfeiture, the seller cannot accelerate the debt. Therefore, the vendee can cure by paying the past-due monthly payments. If the seller wants to terminate the land contract and evict a vendee in chronic default in a foreclosure, the seller can accelerate the debt, making it harder for the tenant to cure.

For an interest-only payment, simply multiply the amount financed by the interest rate, and divide the result by the number of installments in a year. For example, the monthly interest payment on a $200,000 land contract home with an 8% interest rate after a 10% down payment would be $1,200.

Initiating the Transaction The land contract will specify the payment schedule and interest rate. The interest rate may not exceed 11%. Amortized monthly payments are most common, like mortgages. The land contract will also specify the duration of the payments.