Land Contract Forfeiture Form For California

Description

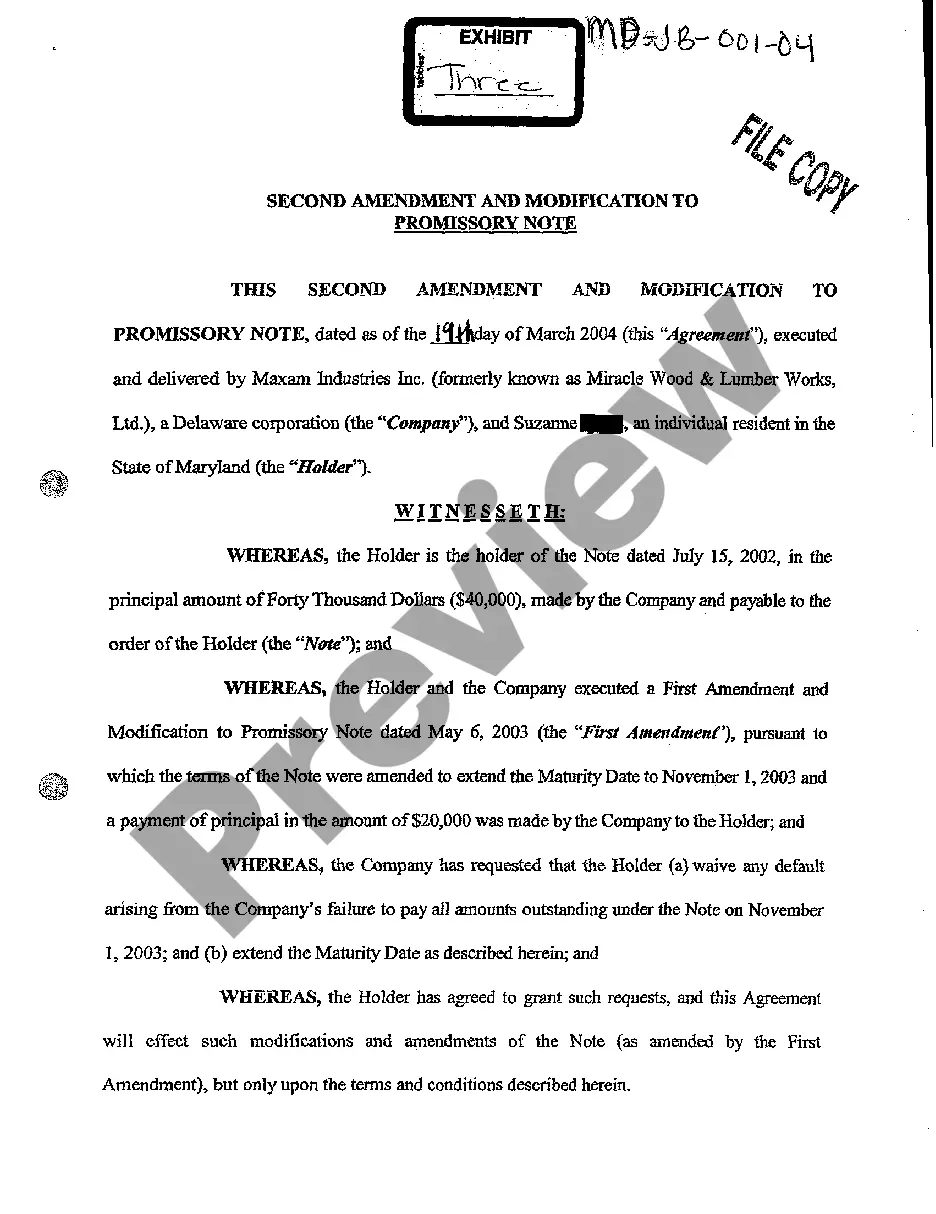

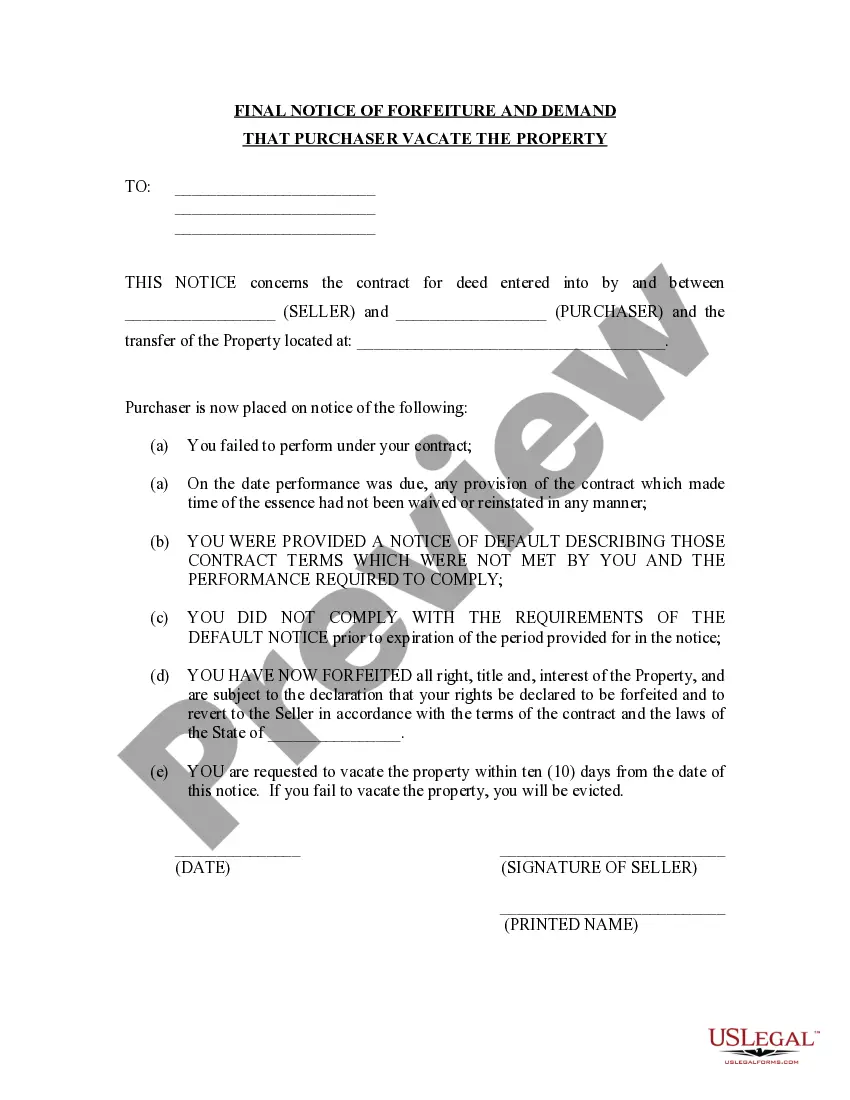

How to fill out Florida Final Notice Of Forfeiture And Request To Vacate Property Under Contract For Deed?

Finding a go-to place to take the most recent and appropriate legal samples is half the struggle of working with bureaucracy. Choosing the right legal papers needs precision and attention to detail, which explains why it is very important to take samples of Land Contract Forfeiture Form For California only from reliable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You can access and see all the details regarding the document’s use and relevance for your circumstances and in your state or region.

Consider the following steps to complete your Land Contract Forfeiture Form For California:

- Utilize the library navigation or search field to locate your sample.

- Open the form’s description to check if it matches the requirements of your state and county.

- Open the form preview, if available, to ensure the template is definitely the one you are looking for.

- Go back to the search and find the right document if the Land Contract Forfeiture Form For California does not match your needs.

- When you are positive regarding the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and access your selected forms in My Forms.

- If you do not have an account yet, click Buy now to obtain the form.

- Choose the pricing plan that fits your needs.

- Go on to the registration to complete your purchase.

- Complete your purchase by picking a payment method (credit card or PayPal).

- Choose the document format for downloading Land Contract Forfeiture Form For California.

- Once you have the form on your device, you may change it with the editor or print it and finish it manually.

Remove the headache that accompanies your legal documentation. Check out the extensive US Legal Forms catalog where you can find legal samples, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

Primary tabs. Contract for deed is a contract for the sale of land which provides that the buyer will acquire possession of the land immediately and pay the purchase price in installments over a period of time, but the seller will retain legal title until all payments are made.

Cons of Owner Financing (for Buyers) Though there may be some upfront fees that the borrower does not need to pay, they may still need to pay more over time. Some owner financing agreements may include balloon payments, which can be challenging for buyers to manage and potentially lead to financial strain or default.

In a straight land contract, you receive equitable title so that you gain equity as you make payments on the loan from the seller. However, the seller still holds legal title until the property is paid off. This could cause issues around who owns the home if any legal disputes or insurance claims need to be filed.

In Owner Financing, Who Holds The Deed? Property ownership is equitable, but complete ownership doesn't transfer until the seller receives payment for the loan. Due to the deed's legal position, the seller holds it until the buyer pays off the loan.

The Note is signed by the people who agree to pay the debt (the people that will be making the mortgage payments). The Deed and the Deed of Trust are signed by those who will own the property that is being mortgaged.