Discharge and Release of Lien by Individual

Note: This summary is not intended to be an all-inclusive

discussion of Connecticut's construction or mechanic's lien laws, but does

include basic provisions.

What is a construction or mechanic's lien?

Every state permits a person who supplies labor or materials for a construction project to

claim a lien against the improved property. While some states differ

in their definition of improvements and some states limit lien claims to

buildings or structures, most permit the filing of a document with the

local court that puts parties interested in the property on notice that

the party asserting the lien has a claim. States differ widely in

the method and time within which a party may act on their lien. Also

varying widely are the requirements of written notices between property

owners, contractors, subcontractors and laborers, and in some cases lending

institutions. As a general rule, these statutes serve to prevent

unpleasant surprises by compelling parties who wish to assert their legal

rights to put all parties who might be interested in the property on notice

of a claim or the possibility of a claim. This by no means constitutes

a complete discussion of construction lien law and should not be interpreted

as such. Parties seeking to know more about construction laws in

their state should always consult their state statutes directly.

Who can claim a lien in this state?

Connecticut law permits

any person with a claim for more than ten dollars for materials furnished

or services rendered in the construction, raising, removal, or repair of

a building, or the development of any lot or plot, to claim a mechanic's

lien. Conn. Gen. Stat. §49-33.

How long does a party have to claim a lien?

A party seeking

to claim a lien must file a Certificate of Lien within ninety (90)

days after the cessation of work, and

serve a true and attested copy on the property owner within ninety (90) days

of the cessation of work or prior to the lodging

of the certificate but not later than thirty (30) days after the lodging of the

certificate. Conn. Gen. Stat. §49-34.

What kind of notice is required prior to claiming

a lien?

Original contractors and subcontractors who have the written assent

of the party contracting for the improvements are the only parties that

may clam a lien unless a Notice of Intent is served upon the property owner.

This notice serves to advise the property owner that materials and services

are being provided and by whom. Conn. Gen. Stat. §49-35.

By what method is a lien claimed in this state?

To claim a lien, a party must file a Certificate of Lien. The Certificate states the date

of commencement of furnishing of materials or services, and the amount

currently due. The Certificate is recorded with the town clerk of

the town in which the property is situated and a true and attested copy

must be served upon the property owner. Conn. Gen. Stat. §49-34.

How long is a lien good for?

A mechanic's lien shall not continue in force for a longer period than one year after the lien

has been perfected, unless the party claiming the lien commences a legal

action to foreclose it within that period. Conn. Gen. Stat. §49-39.

Are liens assignable?

With the exception of regional water and sewer authorities, Connecticut law does not provide

for the assignment of liens.

Does this state require or provide for a notice

from contractors and subcontractors to property owners?

As described above, some parties will be required to provide a Notice of Intent certifying

the furnishing of materials or services in order to claim a lien.

Also, an original contractor may provide notice to all parties by recording

an Affidavit with the town recorder certifying his involvement in the construction

project. Conn. Gen. Stat. §49-35.

Does this state permit a person with an interest

in property to deny responsibility for improvements?

While some states allow a party with an interest in property to deny responsibility for improvements,

Connecticut law does not appear to contain such a provision.

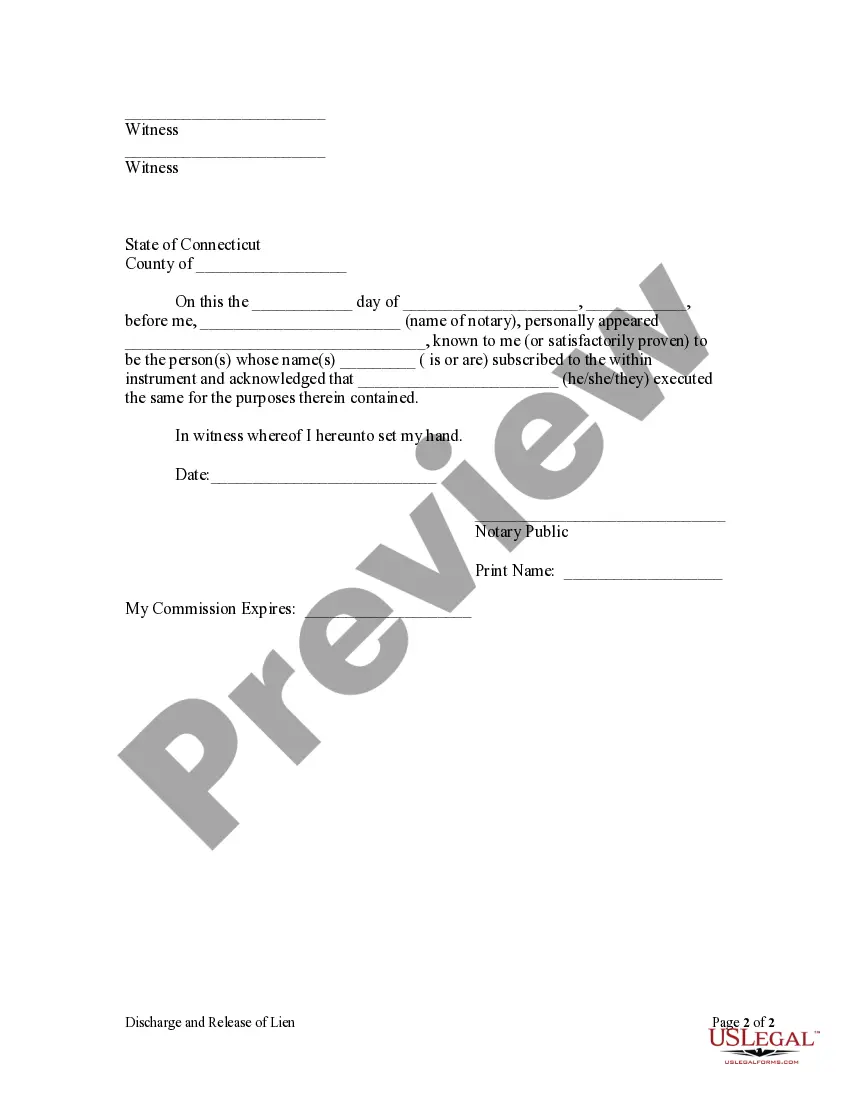

Is a notice attesting to the satisfaction of a

lien provided for or required?

Connecticut law provides that if a lien is invalid, a party with an interest in the property may

demand that the lien holder provide a release. Failure to comply

with this request within thirty (30) days will permit the party in interest

to bring a legal action. The court is empowered to award that party

damages that result from the lien holder's refusal to provide a release.

Conn. Gen. Stat. §49-51.

Does this state permit the use of a bond to release

a lien?

Yes.

Connecticut law allows a property owner whose property is encumbered with

a lien to make an application to the Superior Court that the lien be dissolved.

Conn. Gen. Stat. §49-37.