Co Common Law Colorado Withholding

Description

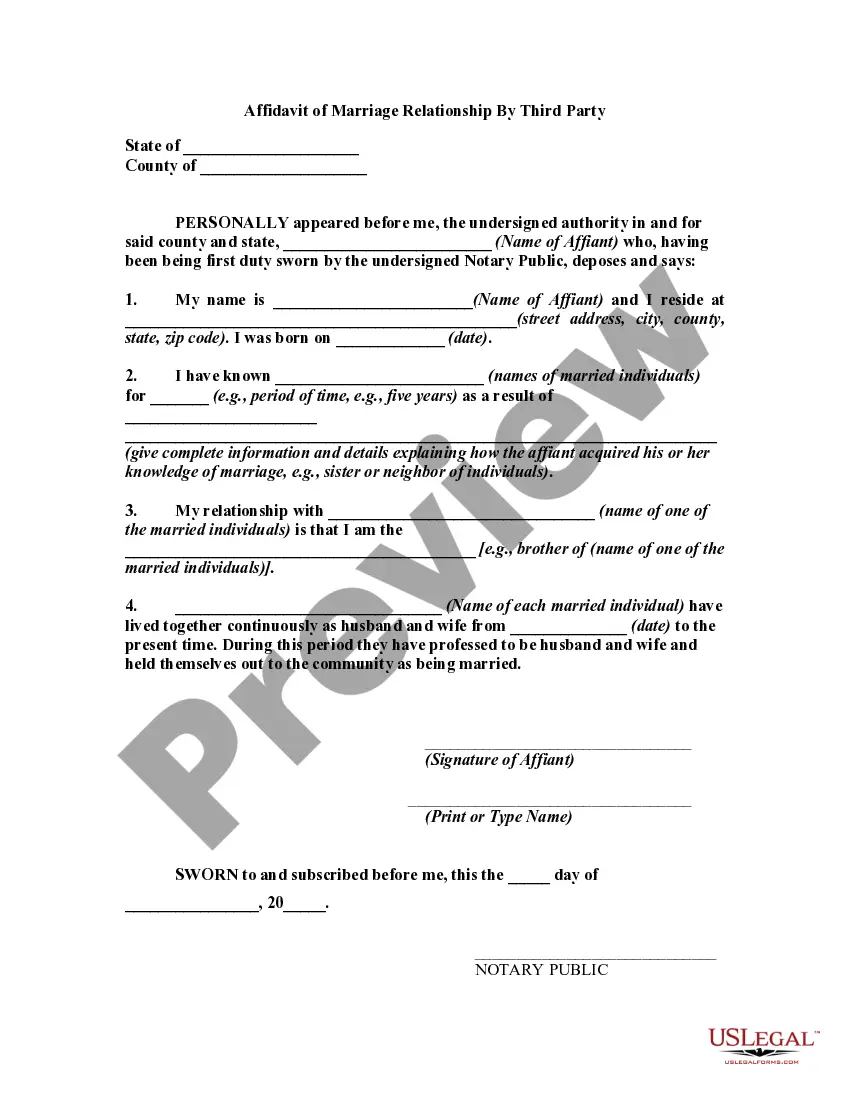

How to fill out Colorado Affidavit Of Common Law Marriage?

It’s obvious that you can’t become a law professional overnight, nor can you figure out how to quickly draft Co Common Law Colorado Withholding without the need of a specialized background. Putting together legal forms is a time-consuming process requiring a particular training and skills. So why not leave the preparation of the Co Common Law Colorado Withholding to the specialists?

With US Legal Forms, one of the most extensive legal template libraries, you can find anything from court documents to templates for in-office communication. We understand how crucial compliance and adherence to federal and local laws are. That’s why, on our website, all templates are location specific and up to date.

Here’s start off with our platform and get the document you require in mere minutes:

- Find the document you need with the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to determine whether Co Common Law Colorado Withholding is what you’re searching for.

- Start your search over if you need a different form.

- Register for a free account and select a subscription option to buy the form.

- Pick Buy now. Once the transaction is complete, you can download the Co Common Law Colorado Withholding, fill it out, print it, and send or mail it to the designated individuals or entities.

You can re-access your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your paperwork-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

Colorado 2% Withholding (DR 1083) In general, sales of Colorado real property valued at more than $100,000 and made by non-residents of Colorado, are subject to a withholding tax in anticipation of any Colorado income tax that could be due on the gain of the sale.

This Certificate is Optional for Employees. If you do not complete this certificate, then your employer will calculate your Colorado withholding based on your IRS Form W-4.

Overview of Colorado Taxes Colorado is home to Rocky Mountain National Park, upscale ski resorts and a flat income tax rate of 4.5%. Aside from state and federal taxes, Centennial State residents who live in Aurora, Denver, Glendale, Greenwood Village or Sheridan must also pay local taxes.

If you don't want to reveal to your employer that you have a second job, or that you get income from other non-job sources, you have a few options: On line 4(c), you can instruct your employer to withhold an extra amount of tax from your paycheck. Alternatively, don't factor the extra income into your W-4.

Coloradans' income is taxed at a flat rate of 4.50% of their taxable income, regardless of your income bracket or marital status. If you work in Aurora, Denver, Glendale, Sheridan or Greenwood Village, you will also have to pay local taxes. These taxes are also flat rates.