Estate Form Information For The Current Branch

Description

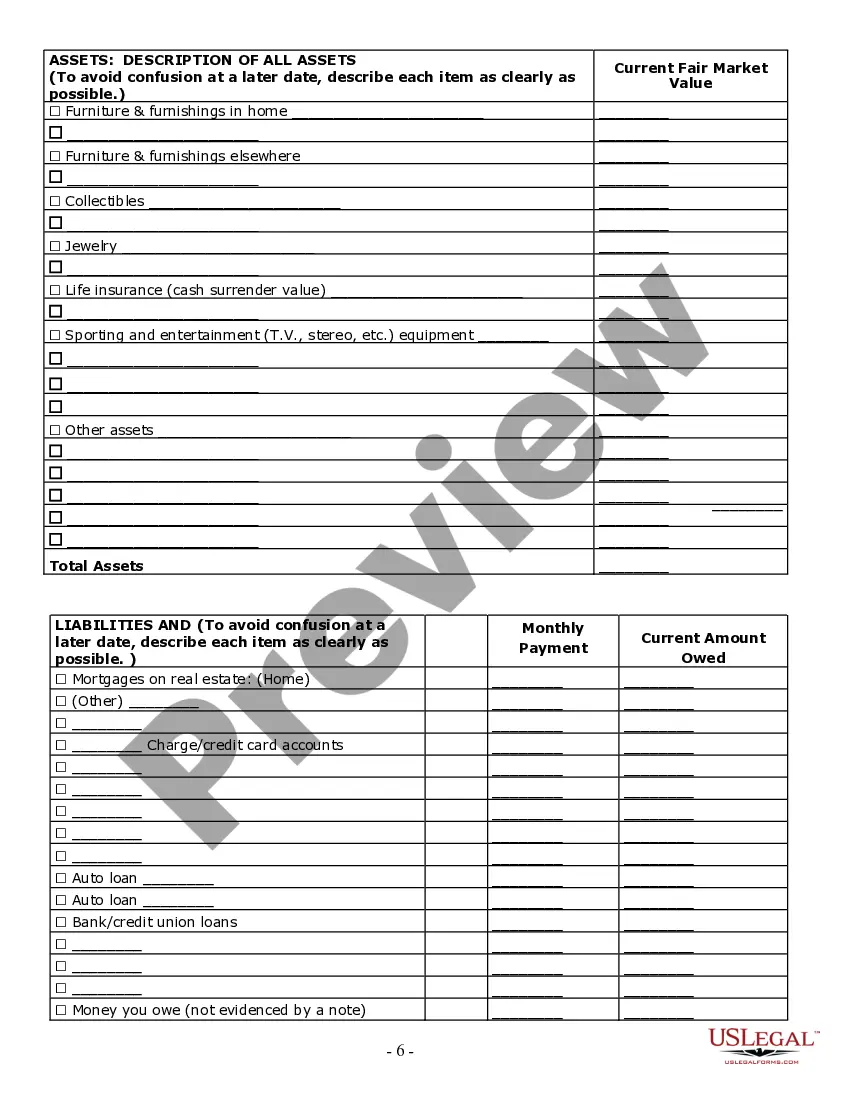

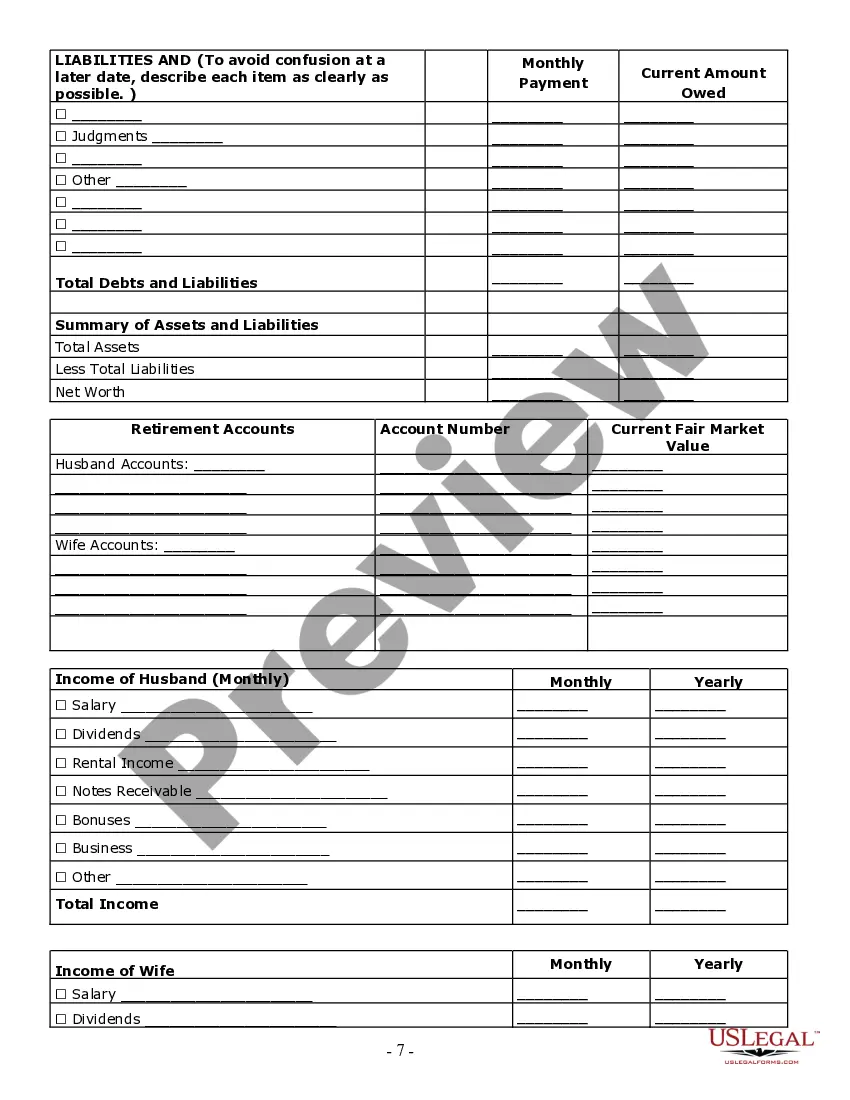

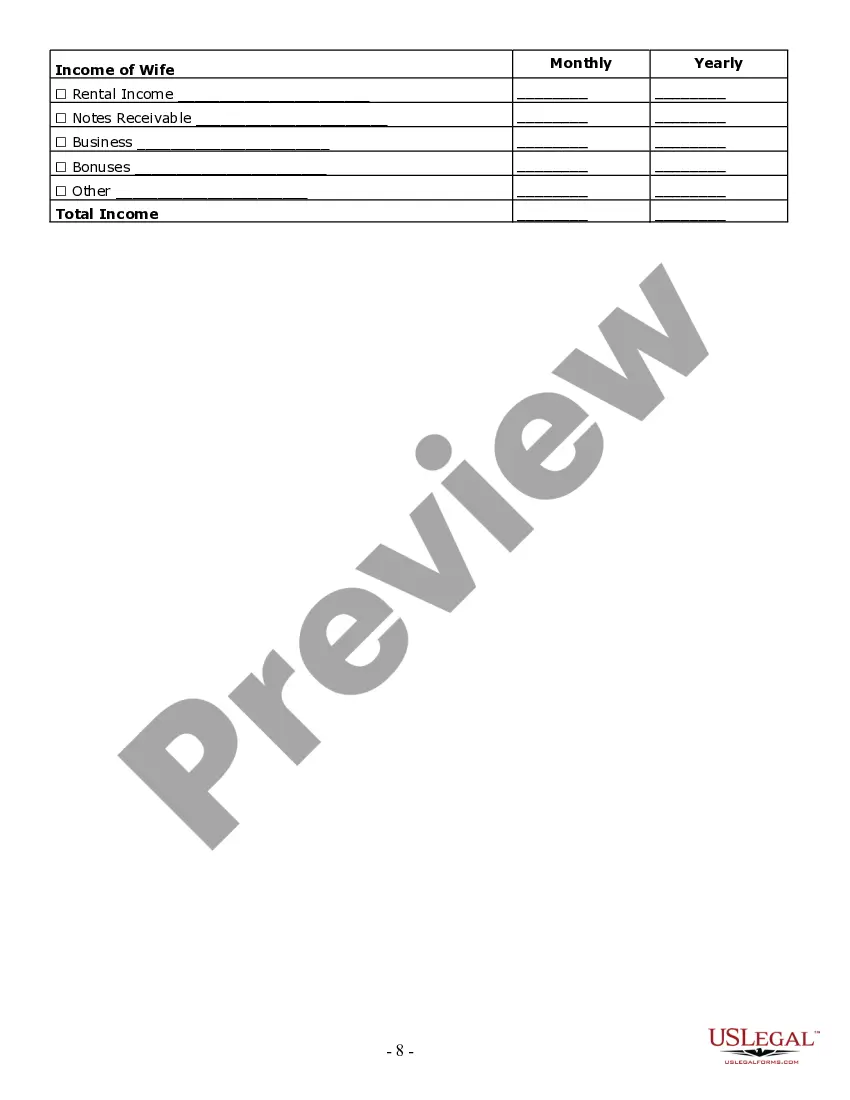

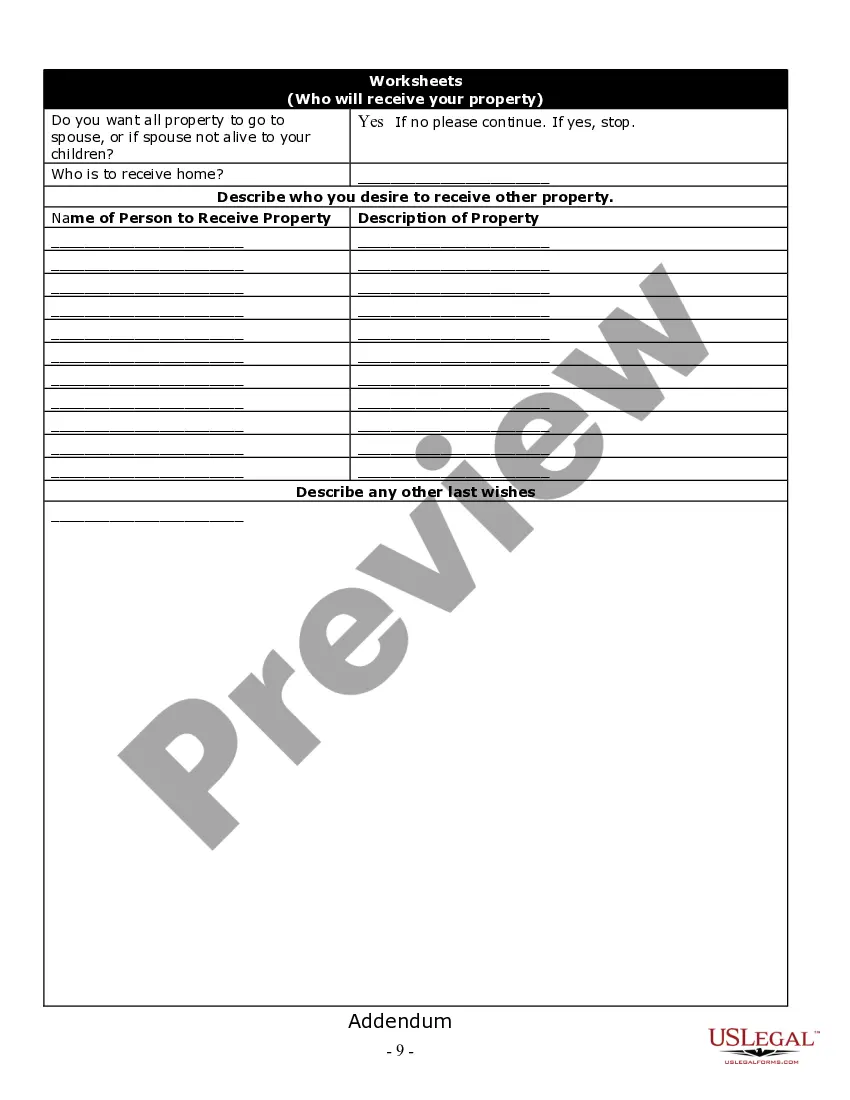

How to fill out California Estate Planning Questionnaire And Worksheets?

Whether for business purposes or for individual affairs, everybody has to handle legal situations at some point in their life. Completing legal papers needs careful attention, starting with choosing the appropriate form template. For instance, if you pick a wrong version of a Estate Form Information For The Current Branch, it will be turned down when you submit it. It is therefore important to have a trustworthy source of legal documents like US Legal Forms.

If you have to get a Estate Form Information For The Current Branch template, follow these easy steps:

- Get the sample you need by utilizing the search field or catalog navigation.

- Look through the form’s information to make sure it matches your situation, state, and county.

- Click on the form’s preview to view it.

- If it is the wrong document, get back to the search function to locate the Estate Form Information For The Current Branch sample you require.

- Get the file when it matches your needs.

- If you already have a US Legal Forms account, click Log in to gain access to previously saved documents in My Forms.

- In the event you don’t have an account yet, you may obtain the form by clicking Buy now.

- Choose the correct pricing option.

- Complete the account registration form.

- Choose your payment method: you can use a bank card or PayPal account.

- Choose the file format you want and download the Estate Form Information For The Current Branch.

- When it is downloaded, you are able to fill out the form by using editing software or print it and finish it manually.

With a large US Legal Forms catalog at hand, you don’t need to spend time seeking for the appropriate sample across the internet. Make use of the library’s easy navigation to find the right form for any situation.

Form popularity

FAQ

Letters of Testamentary, also called Letters of Administration or Letters of Representation, is a document issued by the probate court. The document grants the authority to an estate administrator, executor or personal representative to manage the deceased taxpayer's affairs and estate.

In Virginia, any estate valued at greater than $50,000 at the time of the owner's passing must go through the probate procedure.

For small estates, North Carolina has a simplified process which allows you to wrap up the estate without formal probate. This process applies to estates with personal property valued at $20,000, or $30,000 if the surviving spouse inherits everything under state law.

Assets that are designed to have a named beneficiary but lack one can also be included in the residuary estate. So, for example, if you set up a payable on death account at your bank but fail to add a beneficiary to it, any funds in the account would get lumped in to the residual estate.

Letters of Administration are similar to a Grant of Probate but are issued instead to the next of kin of an individual who dies without a valid Will. If you have not made a Will, this means you have not appointed a specific person as your Executor to administer your Estate.