California Assets With Right Of Survivorship

Description

How to fill out California Organizing Your Personal Assets Package?

Getting a go-to place to take the most current and relevant legal templates is half the struggle of dealing with bureaucracy. Choosing the right legal documents calls for accuracy and attention to detail, which is the reason it is vital to take samples of California Assets With Right Of Survivorship only from reputable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to be concerned about. You can access and check all the details regarding the document’s use and relevance for the situation and in your state or region.

Consider the listed steps to complete your California Assets With Right Of Survivorship:

- Make use of the library navigation or search field to locate your template.

- Open the form’s information to see if it matches the requirements of your state and county.

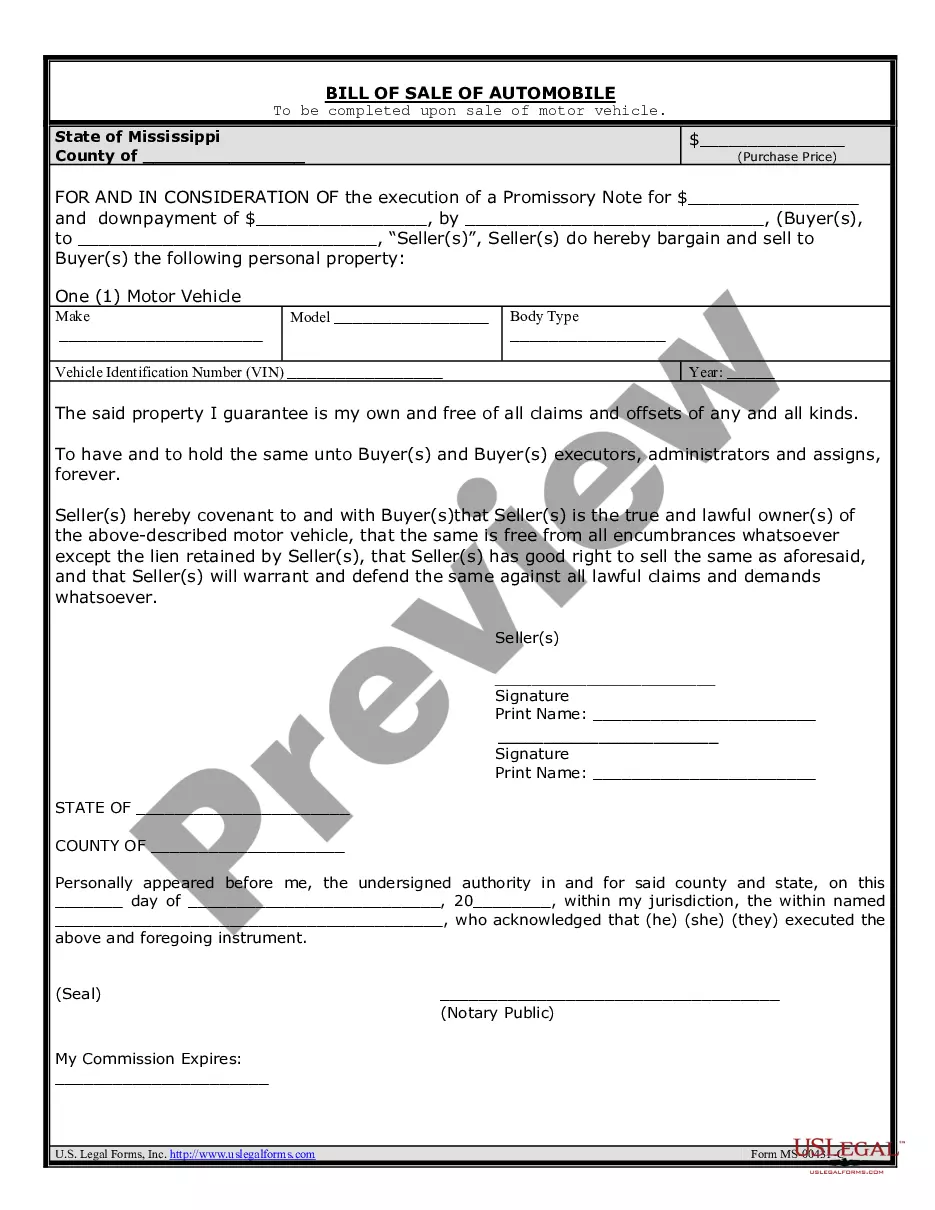

- Open the form preview, if available, to ensure the form is the one you are searching for.

- Go back to the search and find the right document if the California Assets With Right Of Survivorship does not fit your requirements.

- When you are positive about the form’s relevance, download it.

- If you are an authorized customer, click Log in to authenticate and access your selected forms in My Forms.

- If you do not have a profile yet, click Buy now to obtain the form.

- Pick the pricing plan that fits your requirements.

- Go on to the registration to finalize your purchase.

- Complete your purchase by choosing a transaction method (credit card or PayPal).

- Pick the file format for downloading California Assets With Right Of Survivorship.

- When you have the form on your gadget, you may change it using the editor or print it and complete it manually.

Get rid of the headache that accompanies your legal documentation. Explore the extensive US Legal Forms collection to find legal templates, examine their relevance to your situation, and download them on the spot.

Form popularity

FAQ

In order to sever the right of survivorship, a tenant must only record a new deed showing that his or her interest in the title is now held in a ?Tenancy-in-Common? or as ?Community Property?.

Disadvantages of community property with a right of survivorship: If a spouse dies having willed a piece of property titled as community property with a right of survivorship to someone other than their spouse, their gift may be deemed invalid.

Community property with right of survivorship is a legal distinction that allows two spouses to equally share assets through marriage as well as pass on assets to the other spouse upon death without going through probate.

In conclusion, for married couples not in a position to create a Living Trust, titling real property as community property with right of survivorship in California can provide significant benefits, including simplified transfer of ownership upon death and tax savings.