Information Planning Estate With Blended Families

Description

How to fill out California Last Will And Testament Package?

Legal management may be overpowering, even for knowledgeable specialists. When you are searching for a Information Planning Estate With Blended Families and don’t have the time to devote searching for the appropriate and up-to-date version, the processes might be stressful. A strong online form library might be a gamechanger for anyone who wants to take care of these situations successfully. US Legal Forms is a market leader in online legal forms, with more than 85,000 state-specific legal forms accessible to you at any moment.

With US Legal Forms, you are able to:

- Access state- or county-specific legal and business forms. US Legal Forms handles any needs you may have, from personal to enterprise documents, all in one spot.

- Employ advanced tools to complete and handle your Information Planning Estate With Blended Families

- Access a useful resource base of articles, instructions and handbooks and resources related to your situation and needs

Help save time and effort searching for the documents you will need, and utilize US Legal Forms’ advanced search and Review tool to get Information Planning Estate With Blended Families and get it. In case you have a membership, log in in your US Legal Forms account, look for the form, and get it. Review your My Forms tab to find out the documents you previously downloaded and to handle your folders as you see fit.

Should it be your first time with US Legal Forms, make a free account and get unlimited use of all advantages of the platform. Listed below are the steps for taking after getting the form you want:

- Verify it is the right form by previewing it and reading through its description.

- Be sure that the sample is acknowledged in your state or county.

- Pick Buy Now once you are all set.

- Choose a monthly subscription plan.

- Find the format you want, and Download, complete, eSign, print and deliver your papers.

Enjoy the US Legal Forms online library, backed with 25 years of expertise and trustworthiness. Enhance your daily papers administration into a easy and intuitive process today.

Form popularity

FAQ

The key to moving the kids into the backseat, literally and figuratively in blended families, is to make your couple relationship the #1 priority in your stepfamily. Each parent must put that spouse/partner relationship at the very top because if that relationship fails, there is no family unit left to try to blend.

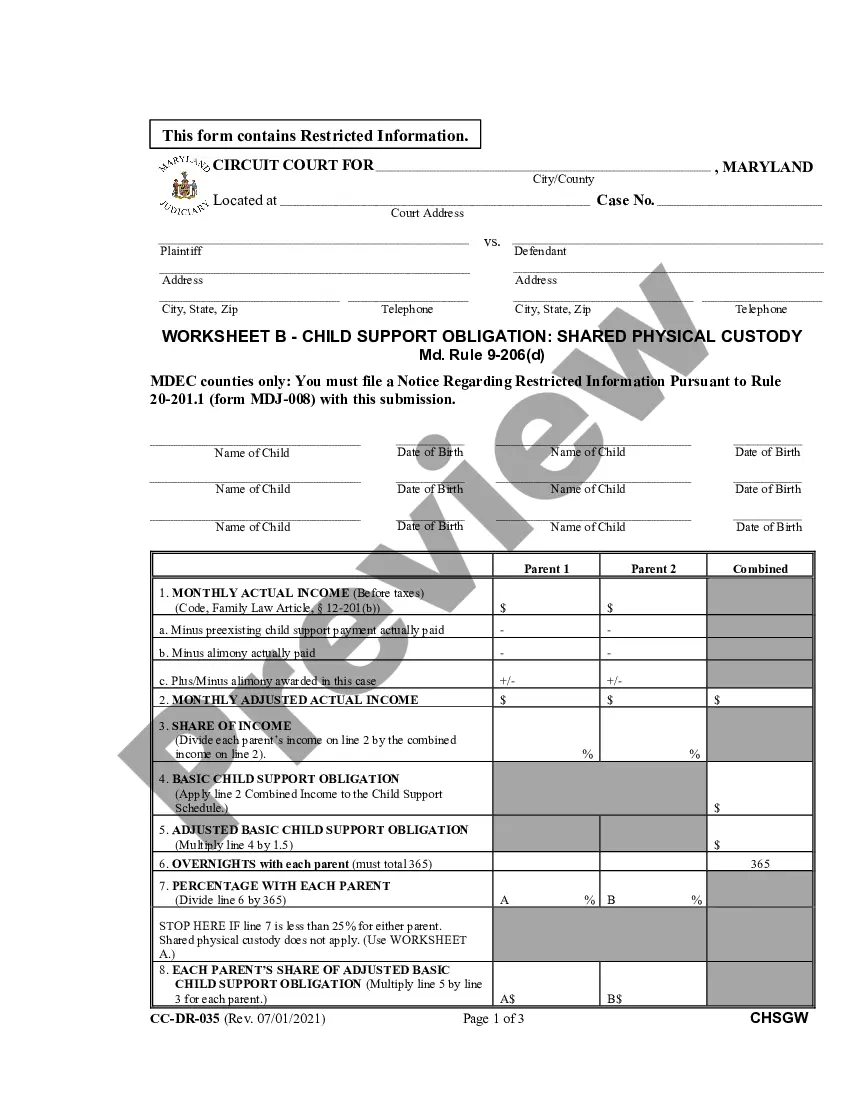

A last will and testament: Name your stepchildren as beneficiaries of your will. You can designate a set amount for them or instruct that they receive a percentage of whatever your estate is worth at the time of your death. A trust: Create a trust and make your stepchildren beneficiaries.

How do blended families structure their wills? Option 1: All to spouse. The simplest option is to say that all assets of the first to die go to the surviving spouse at 100%. ... Option 2: Split gifts. Another option is for the will to provide a split of the assets. ... Option 3: Trusts.

Three Common Challenges Blended Families Face Coping with Sacrifice. Young children especially may not realize how many changes will take place once other siblings come into the picture. ... Maintaining Inclusivity. Perhaps most of the new siblings get along and enjoy quality time together. ... Keeping up with Schedules.

The best Estate Planning option for blended families is one that takes each family relationship into account. Within blended family structures there can be concerns about inheritance size, naming an executor, and overall fairness.