Blocked Account Agreement Form

Description

How to fill out California Order For Withdrawal Of Funds From Blocked Account?

There's no longer a requirement to spend countless hours searching for legal documents to meet your local state stipulations.

US Legal Forms has gathered all of them in one location and enhanced their accessibility.

Our website presents over 85k templates for any business and personal legal needs categorized by state and application area.

Utilize the Search field above to look for another sample if the current one is not to your liking.

- All forms are professionally composed and validated for authenticity, allowing you to be confident in acquiring a current Blocked Account Agreement Form.

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before downloading any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all saved documents at any time needed by accessing the My documents tab in your profile.

- If you're unfamiliar with our platform, the procedure will involve a few more steps.

- Here's how new users can locate the Blocked Account Agreement Form in our library.

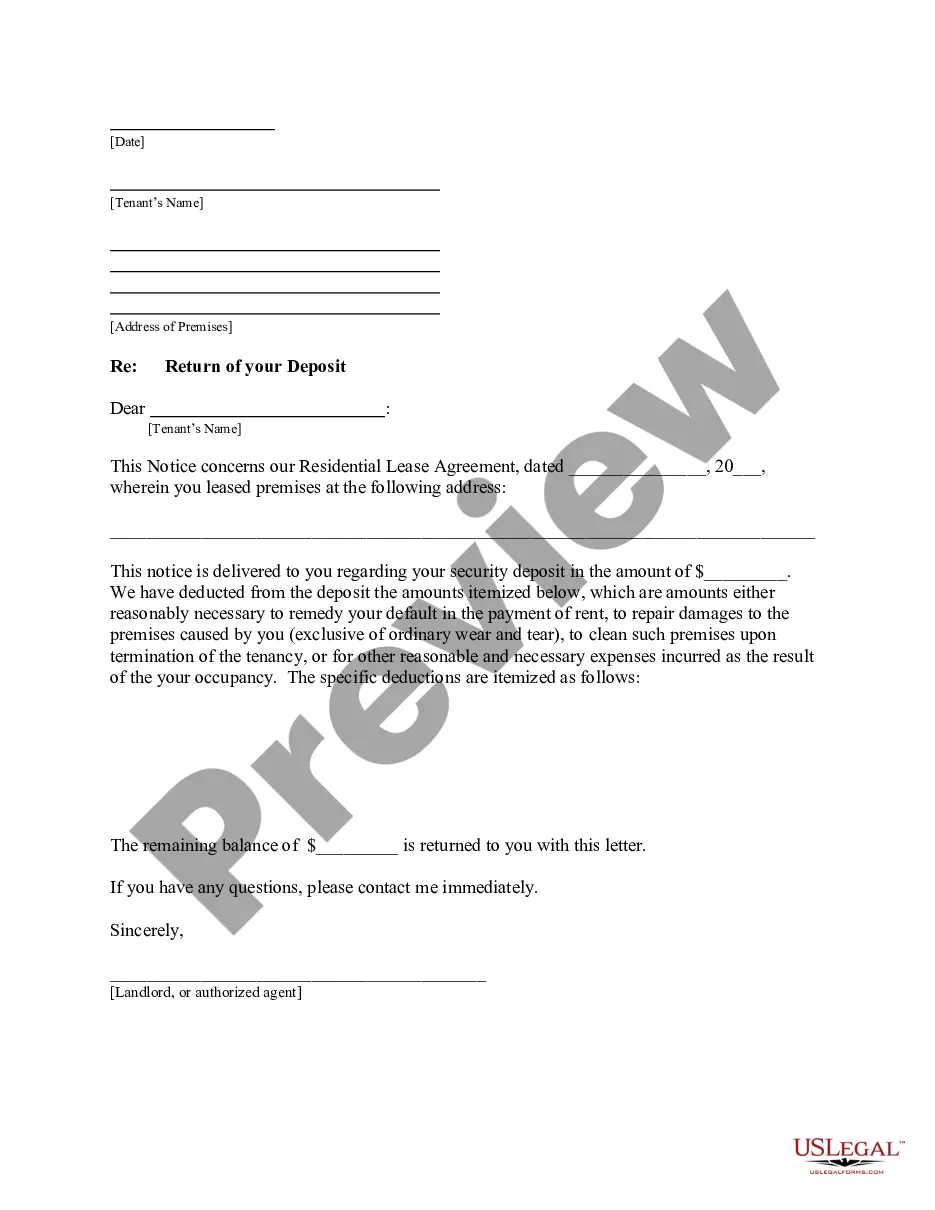

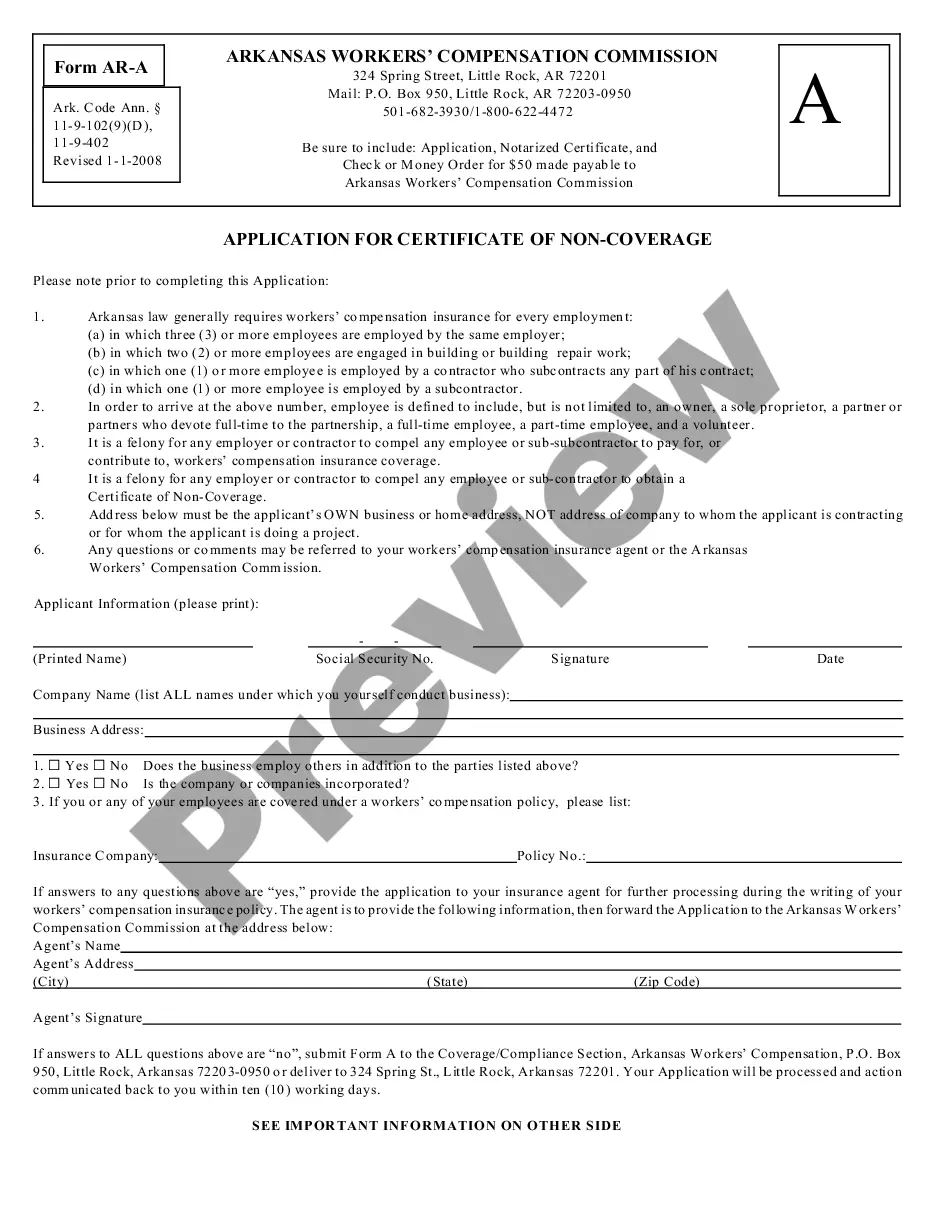

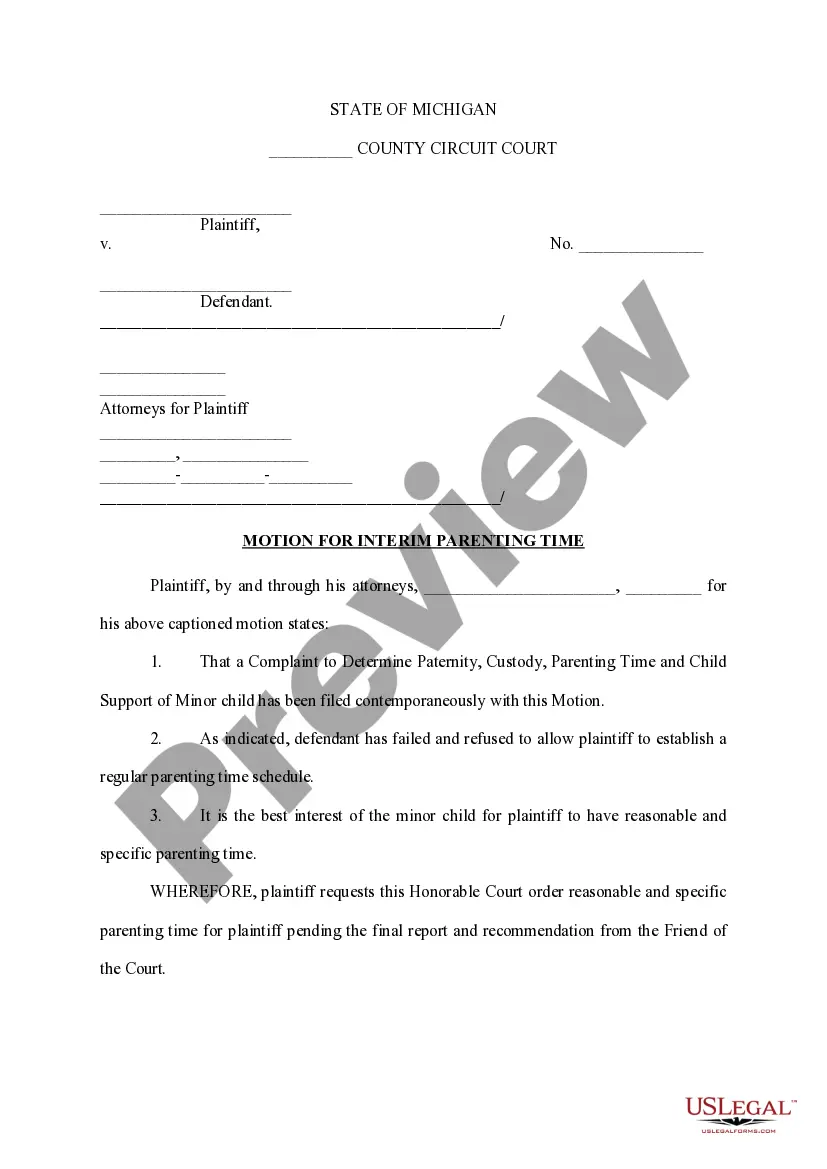

- Examine the page content thoroughly to confirm it includes the sample you need.

- To confirm this, use the form description and preview options if available.

Form popularity

FAQ

An account agreement is a set of conditions that outline both your rights and responsibilities and those of the bank concerning your bank account. This agreement must be read, agreed upon, and signed before your account is activated.

You can still receive deposits into frozen bank accounts, but withdrawals and transfers are not permitted. Banks may freeze bank accounts if they suspect illegal activity such as money laundering, terrorist financing, or writing bad checks. 2026

As noted above, a frozen account means you won't have access to any of your money until the situation is resolved. This means you can't take out any money and scheduled payments won't go through. And because these payments will bounce, you'll probably incur a non-sufficient funds (NSF) charge.

For this, you will have to visit the home branch of your bank. Here, you have to put a request to reactivate the account in writing. Do carry the necessary documents for KYC with you. Remember that the bank cannot charge you any fee for reactivating your account.

Blocked Account Agreements Blocked Account Agreement means an agreement among the Borrower, the Agent and a Clearing Bank, in form and substance satisfactory to the Agent, concerning the collection of payments which represent the proceeds of Accounts or of any other Collateral.