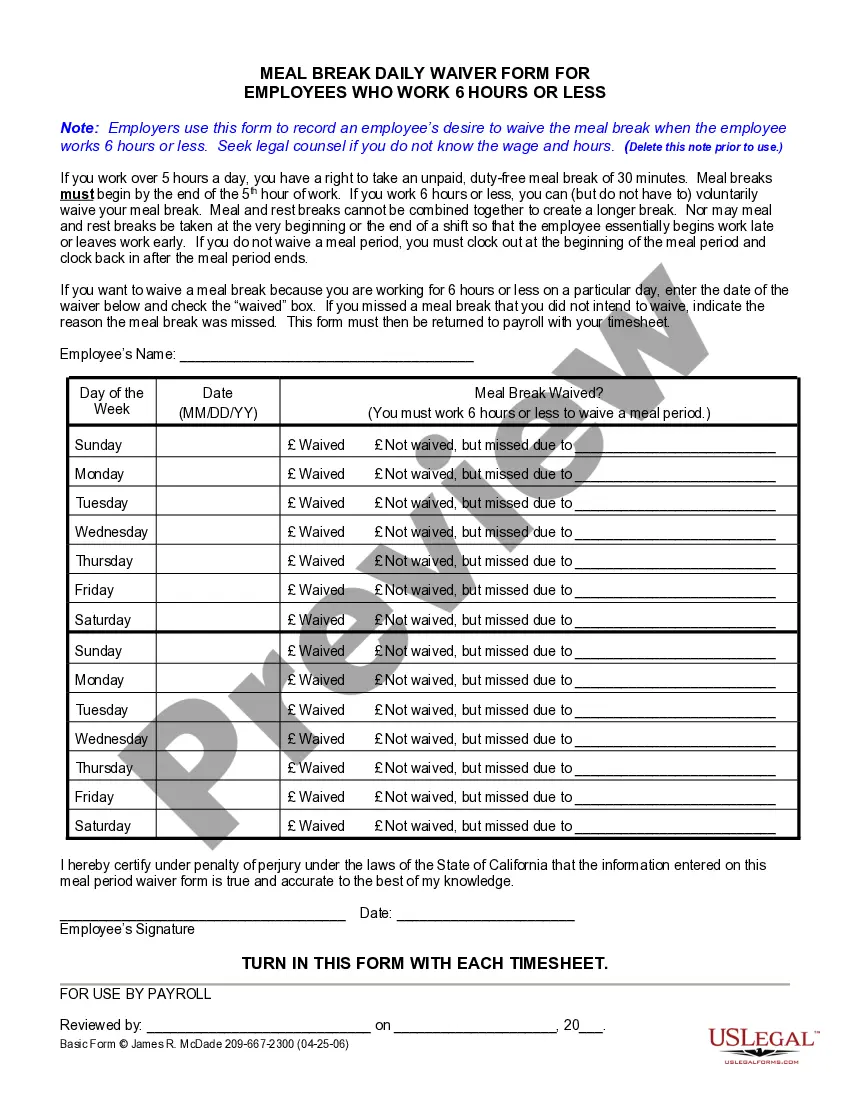

California Meal Form With Decimals

Description

How to fill out California On Duty Meal Period Agreement?

Obtaining legal document samples that comply with federal and local regulations is crucial, and the internet offers a lot of options to pick from. But what’s the point in wasting time searching for the correctly drafted California Meal Form With Decimals sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the biggest online legal catalog with over 85,000 fillable templates drafted by attorneys for any professional and personal scenario. They are simple to browse with all files arranged by state and purpose of use. Our specialists stay up with legislative changes, so you can always be sure your form is up to date and compliant when getting a California Meal Form With Decimals from our website.

Obtaining a California Meal Form With Decimals is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the right format. If you are new to our website, adhere to the instructions below:

- Analyze the template utilizing the Preview feature or through the text description to ensure it meets your requirements.

- Look for a different sample utilizing the search tool at the top of the page if needed.

- Click Buy Now when you’ve found the suitable form and opt for a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Select the best format for your California Meal Form With Decimals and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and complete earlier purchased forms, open the My Forms tab in your profile. Enjoy the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

If you have an LLC, here's how to fill in the California Form 568: Line 1?Total income from Schedule IW. Enter the total income. Line 2?Limited liability company fee. Enter the amount of the LLC fee. The LLC must pay a fee if the total California income is equal to or greater than $250,000.

PAYMENTS Mail Form 568 with payment to: Mail Franchise Tax Board. PO Box 942857. Sacramento, CA 94257-0501. E-Filed returns: Pay electronically using Web Pay, credit card, EFW, or mail form FTB 3588, Payment Voucher for LLC e-filed Returns, with payment to: Mail Franchise Tax Board. PO Box 942857. Sacramento, CA 94257-0531.

Which Form To Use. Use Form 540NR if either you or your spouse/RDP were a nonresident or part-year resident in tax year 2022. If you and your spouse/RDP were California residents during the entire tax year 2022, use Form 540, California Resident Income Tax Return, or 540 2EZ, California Resident Income Tax Return.

Use form FTB 3804-CR to claim the amount of the credit that equals 9.3 percent of the sum of the taxpayer's pro rata share or distributive share and guaranteed payments of qualified net income subject to the election made by an electing qualified entity under the Small Business Relief Act.

Limitation on employer's deduction for fringe benefit expenses ? Under federal law, deductions for entertainment expenses are disallowed; the current 50 percent limit on the deductibility of business meals is expanded to meals provided through an in-house cafeteria or otherwise on the premises of the employer; the 50 ...