Small Estate Form Equiniti

Description

How to fill out California Affidavit For Collection Of Personal Property - Probate Code Section 13100 - Small Estates Under $208,850?

It's well-known that you can't transform into a legal expert instantly, nor can you understand how to rapidly prepare the Small Estate Form Equiniti without possessing a specific background.

Assembling legal documents is an arduous process that necessitates a distinct education and expertise. Therefore, why not entrust the preparation of the Small Estate Form Equiniti to the experts.

With US Legal Forms, one of the most extensive legal document repositories, you can discover everything from court documents to templates for in-office correspondence. We recognize how vital it is to comply with and adhere to federal and local statutes and regulations. That's the reason, on our site, all forms are specific to your location and continually updated.

You can regain access to your forms from the My documents tab anytime. If you are a current client, you can simply Log In and find and download the template from the same tab.

No matter the intention behind your forms—whether financial and legal, or personal—our website meets your needs. Give US Legal Forms a try now!

- Find the form you require using the search bar at the upper part of the page.

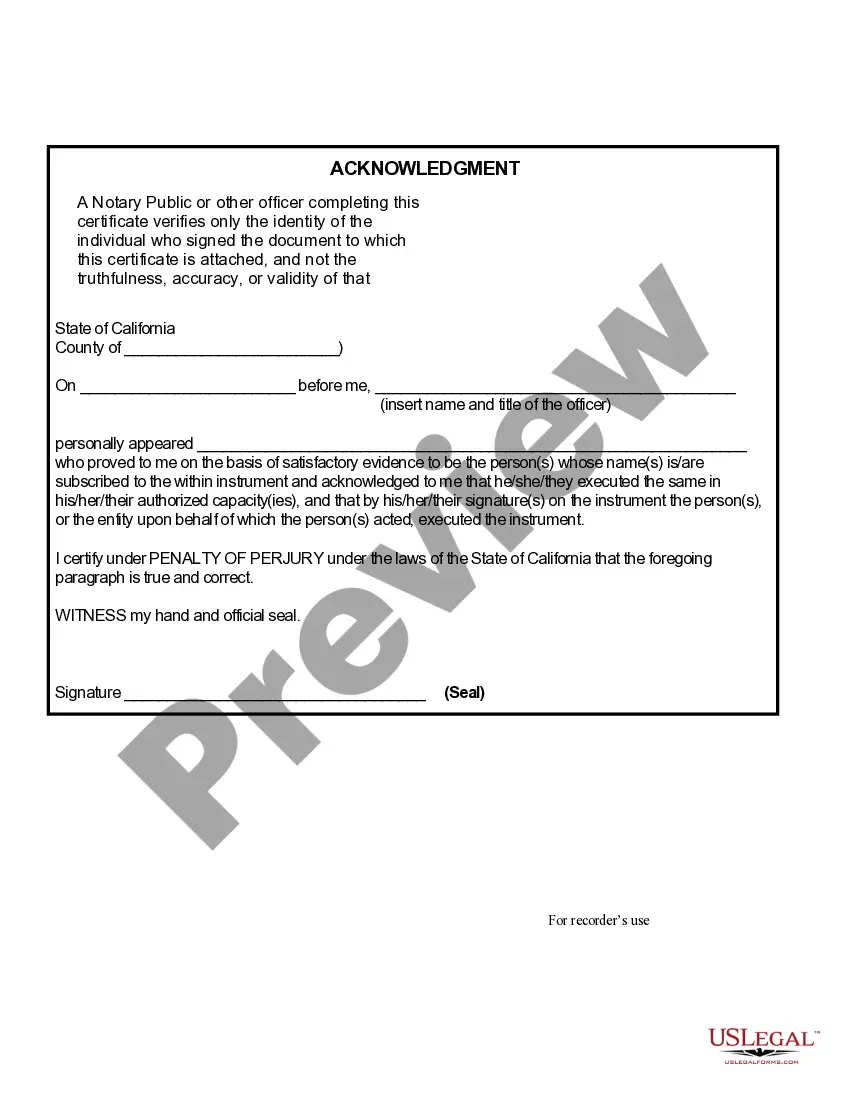

- Preview it (if this feature is available) and review the accompanying description to determine if the Small Estate Form Equiniti is what you are looking for.

- Restart your search if you need another form.

- Create a complimentary account and choose a subscription plan to acquire the form.

- Click Buy now. After processing the payment, you can access the Small Estate Form Equiniti, complete it, print it, and send or mail it to the necessary parties or organizations.

Form popularity

FAQ

Filling out the small estate affidavit requires you to gather important details about the deceased's assets, debts, and the individuals who will inherit these assets. The small estate form Equiniti provides a user-friendly template to guide you through this process. Make sure to enter accurate information and have the required signatures. This affidavit can greatly simplify the settlement process, allowing you to handle matters fairly and efficiently.

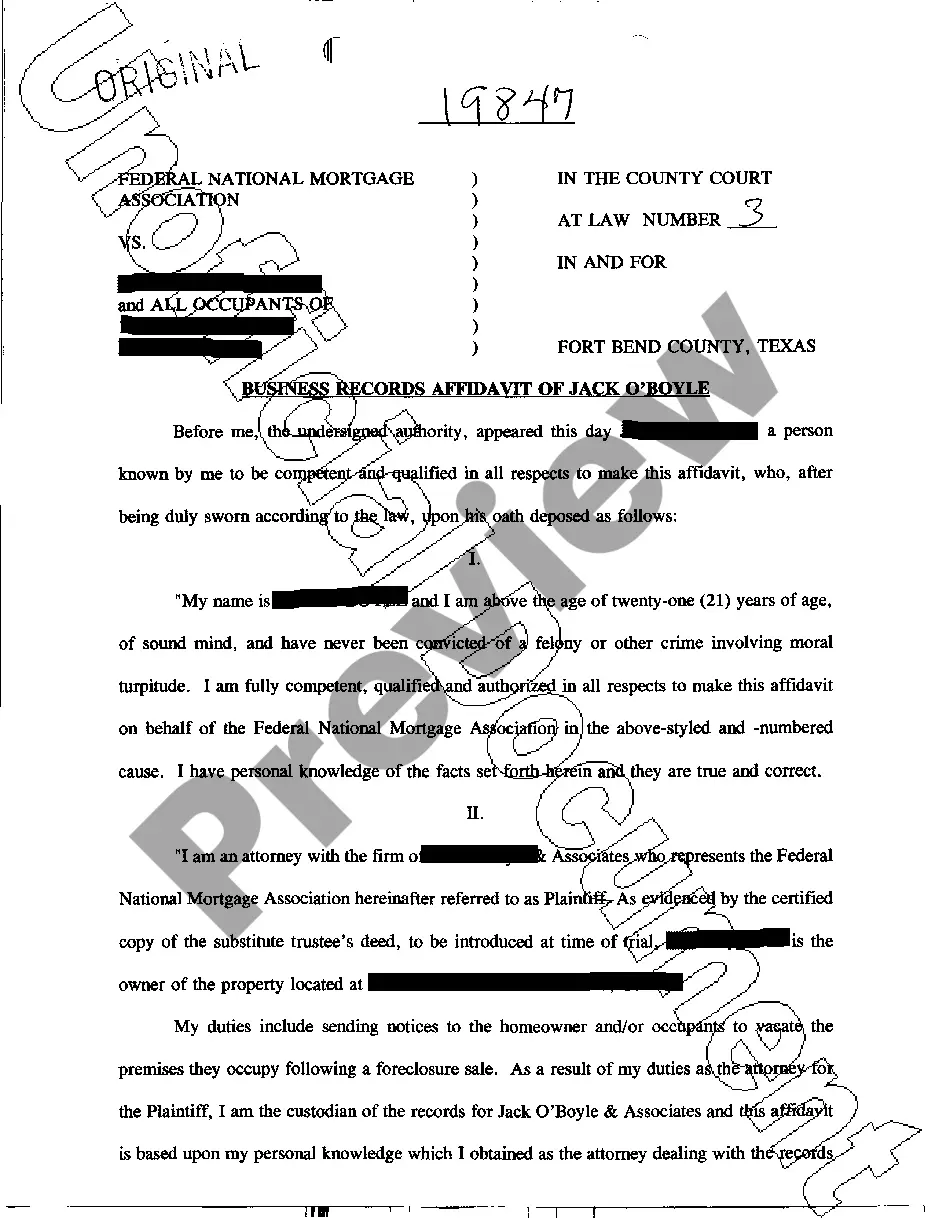

Transferring shares owned by a deceased individual involves gathering necessary documents like the death certificate and the small estate form Equiniti. This form assists in facilitating the transfer process without going through probate. You should reach out to the stockbroker or financial institution that holds the shares to follow their specific process. By using the small estate form Equiniti, you can complete the transfer efficiently, easing the burden on beneficiaries.

To transfer ownership of a stock after someone has passed away, you typically need to provide documentation such as a death certificate and the small estate form Equiniti. This form simplifies the process by allowing you to claim shares without the lengthy probate procedure. Ensure you contact Equiniti for specific instructions and any additional requirements. This approach often makes the transition smoother for heirs.

To transfer Equiniti shares when someone dies, you generally need to submit a small estate form Equiniti along with a copy of the death certificate and any required identification. This process helps beneficiaries claim their inheritance without the complications of probate. It's advisable to contact Equiniti directly or consult with a legal professional for specific steps and documentation needed. Properly navigating this can ensure that the transfer goes smoothly.

To obtain a small estate affidavit, you typically need to fill out a specific form provided by your state’s probate court or relevant authority. This document serves as proof of your claim to the deceased's assets without the need for lengthy probate. If you have Equiniti shares to manage, using the small estate form Equiniti can make the task easier. Make sure you have all relevant information about the estate to support your application.

A small estates declaration is a legal statement made to affirm the value of the deceased's assets, allowing for the transfer without full probate proceedings. It simplifies the process and can be filed more quickly than traditional probate forms. If you are handling shares with Equiniti, using the small estate form Equiniti may be a beneficial step for managing the estate effectively. Confirm all requirements are met to ensure a smooth process.

To obtain a copy of a small estate affidavit, you typically need to file a request with the appropriate court or department where the estate was settled. Some states may offer online services for this purpose. If you're dealing with Equiniti shares, utilizing the small estate form Equiniti can assist in this process as you gather necessary documentation. Always check local regulations to ensure proper steps are followed.

A small estate is typically an estate that falls below a specific financial threshold, which allows heirs to bypass the probate process. In contrast, a probate estate requires court intervention to settle debts and distribute assets. Using the small estate form Equiniti can help simplify the process for those eligible, easing the burden on families during a difficult time. Understanding this can aid in managing your loved one’s affairs more efficiently.

A small estate declaration form is a document that allows heirs to claim the deceased person's assets without the need for formal probate. This form simplifies the process and helps facilitate the transfer of property quickly. In the context of Equiniti, utilizing the small estate form Equiniti can streamline how you handle shares and other assets. Make sure to gather all necessary documentation before completing the form.

The small estate limit in Nevada is currently set at $100,000 for personal property. This means that if the total value of the estate falls below this threshold, heirs may not need to go through the lengthy probate process. Instead, you can use a small estate form Equiniti to expedite the transfer of assets. Always consult with an attorney for confirmation of the latest limits.