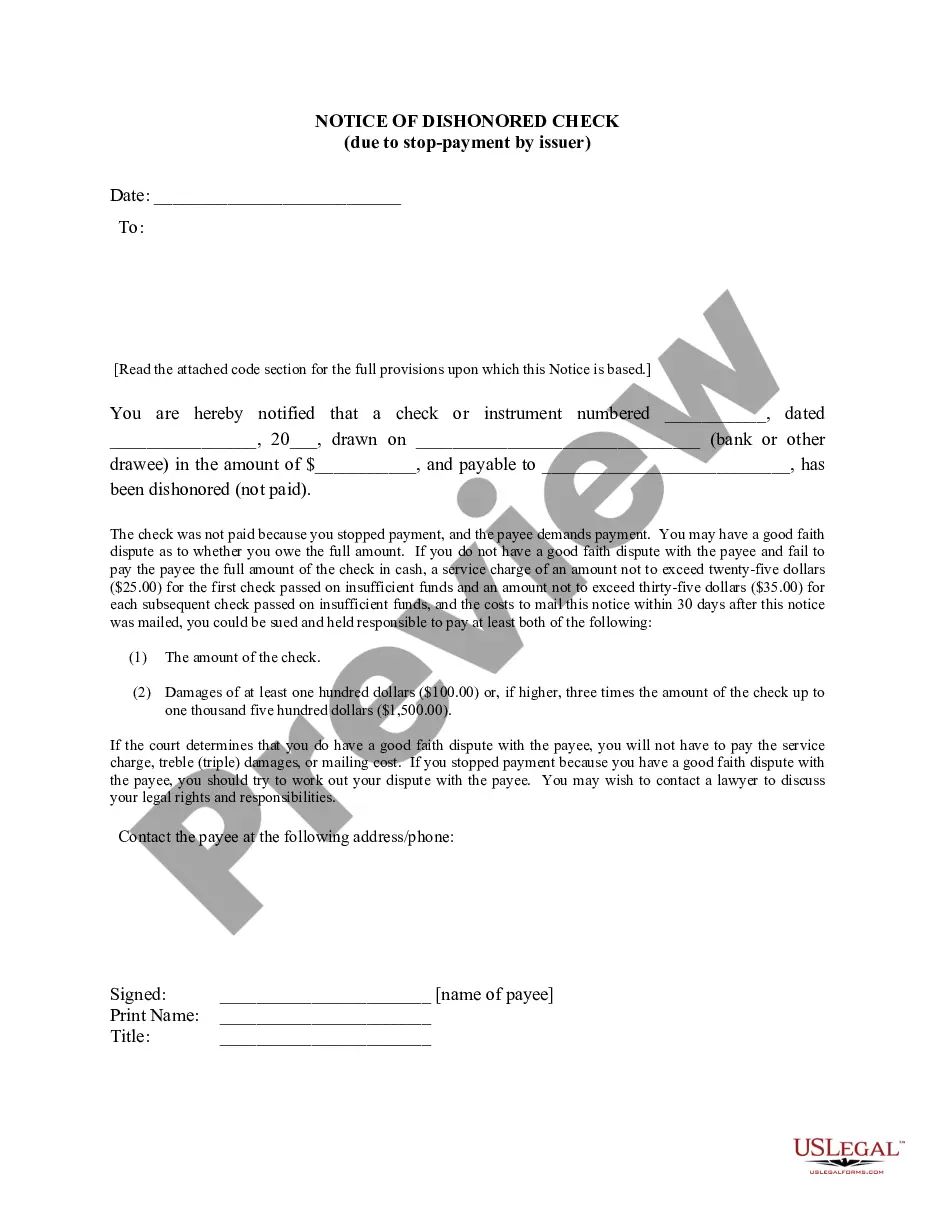

Notice of Dishonored Check - Civil - Only for Stopped Payment - Keywords: bad check, bounced check

Note: This summary is not intended to be an

all-inclusive summary of the law of bad checks, but does contain basic

and other provisions.

NOTE: SEE, (c) BELOW, FOR CHECKS UPON WHICH PAYMENT HAS BEEN

STOPPED.

CIVIL PROVISIONS

CALIFORNIA CODE

CALIFORNIA CIVIL CODE

TITLE 5. EXTINCTION OF CONTRACTS

PART 3. OBLIGATIONS IMPOSED BY LAW

SECTION 1719

SEC. 1719 - California Civil Code:

(a)

(1) Notwithstanding any penal sanctions that may apply,

any person who passes a check on insufficient funds shall be liable to

the payee for the amount of the check and a service charge payable to the

payee for an amount not to exceed twenty-five dollars ($25) for the first

check passed on insufficient funds and an amount not to exceed thirty-five

dollars ($35) for each subsequent check to that payee passed on insufficient

funds.

(2) Notwithstanding any penal sanctions that may apply,

any person who passes a check on insufficient funds shall be liable to

the payee for damages equal to treble the amount of the check if a written

demand for payment is mailed by certified mail to the person who had passed

a check on insufficient funds and the written demand informs this person

of (A) the provisions of this section, (B) the amount of the check, and

(C) the amount of the service charge payable to the payee. The person

who had passed a check on insufficient funds shall have 30 days from the

date the written demand was mailed to pay the amount of the check, the

amount of the service charge payable to the payee, and the costs to mail

the written demand for payment. If this person fails to pay in

full the amount of the check, the service charge payable to the payee,

and the costs to mail the written demand within this period, this person

shall then be liable instead for the amount of the check, minus any partial

payments made toward the amount of the check or the service charge within

30 days of the written demand, and damages equal to treble that amount,

which shall not be less than one hundred dollars ($100) nor more than one

thousand five hundred dollars ($1,500). When a person becomes liable

for treble damages for a check that is the subject of a written demand,

that person shall no longer be liable for any service charge for that check

and any costs to mail the written demand.

(3) Notwithstanding paragraphs (1) and (2), a person

shall not be liable for the service charge, costs to mail the written demand,

or treble damages if he or she stops payment in order to resolve a good

faith dispute with the payee. The payee is entitled to the service

charge, costs to mail the written demand, or treble damages only upon proving

by clear and convincing evidence that there was no good faith dispute,

as defined in subdivision (b).

(4) Notwithstanding paragraph (1), a person shall not

be liable under that paragraph for the service charge if, at any time,

he or she presents the payee with written confirmation by his or her financial

institution that the check was returned to the payee by the financial institution

due to an error on the part of the financial institution.

(5) Notwithstanding paragraph (1), a person shall not

be liable under that paragraph for the service charge if the person presents

the payee with written confirmation that his or her account had insufficient

funds as a result of a delay in the regularly scheduled transfer of, or

the posting of, a direct deposit of a social security or government benefit

assistance payment.

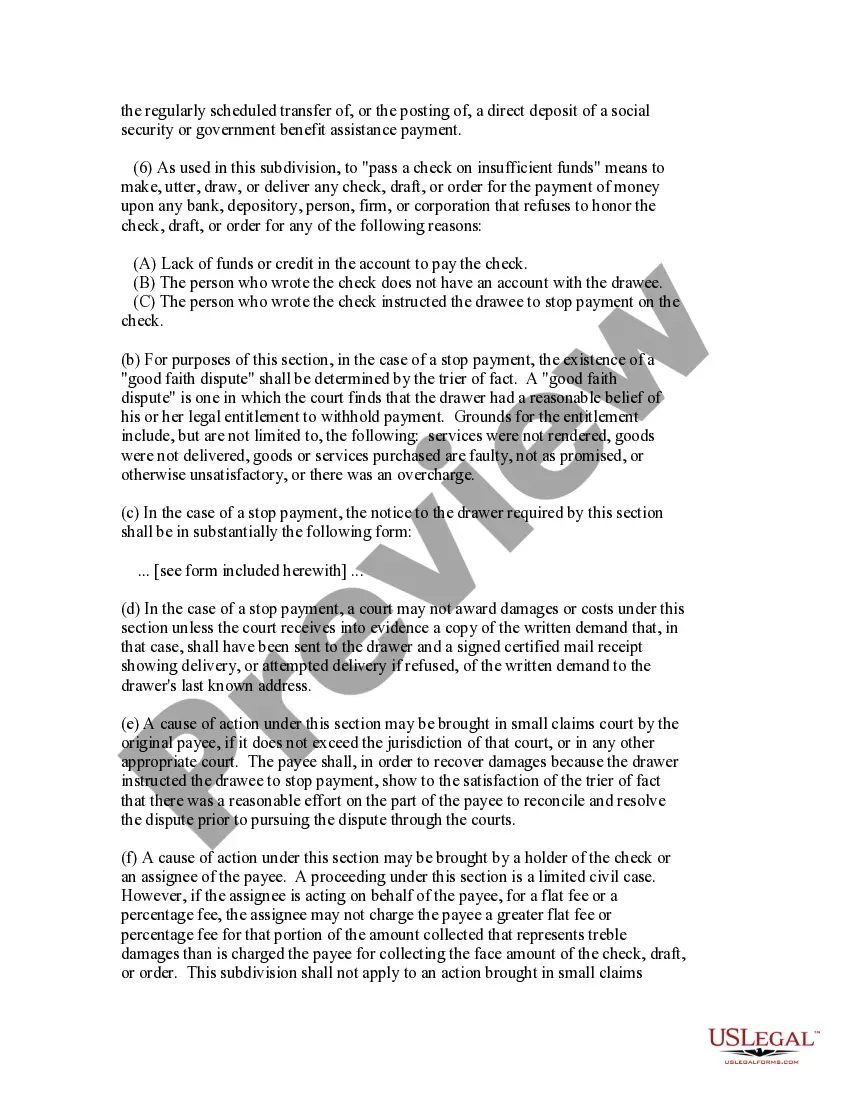

(6) As used in this subdivision, to "pass a check on

insufficient funds" means to make, utter, draw, or deliver any check, draft,

or order for the payment of money upon any bank, depository, person, firm,

or corporation that refuses to honor the check, draft, or order for any

of the following reasons:

(A) Lack of funds or credit in the account to pay the

check.

(B) The person who wrote the check does not have an

account with the drawee.

(C) The person who wrote the check instructed the

drawee to stop payment on the check.

(b) For purposes of this section, in the case of a stop payment,

the existence of a "good faith dispute" shall be determined by the trier

of fact. A "good faith dispute" is one in which the court finds that

the drawer had a reasonable belief of his or her legal entitlement to withhold

payment. Grounds for the entitlement include, but are not limited

to, the following: services were not rendered, goods were not delivered,

goods or services purchased are faulty, not as promised, or otherwise unsatisfactory,

or there was an overcharge.

(c) In the case of a stop payment, the notice to the drawer required

by this section shall be in substantially the following form:

... [ see, USLF form CA-402N ] ...

(d) In the case of a stop payment, a court may not award damages

or costs under this section unless the court receives into evidence a copy

of the written demand that, in that case, shall have been sent to the drawer

and a signed certified mail receipt showing delivery, or attempted delivery

if refused, of the written demand to the drawer's last known address.

(e) A cause of action under this section may be brought in small

claims court by the original payee, if it does not exceed the jurisdiction

of that court, or in any other appropriate court. The payee shall,

in order to recover damages because the drawer instructed the drawee to

stop payment, show to the satisfaction of the trier of fact that there

was a reasonable effort on the part of the payee to reconcile and resolve

the dispute prior to pursuing the dispute through the courts.

(f) A cause of action under this section may be brought by a holder

of the check or an assignee of the payee. A proceeding under this

section is a limited civil case. However, if the assignee is acting

on behalf of the payee, for a flat fee or a percentage fee, the assignee

may not charge the payee a greater flat fee or percentage fee for that

portion of the amount collected that represents treble damages than is

charged the payee for collecting the face amount of the check, draft, or

order. This subdivision shall not apply to an action brought in small

claims court.

(g) Notwithstanding subdivision (a), if the payee is the court,

the written demand for payment described in subdivision (a) may be mailed

to the drawer by the court clerk. Notwithstanding subdivision (d),

in the case of a stop payment where the demand is mailed by the court clerk,

a court may not award damages or costs pursuant to subdivision (d), unless

the court receives into evidence a copy of the written demand, and a certificate

of mailing by the court clerk in the form provided for in subdivision (4)

of Section 1013a of the Code of Civil Procedure for service in civil actions.

For purposes of this subdivision, in courts where a single court clerk

serves more than one court, the clerk shall be deemed the court clerk of

each court.

(h) The requirements of this section in regard to remedies are mandatory

upon a court.

(i) The assignee of the payee or a holder of the check may demand,

recover, or enforce the service charge, damages, and costs specified in

this section to the same extent as the original payee.

(j)

(1) A drawer is liable for damages and costs only if

all of the requirements of this section have been satisfied.

(2) The drawer shall in no event be liable more than

once under this section on each check for a service charge, damages, or

costs.

(k) Nothing in this section is intended to condition, curtail, or

otherwise prejudice the rights, claims, remedies, and defenses under Division

3 (commencing with Section 3101) of the Commercial Code of a drawer, payee,

assignee, or holder, including a holder in due course as defined in Section

3302 of the Commercial Code, in connection with the enforcement of this

section.