Ca Deed California Withholding

Description

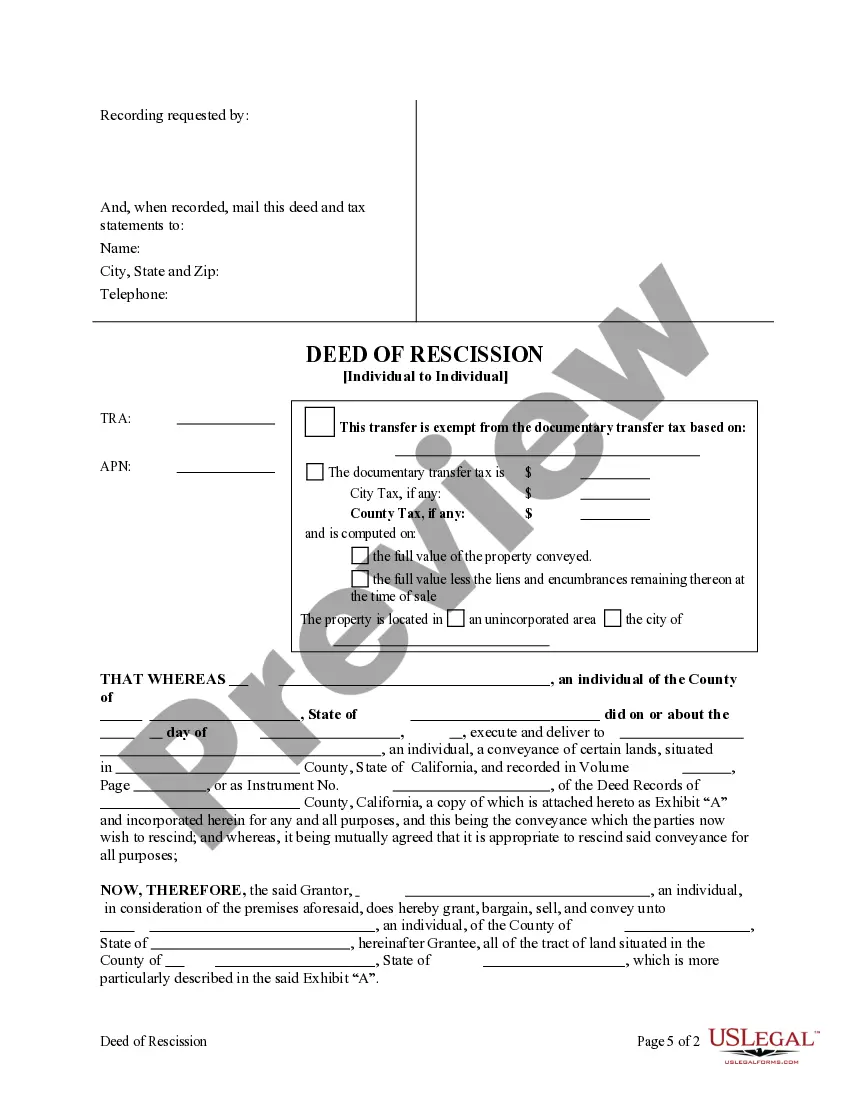

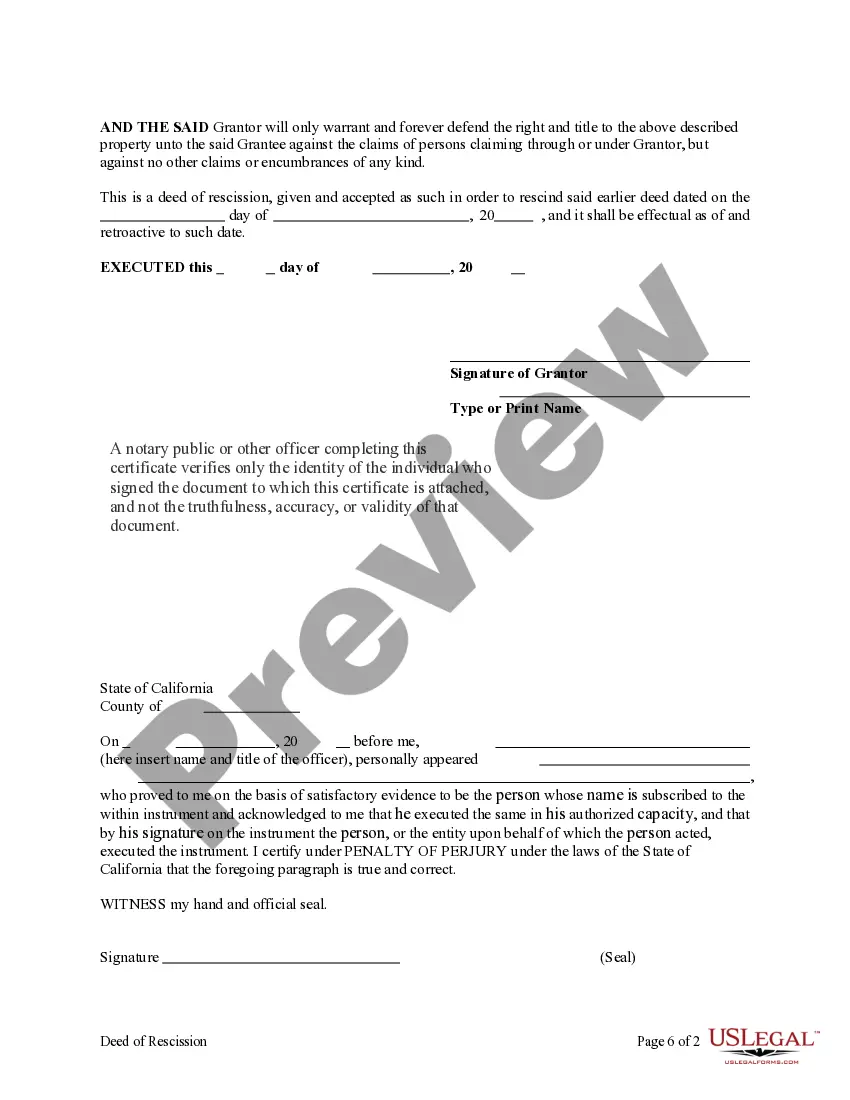

How to fill out California Deed Of Rescission - Individual To Individual?

Engaging with legal paperwork and procedures can be a lengthy addition to your entire day.

Ca Deed California Withholding and similar forms typically necessitate you to look for them and figure out how to fill them out accurately.

As a result, regardless if you're managing financial, legal, or personal issues, having a detailed and accessible online repository of forms at your disposal can be incredibly helpful.

US Legal Forms is the premier online platform for legal templates, featuring over 85,000 state-specific forms and various tools to help you finish your documents swiftly.

Is this your first time using US Legal Forms? Sign up and create an account in just a few minutes, and you will gain access to the form library and Ca Deed California Withholding. Then, adhere to the following steps to finalize your form.

- Explore the library of relevant documents available to you with just a single click.

- US Legal Forms provides you with state- and county-specific forms accessible at any time for download.

- Protect your document management processes with a high-quality service that enables you to assemble any form within minutes without extra or concealed charges.

- Simply Log In to your account, locate Ca Deed California Withholding, and retrieve it instantly from the My documents section.

- You can also access previously stored forms.

Form popularity

FAQ

Can a Debt Collector Collect After 10 Years? In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

Settling debt can have both a negative and a positive effect on your credit scores. You're most likely to see a drop in points up-front, but over time you can gain back everything you lost and more. Regardless of the setback, you can always work to experience the benefits of better credit.

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

Credit cards are another example of a type of debt that generally doesn't have forgiveness options. Credit card debt forgiveness is unlikely as credit card issuers tend to expect you to repay the money you borrow, and if you don't repay that money, your debt can end up in collections.

Open accounts/written contracts: The Hawaii statute of limitations on open accounts and written contracts is six years. Credit card accounts, loans that do not fall within the ambit of the Uniform Commercial Code, and debts arising under other written agreements all fall under the same six year statute of limitations.

Under this section, judgment, together with all rights and remedies appurtenant to it, are conclusively presumed paid and discharged after ten years unless timely renewed. 82 H.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

Statute of limitations on debt for all states StateWrittenOralCalifornia4 years2Colorado6 years6Connecticut6 years3Delaware3 years346 more rows ?