Sample Letter Revoking Consent For Evaluation

Description

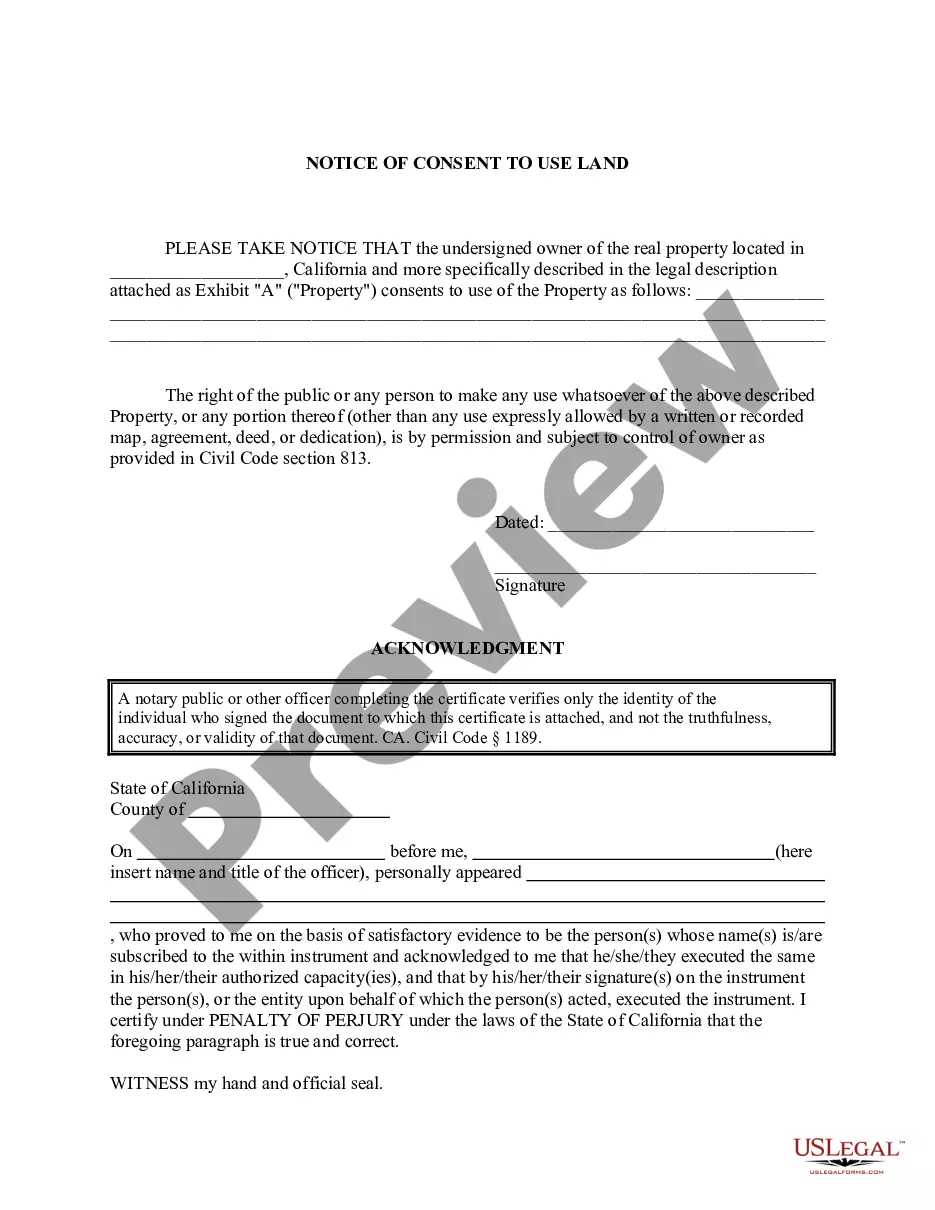

How to fill out California Notice Of Revocation Of Consent To Use Land?

The Example Letter Canceling Approval For Assessment shown on this page is a versatile legal template created by experienced attorneys in accordance with federal and state regulations. For over 25 years, US Legal Forms has delivered individuals, organizations, and legal experts with more than 85,000 validated, state-specific documents for any business and personal situation. It’s the quickest, simplest, and most reliable way to acquire the necessary paperwork, as the service ensures bank-level data security and protection against malware.

Acquiring this Example Letter Canceling Approval For Assessment will require just a few easy steps.

Register for US Legal Forms to have certified legal templates for all of life's situations readily available.

- Search for the document you require and examine it. Browse through the sample you looked for and preview or review the form description to ensure it meets your needs. If it does not, use the search bar to find the accurate one. Click Buy Now once you have identified the template you need.

- Sign up and Log In. Choose the pricing option that fits you and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and verify your subscription to move forward.

- Acquire the editable template. Select the format you desire for your Example Letter Canceling Approval For Assessment (PDF, Word, RTF) and save the sample on your device.

- Fill out and sign the documents. Print the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a legally-binding electronic signature.

- Download your documents once more. Utilize the same document again whenever necessary. Open the My documents tab in your profile to redownload any previously saved forms.

Form popularity

FAQ

Irrevocable Trusts Using an irrevocable trust allows you to minimize estate tax, protect assets from creditors and provide for family members who are under 18 years old, financially dependent, or who may have special needs.

Creating a living trust in Virginia occurs when you create a written trust document and sign it in the presence of a notary. The trust is not official until you transfer assets into it. A living trust can offer a variety of benefits that may appeal to you. Consider what is best for you.

Charges vary from lawyer to lawyer based on their fees, as well as the complexity of your overall estate. In the end, expect to pay $1,000 or more. If you decide to go the DIY route, your costs will likely fall to around $200 to $500, depending on which online program you prefer.

To make a living trust in Virginia, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

Assets that should not be used to fund your living trust include: Qualified retirement accounts ? 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

Furthermore, there are recurring administrative costs such as trustee fees, tax preparation fees, and legal fees. Ongoing Record-Keeping: Trusts also require meticulous record-keeping and can be complex to understand and manage. There is a strict legal framework that must be adhered to, which can be daunting for many.

Charges vary from lawyer to lawyer based on their fees, as well as the complexity of your overall estate. In the end, expect to pay $1,000 or more. If you decide to go the DIY route, your costs will likely fall to around $200 to $500, depending on which online program you prefer.