Grant Deed Form Blank Form 114

Description

How to fill out California Grant Deed?

Discovering a preferred location to acquire the most recent and pertinent legal samples is a significant part of managing bureaucracy.

Selecting the appropriate legal documents necessitates precision and meticulousness, which is why it's crucial to obtain samples of Grant Deed Form Blank Form 114 exclusively from reliable sources, such as US Legal Forms.

Eliminate the stress associated with your legal documentation. Explore the extensive US Legal Forms catalog to discover legal samples, assess their applicability to your situation, and download them immediately.

- Utilize the library navigation or search bar to locate your sample.

- Review the form’s description to determine if it aligns with the requirements of your state and locality.

- Access the form preview, if available, to confirm that the form is what you need.

- Continue searching for the appropriate template if the Grant Deed Form Blank Form 114 does not fulfill your needs.

- If you are confident about the form’s suitability, download it.

- When you are a registered user, click Log in to verify and access your chosen templates in My documents.

- If you haven't created a profile yet, click Buy now to obtain the template.

- Choose the pricing option that suits your requirements.

- Proceed to registration to complete your purchase.

- Finish your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Grant Deed Form Blank Form 114.

- After obtaining the form on your device, you can edit it using the editor or print it out to fill it in by hand.

Form popularity

FAQ

Office Depot does not typically carry quit claim deed forms like the Grant deed form blank form 114. While they offer various office supplies and forms, specialized legal documents are often better sourced from platforms like US Legal Forms. This platform not only provides the Grant deed form blank form 114 but also ensures that you have access to the most accurate and up-to-date versions. If you need a quit claim deed, consider visiting US Legal Forms to find exactly what you need.

To obtain a copy of a grant deed in California, you can visit the county recorder’s office where the deed was recorded. You may need to provide details such as the property's address or the names of the parties involved. Alternatively, using services from US Legal Forms can simplify your search and make it easier to obtain necessary documents quickly.

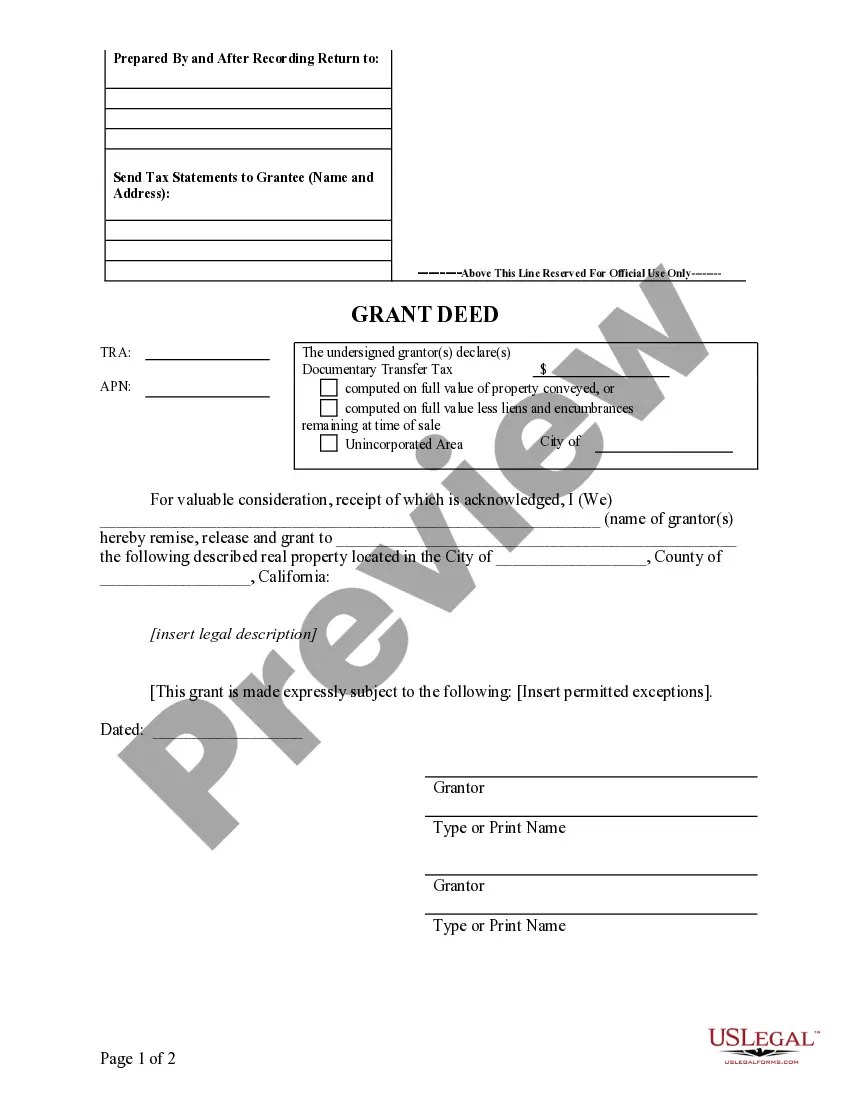

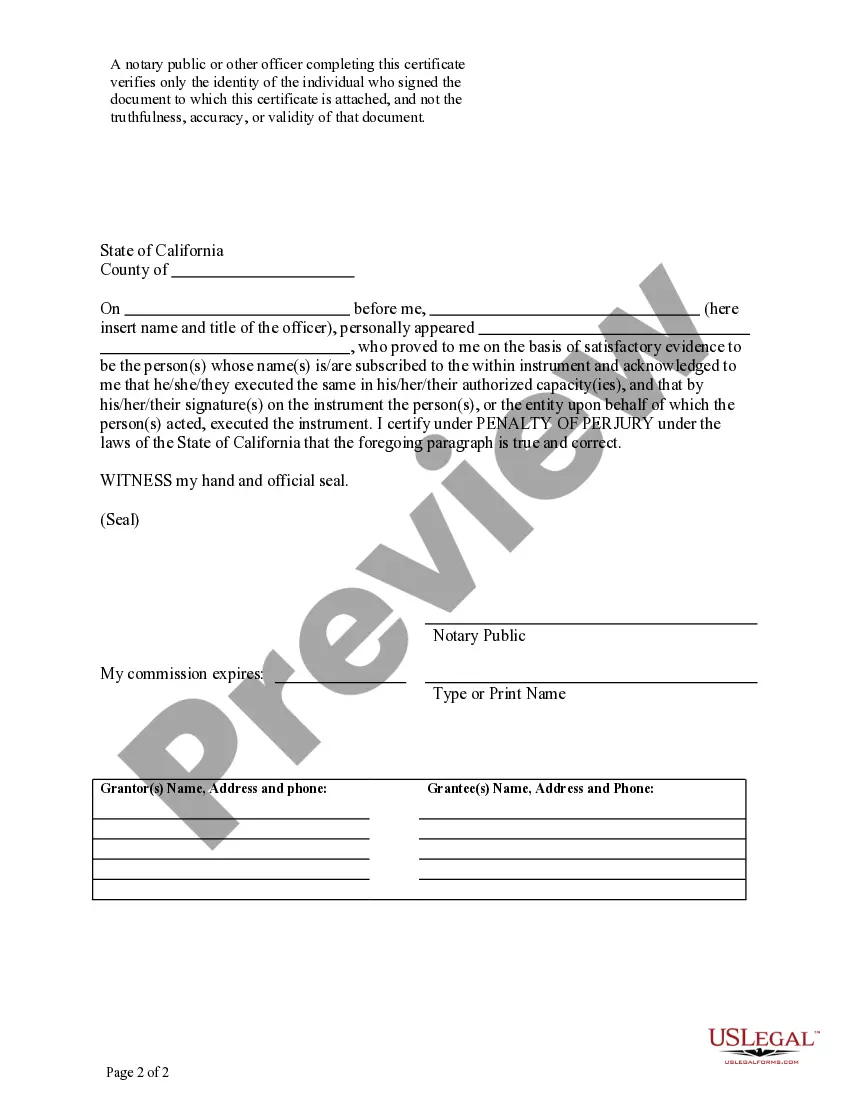

In California, a grant deed must include the Grant deed form blank form 114 filled out with the names of the parties, legal property description, and the grantor's signature. Additionally, the document must be notarized and recorded with the county recorder. Always ensure compliance with California regulations to facilitate property transfers smoothly.

You do not necessarily need a lawyer to write a deed, especially if you use the Grant deed form blank form 114 and understand the requirements. However, consulting a legal professional may be beneficial if you have complex circumstances or questions. They can guide you in ensuring everything is accurate and legally enforceable.

Creating a grant deed involves obtaining the Grant deed form blank form 114 and accurately entering the required information. You must include the names of both the grantor and grantee, along with the property description. Once you complete the form, you'll need to notarize it and file it with the appropriate county office. Using a reliable platform like US Legal Forms can simplify this process.

To prepare a Grant deed, you'll need the Grant deed form blank form 114, which typically includes sections for the names of the parties involved, property details, and a legal description. Start by accurately filling in the details, ensuring clarity and correctness. After completing the form, sign it in the presence of a notary public to ensure its legal validity.

Yes, you can prepare a deed yourself using a Grant deed form blank form 114. This form provides a straightforward way to transfer property ownership. However, you must ensure that all information is filled in correctly to avoid issues later. Consider checking local regulations to verify the requirements for your specific state.

A grant deed generally offers limited protection compared to other types of deeds. One significant disadvantage is that it does not guarantee against undisclosed claims on the property; if a prior owner failed to settle debts, these could affect your ownership. Additionally, a grant deed form blank form 114 may not explicitly address certain easements or restrictions that could limit your use of the property. As with any legal document, consulting with a professional or using reliable platforms like US Legal Forms can help you navigate these potential pitfalls effectively.

Yes, in California, it is crucial to record a grant deed for it to be legally effective. Recording provides notice to the public of the ownership change and protects your rights as a property owner. Utilize the grant deed form blank form 114 for an accurate submission, and make sure to file it with the county recorder’s office.

While hiring a lawyer is not required to file a quitclaim deed, it is often advisable. A knowledgeable attorney can ensure that you complete the process correctly, potentially saving you time and effort. If you feel confident, you can use the grant deed form blank form 114 available online and proceed on your own.