Rental Property With Mortgage

Description

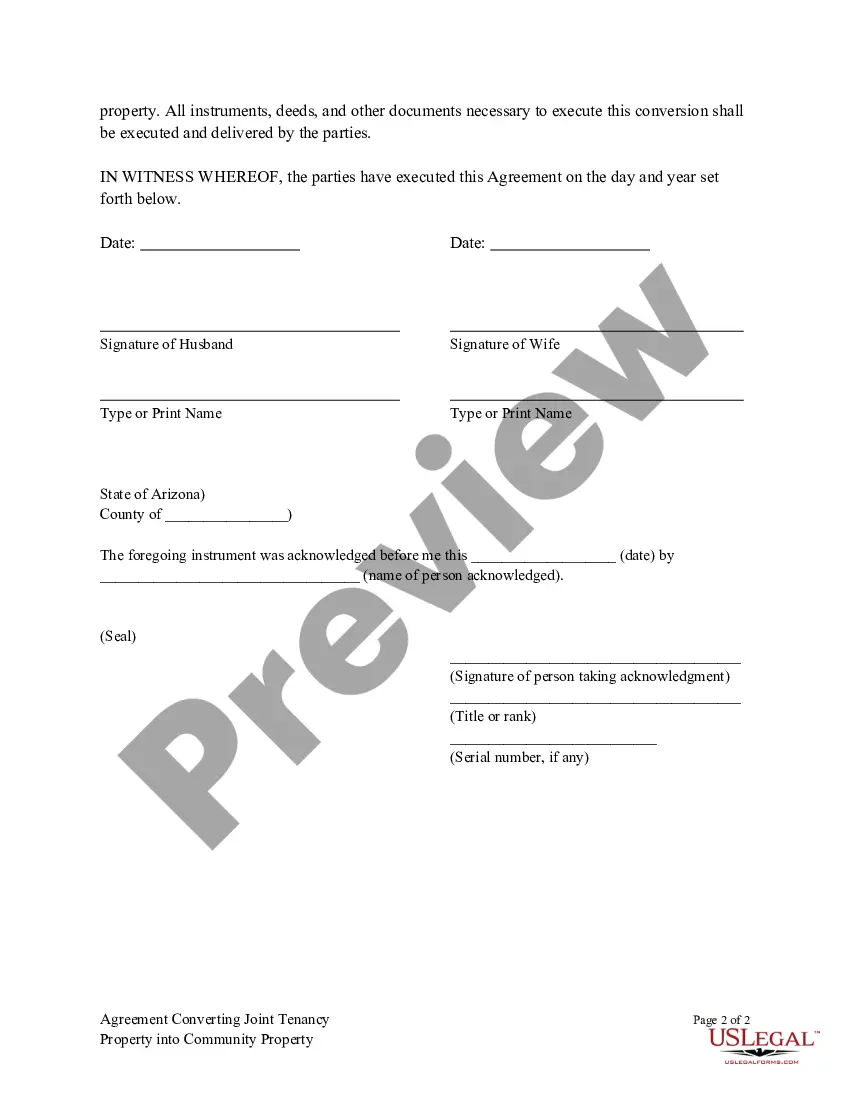

How to fill out Arizona Agreement Converting Joint Tenancy Property Into Community Property - Deed?

Accessing legal templates that meet the federal and state laws is essential, and the internet offers numerous options to pick from. But what’s the point in wasting time searching for the right Rental Property With Mortgage sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the most extensive online legal library with over 85,000 fillable templates drafted by attorneys for any business and personal case. They are easy to browse with all papers arranged by state and purpose of use. Our experts keep up with legislative updates, so you can always be confident your form is up to date and compliant when getting a Rental Property With Mortgage from our website.

Obtaining a Rental Property With Mortgage is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the preferred format. If you are new to our website, follow the instructions below:

- Examine the template using the Preview feature or through the text outline to ensure it fits your needs.

- Browse for a different sample using the search function at the top of the page if necessary.

- Click Buy Now when you’ve found the right form and select a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Rental Property With Mortgage and download it.

All documents you find through US Legal Forms are reusable. To re-download and complete previously obtained forms, open the My Forms tab in your profile. Benefit from the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

You can deduct the interest charge on money you borrow to buy or improve your rental property. If you have interest expenses that relate to the construction or renovation period, go to Construction soft costs. You can also deduct interest charges you paid to tenants on rental deposits.

Only the interest portion of the mortgage is deductible, and the interest is only deductible in the original term of the loan. If a lump sum amount was paid to reduce the interest rate on a mortgage, only a pro-rated portion of that lump sum is deductible in the tax year it was paid.

Good news: you can claim mortgage interest or interest on money you borrowed to finance the purchase of your rental property or to improve it. Unfortunately, you can't claim a tax deduction for your mortgage principal. As for loan interest, deduct only the money you borrowed to cover soft costs.

Renting out your house without telling your mortgage lenders could jeopardize the agreement, leading to penalties in the form of costs and fees. If you find that the terms of your mortgage no longer meet your needs, homeowners are able to break or renegotiate their mortgage contract before the end of the term.

The CRA obtains information about rental income through various means, such as data matching with property records and information received from third parties, including banks and financial institutions. They may also conduct audits and investigations to ensure compliance with reporting requirements.