Rental Property For Sale

Description

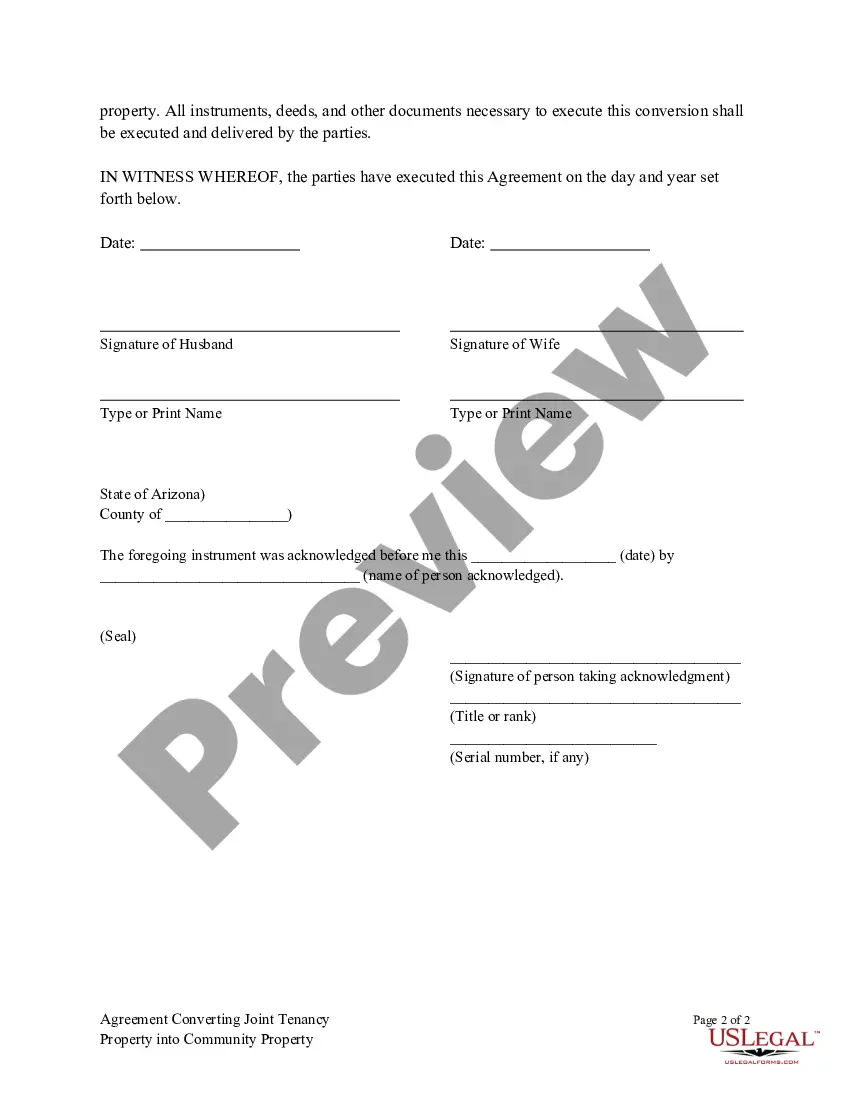

How to fill out Arizona Agreement Converting Joint Tenancy Property Into Community Property - Deed?

Dealing with legal documents and operations can be a time-consuming addition to the day. Rental Property For Sale and forms like it often need you to look for them and navigate the way to complete them properly. Therefore, regardless if you are taking care of economic, legal, or personal matters, having a extensive and hassle-free online catalogue of forms close at hand will go a long way.

US Legal Forms is the best online platform of legal templates, offering over 85,000 state-specific forms and a number of resources to help you complete your documents quickly. Explore the catalogue of pertinent documents open to you with just one click.

US Legal Forms gives you state- and county-specific forms offered at any time for downloading. Protect your papers management procedures by using a top-notch support that lets you put together any form within a few minutes without having additional or hidden charges. Simply log in in your profile, find Rental Property For Sale and acquire it immediately from the My Forms tab. You may also gain access to previously saved forms.

Would it be the first time using US Legal Forms? Sign up and set up your account in a few minutes and you’ll gain access to the form catalogue and Rental Property For Sale. Then, adhere to the steps listed below to complete your form:

- Be sure you have discovered the proper form using the Preview feature and looking at the form information.

- Select Buy Now when all set, and choose the monthly subscription plan that fits your needs.

- Press Download then complete, sign, and print the form.

US Legal Forms has twenty five years of expertise assisting users control their legal documents. Obtain the form you need today and streamline any process without having to break a sweat.

Form popularity

FAQ

If you sell a buy-to-let property for more than you bought it, you make a 'capital gain' ? and this may be subject to capital gains tax (CGT). However, in some circumstances you may be able to reduce the amount of CGT you have to pay.

Ways to reduce your CGT bill on buy-to-let property Make the most of your tax-free allowance. ... Consider joint ownership with a spouse. ... Deduct your costs. ... Set up a limited company. ... Check whether you're entitled to private residence relief or letting relief.

It should outline key information including your preferred tenancy start date, the rental amount you're prepared to pay, any requests for the property ? such as a professional clean to be carried out prior to the start of the tenancy ? any furniture you'd like provided or removed, and so on.

A few options to legally avoid paying capital gains tax on investment property include buying your property with a retirement account, converting the property from an investment property to a primary residence, utilizing tax harvesting, and using Section 1031 of the IRS code for deferring taxes.

The best approach, therefore, is to be as honest and open as you can. Let your tenant know as soon as possible that you are planning to sell. ... Offer them first refusal to buy the property. ... Be considerate about viewings and other visits. ... Offer a reduction in rent.