Arizona Wage Garnishment For Child Support

Description

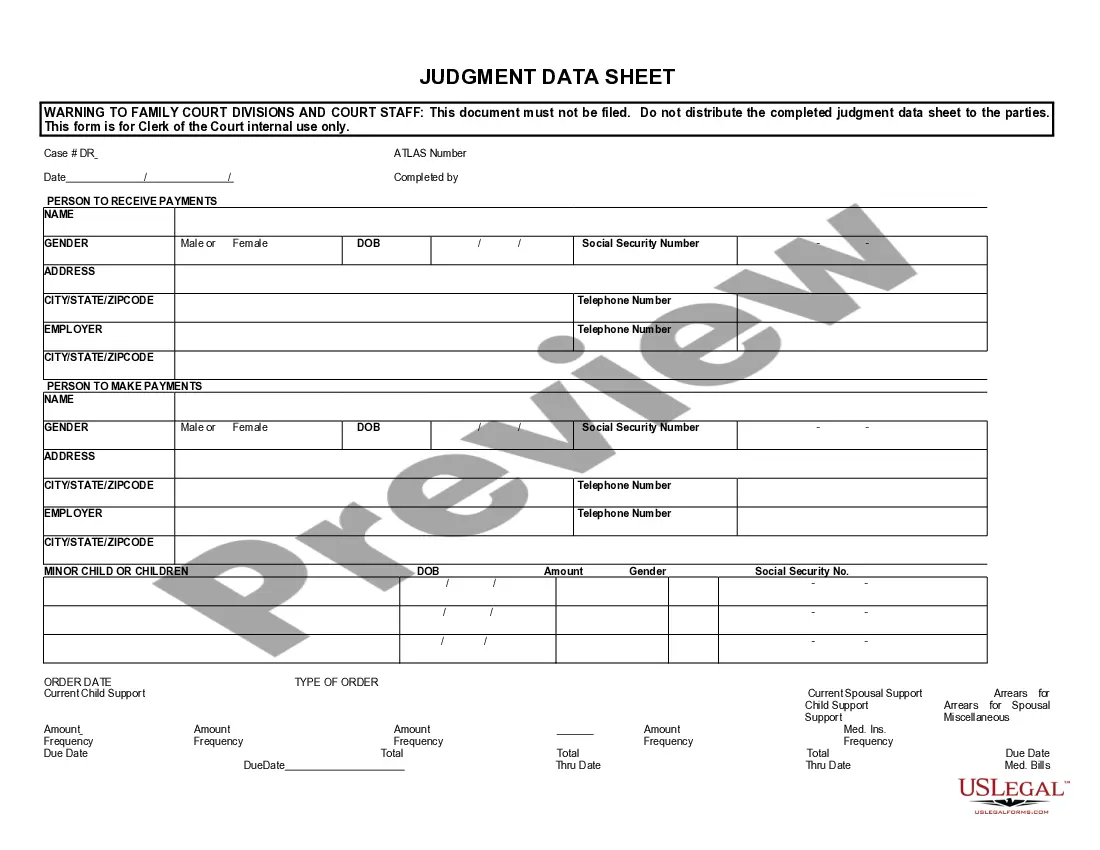

How to fill out Arizona Order To Stop Wage Assign.?

Bureaucracy demands meticulousness and exactness.

Unless you manage completing paperwork like Arizona Wage Garnishment For Child Support every day, it may result in certain misconceptions.

Choosing the appropriate sample from the outset will ensure that your document submission proceeds smoothly and avert any hassle of re-sending a file or completely redoing the same task from the beginning.

If you are not a registered user, locating the necessary sample will take a few additional steps: Find the template using the search bar. Ensure the Arizona Wage Garnishment For Child Support you have found is suitable for your state or district. Review the preview or peruse the description that contains the details concerning the use of the template. If the result meets your requirements, click the Buy Now button. Select the right option from the available subscription plans. Log In to your account or create a new one. Finalize the purchase using a credit card or PayPal account. Download the form in your preferred file format. Finding the appropriate and updated samples for your paperwork takes just a few minutes with a US Legal Forms account. Sidestep the bureaucracy issues and enhance your efficiency with forms.

- Acquire the correct sample for your records at US Legal Forms.

- US Legal Forms stands as the largest online repository of forms that presents more than 85 thousand templates across various fields.

- You can discover the latest and most pertinent version of the Arizona Wage Garnishment For Child Support by merely searching on the platform.

- Retrieve, save, and download templates in your account or refer to the description to confirm you have the correct one at your disposal.

- With a US Legal Forms account, you can effortlessly amass, keep in one location, and navigate the templates you save for quick access.

- While on the website, click the Log In button to Log In.

- Next, head to the My documents page, where your document history is maintained.

- Examine the description of the forms and download the ones required at any time.

Form popularity

FAQ

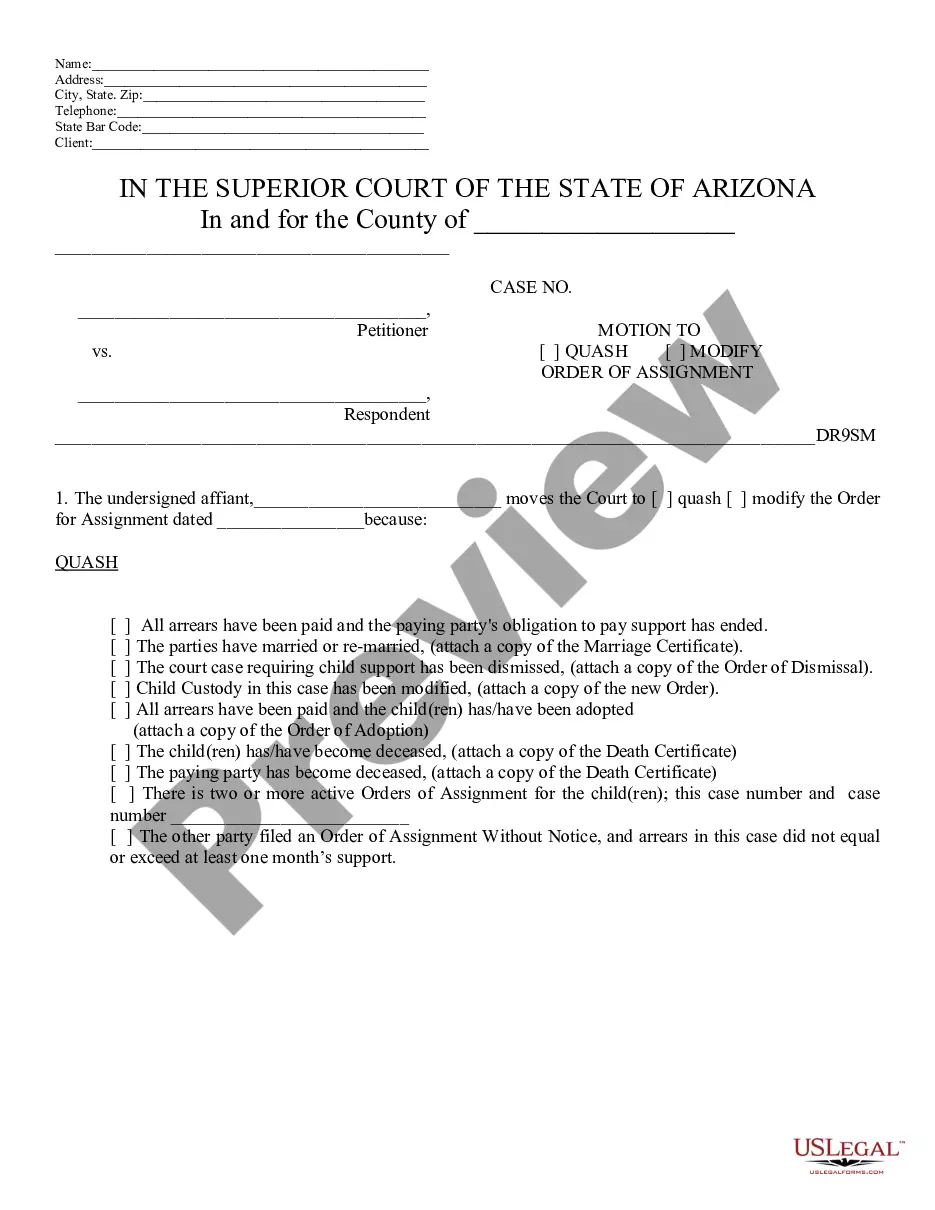

In Arizona, child support cannot be garnished without a court order. The child support enforcement agency must obtain a court's approval before initiating wage garnishment for any unpaid dues. By engaging with USLegalForms, you can find the necessary forms and instructions to seek the proper court order, ensuring that the garnishment process is handled legally and correctly.

The new garnishment law in Arizona has introduced changes aimed at making the process more transparent and efficient for parents involved in child support cases. One significant aspect is the requirement for employers to respond promptly to garnishment orders, ensuring that payments are collected quickly and accurately. Staying informed about these changes is important, and using resources like USLegalForms can help you navigate the adjustments smoothly, ensuring your rights are protected.

In Arizona, wage garnishment for child support operates under specific rules designed to protect both the recipient and the payer. The law strictly outlines the percentage of income that can be garnished, which typically should not exceed 50% of a parent's disposable income if they are supporting a second family. For detailed information and guidance, USLegalForms offers resources that simplify understanding these regulations, making compliance easier for everyone involved.

To stop child support garnishment in Arizona, you must file a motion with the court that issued the garnishment order. This motion should include valid reasons for your request, such as changes in your financial situation or proof of having fulfilled your support obligations. You may also consider seeking assistance through platforms like USLegalForms to guide you through the process efficiently. Remember, timely action is crucial to prevent ongoing deductions from your wages.

In Arizona, child support can take up to 50% of your disposable income from your paycheck for current child support obligations. This amount can rise to 60% if you are also responsible for past due payments. Recognizing how Arizona wage garnishment for child support operates allows you to plan your budget effectively and comply with the legal requirements.

Yes, Arizona does garnish wages for child support to ensure timely payments for children. The garnishment process occurs through the courts, where legal orders define how much is withheld from your paycheck. Knowing how Arizona wage garnishment for child support works can help you navigate the implications of such orders and ensure compliance while managing your finances.

Arizona can take up to 50% of your disposable earnings for child support obligations. However, if you have arrears, the state may increase this to as much as 60%. Understanding Arizona wage garnishment for child support falls under legal provisions aimed at ensuring that children receive the support they need while also protecting the payer from undue hardship.

The maximum child support withholding in Arizona adheres to federal guidelines, allowing up to 50% of disposable earnings for current support obligation. If you're also paying arrears, this amount could increase, allowing a maximum of 60% to be withheld. By understanding Arizona wage garnishment for child support, you can plan your finances better while fulfilling your obligations.

The new garnishment rules in Arizona clarify how courts handle wage garnishment for child support. Under these rules, the process aims to ensure that child support payments are collected efficiently while balancing the needs of the payer. Arizona wage garnishment for child support must comply with federal guidelines, which protect a portion of the income from garnishment, ensuring that the payer can still meet their basic living expenses.

Minnesota law on child support outlines how payments are calculated based on income and needs of the child. This law helps prioritize the child's financial welfare while ensuring both parents share the responsibility. Similar to Arizona, failing to meet child support obligations can result in wage garnishments. For a clearer understanding of child support across states, you might turn to platforms like UsLegalForms for comprehensive assistance.