Arizona Occupancy Withholding

Description

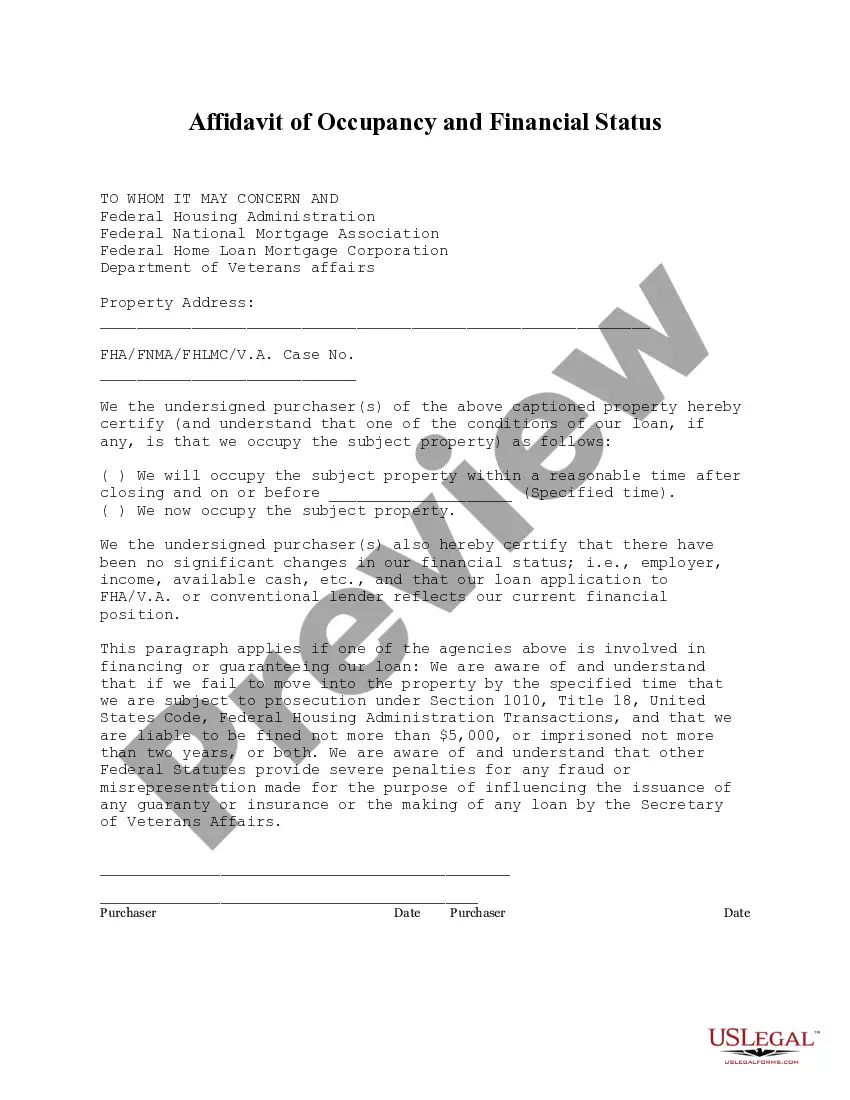

How to fill out Arizona Affidavit Of Occupancy And Financial Status?

Creating legal documents from the beginning can occasionally be intimidating.

Certain situations may require extensive research and significant financial investment.

If you're looking for a more straightforward and economical method to generate Arizona Occupancy Withholding or any other forms without unnecessary complications, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal templates encompasses nearly every facet of your financial, legal, and personal matters.

However, before proceeding directly to downloading the Arizona Occupancy Withholding, consider these suggestions: Review the document preview and descriptions to confirm that you have discovered the form you need. Verify if the form you choose adheres to the standards of your state and county. Select the appropriate subscription option to acquire the Arizona Occupancy Withholding. Download the form, then complete, sign, and print it. US Legal Forms has an impeccable reputation and over 25 years of expertise. Join us now and make document processing a simple and efficient task!

- With just a few clicks, you can swiftly access state- and county-compliant documents meticulously crafted for you by our legal professionals.

- Utilize our platform whenever you require trusted and dependable services through which you can effortlessly locate and obtain the Arizona Occupancy Withholding.

- If you’re familiar with our website and have previously registered an account with us, simply Log In to your account, find the template, and download it or re-download it anytime later in the My documents section.

- Don't have an account? No problem.

- It takes little time to sign up and browse the catalog.

Form popularity

FAQ

The primary form used for state tax withholding in Arizona is the Form A-4. This form allows employees to specify their withholding preferences and ensures that the correct amount of state income tax is deducted from their paychecks. For convenience, you can access this form through US Legal Forms, which offers an array of legal documents and guidance tailored to your needs.

Yes, Arizona has state withholding for income tax. Employers are required to withhold a certain percentage from employees' wages to cover state income tax obligations. To ensure compliance and ease of use, consider utilizing resources like US Legal Forms, which help you understand the requirements and provide the necessary forms.

On your Arizona tax withholding form, you should include your personal information, such as your name, address, and Social Security number. Additionally, indicate the number of allowances you wish to claim, as this will influence the withholding amount. If you need assistance with this process, platforms like US Legal Forms can provide valuable templates and instructions to ensure accuracy.

A 4 withholding in Arizona refers to the amount of state income tax withheld from an employee's paycheck as specified on the Arizona Form A-4. This form allows employees to claim allowances, which can reduce their taxable income and affect how much tax is withheld. Understanding this process is vital to managing your finances effectively, and resources like US Legal Forms can assist you in navigating these forms.

Yes, Arizona does have a state withholding form, specifically the Form A-4. This form is crucial for employees to indicate their withholding preferences and ensure the correct amount is deducted for state income tax. Utilizing US Legal Forms can simplify the process, providing easy access to the form and guidance on how to fill it out correctly.

For Arizona occupancy withholding, you typically use the Arizona Form A-4. This form allows employers to calculate the correct amount of state income tax to withhold from their employees' wages. You can easily find this form on the Arizona Department of Revenue's website or through platforms like US Legal Forms, which offer user-friendly access to essential tax documents.

The primary form used for withholding in Arizona is the Arizona Employee's Withholding Percentage Election Form. This form allows employees to select their desired withholding percentage and provides essential information for employers. Completing this form accurately ensures that your withholding aligns with state tax requirements. For a streamlined experience, consider using US Legal Forms, which offers easy access to the required forms for Arizona occupancy withholding.

Electing an Arizona withholding percentage of zero means that no state income tax will be withheld from your paycheck. This option is typically chosen by individuals who expect to owe no state tax due to deductions or other factors. However, it is crucial to ensure that this election aligns with your tax situation to avoid a tax bill at the end of the year. For guidance on making this election correctly, US Legal Forms can assist you with the necessary forms and information regarding Arizona occupancy withholding.

Determining your Arizona withholding percentage involves reviewing your income and the guidelines set by the Arizona Department of Revenue. You can use the state's tax tables or online calculators to estimate the appropriate percentage based on your earnings. Additionally, consider your personal and financial circumstances, as these factors can influence your withholding needs. For further clarity, US Legal Forms provides tools and forms that simplify understanding Arizona occupancy withholding.

To select a tax withholding election in Arizona, you need to fill out the appropriate form provided by the Arizona Department of Revenue. This form will allow you to choose your desired withholding rate based on your income and financial situation. It's important to review your options carefully, as your election will affect your tax obligations throughout the year. If you need assistance, US Legal Forms offers resources to help you navigate the Arizona occupancy withholding process.