Lease Agreement With Tenant Improvements

Description

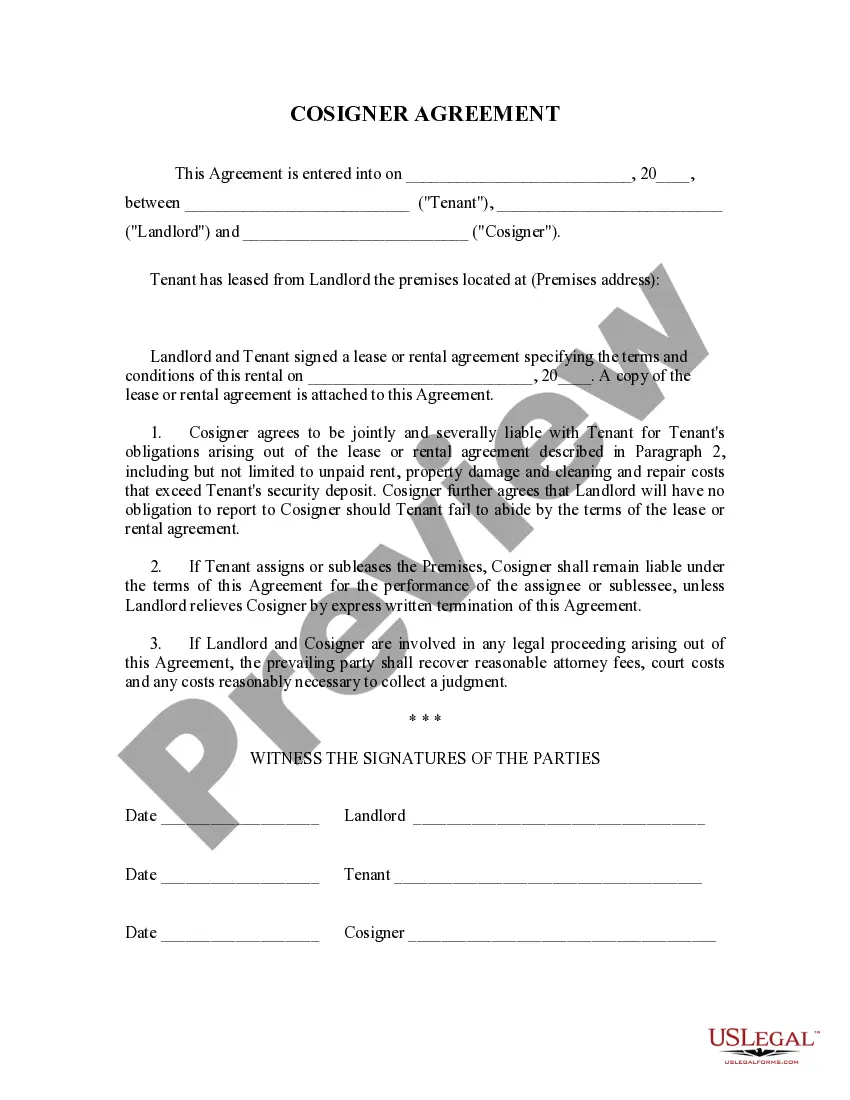

How to fill out Arizona Landlord Tenant Lease Co-Signer Agreement?

There’s no longer a need to spend time searching for legal documents to fulfill your local state obligations.

US Legal Forms has compiled all of them in one location and made their retrieval easier.

Our site provides over 85k templates for various personal and business legal matters organized by state and area of application.

Use the Search bar above to find another template if the current one does not meet your needs. Click Buy Now next to the template title once you identify the right one. Select your preferred subscription plan and register for an account or Log In. Complete your subscription payment with a card or via PayPal to proceed. Choose the file format for your Lease Agreement With Tenant Improvements and download it to your device. Print your form to fill it out manually or upload the template if you prefer to use an online editor. Drafting legal documents in accordance with federal and state regulations is fast and easy with our platform. Experience US Legal Forms today to keep your records organized!

- All forms are expertly created and validated for compliance, ensuring you receive an up-to-date Lease Agreement With Tenant Improvements.

- If you are acquainted with our services and already possess an account, verify that your subscription is active prior to acquiring any templates.

- Log In to your account, select the document, and click Download.

- You can also access any saved documents at any time by opening the My documents tab in your profile.

- If you have not used our service previously, the procedure will require a few additional steps to complete.

- Here’s how new users can find the Lease Agreement With Tenant Improvements in our catalog.

- Carefully review the page content to confirm it contains the template you require.

- To do this, utilize the form description and preview options if available.

Form popularity

FAQ

The cost of leasehold improvements over the capitalization threshold of $50k should be capitalized. Examples of costs that would be included as parts of a leasehold improvement include: Interior partitions made up of drywall, glass and metal. Miscellaneous millwork, carpentry, lumber, metals, steel, and paint.

The cash allowance for tenant improvements would be treated as a lease acquisition cost to the landlord, who would amortize this cost, along with other lease acquisition costs, ratably over the term of the lease.

What isn't included in operating expenses? Operating expenses should not include debt service, CAPEX, property marketing costs, capital reserves for future large repair projects, leasing commissions or tenant improvements allowances.

If the landlord makes tenant improvements, the capital expenditure is recorded as an asset on the landlord's balance sheet. Then the expense is recorded on the landlord's income statements using depreciation over the useful life of the asset.

As discussed above, a tenant improvement allowance is recorded as a liability which is amortized (as a reduction to rent expense) over the life of the lease.