Arizona Deed Beneficiary With The Inheritance Payment

Description

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Two Individuals?

It’s no secret that you can’t become a legal expert overnight, nor can you learn how to quickly draft Arizona Deed Beneficiary With The Inheritance Payment without the need of a specialized background. Putting together legal documents is a long process requiring a particular education and skills. So why not leave the preparation of the Arizona Deed Beneficiary With The Inheritance Payment to the professionals?

With US Legal Forms, one of the most comprehensive legal template libraries, you can find anything from court documents to templates for internal corporate communication. We understand how important compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all templates are location specific and up to date.

Here’s how you can get started with our platform and get the form you need in mere minutes:

- Find the form you need with the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to figure out whether Arizona Deed Beneficiary With The Inheritance Payment is what you’re searching for.

- Begin your search over if you need any other form.

- Set up a free account and choose a subscription plan to purchase the template.

- Choose Buy now. Once the transaction is through, you can download the Arizona Deed Beneficiary With The Inheritance Payment, fill it out, print it, and send or send it by post to the designated individuals or organizations.

You can re-access your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your paperwork-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

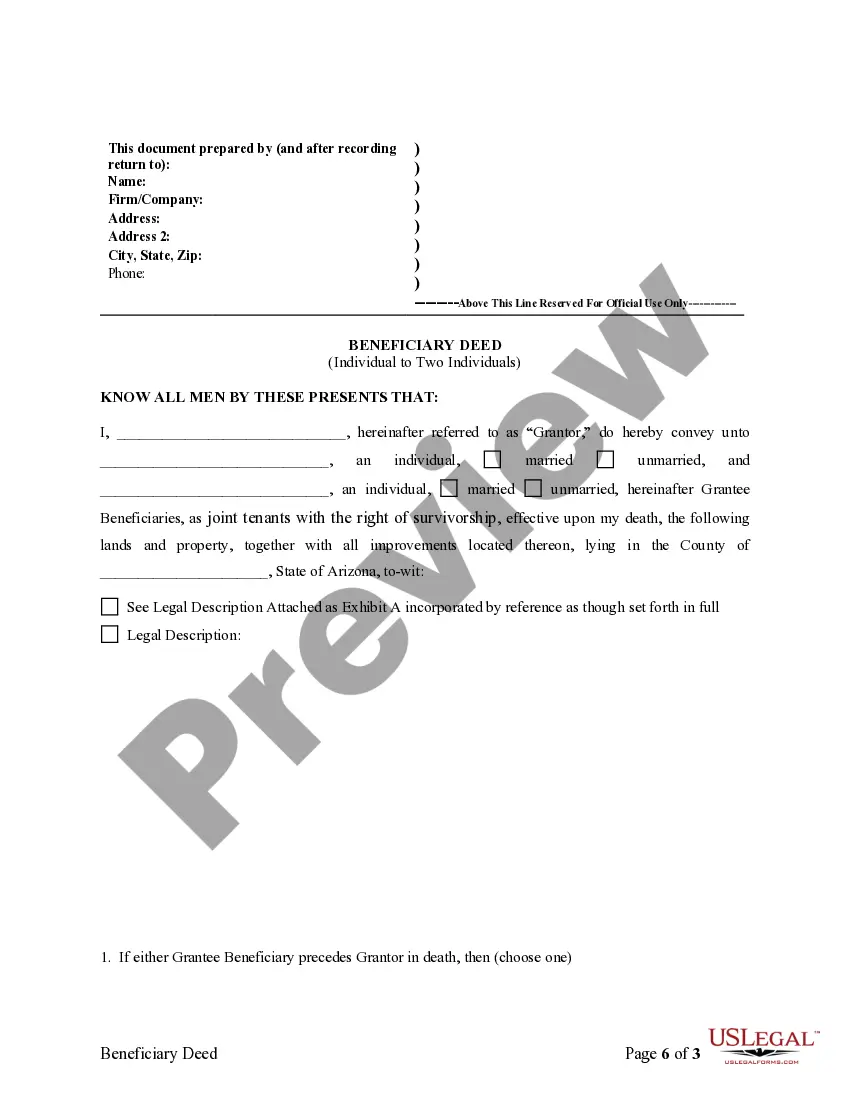

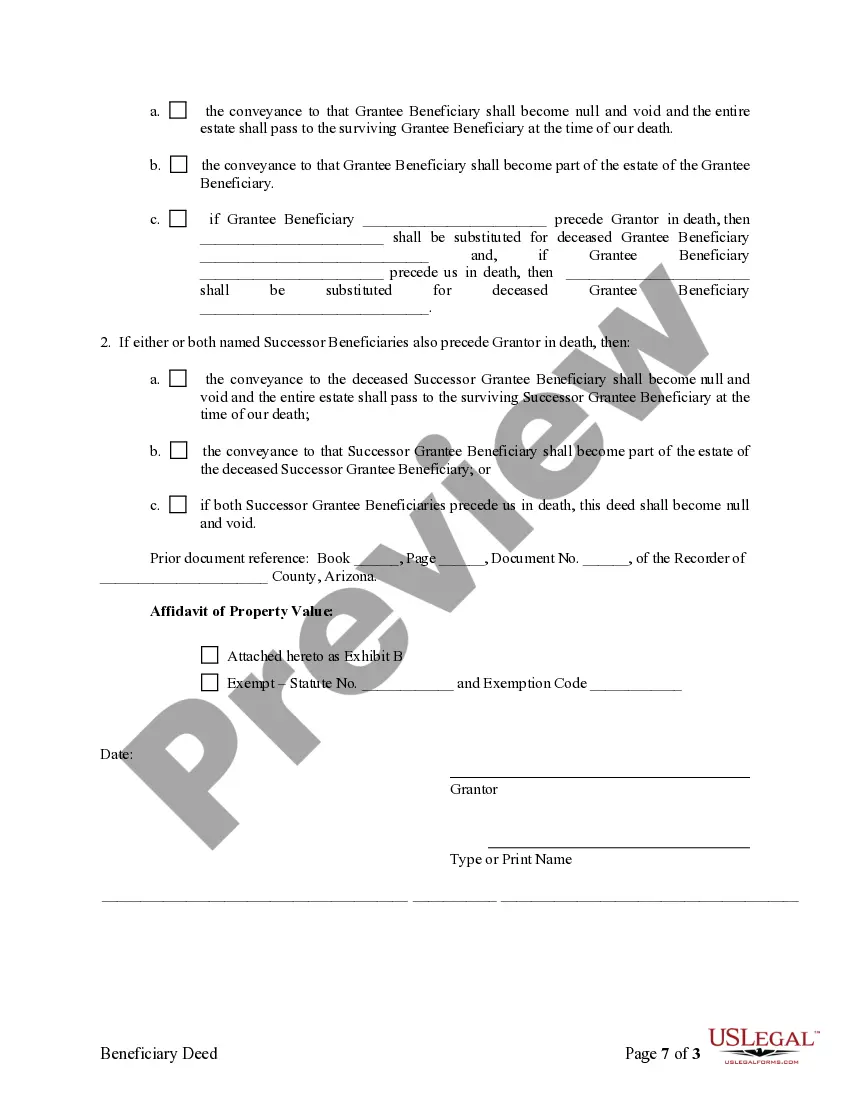

You must sign the deed and get your signature notarized, and then record (file) the deed with the recorder's office before your death. Otherwise, it won't be valid. You can make an Arizona beneficiary deed with WillMaker.

In the event that your mother recorded the beneficiary deed, the home likely became yours immediately upon her death, and it should not be subject to the terms of her will.

An Arizona Beneficiary Deed is much simpler than creating and administering a trust. In addition, the owner retains complete control over the property with an Arizona Beneficiary Deed. No gift tax liability. Since an Arizona Beneficiary Deed does not transfer property as a ?gift,? it is not subject to gift taxes.

An Arizona beneficiary deed, referred to as a transfer on death deed in other states, is a legal document used to transfer real property to descendants outside of probate proceedings. For this deed to be valid in Arizona, it must be signed before a notary and recorded with the respective county recorder's office.

Arizona Beneficiary Deed Example 3 A Beneficiary Deed must also be properly recorded before the death of the owner or the last surviving owner. Example 3: John & Mary are married and own their home as community property with right of survivorship.