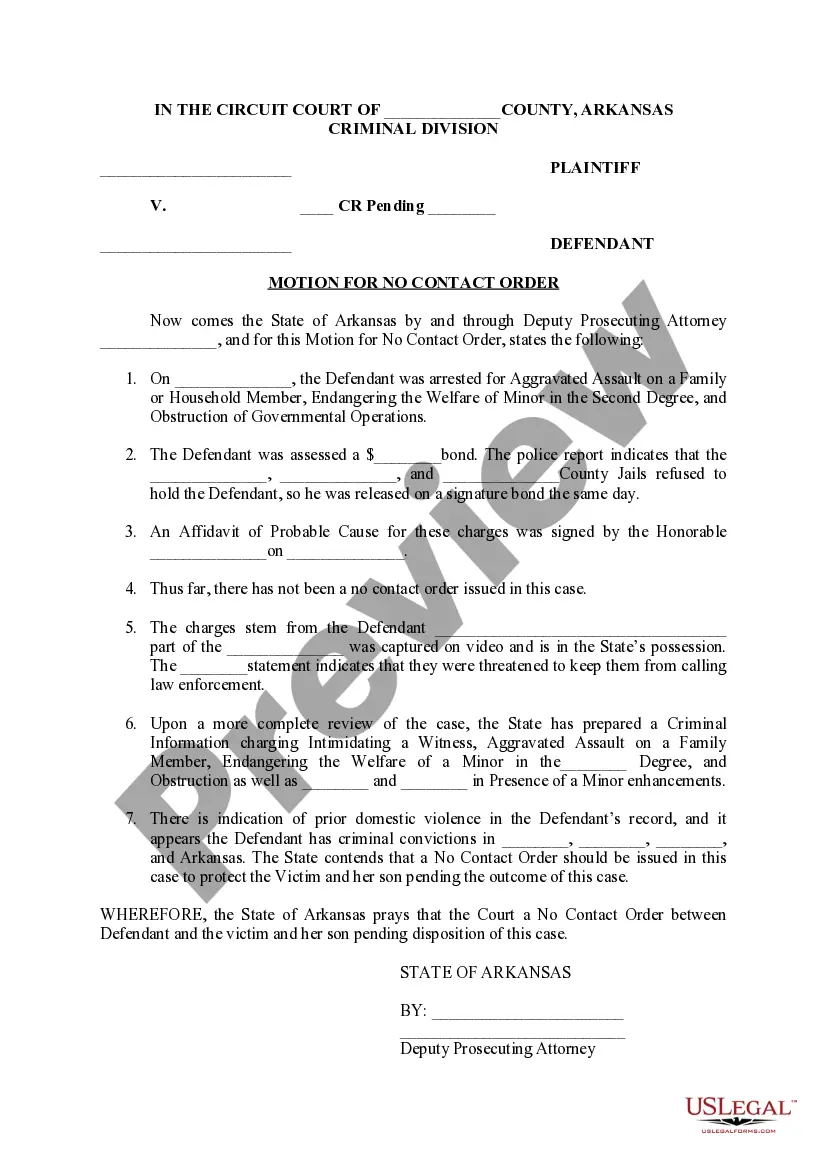

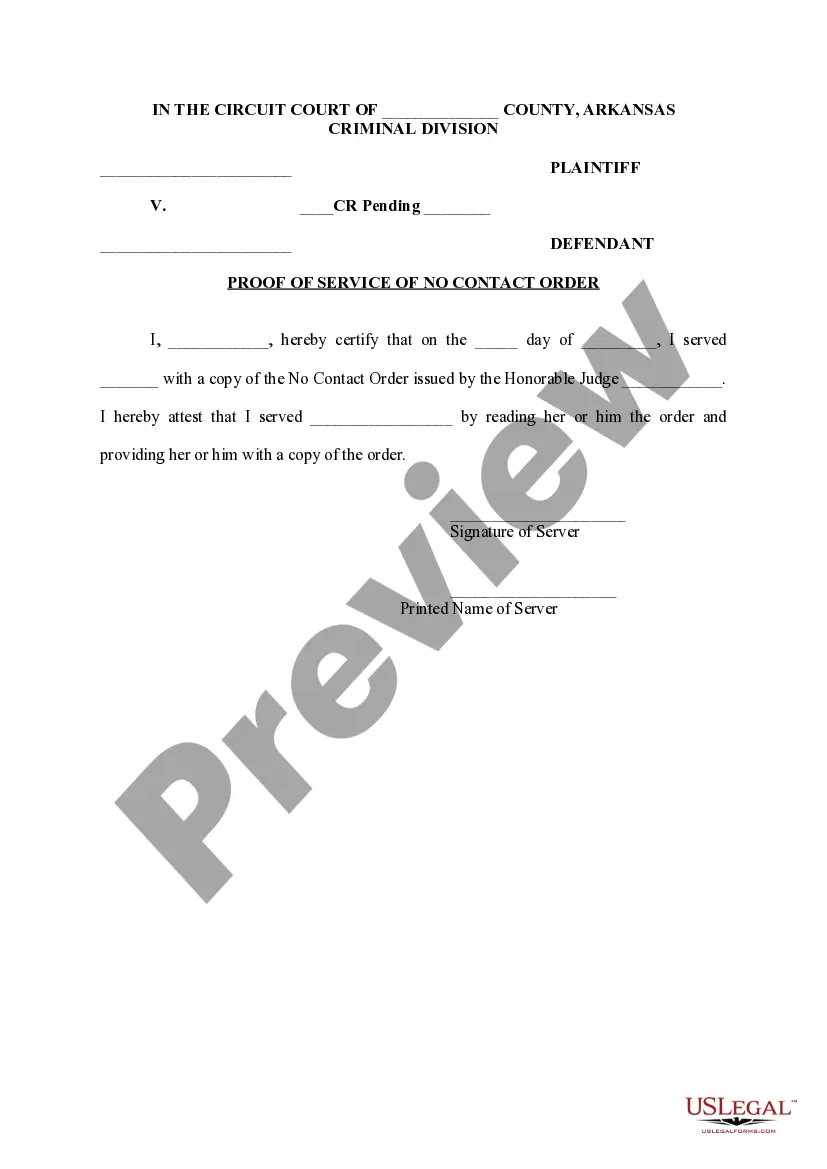

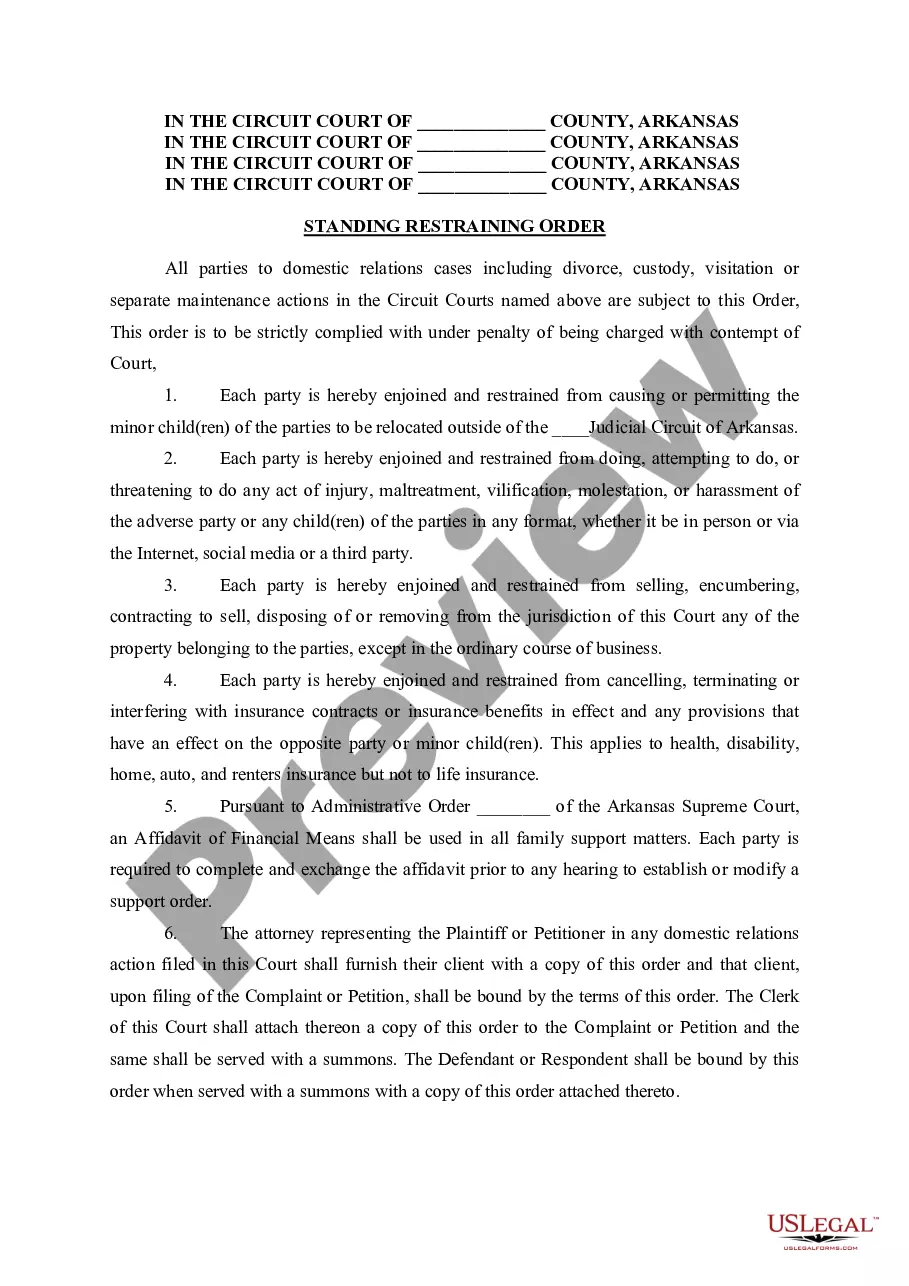

No Contact Order Rules Arkansas With Victim

Description

How to fill out Arkansas No Contact Order?

It’s evident that you cannot transform into a legal expert instantly, nor can you discover how to swiftly prepare No Contact Order Rules Arkansas With Victim without possessing a specialized skill set.

Creating legal documents is a lengthy process necessitating specific training and expertise. So why not entrust the creation of the No Contact Order Rules Arkansas With Victim to the professionals.

With US Legal Forms, one of the most comprehensive legal document collections, you can find anything from court filings to templates for office communication.

You can regain access to your documents from the My documents tab whenever required. If you are an existing customer, you can simply Log In, and locate and download the template from the same tab.

Regardless of the purpose of your documentation-whether it pertains to financial, legal, or personal matters-our website has everything you need. Explore US Legal Forms today!

- Identify the form you need by utilizing the search bar located at the top of the page.

- Preview it (if this option is available) and review the accompanying description to verify if No Contact Order Rules Arkansas With Victim is what you seek.

- Restart your search if a different template is needed.

- Sign up for a complimentary account and select a subscription plan to purchase the form.

- Click Buy now. Once the payment is processed, you can acquire the No Contact Order Rules Arkansas With Victim, complete it, print it, and send or mail it to the appropriate individuals or organizations.

Form popularity

FAQ

Yes, a victim can get in trouble for violating a no contact order, even in California. If a victim initiates contact against the order, legal repercussions could follow, including fines and other penalties. It's vital to understand the no contact order rules in Arkansas with victim as well as any relevant laws in your state to stay informed and avoid legal trouble.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

Do you need to notarize a Loan Agreement? First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

Typical personal loan documentation requirements Proof of your identity. First and foremost, you have to prove to lenders that you are who you say you are. ... Proof of address. ... Proof of income. ... Recurring monthly expenses. ... Your credit score. ... Your purpose for the personal loan.