Starting An Llc In Arkansas For A Business

Description

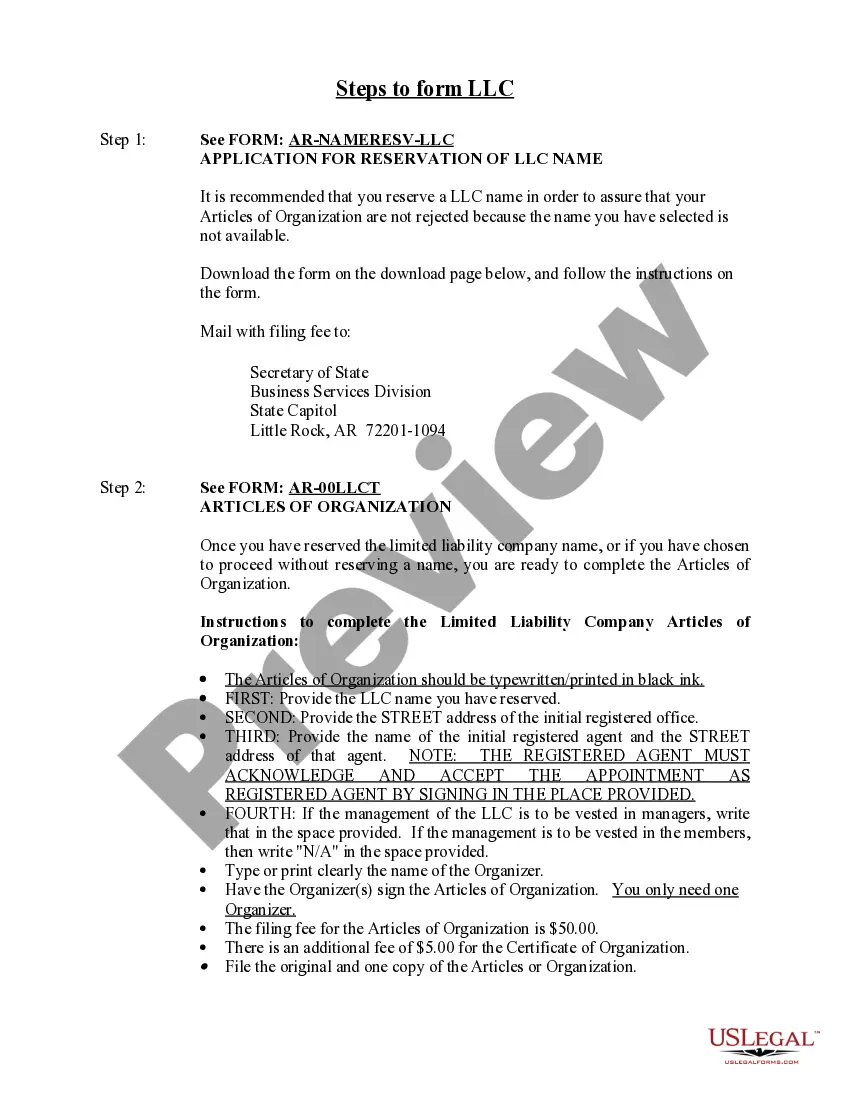

How to fill out Arkansas Limited Liability Company LLC Formation Package?

Handling legal paperwork can be exasperating, even for the most experienced experts.

When searching for Starting An Llc In Arkansas For A Business and lacking the time to invest in locating the appropriate and current version, the tasks can become overwhelming.

Leverage sophisticated tools to complete and manage your Starting An Llc In Arkansas For A Business.

Tap into a valuable resource pool of articles, guides, and documentation pertinent to your needs and situation.

Confirm it’s the correct form by previewing and reviewing its particulars.

- Save effort and time scouring for the forms you require, and utilize US Legal Forms’ enhanced search and Review feature to locate Starting An Llc In Arkansas For A Business and acquire it.

- If you're an existing member, Log In to your US Legal Forms account, search for the form, and obtain it.

- Explore the My documents tab to see the documents you previously downloaded and manage your folders as needed.

- If it’s your first encounter with US Legal Forms, create an account for unlimited access to all platform benefits.

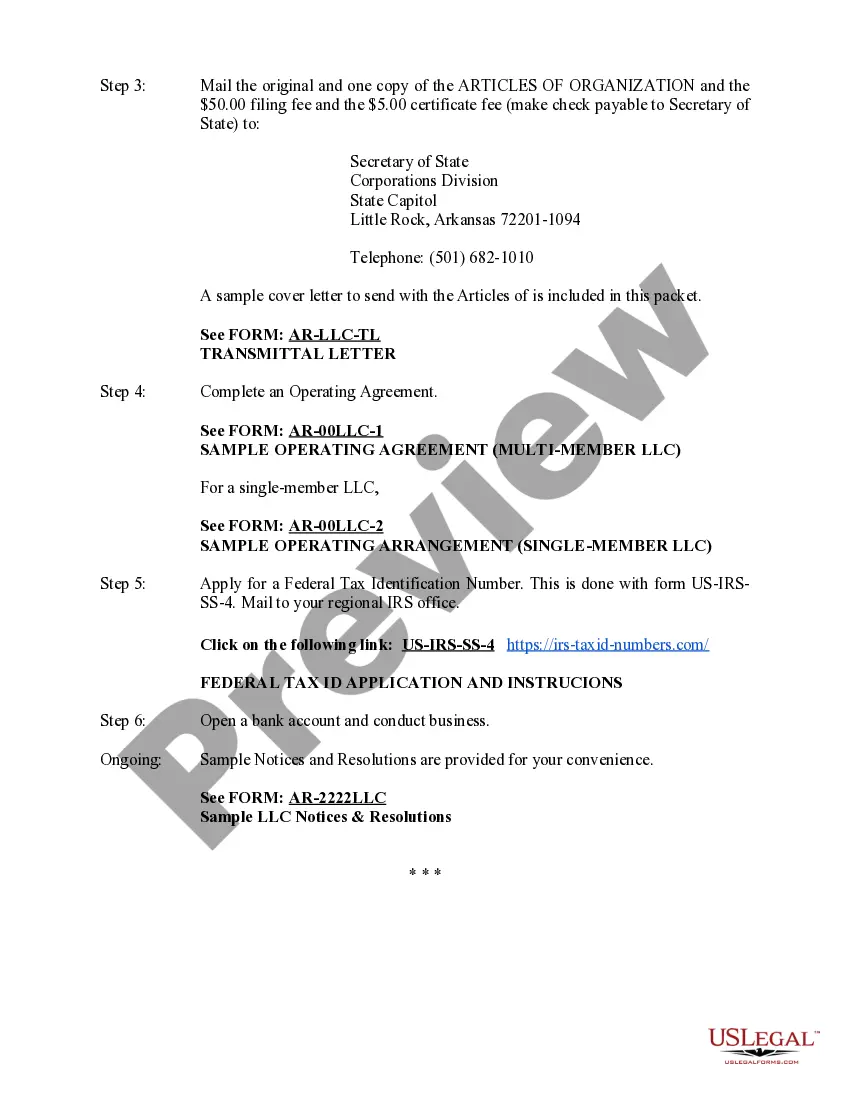

- Here are the steps to follow after acquiring the form you need.

- Employ a comprehensive web document library that could transform the way you manage these challenges.

- US Legal Forms stands as a frontrunner in online legal documents, featuring over 85,000 state-specific legal templates available at your convenience.

- Access localized legal and corporate forms, catering to any requirements you might have, from personal to business paperwork, all in one location.

Form popularity

FAQ

Arkansas LLC Cost. Arkansas charges a $45 state fee to form an LLC ($50 by mail). You'll also need to pay $150 every year to file a franchise tax report, and you may have to pay for additional services for your LLC?such as filing a DBA or hiring a professional registered agent.

In addition to the general asset protection and income tax advantages, Arkansas offers some unique incentives to open and run your business in their state. For example, Arkansas offers tax credits for new businesses.

Starting an LLC in Arkansas will include the following steps: #1: Choose a Name for Your Arkansas LLC. #2: Hire a Registered Agent in Arkansas. #3: Request a Federal Employer Identification Number (EIN) #4: File Your Certificate of Organization. #5: Create an Operating Agreement. #6: Fulfill Your Ongoing Obligations.

Arkansas Naming Requirements Your name must include the phrase "limited liability company," "limited company," or the abbreviation "L.L.C.", "LLC", "L.C." or "LC" in uppercase or lowercase letters.

The individual member should report the single member LLC's income and deductions on a Federal Schedule C included with their individual income tax return. All resident and non-resident partners, including corporations, must report and pay taxes on any income derived from an Arkansas partnership.