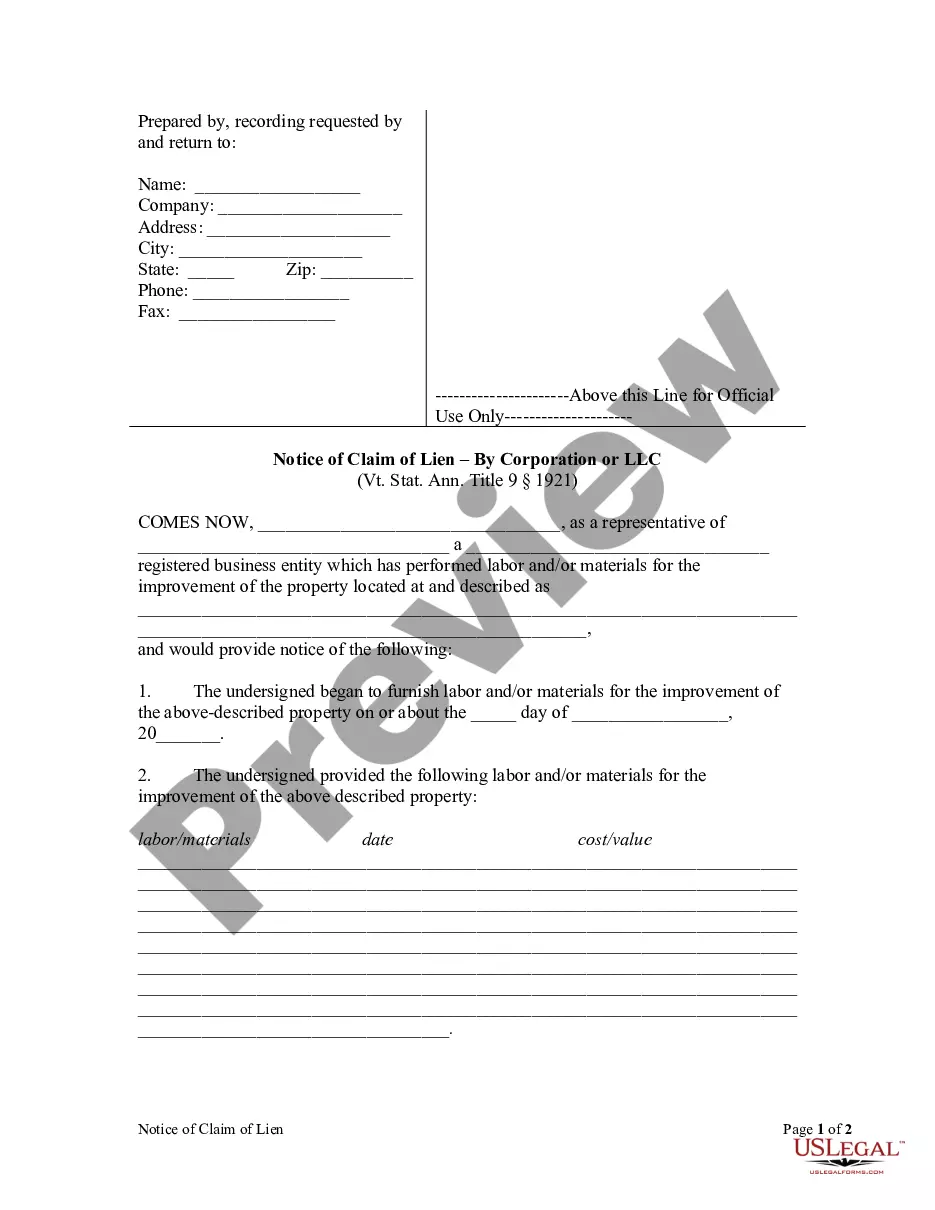

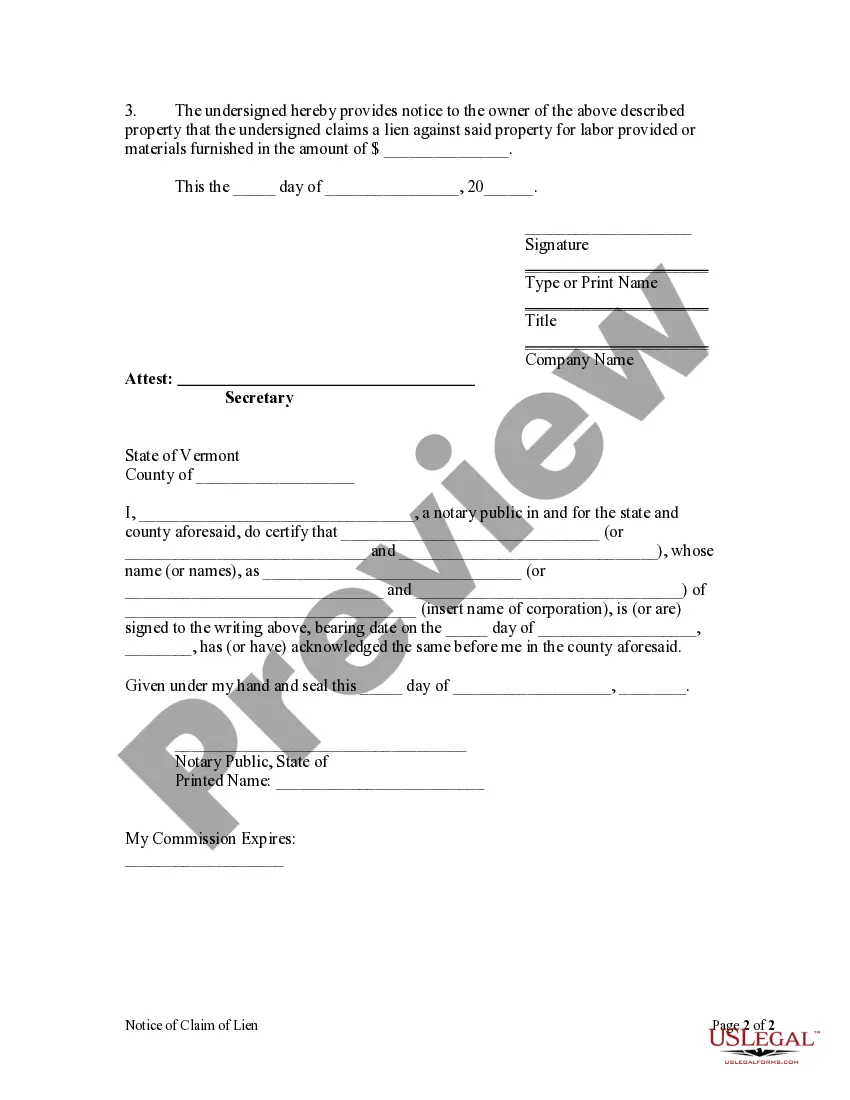

A person claiming a lien under section 1921 shall file for record in the clerk's office of the town where such real estate is situated, a written memorandum, signed by him, asserting his claim, which shall charge such real estate with such lien as of the visible commencement of work or delivery of material to the extent and subject to the exceptions provided in sections 1921 and 1922.

Vermont Notice of Lien by Corporation

Description

How to fill out Vermont Notice Of Lien By Corporation?

Searching for a Vermont Notice of Lien by Corporation or LLC online might be stressful. All too often, you find files which you believe are ok to use, but discover afterwards they are not. US Legal Forms offers over 85,000 state-specific legal and tax forms drafted by professional lawyers in accordance with state requirements. Get any document you are looking for quickly, hassle free.

If you already have the US Legal Forms subscription, just log in and download the sample. It will instantly be added in to the My Forms section. In case you don’t have an account, you need to sign up and select a subscription plan first.

Follow the step-by-step guidelines listed below to download Vermont Notice of Lien by Corporation or LLC from the website:

- Read the form description and click Preview (if available) to check whether the form meets your expectations or not.

- If the form is not what you need, find others with the help of Search field or the provided recommendations.

- If it is right, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay via credit card or PayPal and download the template in a preferable format.

- After downloading it, you may fill it out, sign and print it.

Obtain access to 85,000 legal templates straight from our US Legal Forms catalogue. In addition to professionally drafted templates, users may also be supported with step-by-step guidelines regarding how to find, download, and complete forms.

Form popularity

FAQ

The short answer to that question is usually no. If somebody owes you money you could sue them, you could obtain a judgment, you can obtain what's called a "judgment lien" and once you get the judgment lien, you can have the court record that against their property including the real estate.

Choose a Name for Your LLC. Appoint a Registered Agent. File Articles of Organization. Prepare an Operating Agreement. Comply With Other Tax and Regulatory Requirements. File Vermont Annual Reports. Foreign LLCs Doing Business in Vermont.

In Vermont, a Notice of Mechanics Lien must be filed with the clerk of the town in which the property is located no later than 180 days from the date on which payment became due for the last labor and/or materials furnished to the project.

When you form a corporation or LLC, you need to pay a one-time filing fee to the state's secretary of state office. Arkansas, Colorado, Hawaii, Iowa, Oklahoma and Mississippi all boast the lowest corporation formation fee at $50. It costs $310 to incorporate in Texas.

To form an LLC by yourself, you need to reserve a business name, appoint a registered agent, file the Articles of Organization, obtain an Employer Identification Number, and open a business bank account. The time and money you need to file an LLC yourself depend on the state where you are filing.

There, a construction lien on a commercial project must be filed with a county clerk within 90 days of the last day services or materials were provided. Filing a construction lien on residential projects requires filing a Notice of Unpaid Balance and Right to File Lien within 90 days of the last day of service.

While it's unlikely that just anyone can put a lien on your home or land, it's not unheard of for a court decision or a settlement to result in a lien being placed against a property.

No, you do not need an attorney to form an LLC. You can prepare the legal paperwork and file it yourself, or use a professional business formation service, such as .In all states, only one person is needed to form an LLC.

STEP 1: Name Your Vermont LLC. STEP 2: Choose a Registered Agent in Vermont. STEP 3: File the Vermont LLC Articles of Organization. STEP 4: Create a Vermont LLC Operating Agreement. STEP 5: Get a Vermont LLC EIN.