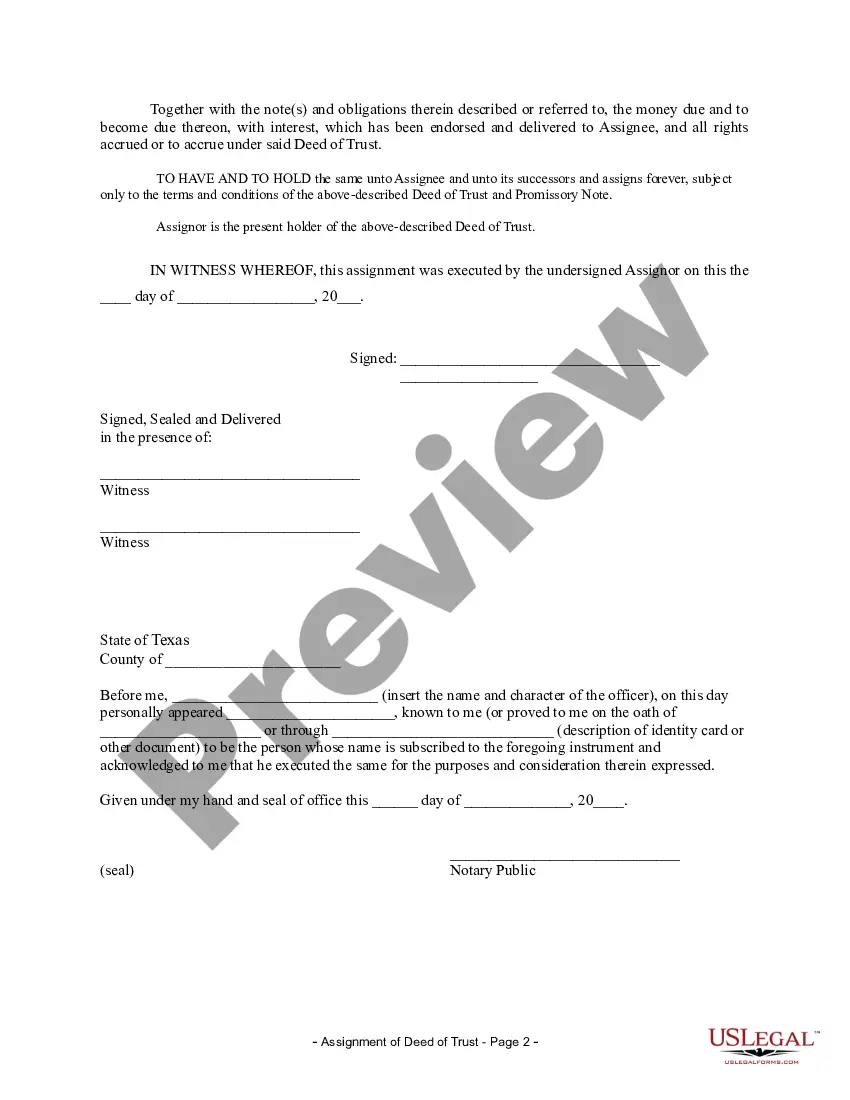

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Texas Assignment of Deed of Trust by Individual Mortgage Holder

Description

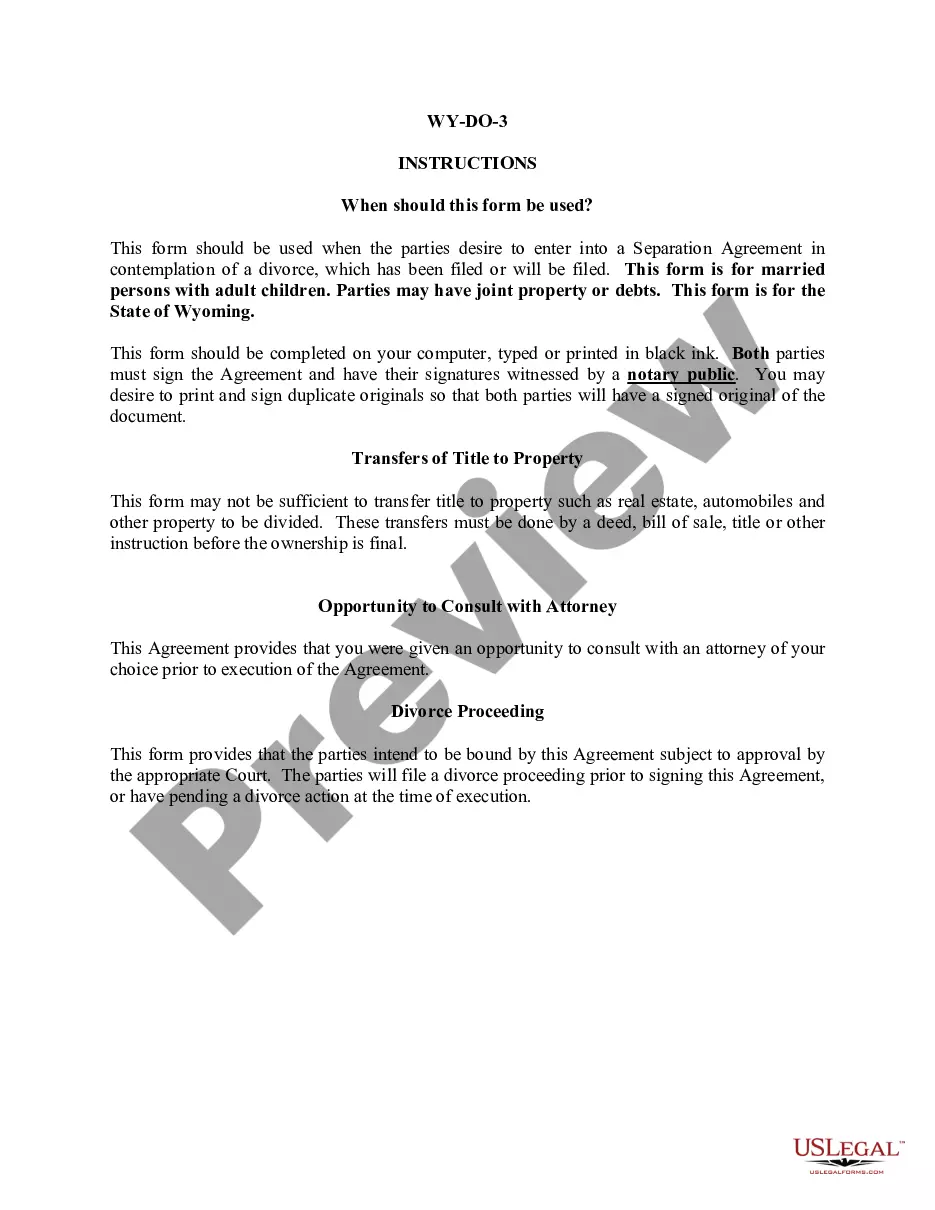

How to fill out Texas Assignment Of Deed Of Trust By Individual Mortgage Holder?

Access to quality Texas Assignment of Deed of Trust by Individual Mortgage Holder templates online with US Legal Forms. Avoid hours of wasted time searching the internet and dropped money on documents that aren’t updated. US Legal Forms offers you a solution to just that. Find around 85,000 state-specific authorized and tax samples you can download and submit in clicks within the Forms library.

To get the sample, log in to your account and then click Download. The file will be stored in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, check out our how-guide listed below to make getting started simpler:

- Verify that the Texas Assignment of Deed of Trust by Individual Mortgage Holder you’re looking at is appropriate for your state.

- See the sample using the Preview function and browse its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to go on to sign up.

- Pay out by card or PayPal to complete making an account.

- Choose a favored format to save the file (.pdf or .docx).

Now you can open the Texas Assignment of Deed of Trust by Individual Mortgage Holder sample and fill it out online or print it out and do it by hand. Think about giving the file to your legal counsel to make sure things are filled in appropriately. If you make a mistake, print and fill application again (once you’ve made an account every document you save is reusable). Create your US Legal Forms account now and access more forms.

Form popularity

FAQ

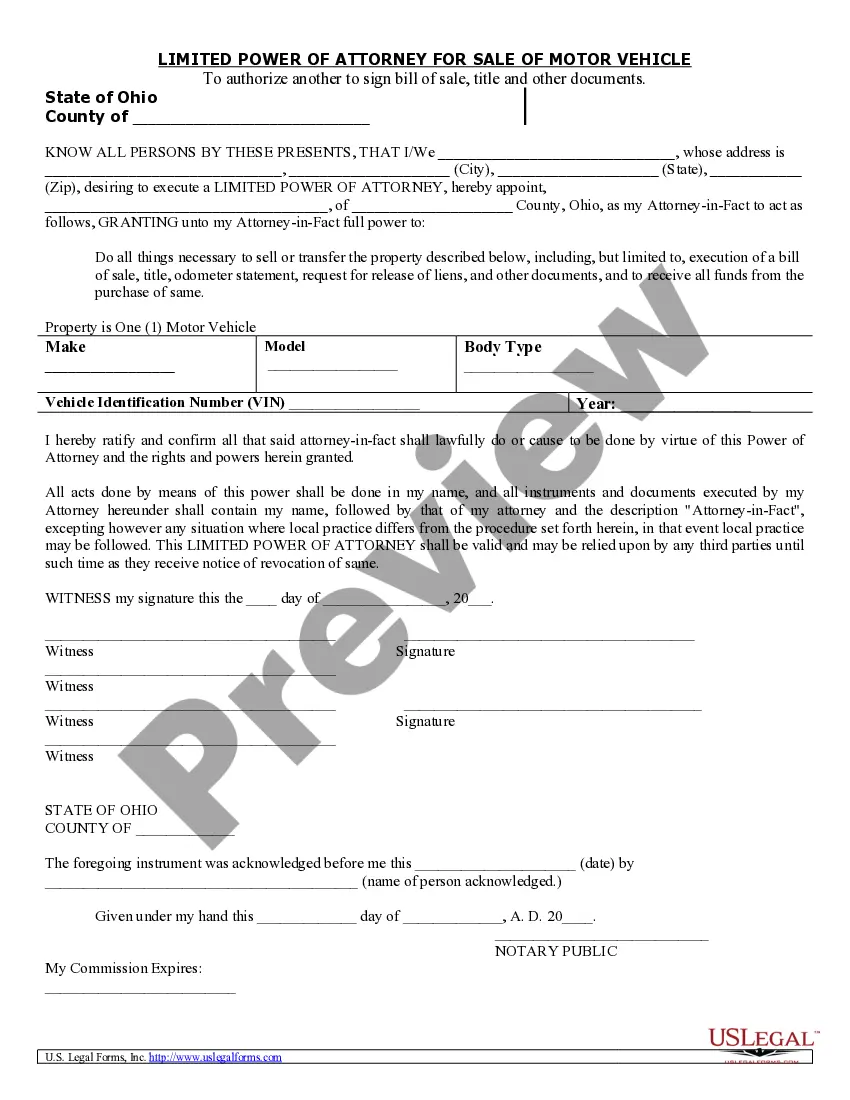

Tip. A security instrument is a legal document giving the bank a security interest in the property. It can be a mortgage, giving the lender a lien on the property, or a deed of trust, whereby a trustee holds the deed for the lender until you finish paying off the loan.

In a deed of trust, the borrower is called the trustor and the lender is the beneficiary. The trustee holds title to the property until the trustor has fully repaid the loan to the beneficiary, at which time the lender notifies the trustee, who then transfers full title of the property to the trustor.

The following states use Deed of Trusts: Alaska, Arizona, California, District of Columbia, Georgia, Mississippi, Missouri, Nevada, North Carolina, and Virginia.

A deed of trust is used to create a security interest in real property as collateral for a loan. A deed of trust is similar to a mortgage, but a deed of trust grants legal title to the trustee while the property owner retains equitable title to the property.

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

A deed of trust is the most commonly used mortgage instrument in Texas for both residential and commercial transactions. A mortgage has also been described as a grant of fee on condition of the payment of a debt.

Some states have laws governing who may or may not serve as a trustee in a deed of trust. Generally, the trustee must be an attorney, title insurance company, trust company, bank, savings and loan, credit union, or other company specifically authorized by law to serve as a trustee.

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.