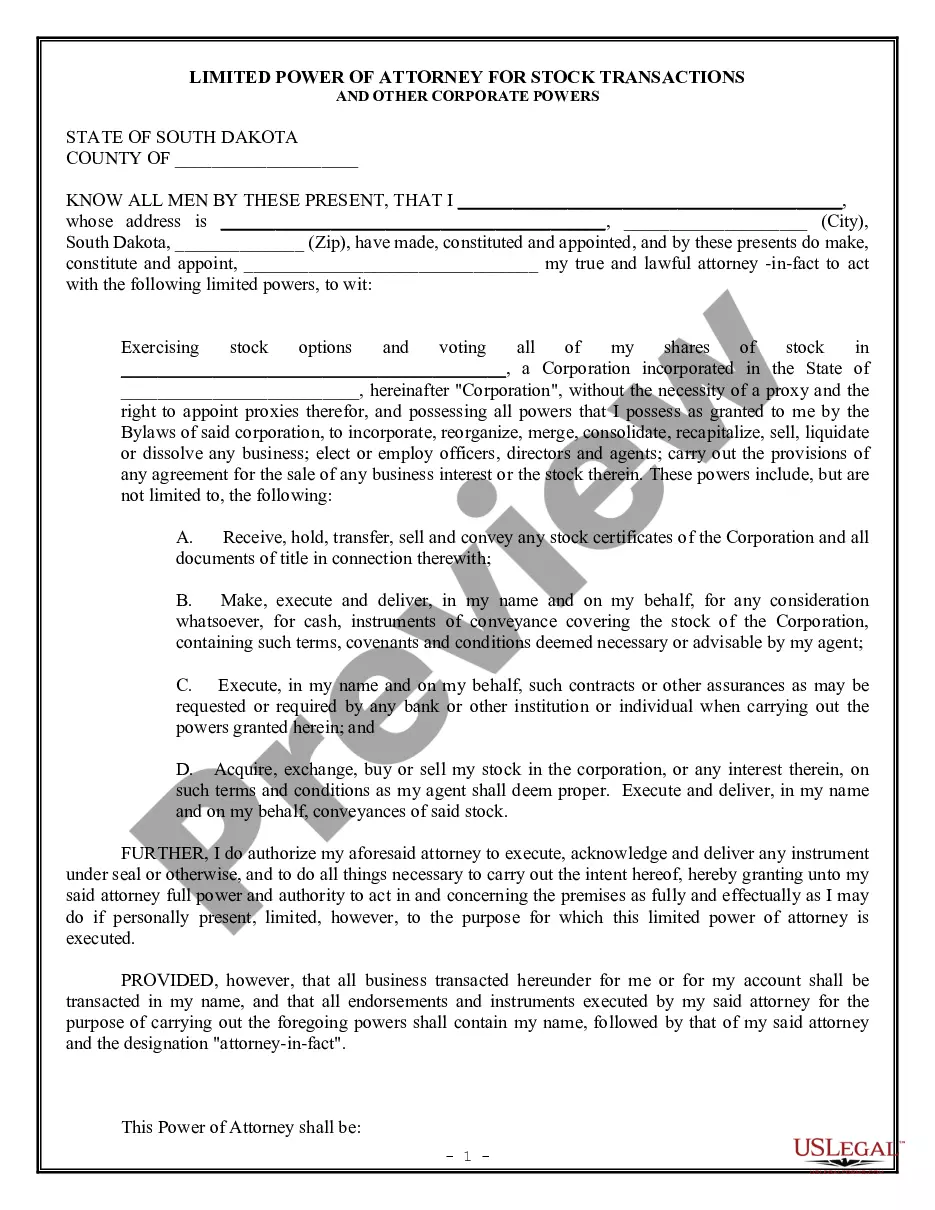

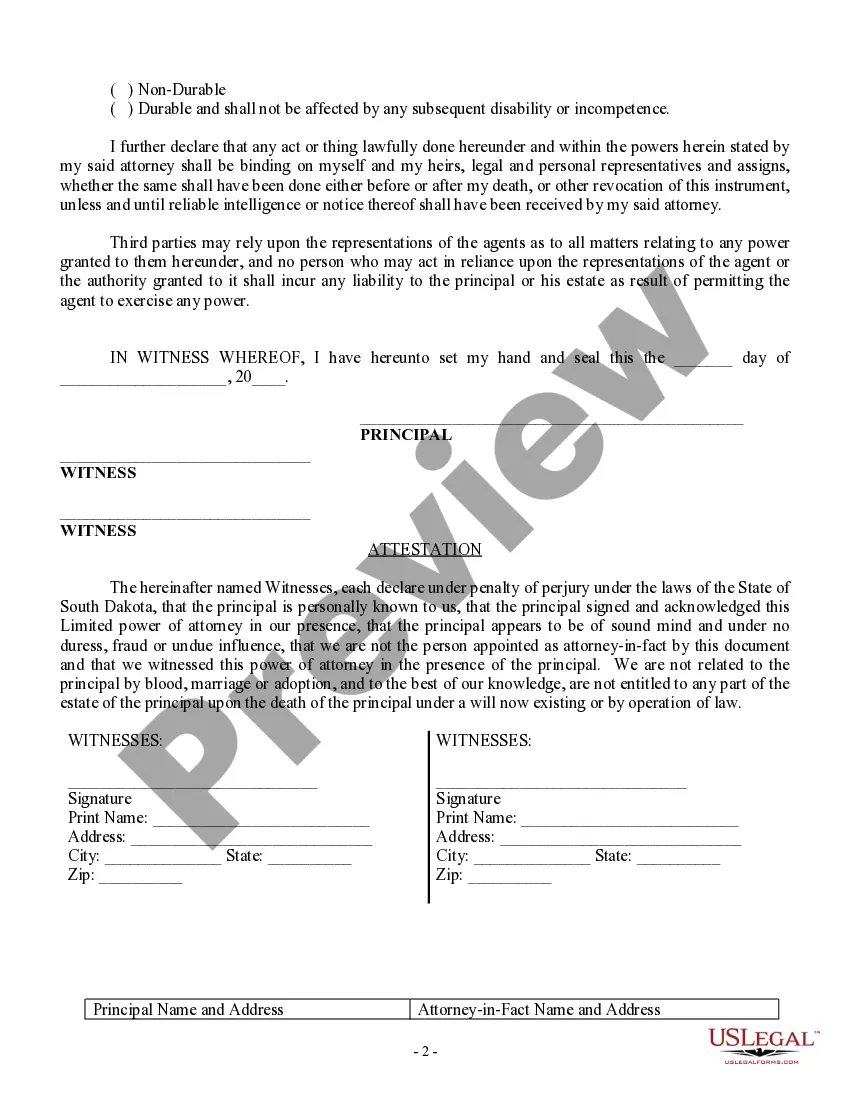

This Limited Power of Attorney form provides for a limited power of attorney for stock transactions only. It used by a shareholder to authorize another person to vote stock and to conduct other corporate powers. The document must be signed before two witnesses.

South Dakota Limited Power of Attorney for Stock Transactions and Corporate Powers

Description

How to fill out South Dakota Limited Power Of Attorney For Stock Transactions And Corporate Powers?

Get access to top quality South Dakota Limited Power of Attorney for Stock Transactions and Corporate Powers samples online with US Legal Forms. Avoid hours of misused time browsing the internet and lost money on documents that aren’t updated. US Legal Forms provides you with a solution to exactly that. Get above 85,000 state-specific authorized and tax forms that you can download and complete in clicks in the Forms library.

To receive the sample, log in to your account and then click Download. The document will be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, look at our how-guide listed below to make getting started easier:

- Find out if the South Dakota Limited Power of Attorney for Stock Transactions and Corporate Powers you’re looking at is appropriate for your state.

- View the sample making use of the Preview function and read its description.

- Go to the subscription page by simply clicking Buy Now.

- Choose the subscription plan to go on to register.

- Pay by credit card or PayPal to complete creating an account.

- Select a favored format to download the file (.pdf or .docx).

Now you can open the South Dakota Limited Power of Attorney for Stock Transactions and Corporate Powers example and fill it out online or print it out and do it by hand. Consider sending the document to your legal counsel to make sure things are completed correctly. If you make a mistake, print and complete application again (once you’ve made an account every document you save is reusable). Create your US Legal Forms account now and get access to a lot more forms.

Form popularity

FAQ

If the agent is acting improperly, family members can file a petition in court challenging the agent. If the court finds the agent is not acting in the principal's best interest, the court can revoke the power of attorney and appoint a guardian. The power of attorney ends at death.

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner. In general, the LPOA allows the manager to execute an agreed-upon investment strategy and take care of routine related business without contacting the account holder.

A limited power of attorney grants the representative that you choose (the agent or attorney-in-fact) the power to act on your behalf under limited circumstances.Under a general power of attorney, the agent or attorney-in-fact can do anything that you can do.

The biggest limitation on a power of attorney is that it can only be signed when the principal is of sound mind.If the principal is unable to make decisions, the principal's family will need to go to court to become a court appointed guardian before they can make financial or medical decisions.

Can the Power of Attorney be used by the agent to take my money or property without my permission? Unfortunately, you can run the risk that the agent you choose to give your Power of Attorney could abuse the power by spending your money or taking your money without your knowledge or worse without your permission.

Signing Requirements: No specific signing requirement; however, it is suggested that the document be notarized. Tax Power of Attorney (Form RV-071) Used when you wish to appoint another to take care of your tax issues in front of the tax authority, such as to obtain information and make filings, etc.

When you give someone the POA, there are important limitations to the power the agent has. First, your agent must make decisions within the terms of the legal document and can't make decisions that break the agreement, and the agent can be held liable for any fraud or negligence.