Oklahoma Renunciation And Disclaimer of Real Property Interest

Description

Definition and meaning

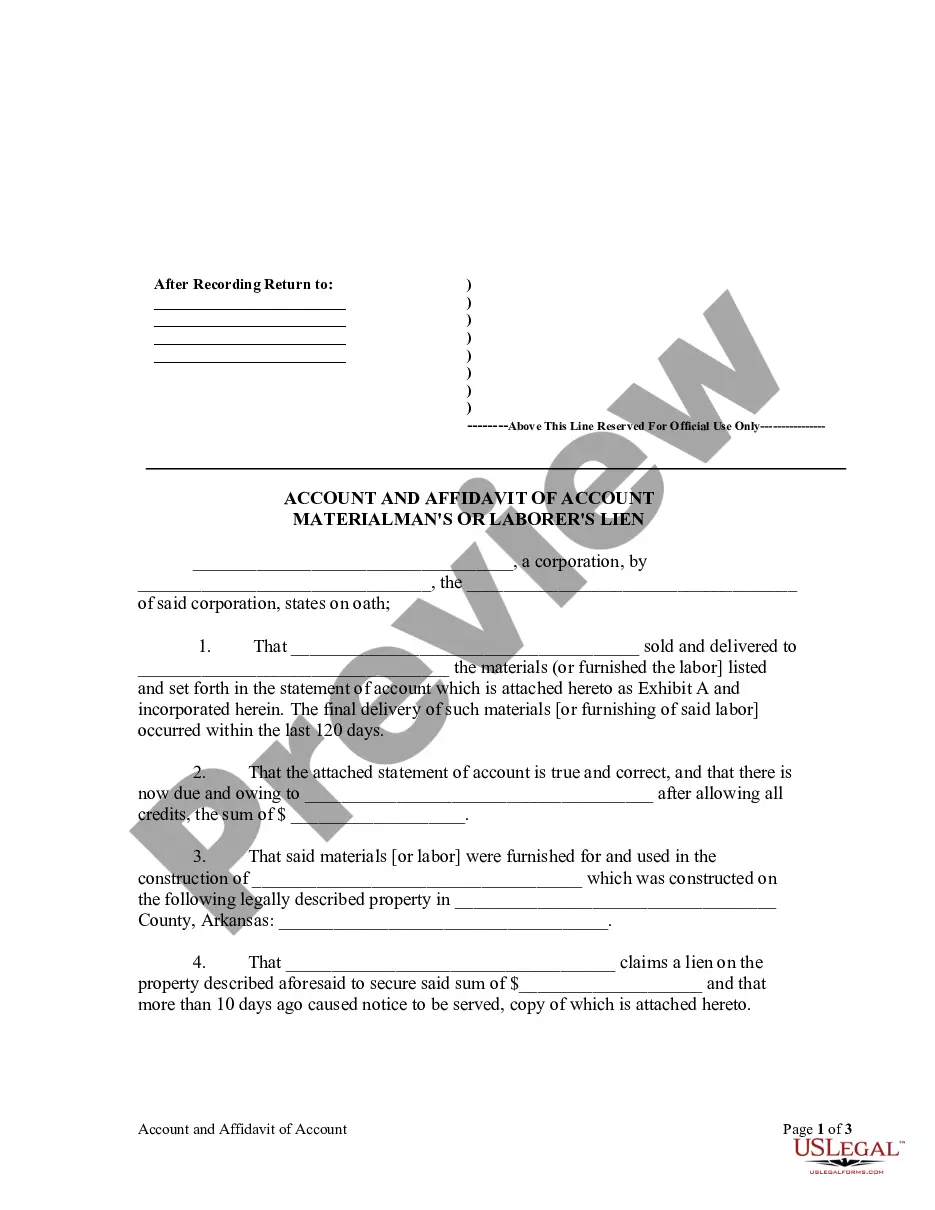

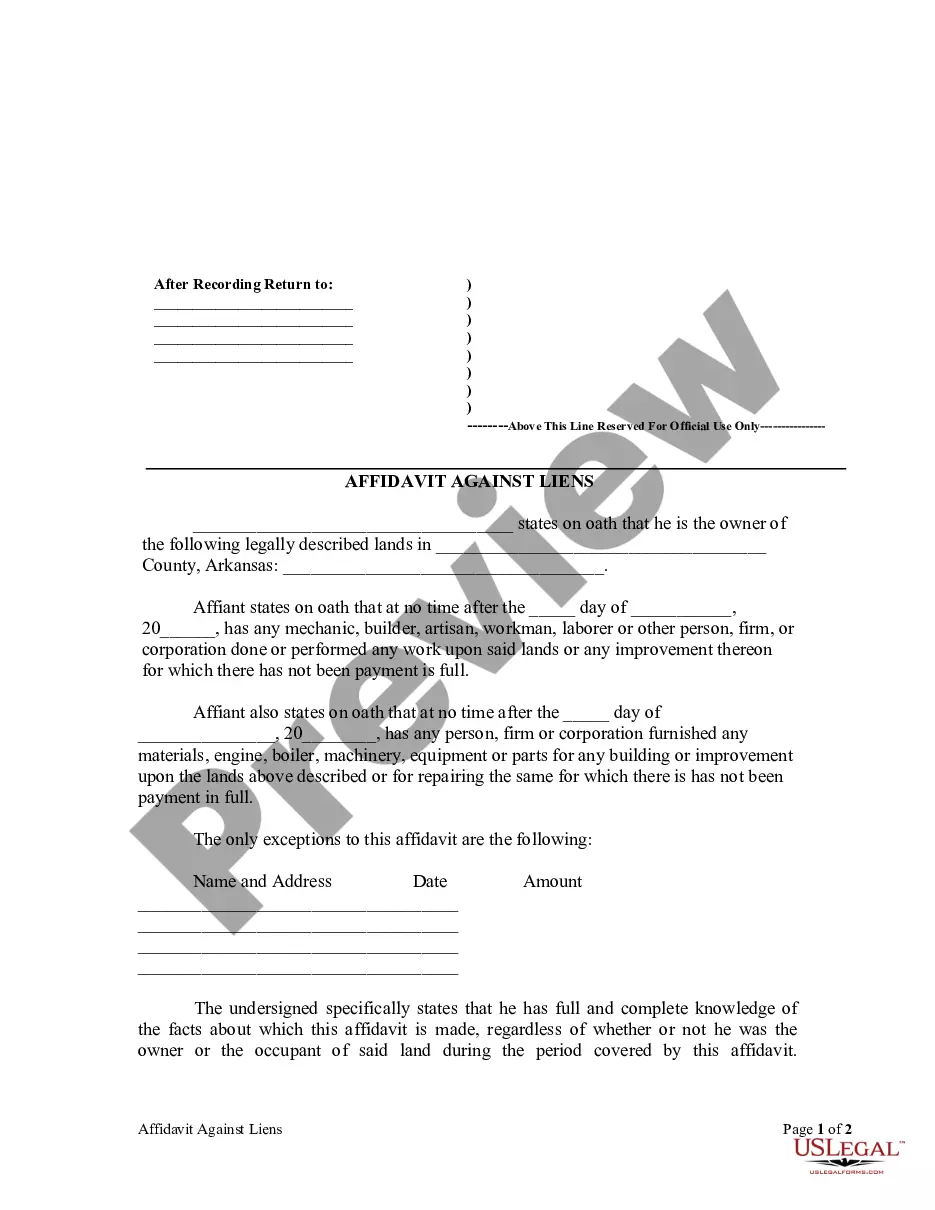

The Oklahoma Renunciation and Disclaimer of Real Property Interest is a legal document that allows a beneficiary to formally decline an interest in real property. By signing this form, the beneficiary indicates that they do not wish to accept the property interest and relinquishes any rights associated with it. This legal procedure is important in situations where a beneficiary wishes to avoid the responsibilities or tax implications that may come with inheriting property.

How to complete a form

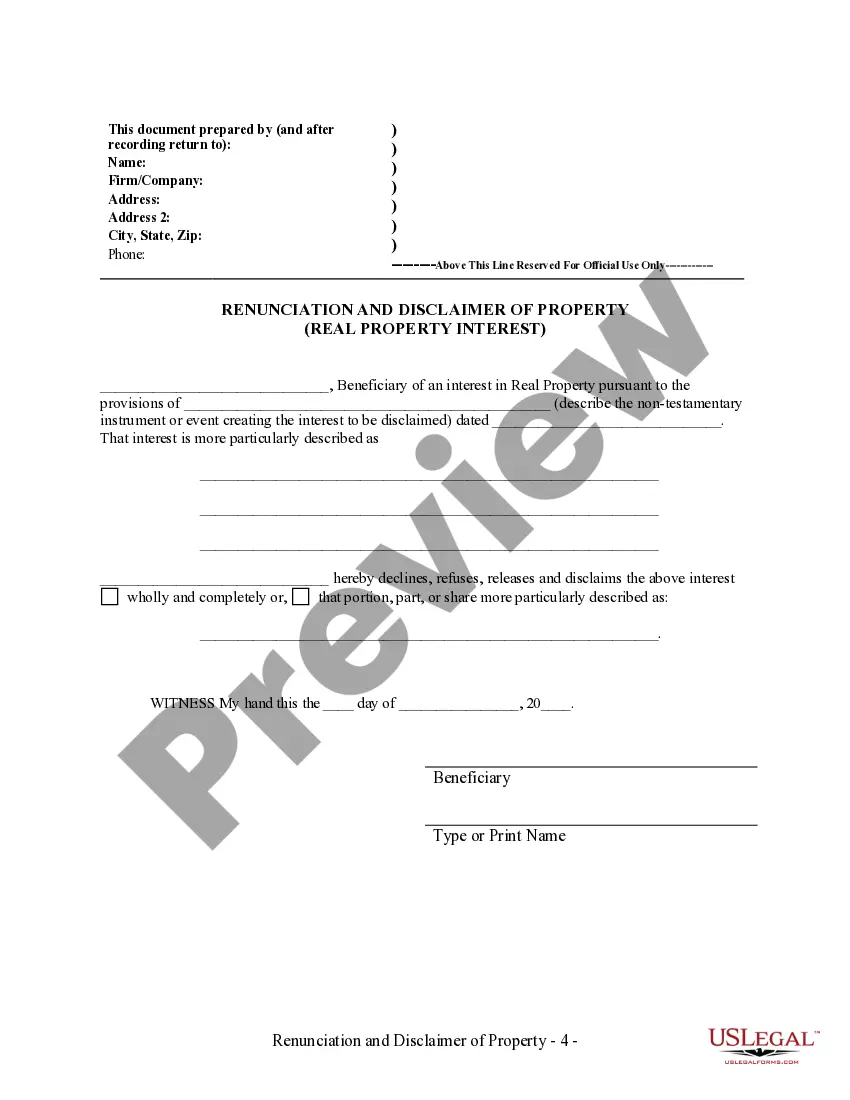

Completing the Oklahoma Renunciation and Disclaimer of Real Property Interest involves a few straightforward steps:

- Begin by entering your name as the beneficiary.

- Clearly identify and describe the non-testamentary instrument or event that created the property interest.

- Specify the details of the property interest you wish to disclaim.

- Sign and date the document in the presence of a notary public to ensure its validity.

Be sure to review each section carefully before submission to avoid errors.

Who should use this form

This form is intended for individuals who have been named beneficiaries of real property interests and wish to renounce those interests. Common scenarios include:

- Inheritors who do not want responsibility for property taxes or maintenance.

- Individuals who are part of a property redistribution arrangement.

- Beneficiaries seeking to avoid legal complications regarding property ownership.

Legal use and context

The Oklahoma Renunciation and Disclaimer of Real Property Interest is governed by state statutes, specifically under Title 60, Chapter 15 of the Oklahoma Statutes. It provides a legal mechanism for beneficiaries to renounce interests without invalidating previous estate planning or beneficiary designations. This can be particularly useful in minimizing tax liabilities or avoiding conflicts among heirs.

Common mistakes to avoid when using this form

To ensure the validity of the Oklahoma Renunciation and Disclaimer of Real Property Interest, users should be mindful of the following pitfalls:

- Failing to accurately describe the interest being renounced.

- Not having the document properly notarized.

- Leaving blank spaces that can lead to confusion or misinterpretation.

- Not retaining a copy of the completed and signed form for personal records.

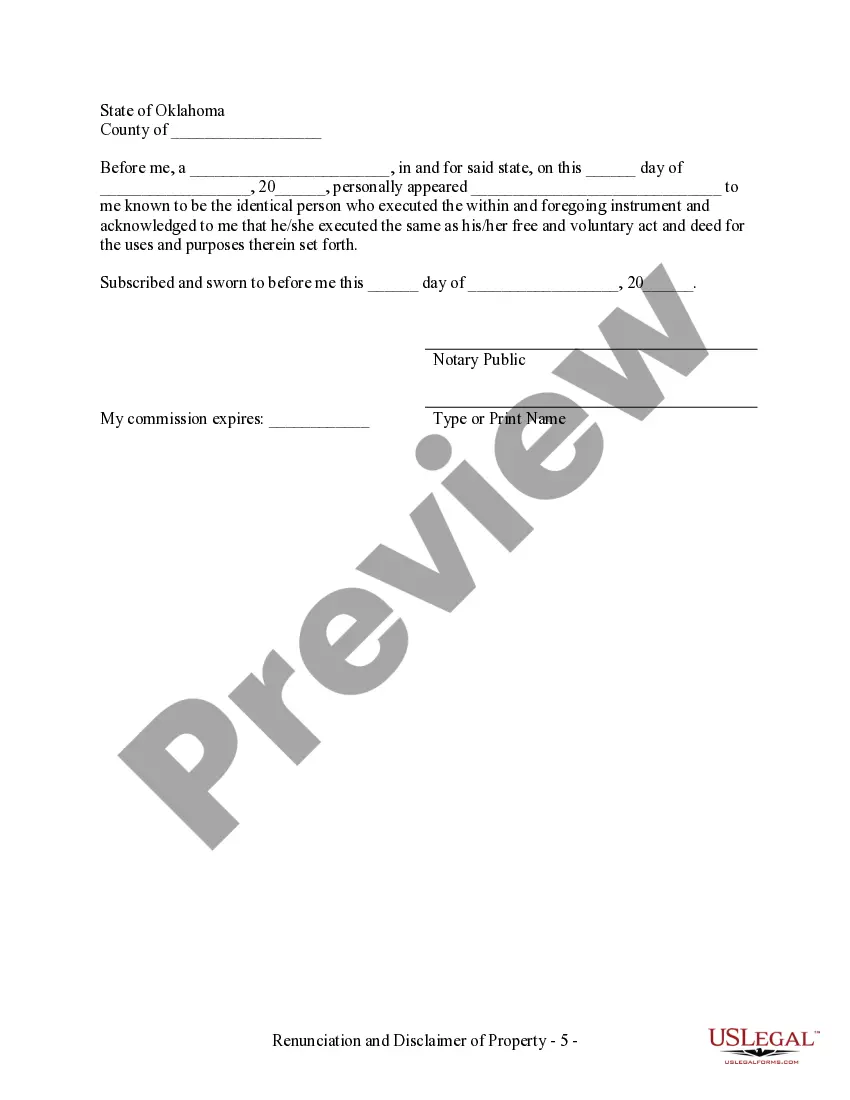

What to expect during notarization or witnessing

When finalizing the Oklahoma Renunciation and Disclaimer of Real Property Interest, it's essential to have the document notarized. Here’s what to expect:

- The notary will verify your identity by asking for valid identification.

- You will need to sign the document in the presence of the notary.

- The notary will complete the acknowledgment section and affix their seal.

This process helps in affirming the legitimacy of the document and protects against disputes later on.

Benefits of using this form online

Using the Oklahoma Renunciation and Disclaimer of Real Property Interest form online provides various advantages:

- Convenience: Access the form anytime and from anywhere.

- Efficiency: Complete the form quickly without the need for physical paperwork.

- Guidance: Online versions often include instructional prompts and tips for completion.

- Storage: Easily save and store the completed document digitally for future reference.

How to fill out Oklahoma Renunciation And Disclaimer Of Real Property Interest?

In terms of completing Oklahoma Renunciation And Disclaimer of Real Property Interest, you probably imagine an extensive procedure that involves getting a suitable form among hundreds of very similar ones then being forced to pay legal counsel to fill it out for you. On the whole, that’s a sluggish and expensive choice. Use US Legal Forms and select the state-specific template in a matter of clicks.

In case you have a subscription, just log in and click Download to find the Oklahoma Renunciation And Disclaimer of Real Property Interest sample.

If you don’t have an account yet but want one, stick to the step-by-step guide listed below:

- Make sure the file you’re getting is valid in your state (or the state it’s needed in).

- Do this by reading through the form’s description and also by clicking on the Preview function (if offered) to see the form’s information.

- Simply click Buy Now.

- Pick the proper plan for your financial budget.

- Subscribe to an account and select how you want to pay out: by PayPal or by card.

- Save the file in .pdf or .docx file format.

- Find the document on the device or in your My Forms folder.

Professional attorneys work on creating our samples to ensure that after downloading, you don't need to bother about editing content material outside of your individual info or your business’s information. Be a part of US Legal Forms and get your Oklahoma Renunciation And Disclaimer of Real Property Interest example now.

Form popularity

FAQ

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

A qualified disclaimer is a part of the U.S. tax code that allows estate assets to pass to a beneficiary without being subject to income tax. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,

In your disclaimer, cover any and all liabilities for the product or service that you provide. You should warn consumers of any dangers or hazards posed by your product. You should list specific risks while at the same time acknowledging that the list is not exhaustive. For example, you could write, NOTICE OF RISK.

These documents can include the will, death certificate, transfer of ownership forms and letters from the estate executor or probate court.If you received the inheritance in the form of cash, request a copy of the bank statement that reflects the deposit.

Disclaimer of interest, in the law of inheritance, wills and trusts, is a term that describes an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust. A disclaimer of interest is irrevocable.

A beneficiary of a trust may wish to disclaim their interest in the trust for:Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest.

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.

When you relinquish property, you don't get any say in who inherits in your place. If you want to control who gets the inheritance, you must accept it and give it to that person. If you relinquish the property and the deceased didn't name a back-up heir, the court will apply state law to decide who inherits.