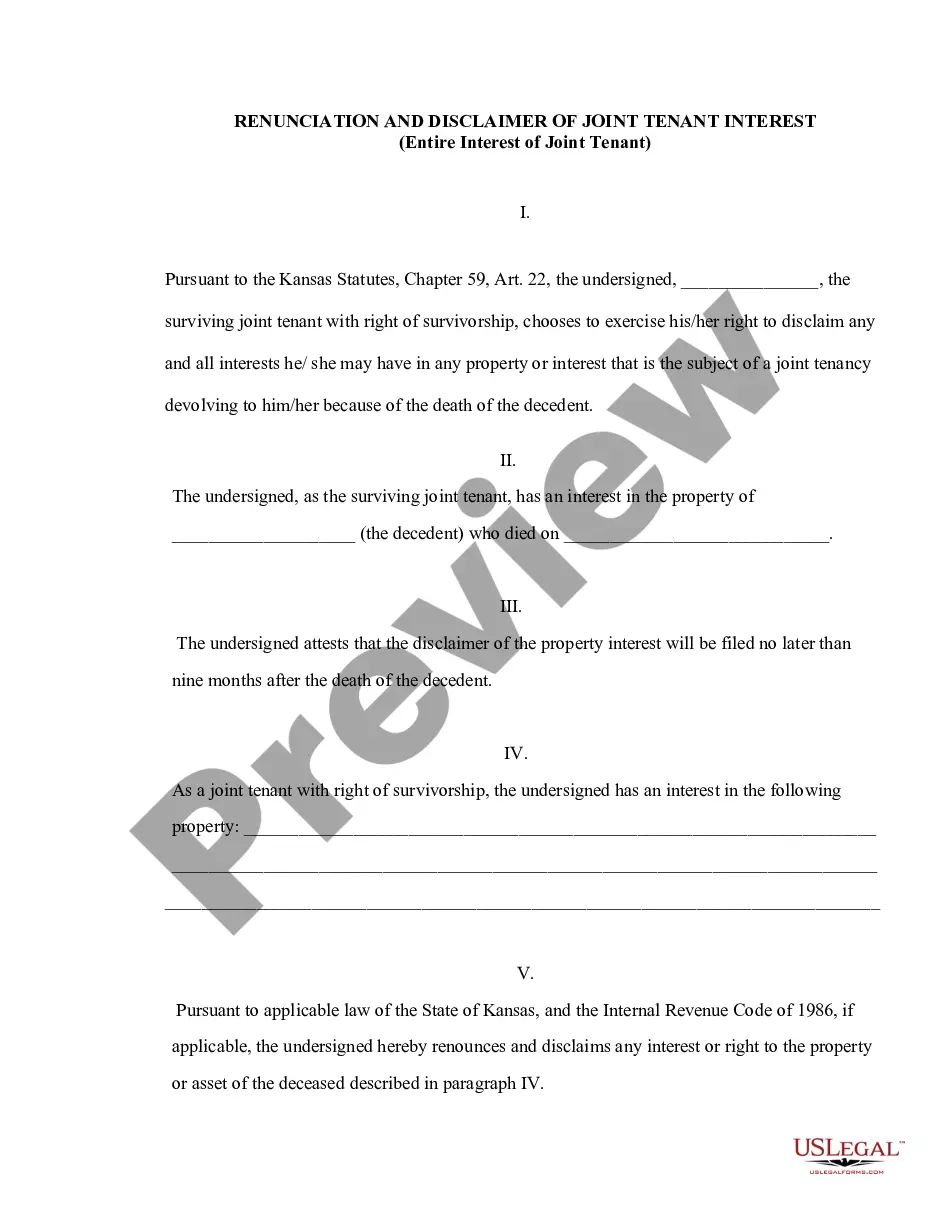

Kansas Renunciation and Disclaimer of Joint Tenant or Tenancy Interest

Description

How to fill out Kansas Renunciation And Disclaimer Of Joint Tenant Or Tenancy Interest?

Searching for Kansas Renunciation and Disclaimer of Joint Tenant or Tenancy Interest documentation and completing them could be an issue.

To conserve time, expenses, and effort, utilize US Legal Forms and locate the appropriate sample specifically for your jurisdiction in just a few clicks.

Our legal experts prepare all documents, so you merely need to complete them. It's truly that straightforward.

Select your plan on the pricing page and set up your account. Choose your payment method, whether by card or through PayPal. Download the document in your desired format. You can now print the Kansas Renunciation and Disclaimer of Joint Tenant or Tenancy Interest template or complete it using any online editor. There’s no need to worry about making errors as your form can be used, submitted, and printed as frequently as you desire. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's webpage to save the document.

- Your saved templates are located in My documents and can be accessed at any time for future use.

- If you haven’t joined yet, you must register.

- Review our detailed instructions on how to acquire the Kansas Renunciation and Disclaimer of Joint Tenant or Tenancy Interest template in a matter of minutes.

- To obtain a qualified sample, confirm its relevance for your state.

- Use the Preview option if it is available to examine the form.

- If a description is provided, read through it to understand the particulars.

- Click on the Buy Now button if you found what you are looking for.

Form popularity

FAQ

Danger #1: Only delays probate. Danger #2: Probate when both owners die together. Danger #3: Unintentional disinheriting. Danger #4: Gift taxes. Danger #5: Loss of income tax benefits. Danger #6: Right to sell or encumber. Danger #7: Financial problems.

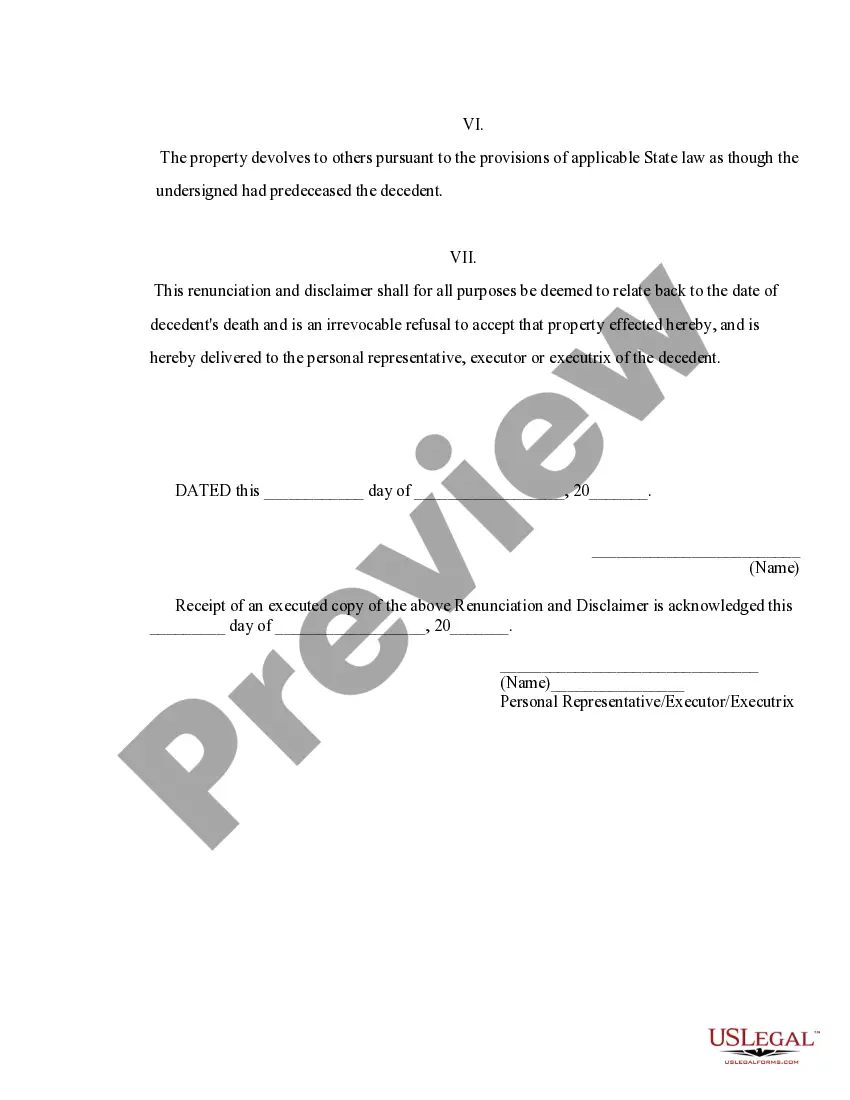

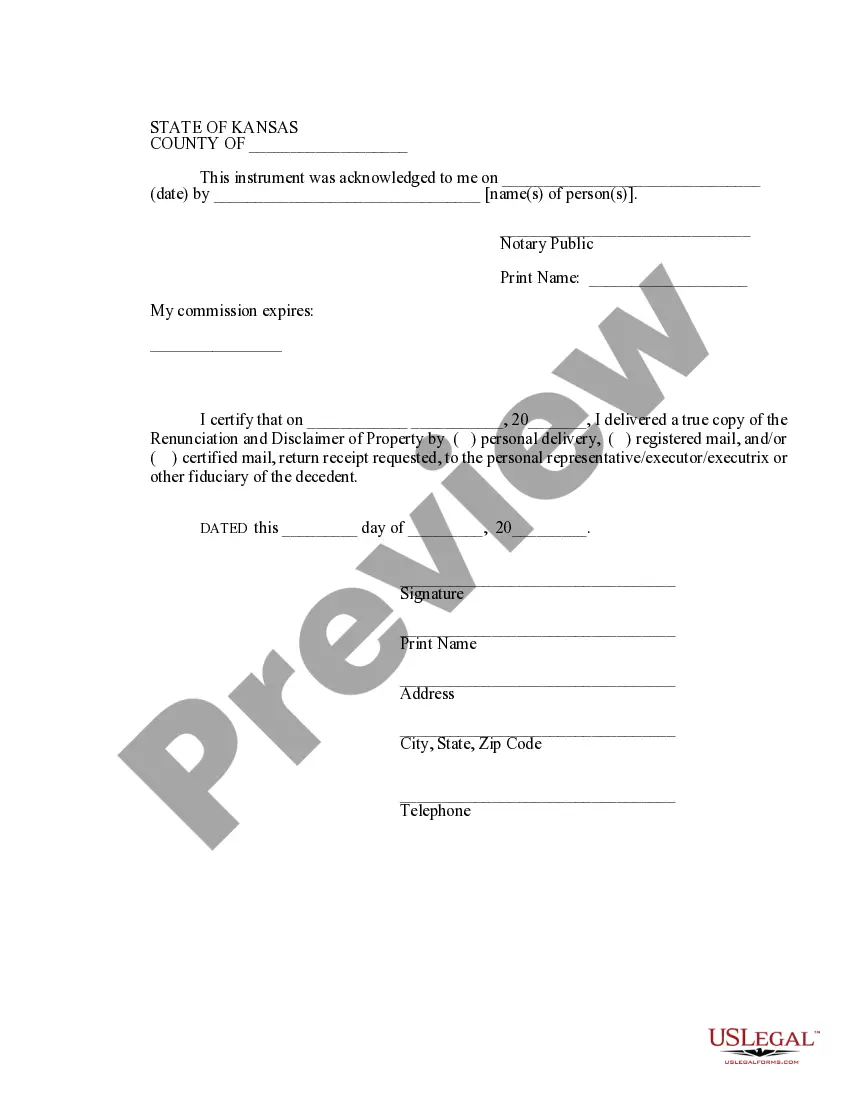

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

Jointly owned property is treated as consisting of a both present and a future interest in the jointly owned property. Thus, a surviving spouse may disclaim the future interest in jointly owned property on the death of their spouse, including assets that were held by the spouses as tenants by the entirety.

The surviving spouse can serve as the sole trustee, but cannot have any power to direct the beneficial enjoyment of the disclaimed property unless the power is limited by an "ascertainable standard." This is necessary both to qualify the disclaimer and to avoid any taxable general power of appointment.

Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies. Setting up a joint tenancy is easy, and it doesn't cost a penny.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,

It must be in writing. It must be made within 9 months of the date of death of the decedent. The disclaimant cannot receive any benefits from the assets.

Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest. Silence or otherwise passive behaviour will not suffice.