What is Last Will and Testament?

A Last Will and Testament is a legal document that details how a person's assets should be distributed after death. It is commonly used to ensure that wishes are respected. Explore templates tailored for your needs.

A Last Will and Testament outlines your wishes for asset distribution. Attorney-drafted templates are quick and easy to complete.

Get everything you need to prepare a Last Will and Testament, ensuring peace of mind for you and your loved ones.

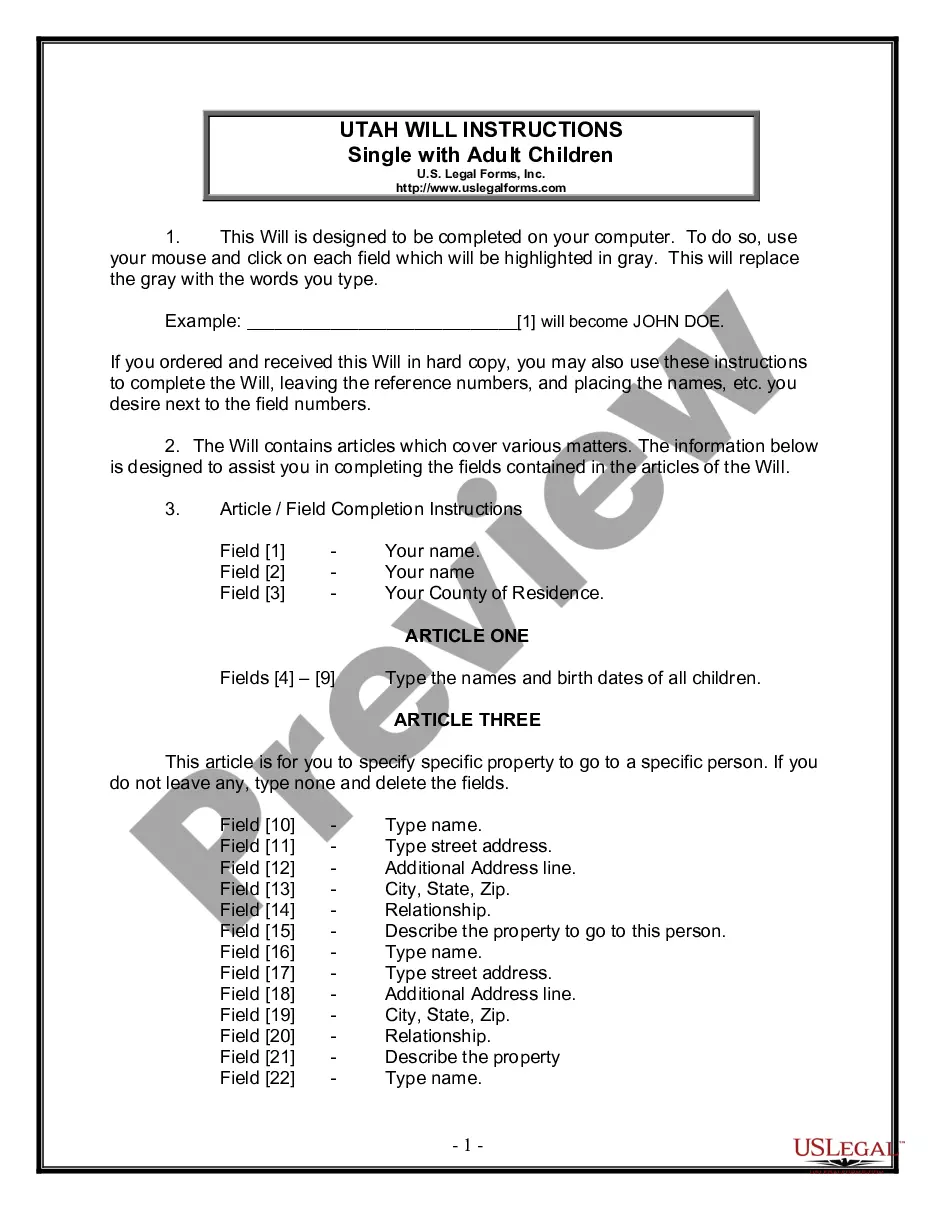

Ensure your assets are distributed according to your wishes with a will that reflects your personal situation as a single individual without children.

Create a legally binding document to express your wishes for property distribution after your death, specifically for widows or widowers with adult children.

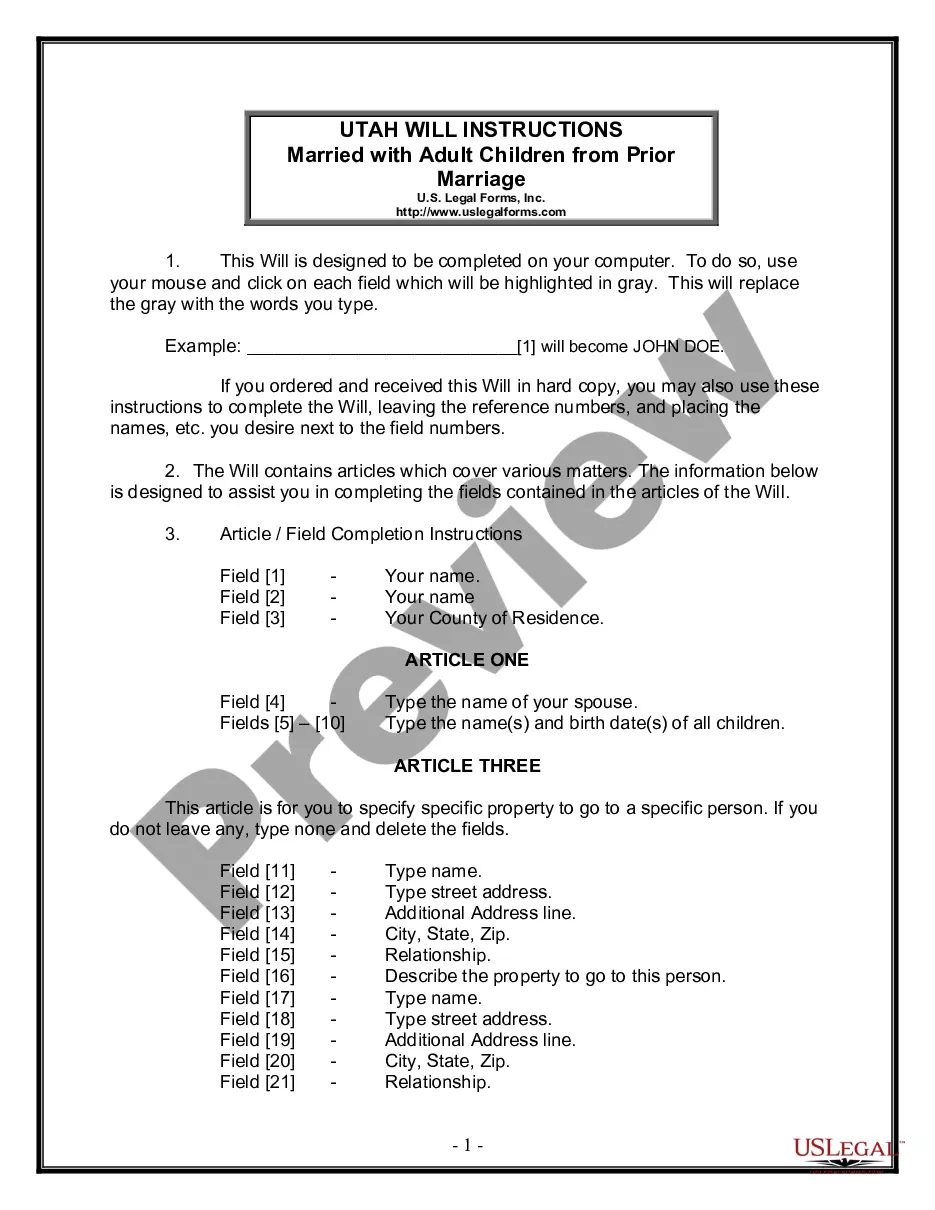

Prepare a legally binding document to specify the distribution of your estate after passing, especially beneficial for those with adult children and previous marriages.

Create a legally binding will to specify how your property should be distributed after your death.

Create a comprehensive plan to distribute your assets among your spouse and adult children from a previous marriage.

Plan your estate effectively by ensuring all assets are transferred to your trust upon your death, addressing gaps that may arise after creating a living trust.

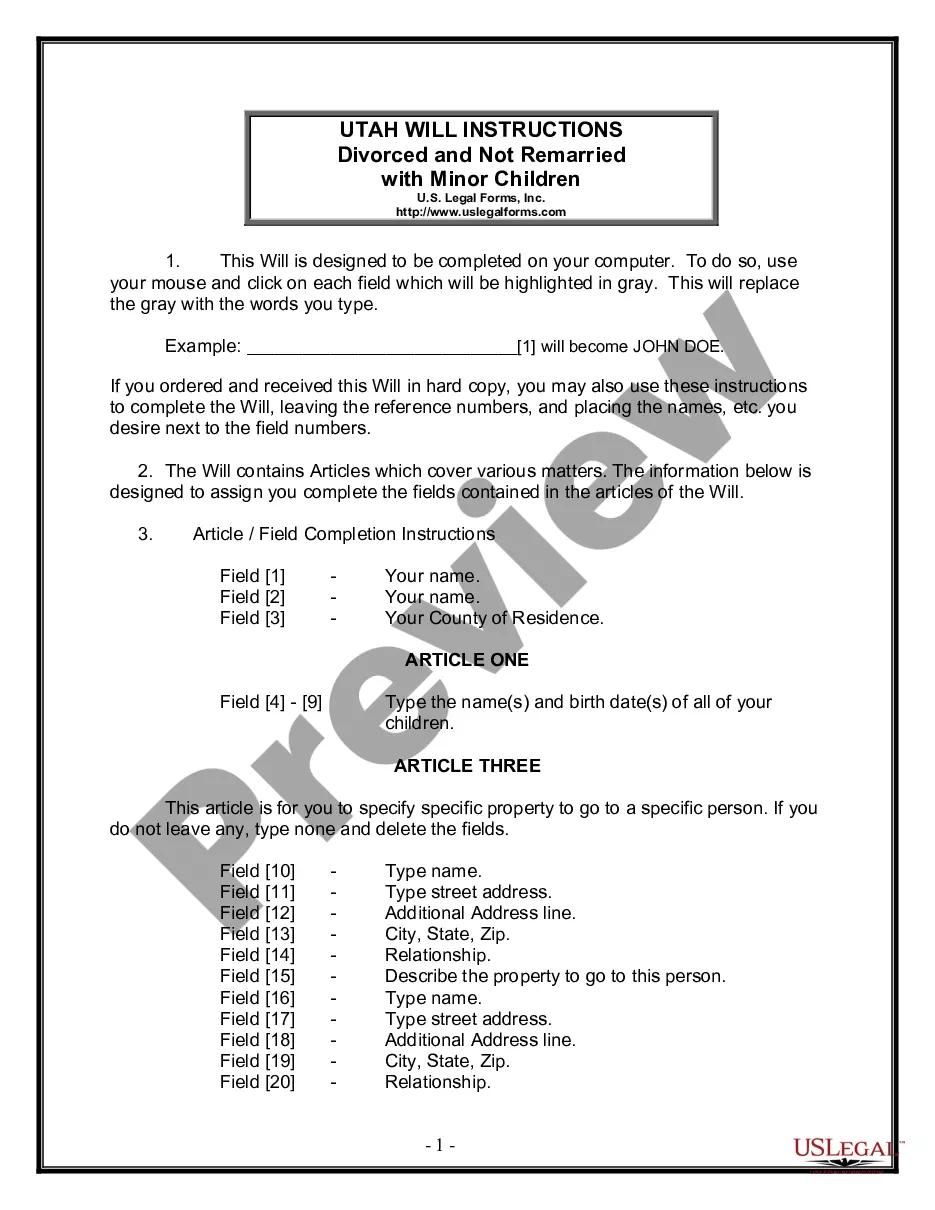

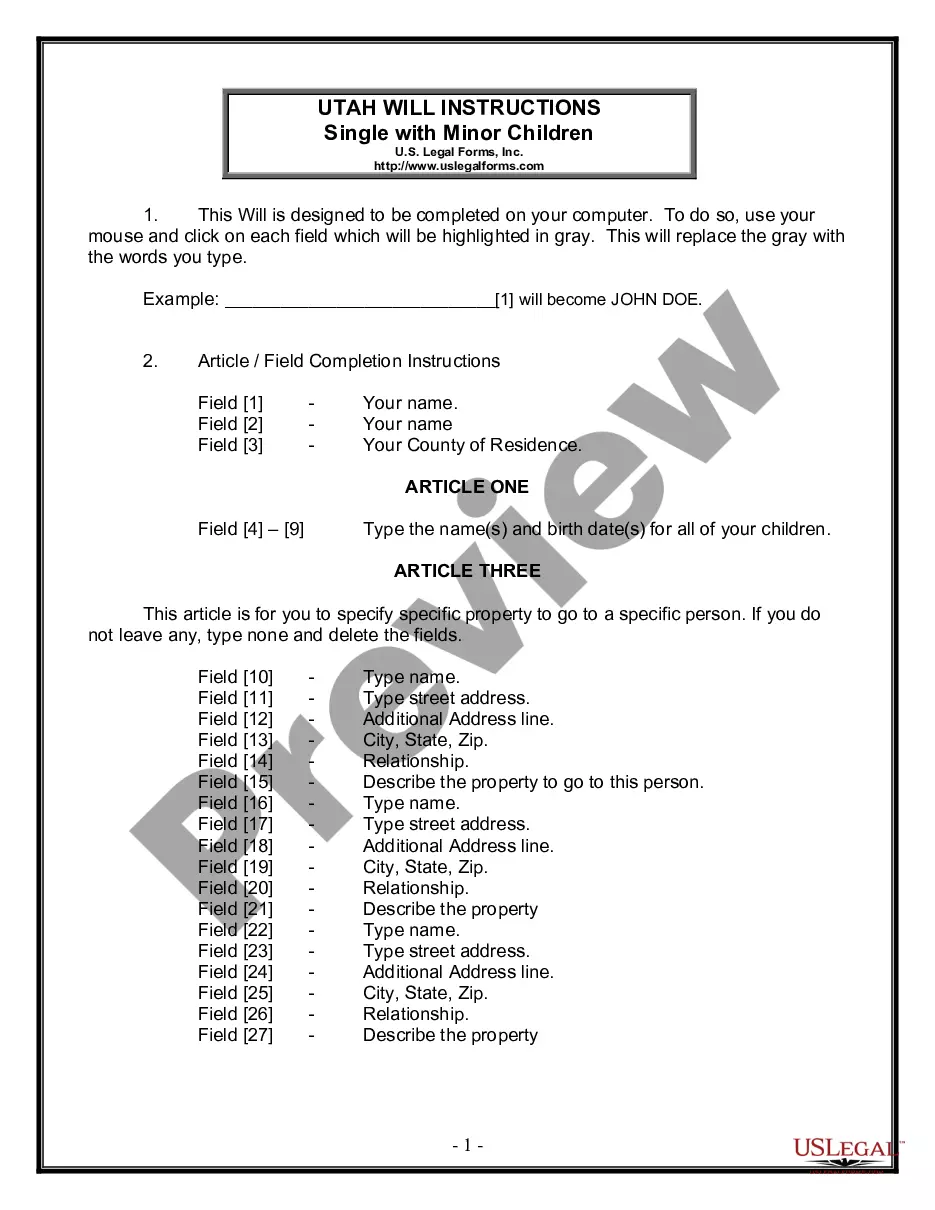

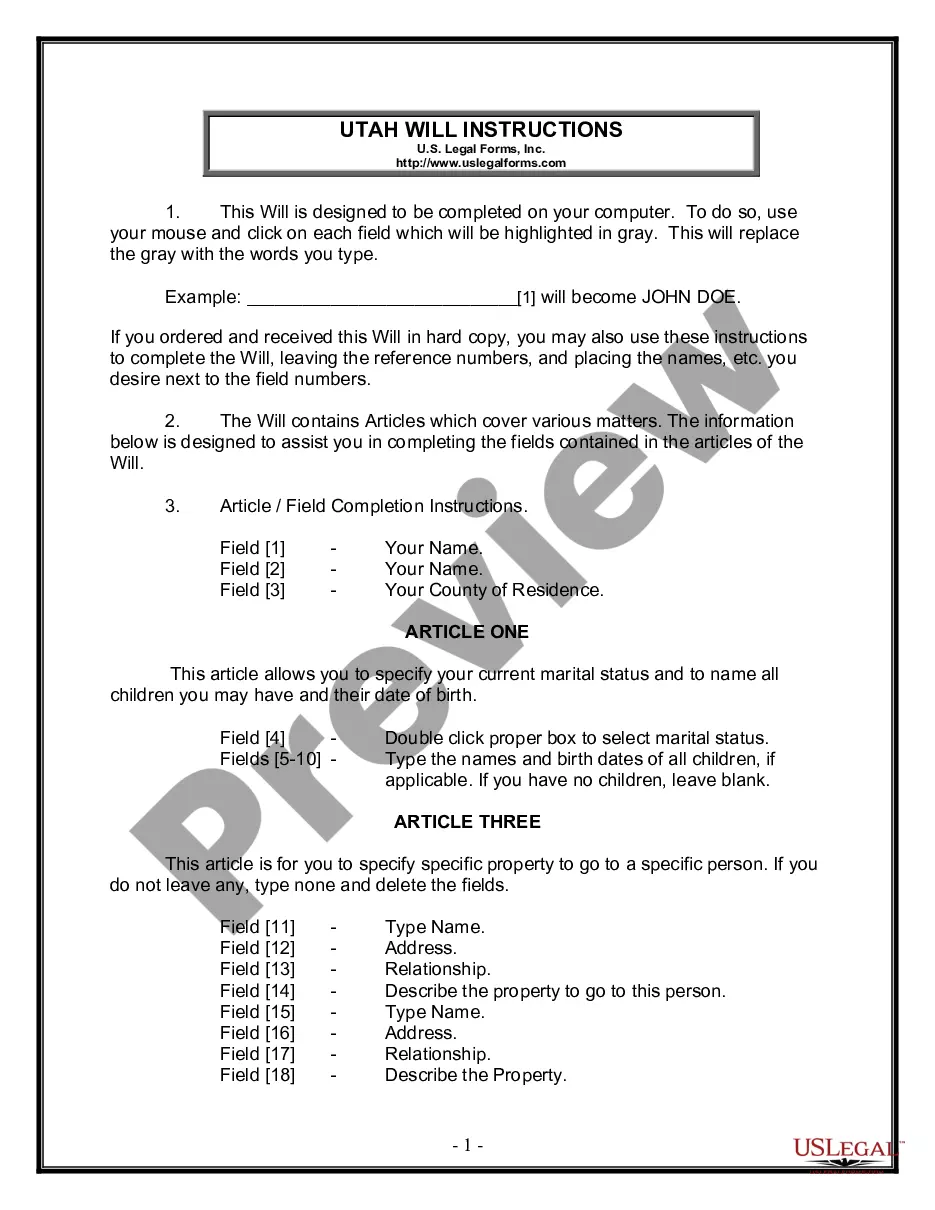

Create a direct plan for your estate, protecting minor children's interests after divorce.

Prepare a will to designate guardians for your minor children and allocate your assets in case of your passing.

Plan your estate and designate beneficiaries with this legal document, essential for ensuring your wishes are honored after your passing.

A Last Will and Testament takes effect after your passing.

Wills should name an executor to manage the estate.

Beneficiaries are designated to receive specific assets.

Witnesses are often required to validate the will.

Wills can be updated or revoked as needed.

Intestacy laws apply if no valid will exists.

Personal property can be included in the will.

Begin your journey in just a few steps.

Not necessarily, but a trust can provide additional control over assets.

Your assets may be distributed according to state laws, not your wishes.

Review your will every few years or after significant life changes.

Beneficiary designations often override will directives, ensuring assets go directly to named individuals.

Yes, you can designate separate individuals for financial and healthcare decisions.