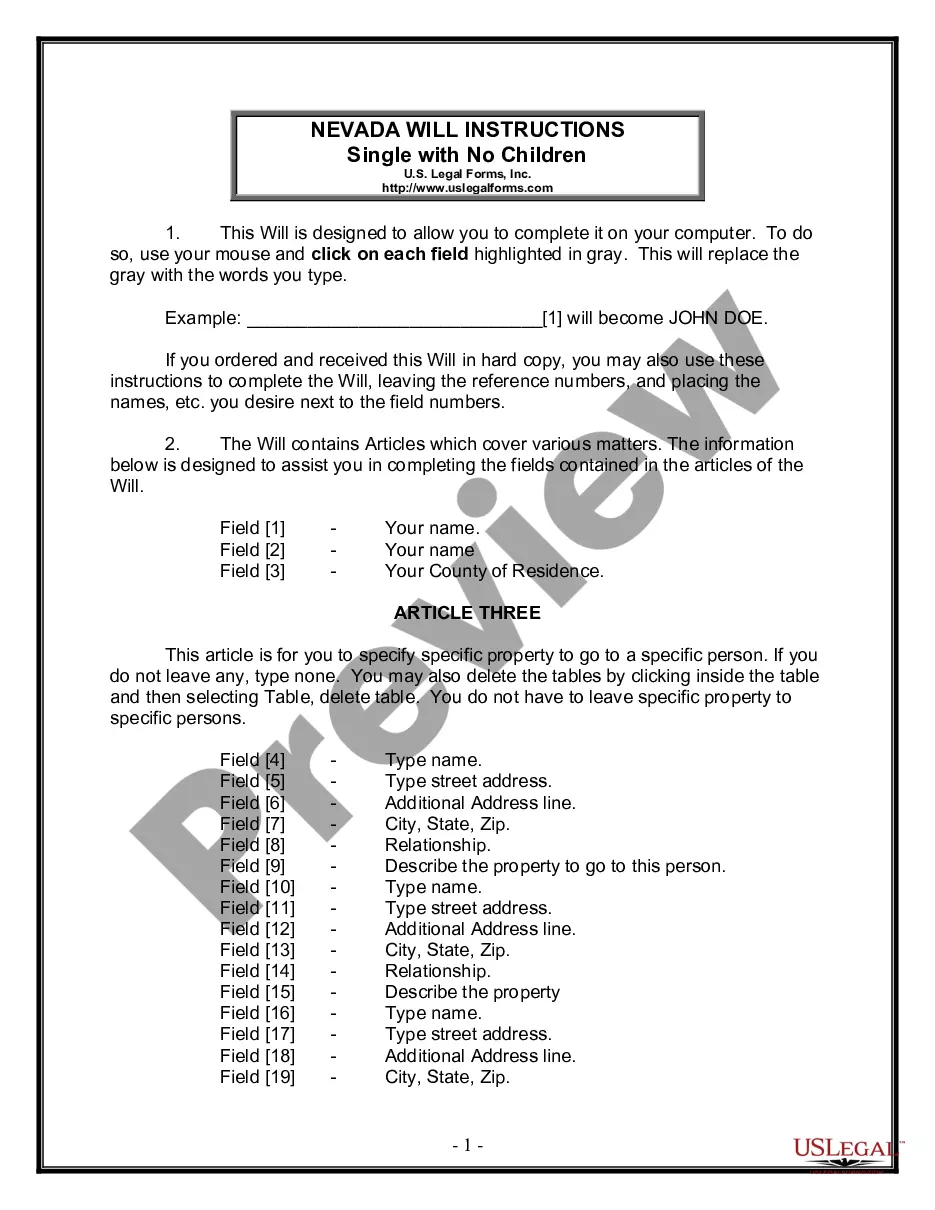

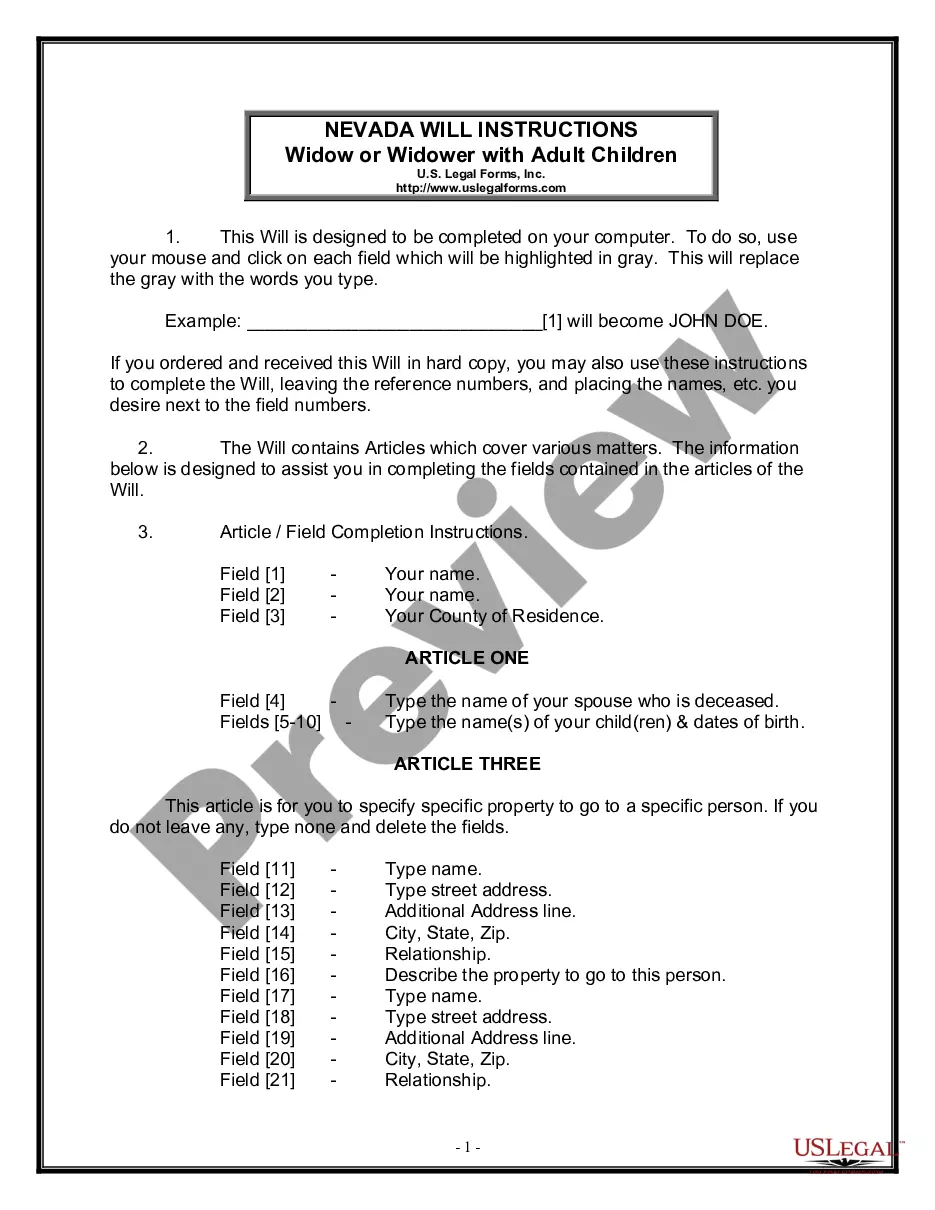

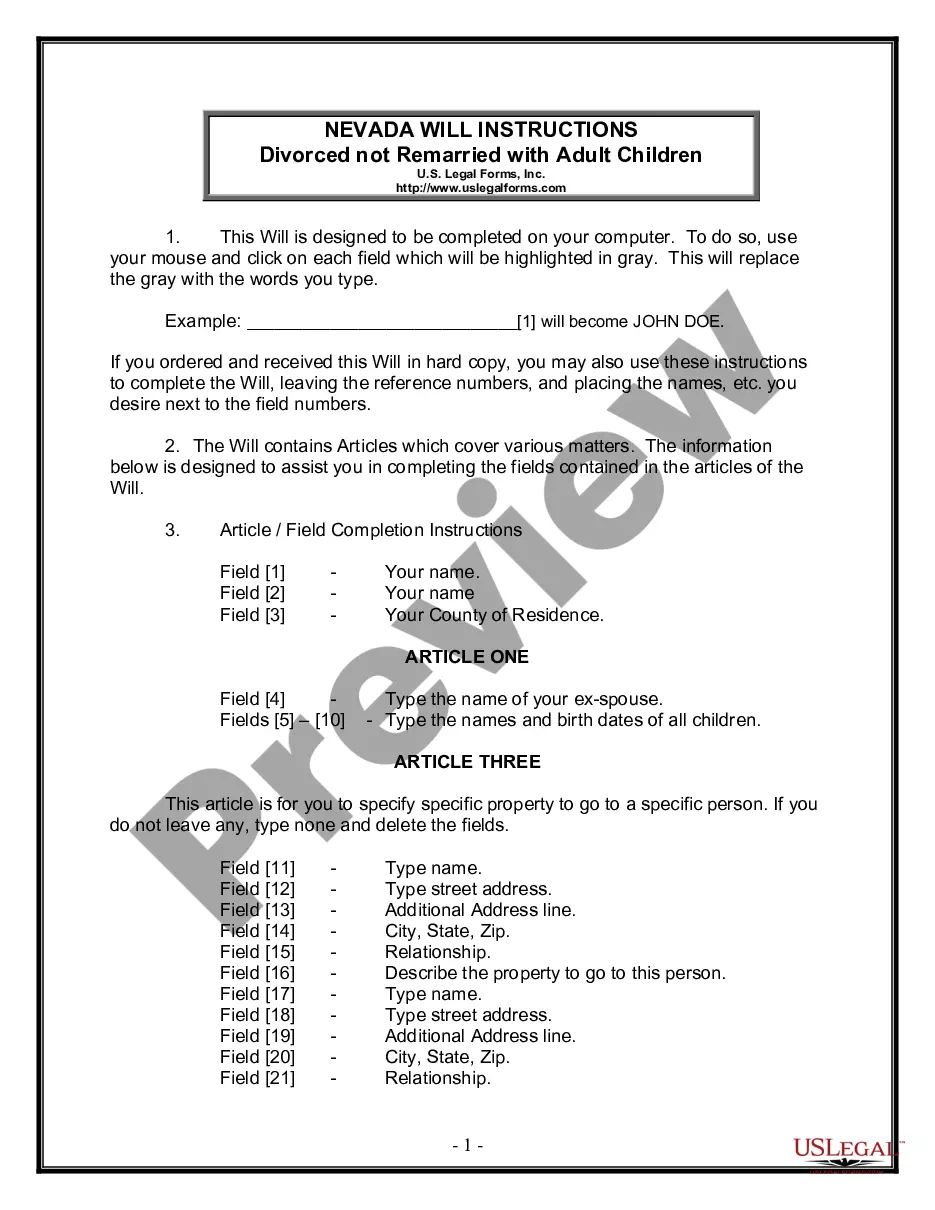

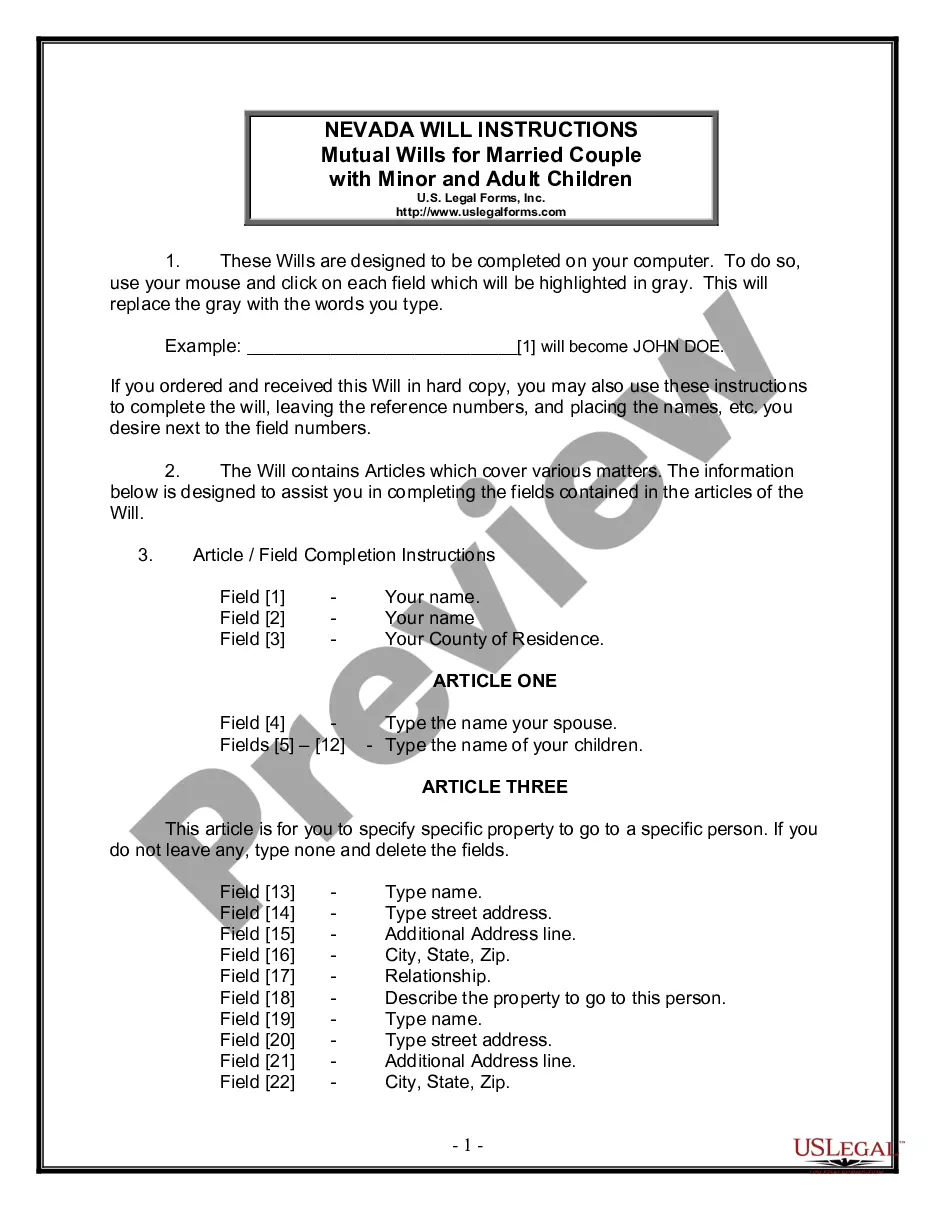

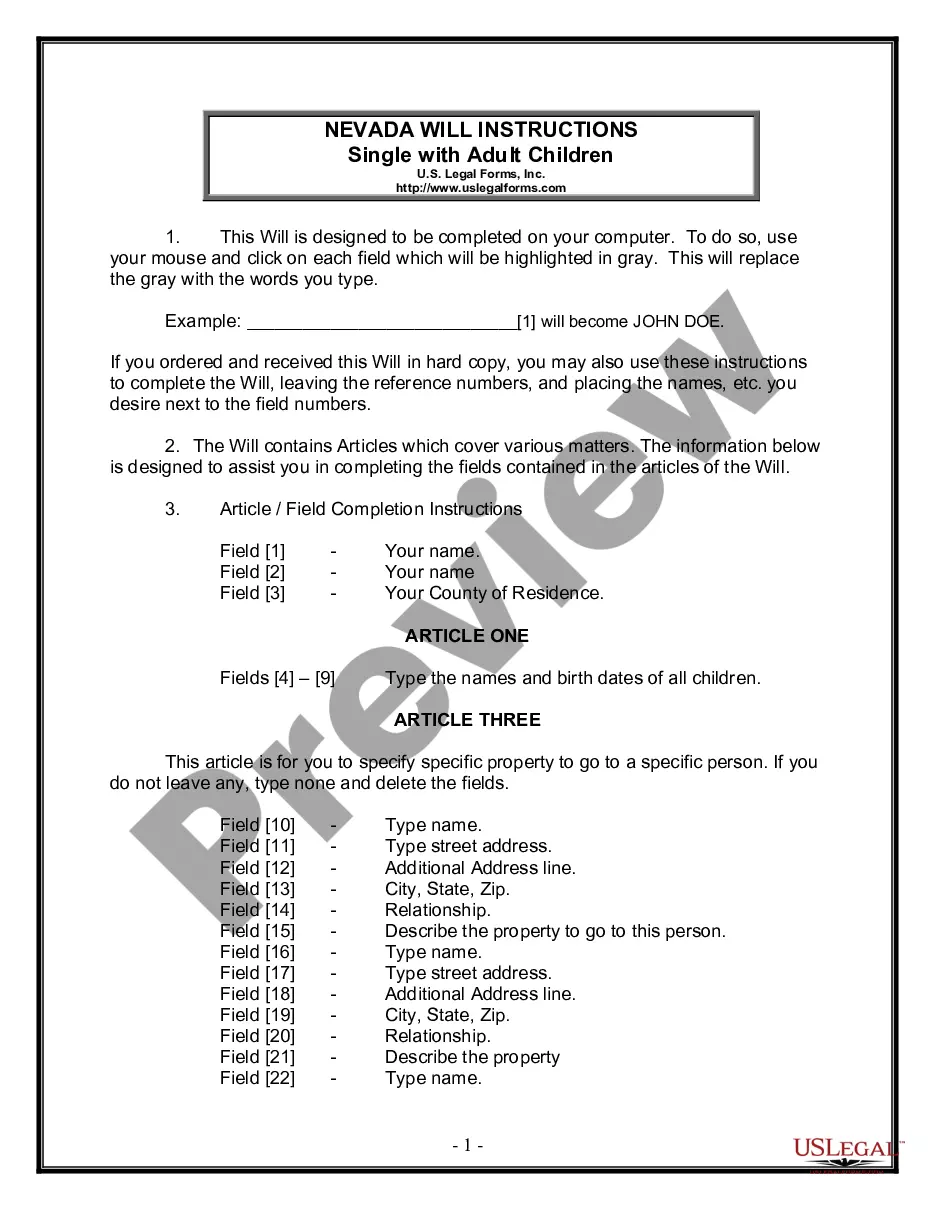

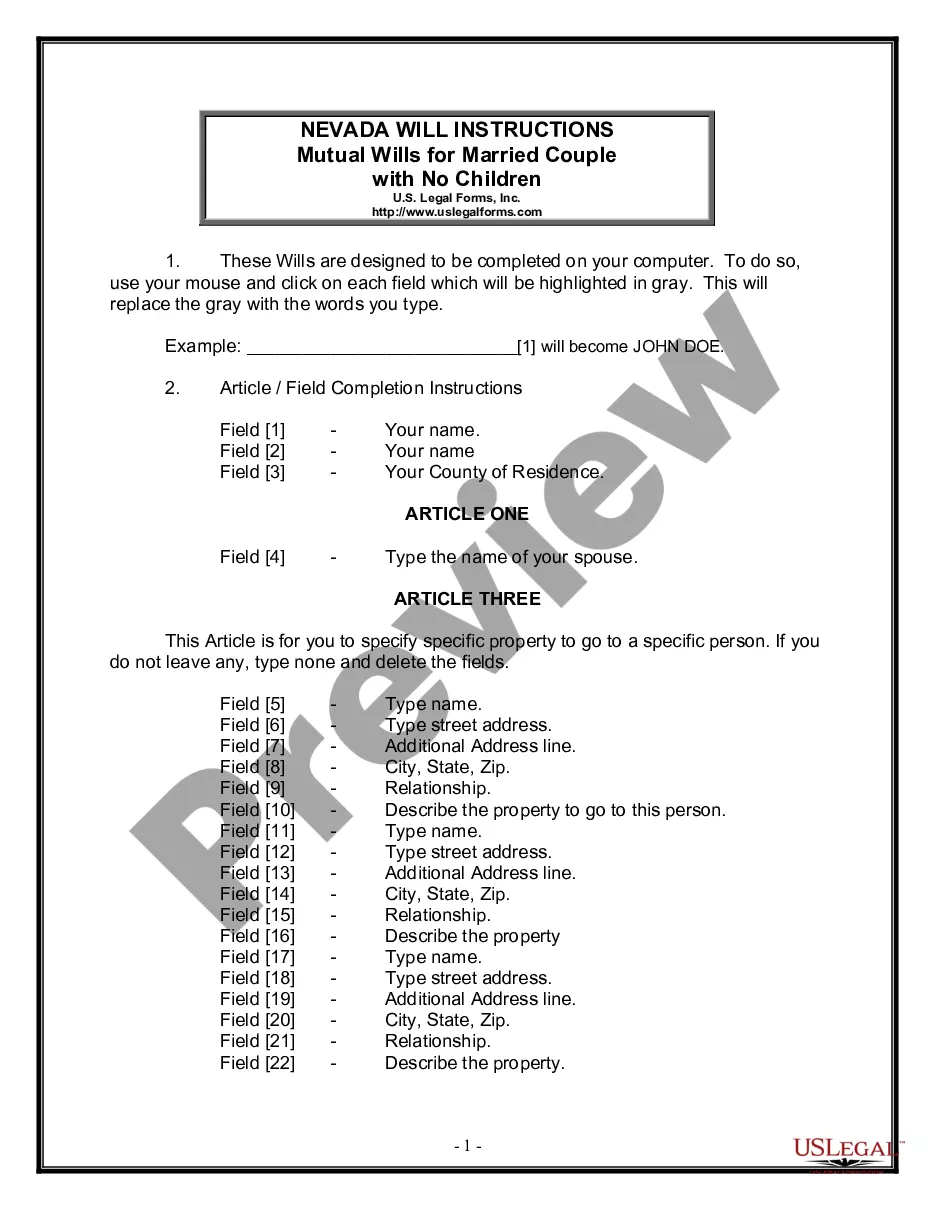

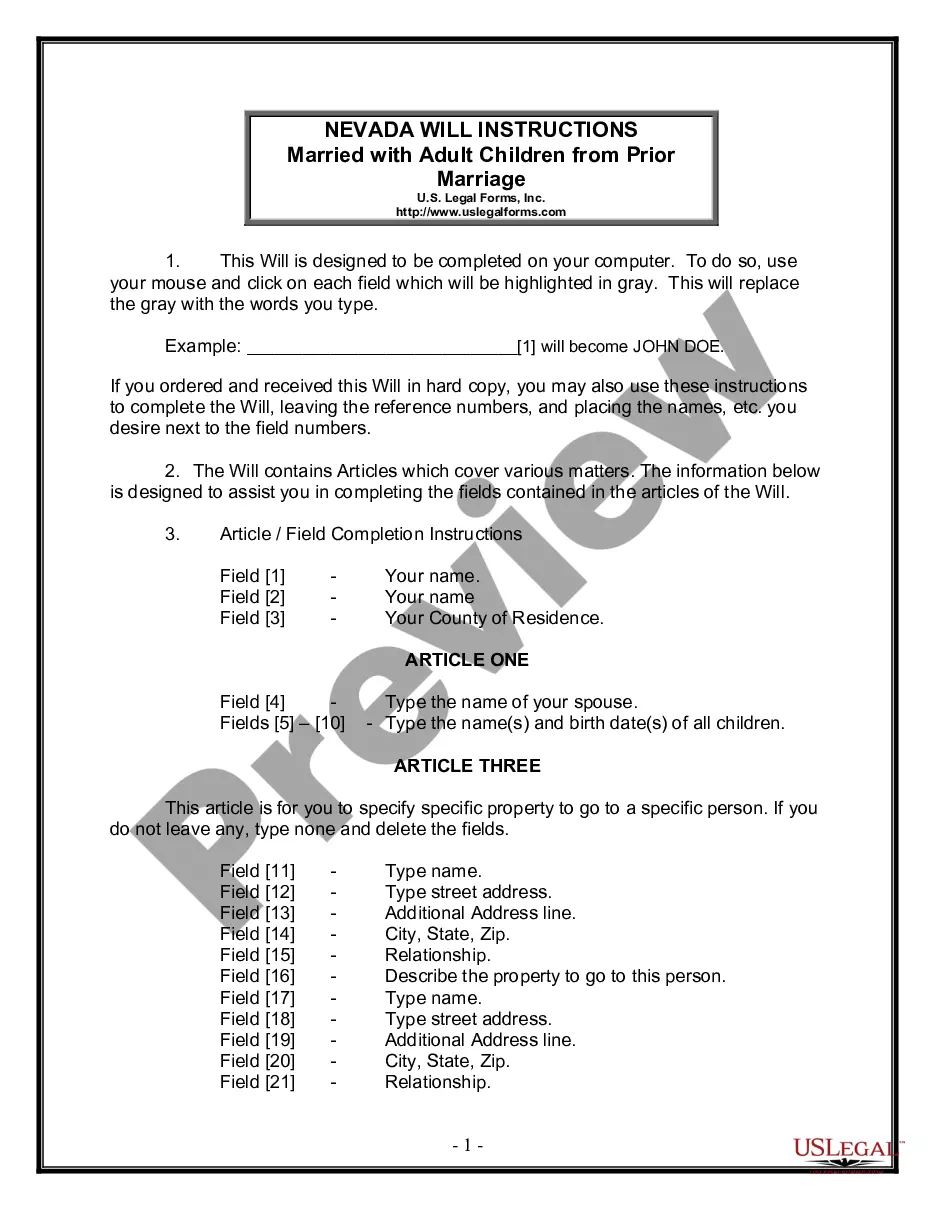

What is Last Will and Testament?

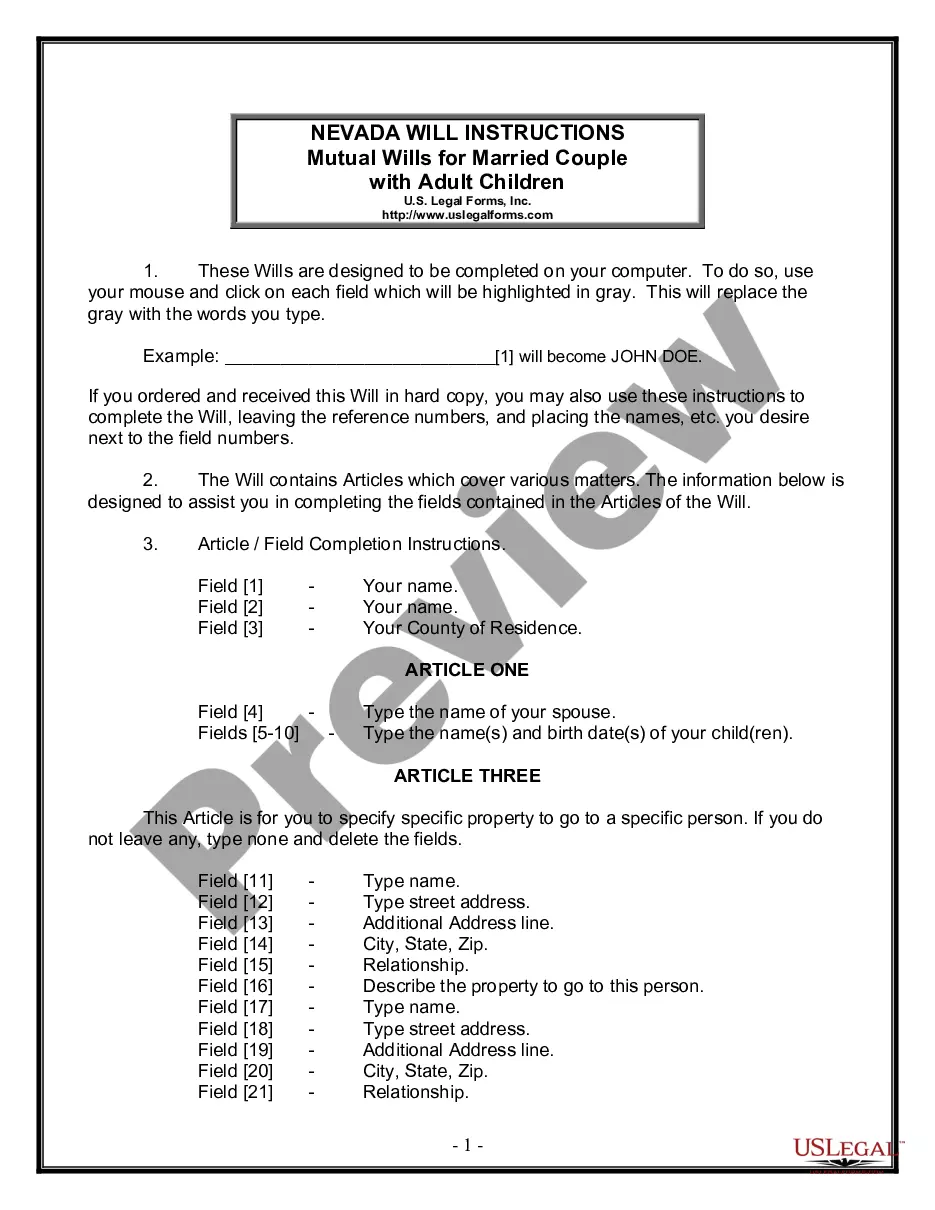

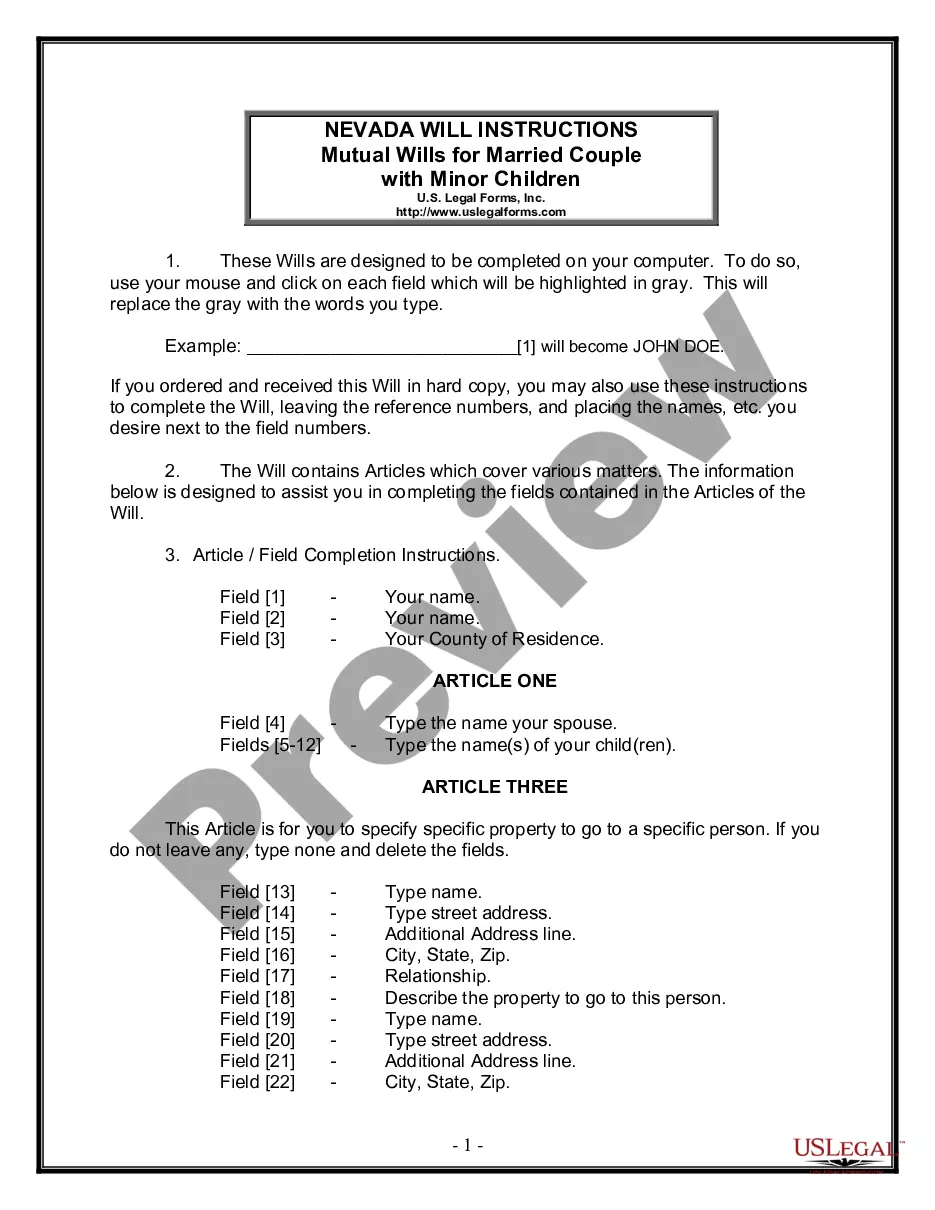

A Last Will and Testament is a legal document that outlines how your assets will be distributed after your death. It is typically used when individuals want to ensure their wishes are honored. Explore our state-specific templates to find the right fit.