What is Last Will and Testament?

A Last Will and Testament is a legal document that specifies how your assets are distributed after your death. It also appoints guardians for minor children. Explore state-specific templates for your needs.

A Last Will and Testament outlines your wishes for asset distribution after death. Attorney-drafted templates simplify the process and are easy to complete.

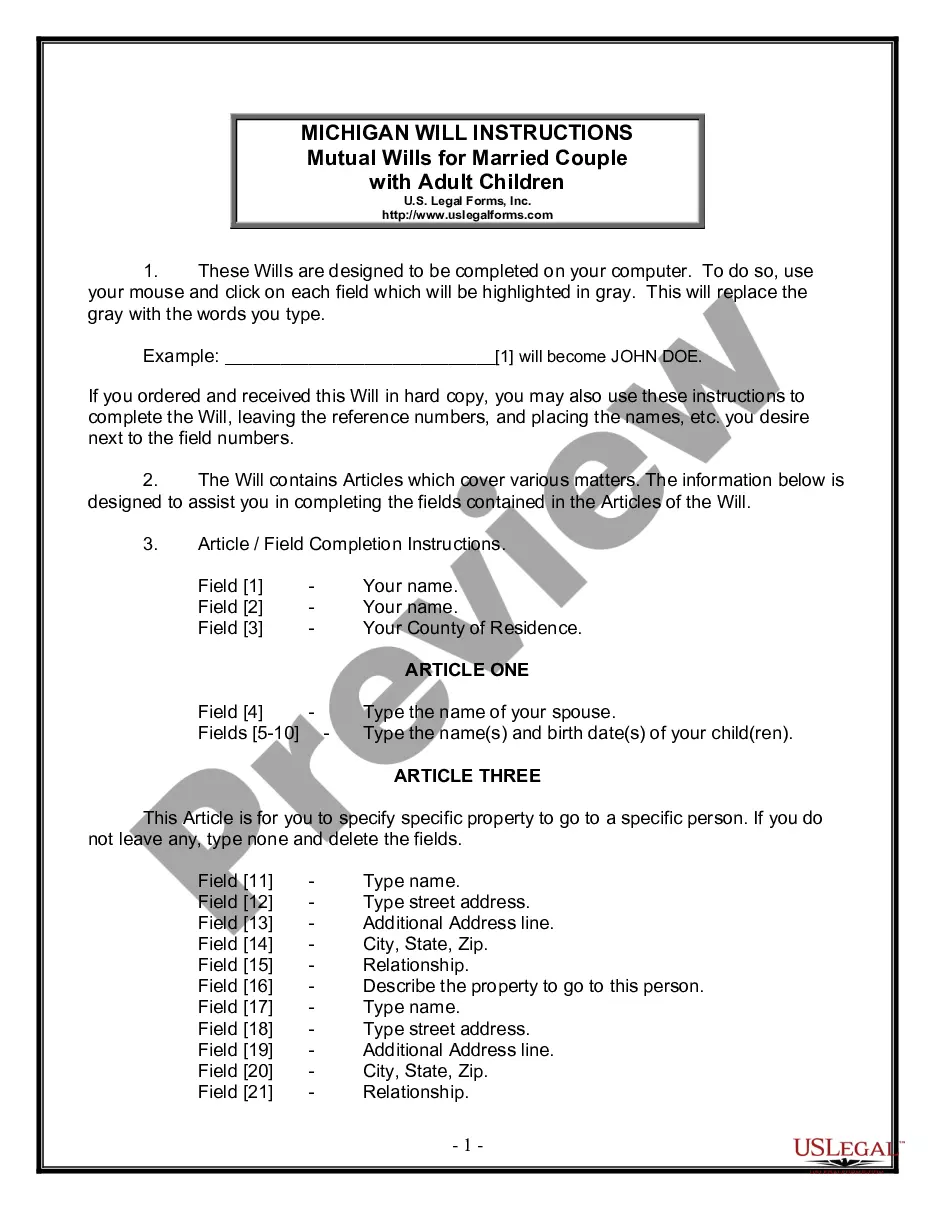

Create legally binding wills to ensure your assets are distributed according to your wishes, protecting your spouse and adult children.

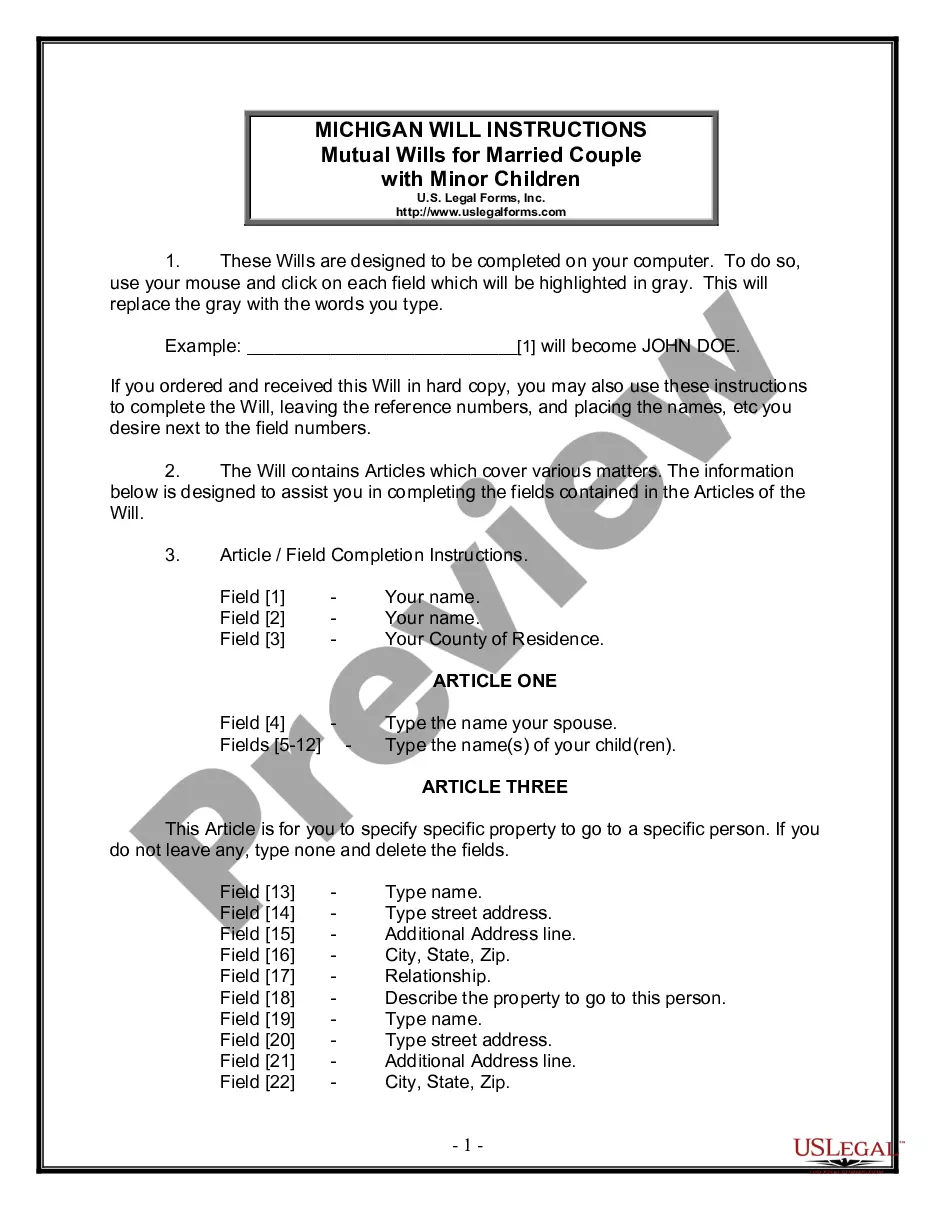

Plan for your family's future with essential wills for married couples with minor children, ensuring your wishes are honored when it matters most.

This package provides essential forms to assist with estate planning and ensuring your loved ones are protected.

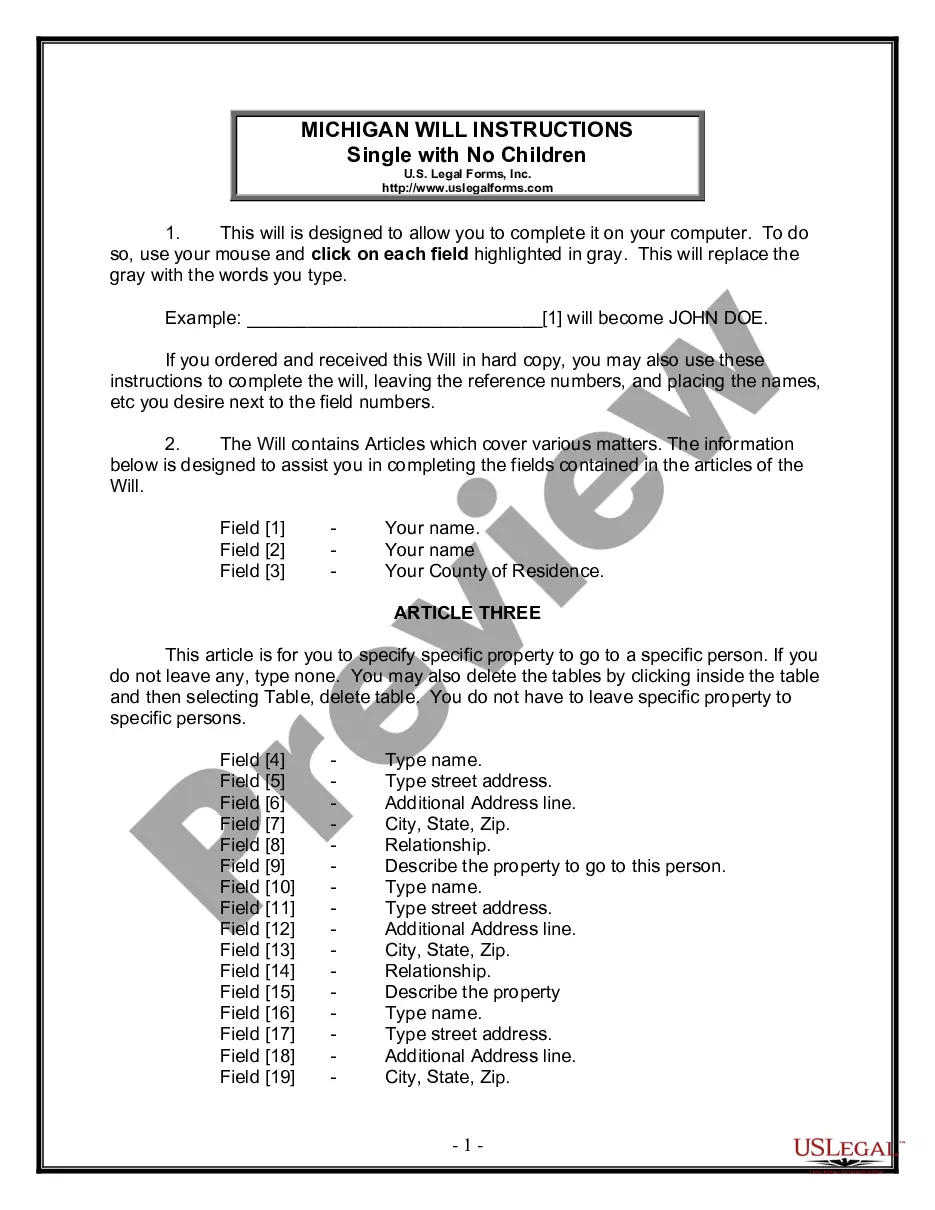

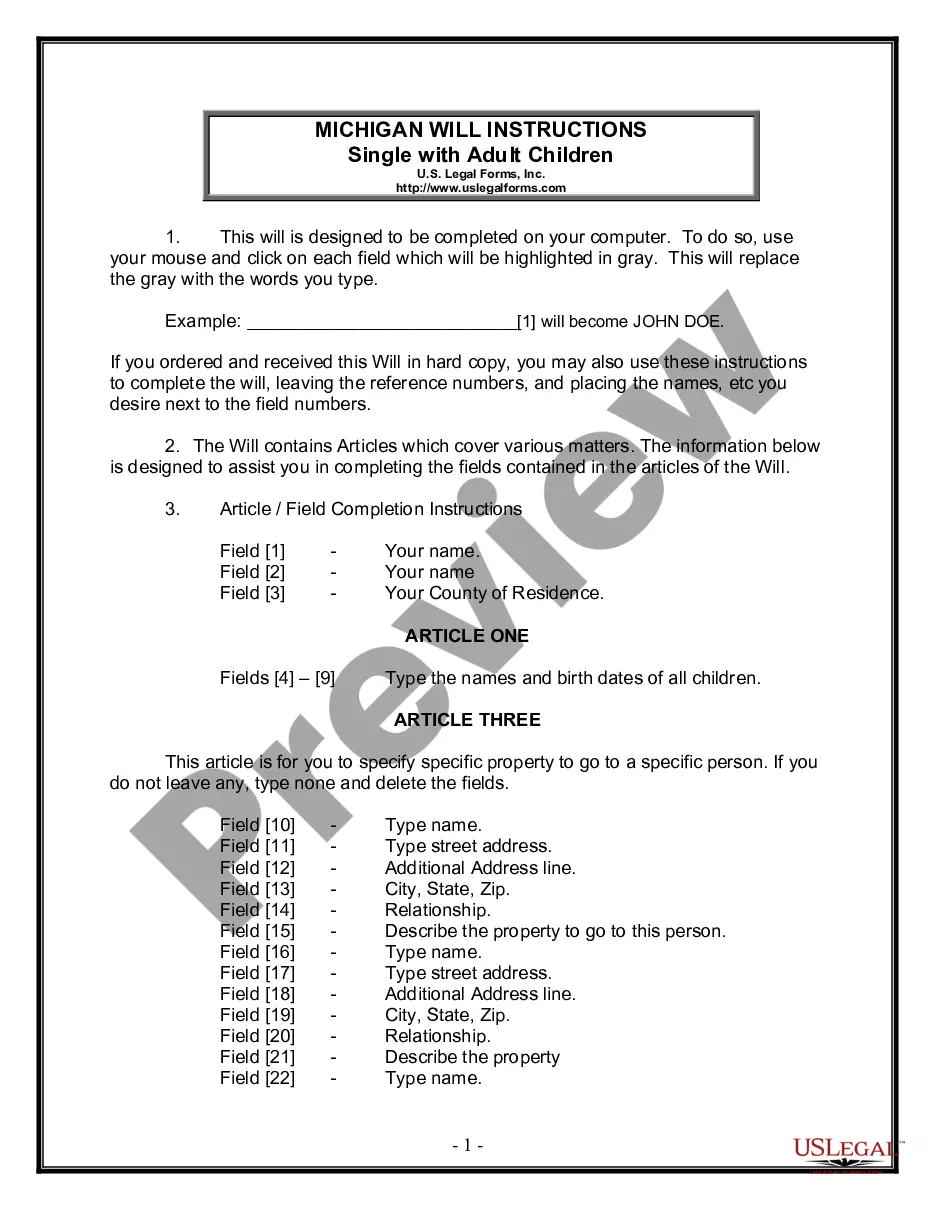

Create a tailored will that specifies how your assets will be distributed upon your death, especially for singles without children.

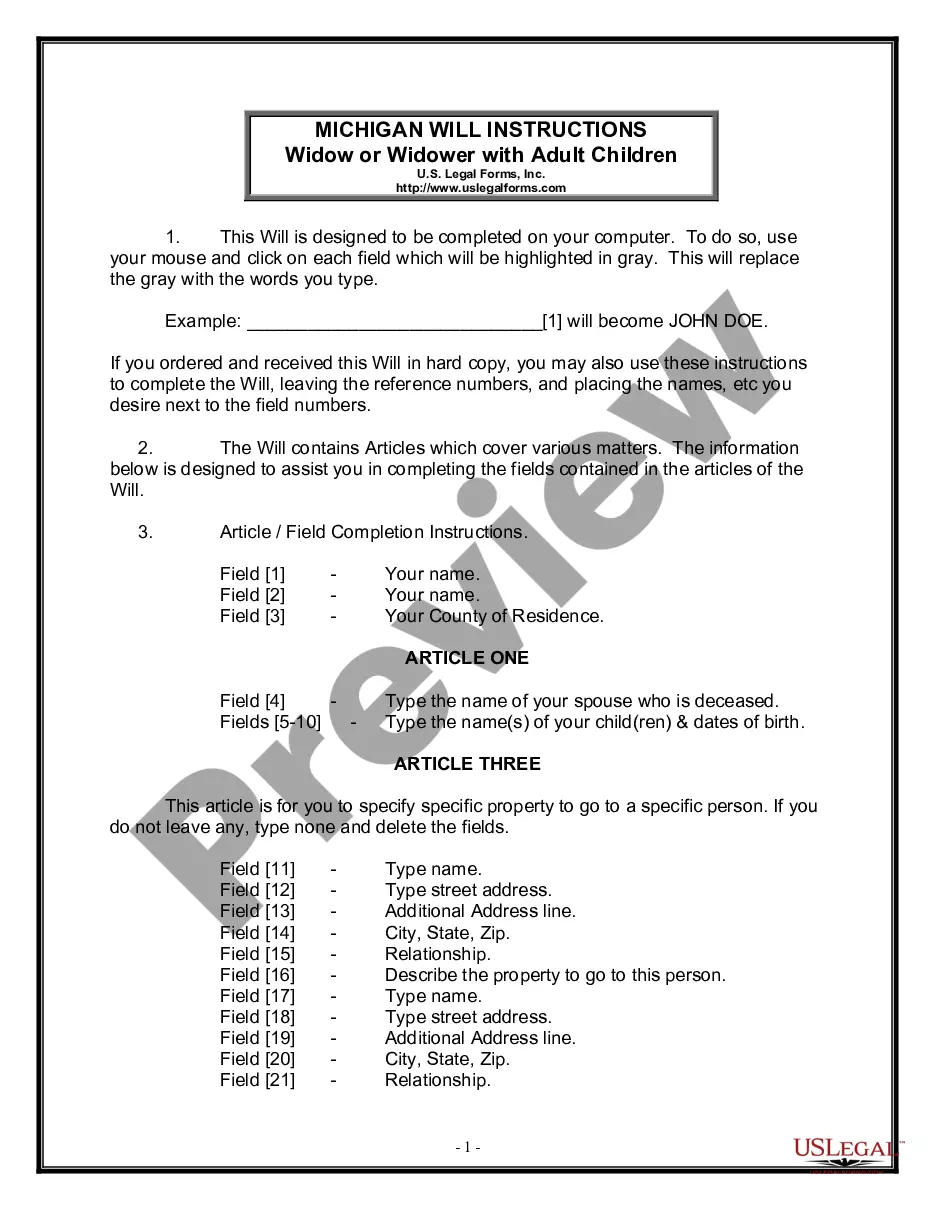

Settle your estate and determine asset distribution with this legal document designed for individuals who have lost a spouse and have adult children.

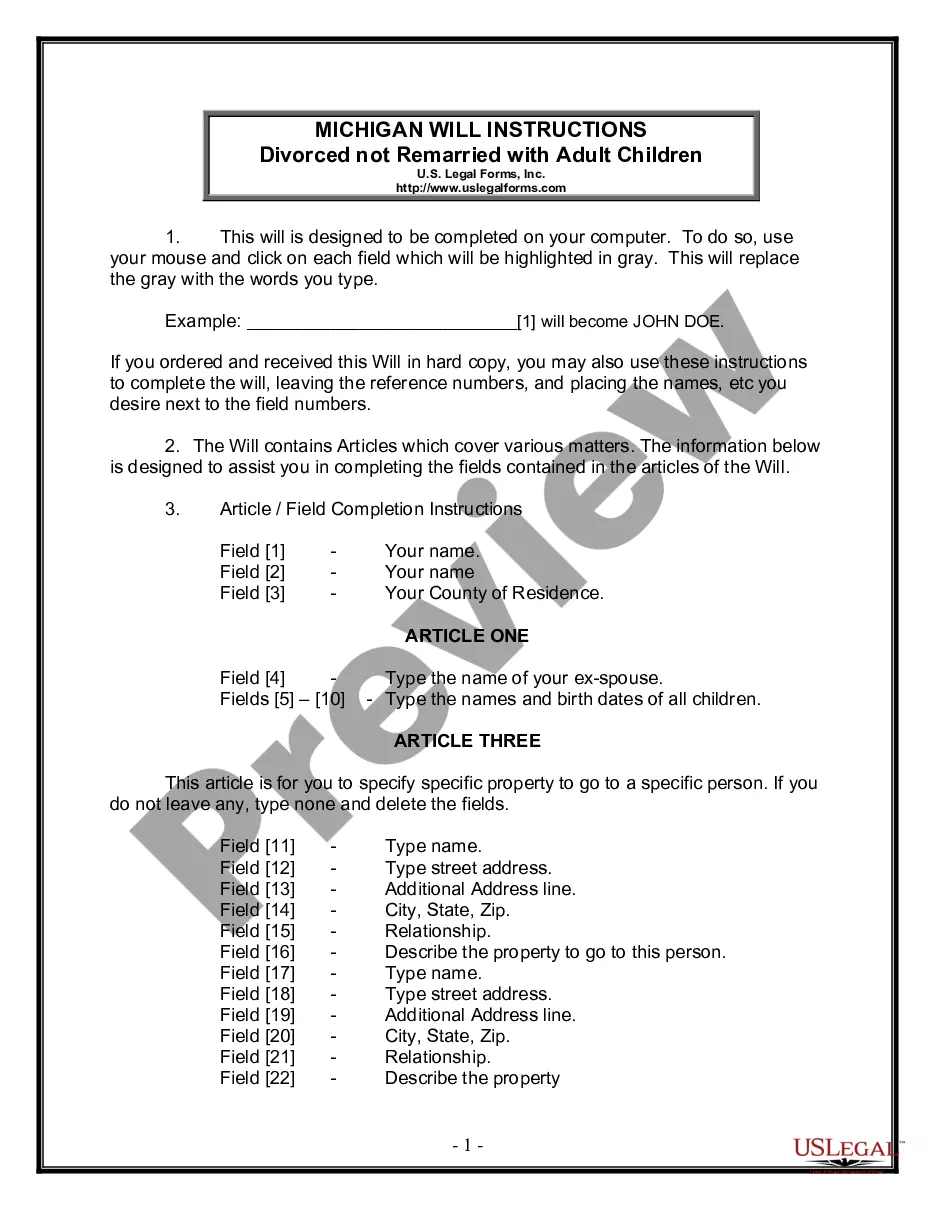

Create a legally binding will tailored for divorced individuals with adult children, ensuring your wishes are honored after your passing.

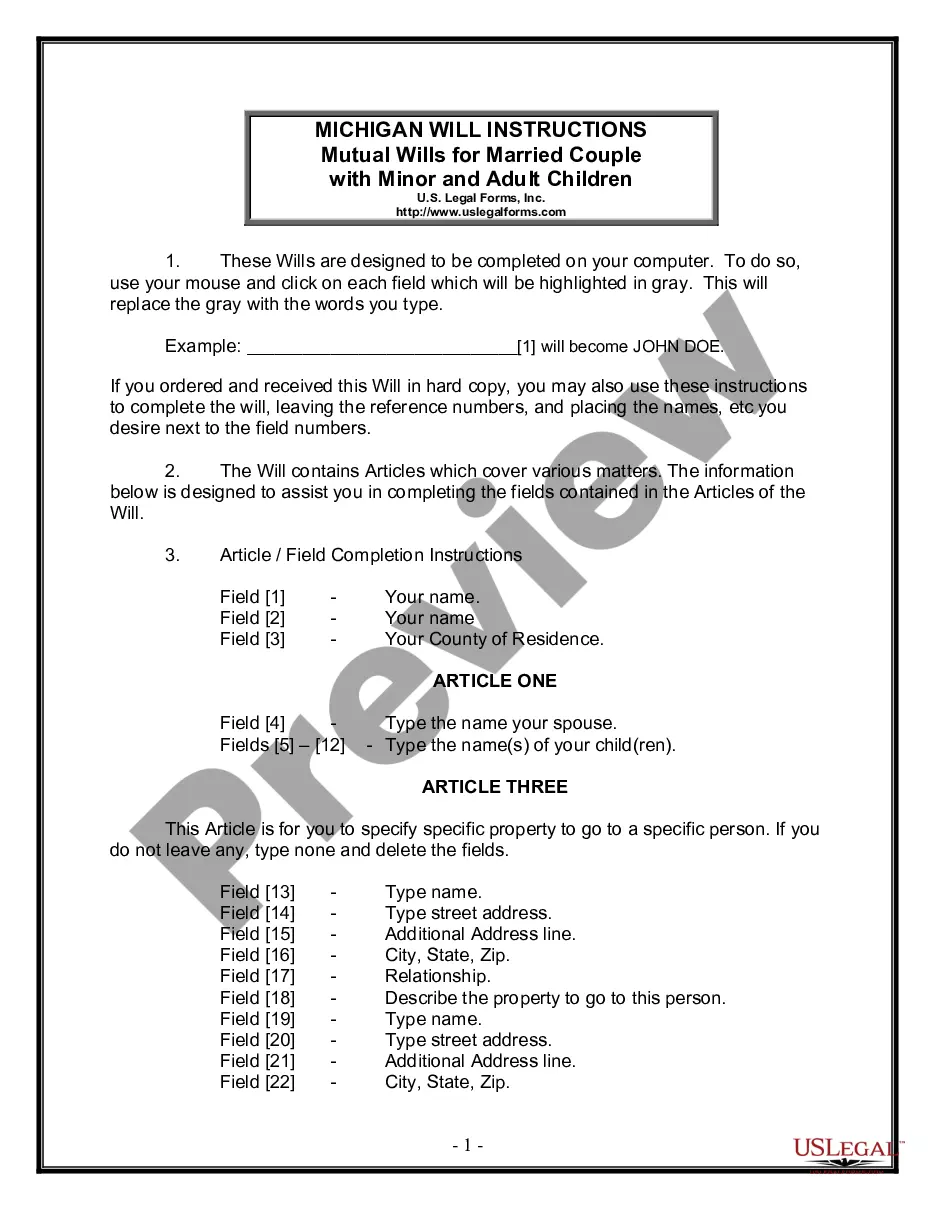

Create legally binding wills for couples with children, ensuring clear distribution of assets and guardianship for minors.

Create an enforceable will for your estate, ensuring your wishes are honored after your passing.

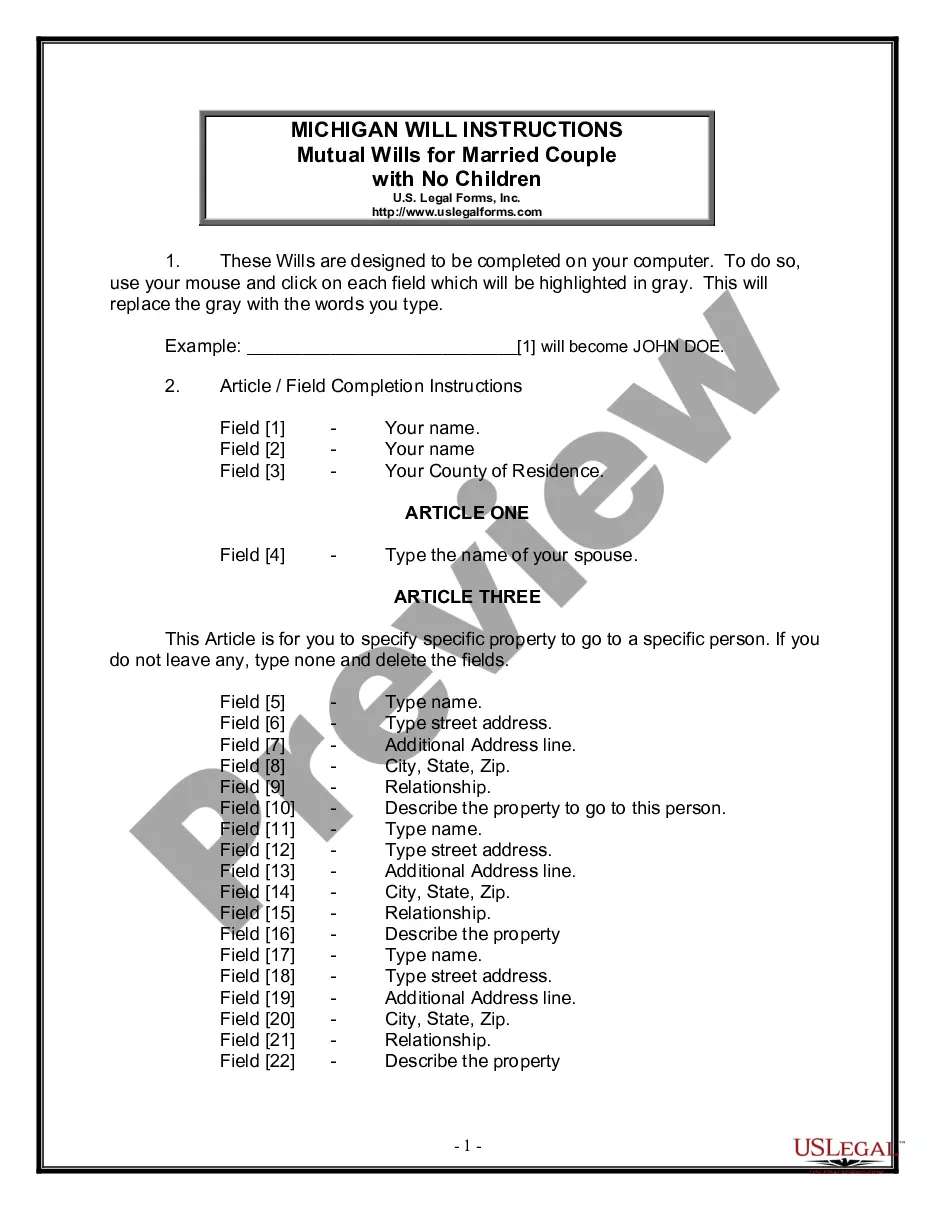

Create legally binding wills tailored for married couples without children to ensure mutual estate planning.

Protect your loved ones by specifying how your assets will be distributed after your death, ensuring clarity and peace of mind.

A Last Will and Testament takes effect after death.

Wills can designate guardians for minor children.

Witnesses are often required for will execution.

Wills can be contested in court if validity is questioned.

Many wills need notarization for added validity.

Changes to a will can be made with a codicil.

Beneficiaries can be named for specific assets.

Begin your journey with these straightforward steps.

A trust can help manage assets during life and avoid probate, but a will is still essential.

If you do not create a will, state laws will dictate asset distribution.

Review your will regularly, especially after major life changes like marriage or having children.

Beneficiary designations on accounts can override your will, so ensure they align.

Yes, you can appoint separate individuals for financial and healthcare decisions in your documents.