What is Last Will and Testament?

A Last Will and Testament outlines how your assets are distributed after your passing. It is vital for ensuring your wishes are honored. Explore state-specific templates for Idaho.

Last Will and Testament documents are essential for planning your estate. Attorney-drafted templates provide fast and easy completion.

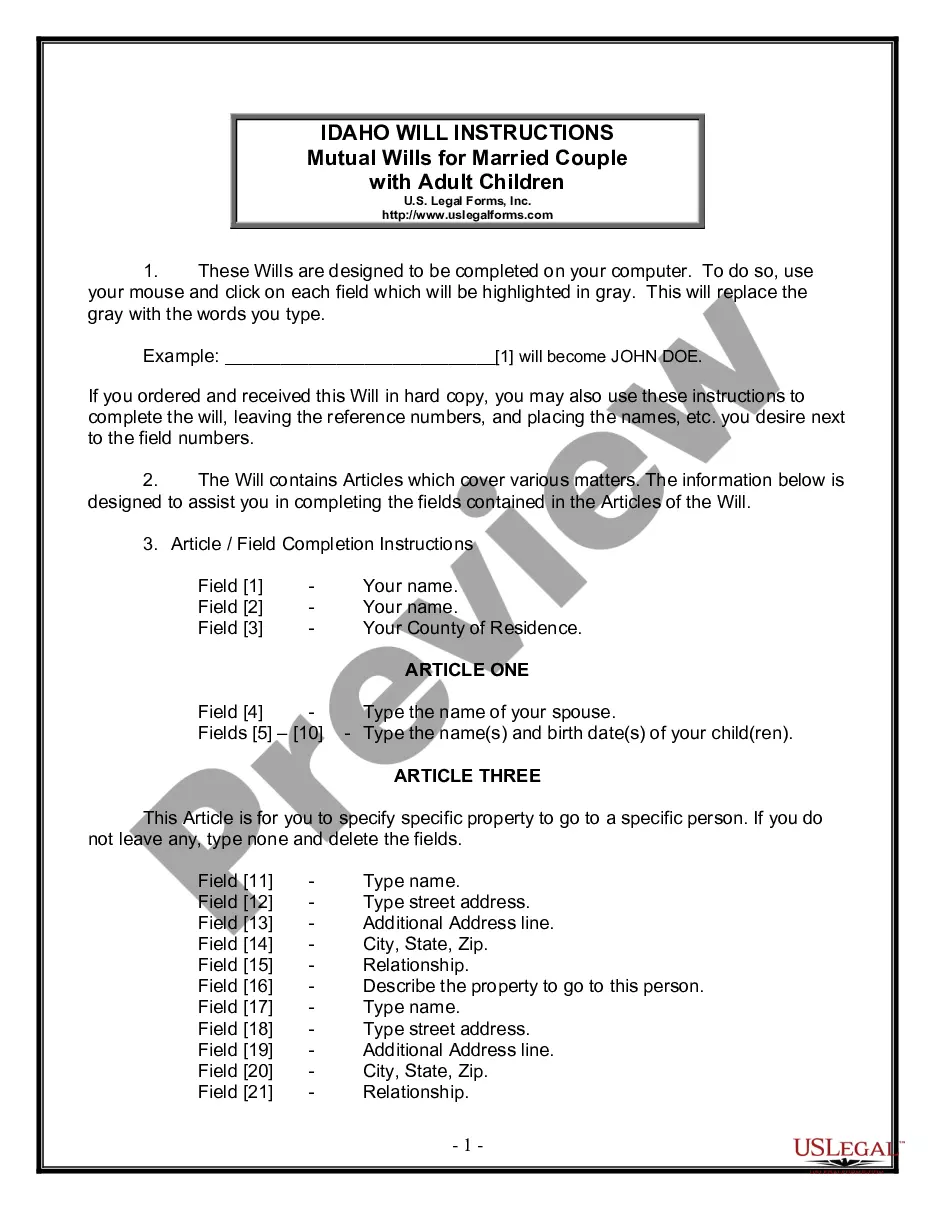

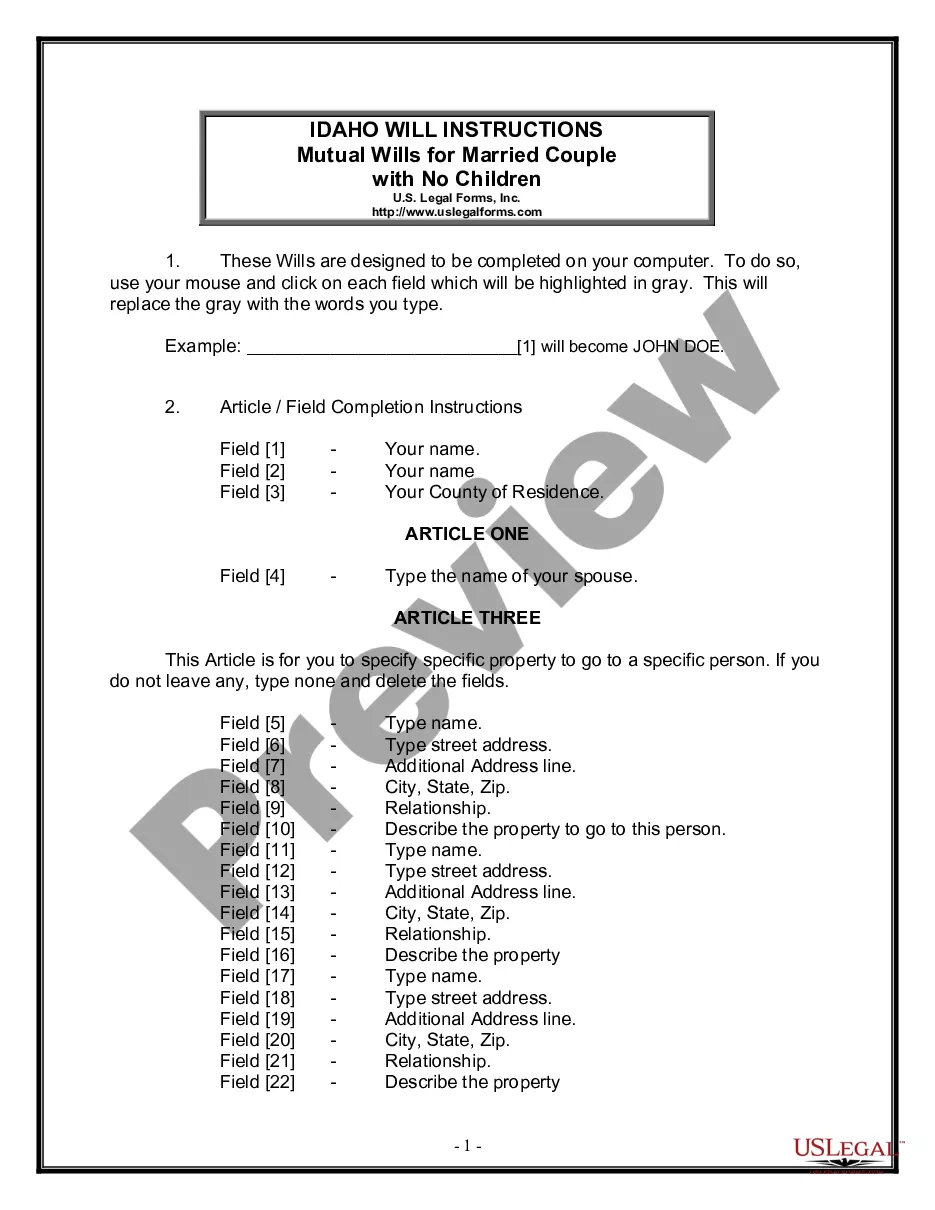

Create mutual wills to ensure both partners' wishes are honored regarding property and guardianship.

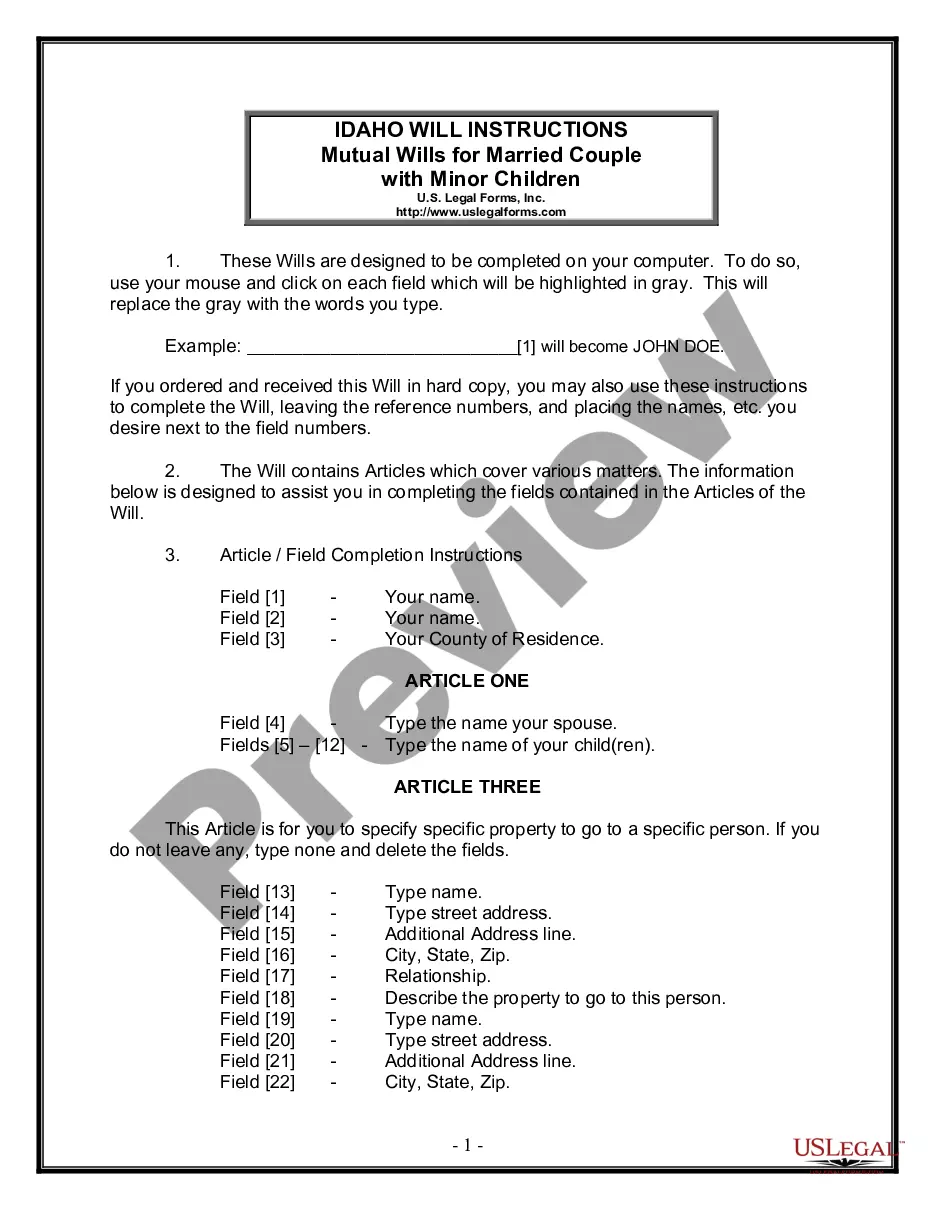

Create comprehensive wills for you and your spouse, ensuring proper guardianship and asset distribution for your minor children.

Get everything needed for your estate planning in one package, ensuring your wishes are clearly documented and your loved ones are protected.

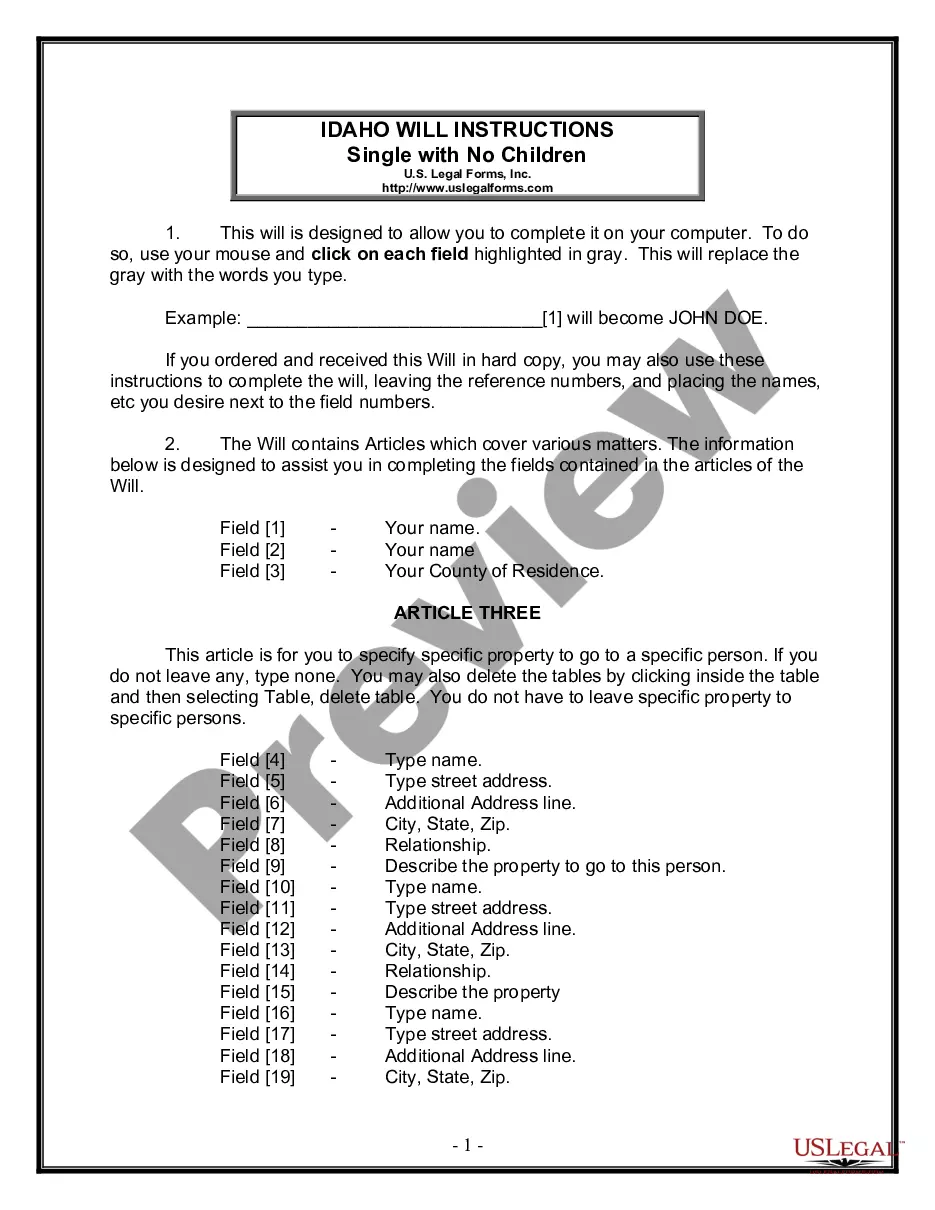

Design a personalized will to outline your property distribution and appoint a personal representative, ensuring your wishes are legally documented.

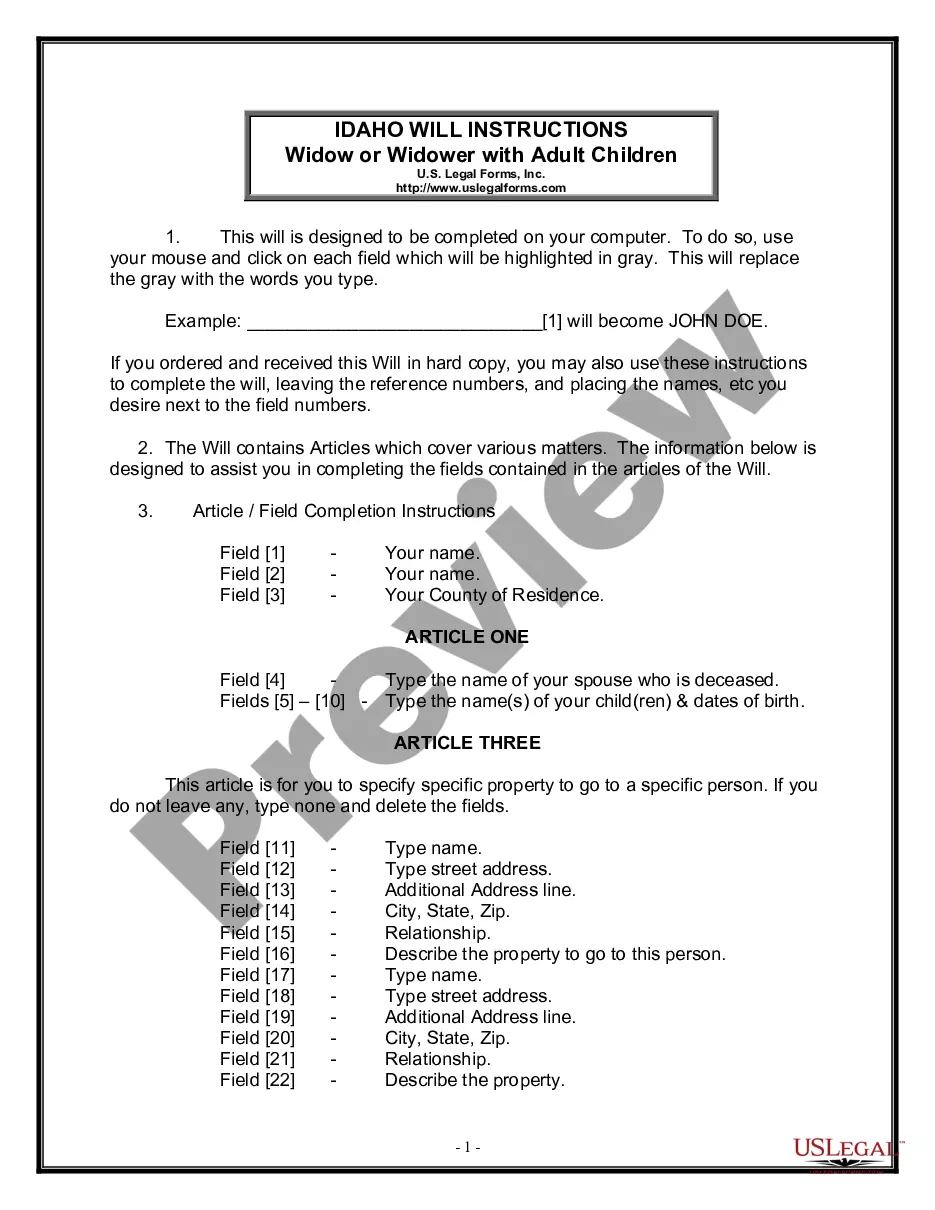

Create a legally binding will tailored for a widow or widower with adult children to ensure your wishes are respected.

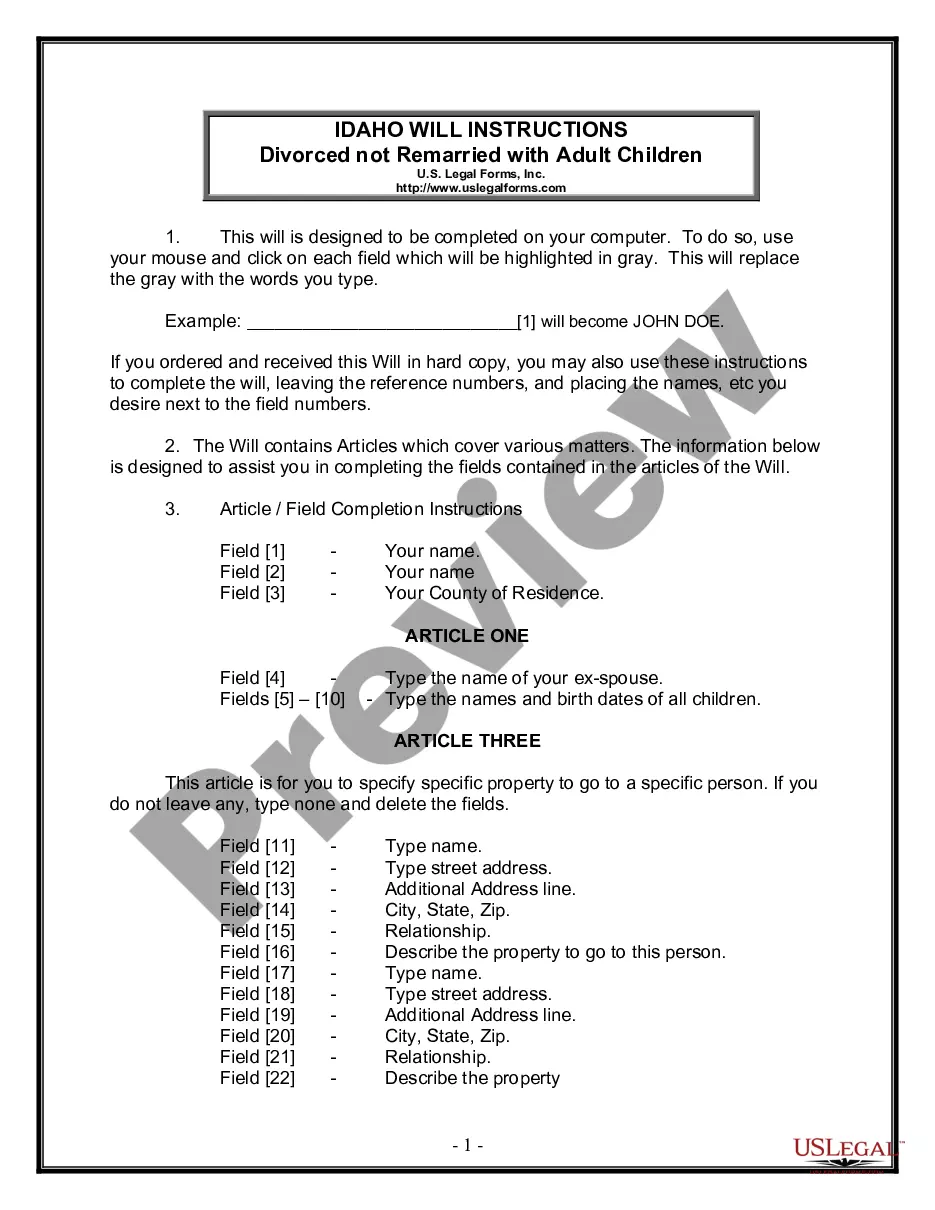

Safeguard your wishes for asset distribution after death, especially tailored for those divorced with adult children.

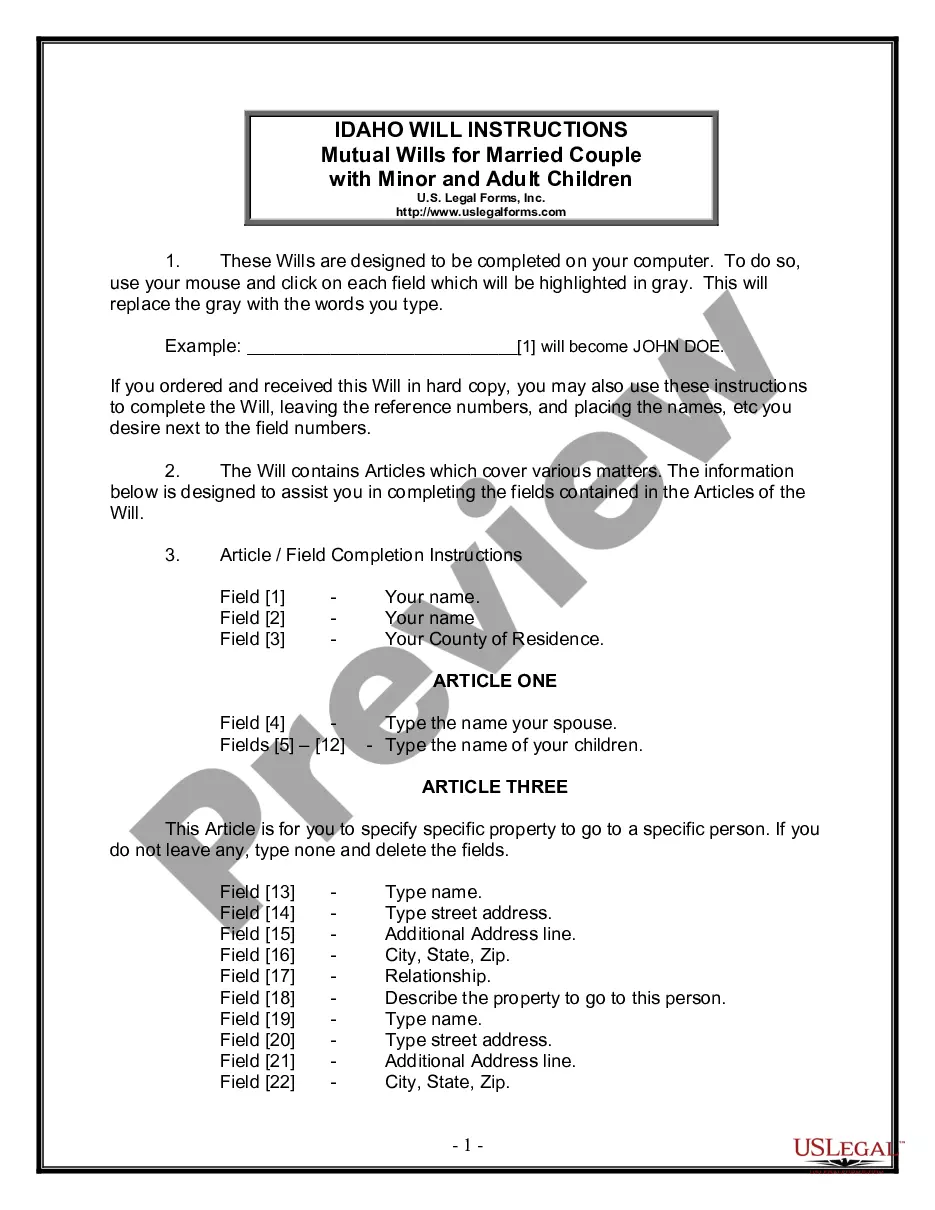

Create legally binding mutual wills for a married couple, addressing the estate plans for both minor and adult children.

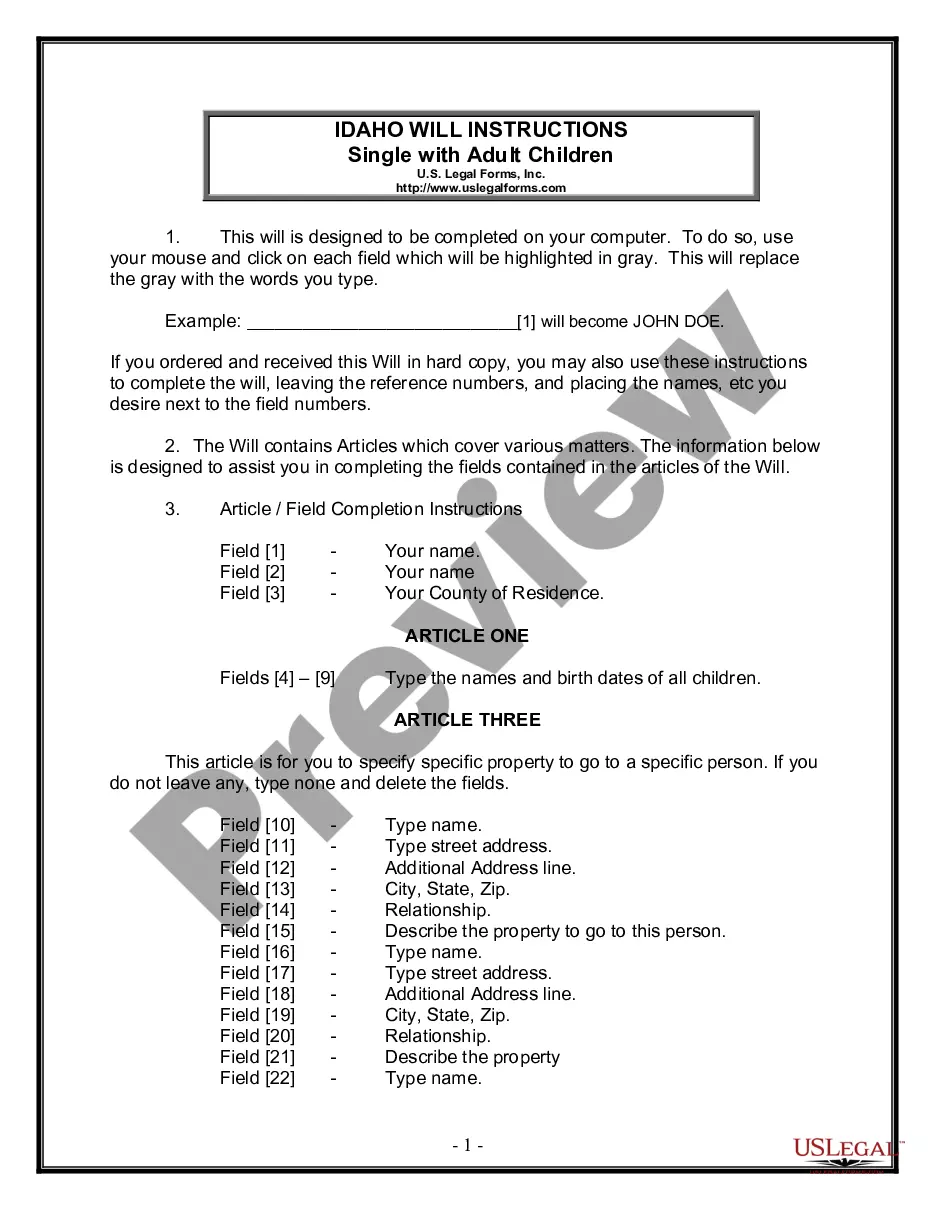

Plan your estate by specifying how you'd like your property distributed upon your death, ensuring your wishes are honored.

Plan your estate with mutual wills, ensuring both partners' wishes are clearly documented and legally binding.

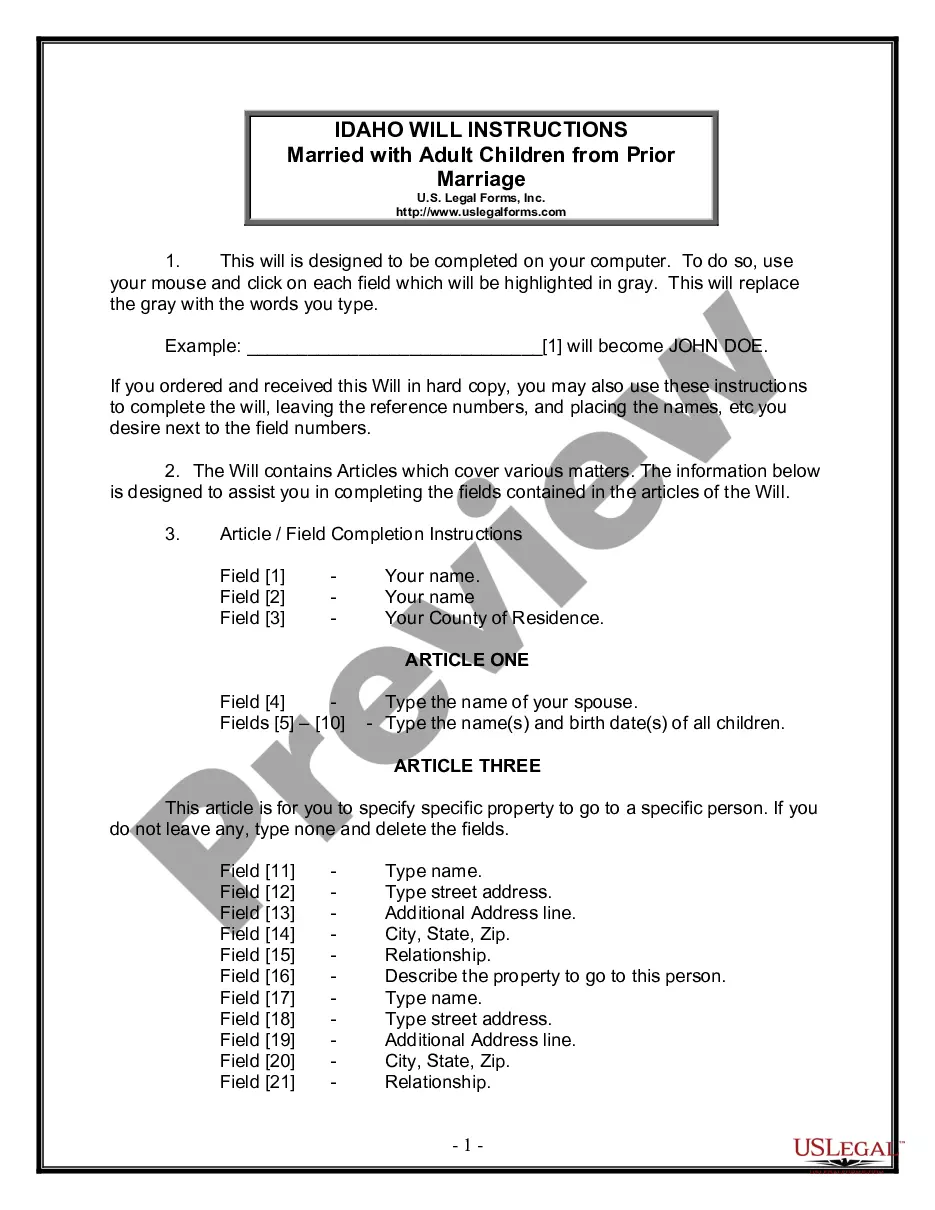

Prepare your estate plan to ensure your assets go to your spouse and adult children from a prior marriage, specifying personal representatives and bequests.

A Last Will and Testament directs asset distribution after death.

It can name guardians for minor children.

Wills generally require witnesses to be valid.

Some states allow for handwritten wills under specific conditions.

Beneficiaries can be named directly in the will.

Wills can be contested by heirs or interested parties.

Regular updates to your will are advisable after major life changes.

Begin your estate planning in a few simple steps.

A trust can offer additional benefits, such as avoiding probate, but is not mandatory.

Without a will, state laws dictate asset distribution, which may not reflect your wishes.

Review your will after major life events, like marriage, divorce, or the birth of a child.

Beneficiary designations on accounts can override your will, so ensure they align.

Yes, you can designate separate individuals for financial and health care decisions.