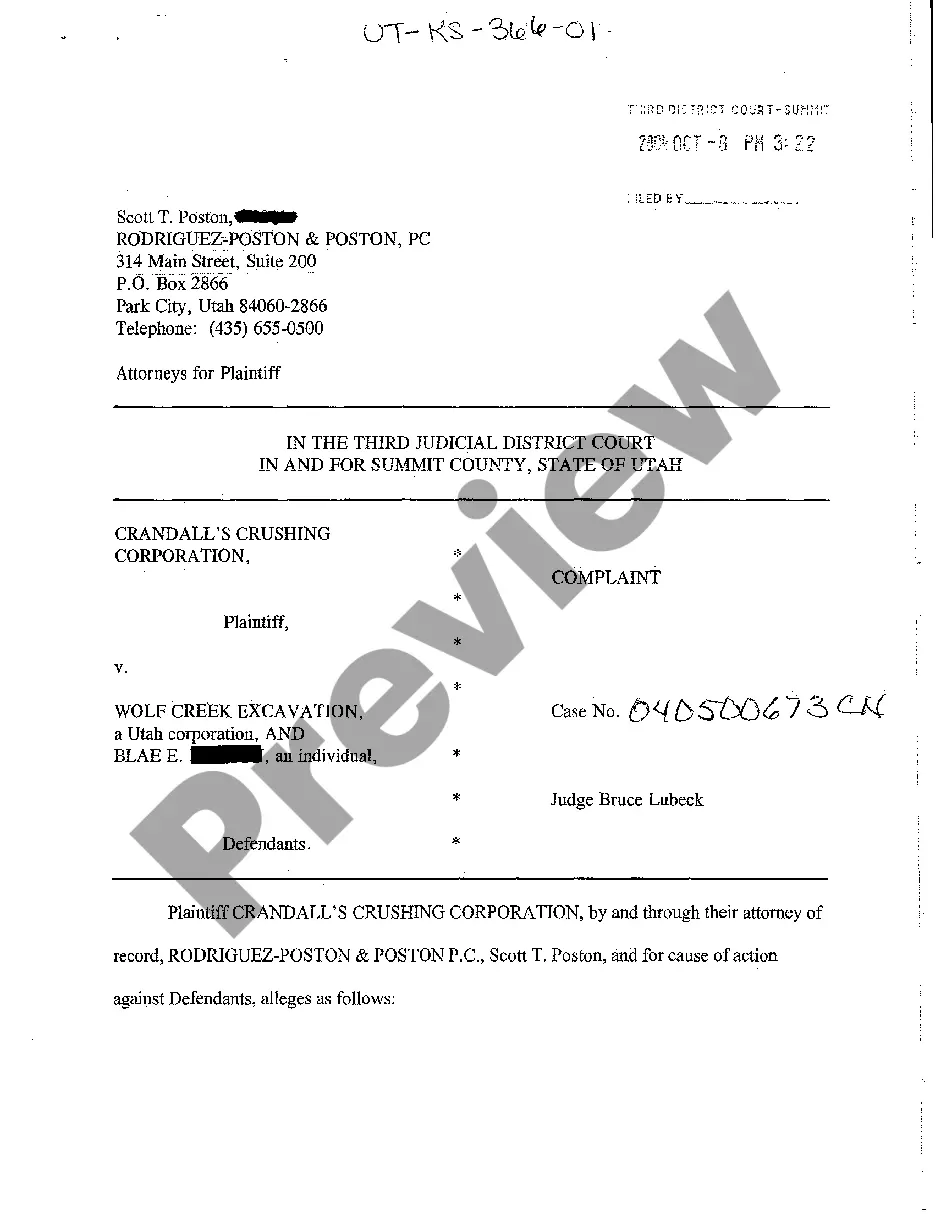

Utah Complaint - Breach of Lease, Personal Guaranty, Unjust Enrichment regarding office equipment

Description

How to fill out Utah Complaint - Breach Of Lease, Personal Guaranty, Unjust Enrichment Regarding Office Equipment?

Among countless free and paid templates that you can get on the net, you can't be sure about their accuracy. For example, who made them or if they’re competent enough to take care of what you need those to. Always keep relaxed and utilize US Legal Forms! Find Utah Complaint - Breach of Lease, Personal Guaranty, Unjust Enrichment regarding office equipment templates developed by skilled attorneys and avoid the high-priced and time-consuming process of looking for an lawyer and then paying them to write a document for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button next to the file you are seeking. You'll also be able to access all of your previously acquired files in the My Forms menu.

If you’re making use of our platform for the first time, follow the instructions below to get your Utah Complaint - Breach of Lease, Personal Guaranty, Unjust Enrichment regarding office equipment easily:

- Make certain that the document you find is valid where you live.

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing process or find another sample using the Search field found in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

As soon as you’ve signed up and paid for your subscription, you can use your Utah Complaint - Breach of Lease, Personal Guaranty, Unjust Enrichment regarding office equipment as often as you need or for as long as it stays active in your state. Change it with your preferred offline or online editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

Unless a business is a sole proprietorship, personal guarantees can only be discharged by filing an individual bankruptcy. A business bankruptcy will not eliminate a personal guarantee. Likewise, the Chapter 13 co-debtor stay only applies to consumer debts and personal guarantees are usually considered business debts.

The term personal guarantee refers to an individual's legal promise to repay credit issued to a business for which they serve as an executive or partner. Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance.

What happens if you default on a personal guarantee? Defaulting on a loan when you've signed a personal guarantee will likely impact your credit score for up to 10 years. If you default and you haven't signed a personal guarantee, your business's credit score will be impacted.

A personal guarantee will not be enforceable in any terms unless it's in writing and signed by the guarantor.Personal guarantees that are expressed as a deed and formally delivered and with wording as to that in intention are likely to be treated as unconditional.

An otherwise valid and enforceable personal guarantee can be revoked later in several different ways. A guaranty, much like any other contract, can be revoked later if both the guarantor and the lender agree in writing. Some debts owed by personal guarantors can also be discharged in bankruptcy.

Business owners can exercise their right to revoke the guarantee. Finally, business owners need to be aware that the personal guarantee may include a right to revoke. Typically, a right to revoke the guarantee does not limit the amount of the guarantor's liability as of the date of the revocation.

Ask for an amendment to the lease after 12-24 months. Ask for the guarantee to expire after 12-24 months as long as you have paid rent payments on time. Try to renegotiate the guarantee terms. Offer to pay a large security deposit.

A personal guaranty is not enforceable without consideration In fact, no contract is enforceable without consideration. A personal guaranty is a type of contract. A contract is an enforceable promise. The enforceability of a contract comes from one party's giving of consideration to the other party.

Obviously, repayment is one way to release yourself from a personal guarantee on a loan for your business. You may also be able to renegotiate the loan with your bank, asking them to remove your personal guarantee based on the company's assets and performance.