Complaint for Past Due Promissory Note

Overview of this form

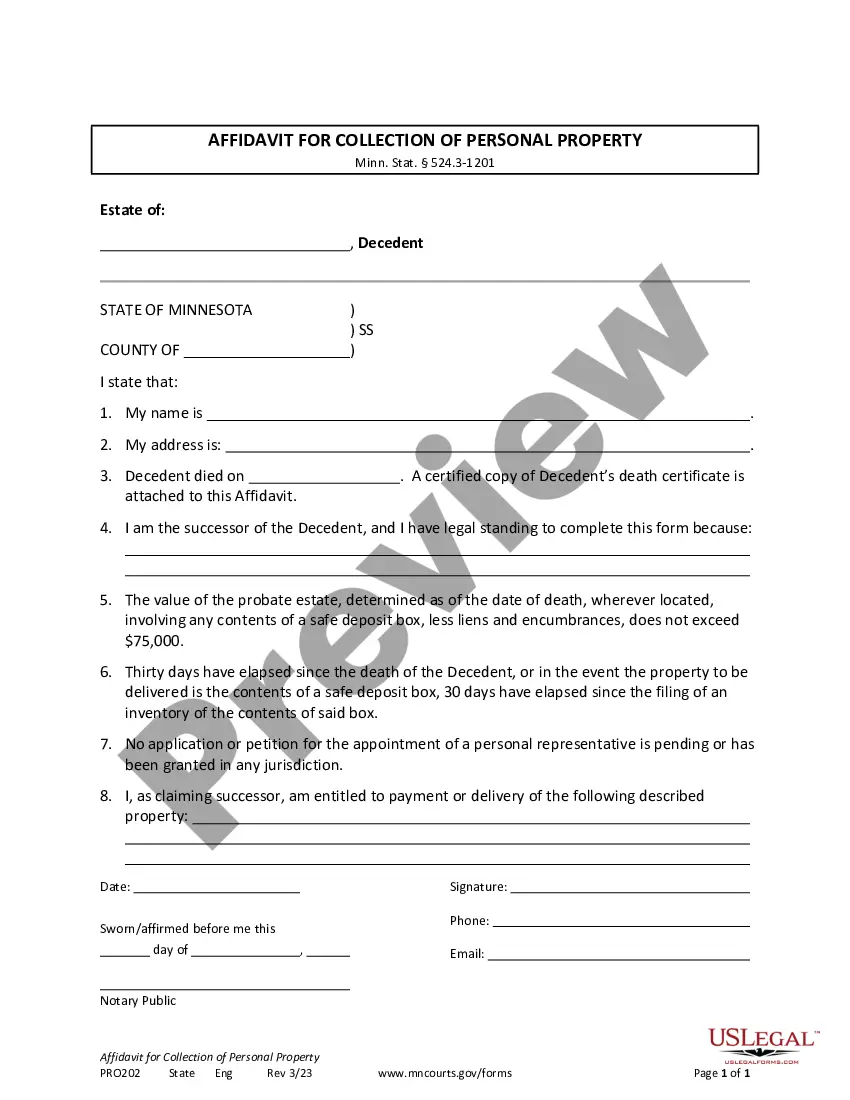

The Complaint for Past Due Promissory Note is a legal document used to initiate a lawsuit for unpaid amounts owed under a promissory note. This form adheres to the "notice pleadings" format established by the Federal Rules of Civil Procedure, which many states have adopted. It differs from other complaint forms by specifically addressing defaults related to promissory notes.

Main sections of this form

- Information about the plaintiff and defendant, including names and addresses.

- Details of the promissory note, including the date of execution and the address where it was executed.

- Statements confirming that the plaintiff has fulfilled their obligations under the note.

- Allegations regarding the defendant's default on the obligations.

- A demand for specific amounts due, including principal, interest, and attorney fees.

- A request for judgment and additional relief as deemed appropriate by the court.

When this form is needed

This form is appropriate for use when an individual or entity has loaned money under a promissory note and the borrower has failed to make the required payments. You may need to file this complaint if efforts to collect the debt have been unsuccessful and you intend to pursue legal action to recover the owed funds.

Who can use this document

- Lenders seeking to recover funds due under a promissory note.

- Individuals or businesses who have been unable to collect payments from borrowers.

- Attorneys representing plaintiffs in cases of debt collection related to promissory notes.

Instructions for completing this form

- Identify the plaintiff and defendant by providing their names and addresses.

- Describe the promissory note, including the execution date and details of the property involved.

- State that the plaintiff has fulfilled all obligations under the note.

- Indicate the default on payments by the defendant and the amount owed.

- Sign the complaint and include the attorney's information, if applicable.

Does this form need to be notarized?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include accurate names and addresses of all parties involved.

- Omitting details about the promissory note or the default.

- Not specifying the total amount owed, including any interest or attorney fees.

- Missing or incorrect signatures, particularly when an attorney is involved.

Why complete this form online

- Convenience of downloading and filling out the form at your own pace.

- Editable templates allow for customization to fit specific jurisdictional requirements.

- Access to a reliable, attorney-drafted document that meets legal standards.

Looking for another form?

Form popularity

FAQ

The owner of the promissory note can file a civil lawsuit against the signer of the note if the signer refuses to pay. The purpose of the lawsuit is to obtain a judgment against the note's signer, which will give the owner of the note the ability to pursue the signer's assets.

The lender can file a civil suit for recovering the money he owed through promissory note or loan agreement. He can do so under Order 37 of CPC which allows the lender to file a summary suit. He can file this suit in any high court, City Civil Court, Magistrate Court, Small Causes Court.

Whatever the scope of the promissory note, the basic tenet is that once it is signed by the involved parties, it becomes a legal instrument that can be enforced via legal remedy if one of the parties does not uphold their end of the bargain.

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid.The value of the amount of debt forgiven may be deemed either taxable income, or a gift subject to the federal estate and gift tax.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

Types of Property that can be used as collateral. Speak to them in person. Draft a Demand / Notice Letter. Write and send a Follow Up Letter. Enlisting a Professional Collection Agency. Filing a petition or complaint in court. Selling the Promissory Note. Final Tips.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

A promissory note is usually held by the party owed money; once the debt has been fully discharged, it must be canceled by the payee and returned to the issuer.