Tx Claim Against Online

Description Texas Statement Estate File

How to fill out Texas State Formation?

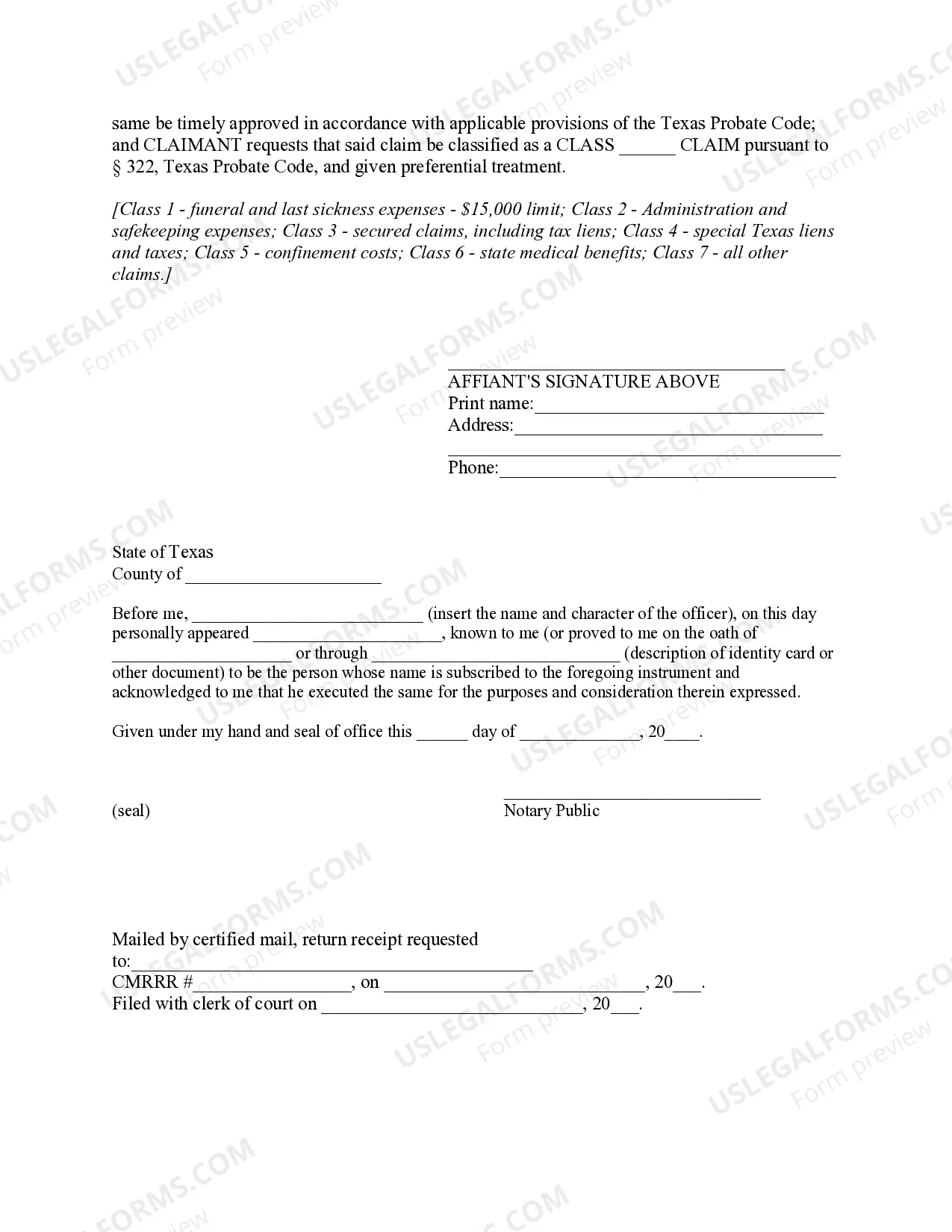

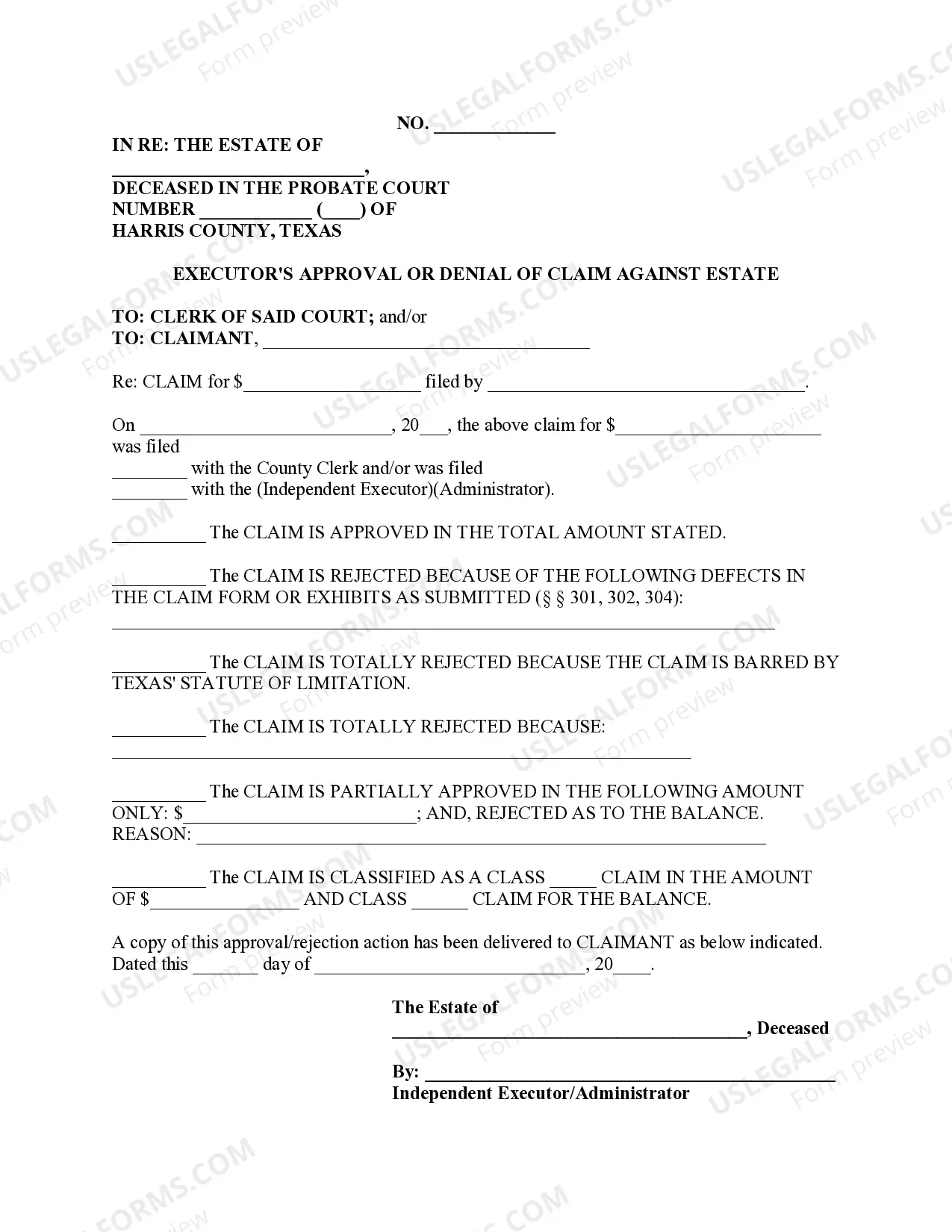

Get access to top quality Sworn Statement Supporting Claim Against Estate - Texas forms online with US Legal Forms. Steer clear of days of wasted time browsing the internet and lost money on forms that aren’t up-to-date. US Legal Forms provides you with a solution to just that. Get above 85,000 state-specific legal and tax forms that you could download and fill out in clicks in the Forms library.

To receive the sample, log in to your account and then click Download. The file is going to be saved in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

- See if the Sworn Statement Supporting Claim Against Estate - Texas you’re considering is suitable for your state.

- Look at the sample using the Preview option and browse its description.

- Check out the subscription page by simply clicking Buy Now.

- Choose the subscription plan to go on to sign up.

- Pay out by credit card or PayPal to finish making an account.

- Pick a preferred format to download the document (.pdf or .docx).

Now you can open the Sworn Statement Supporting Claim Against Estate - Texas sample and fill it out online or print it and get it done by hand. Consider giving the file to your legal counsel to make sure things are filled out correctly. If you make a mistake, print and complete sample again (once you’ve made an account every document you save is reusable). Create your US Legal Forms account now and get a lot more forms.