What is Power of Attorney?

Power of Attorney enables one person to act on another's behalf. These documents are essential for managing finances and healthcare in specific situations. Discover state-specific templates to suit your needs.

Power of Attorney documents allow individuals to appoint others to make decisions. Attorney-drafted templates are quick and easy to complete.

Prepare for the future with multiple legal forms designed to protect your health and finances, all conveniently packaged for peace of mind.

Empower someone to manage your finances immediately, even if you become incapacitated. This document grants extensive authority over your property.

Grant someone the authority to manage your finances if you become incapacitated, ensuring your affairs remain in good hands.

Get peace of mind with essential legal forms for managing your health and finances, all in one convenient package.

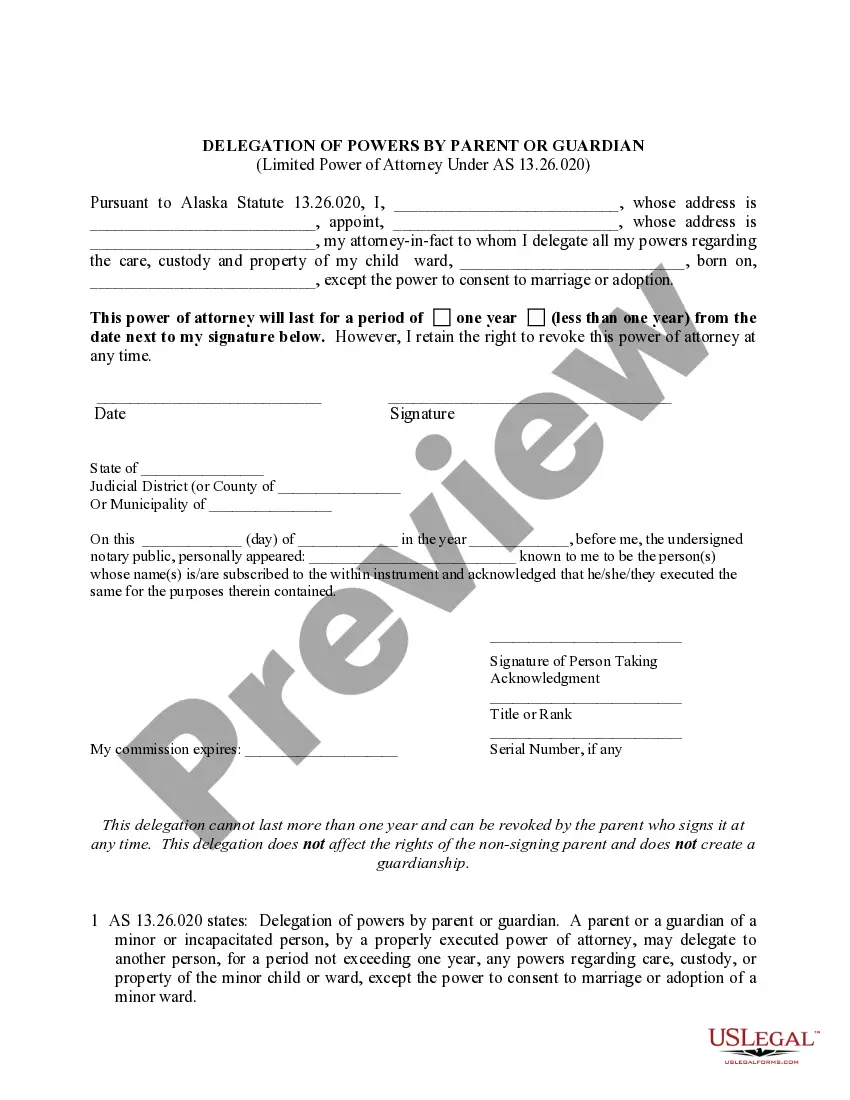

Assign temporary care and custody of your child to someone else, while retaining the right to revoke it at any time.

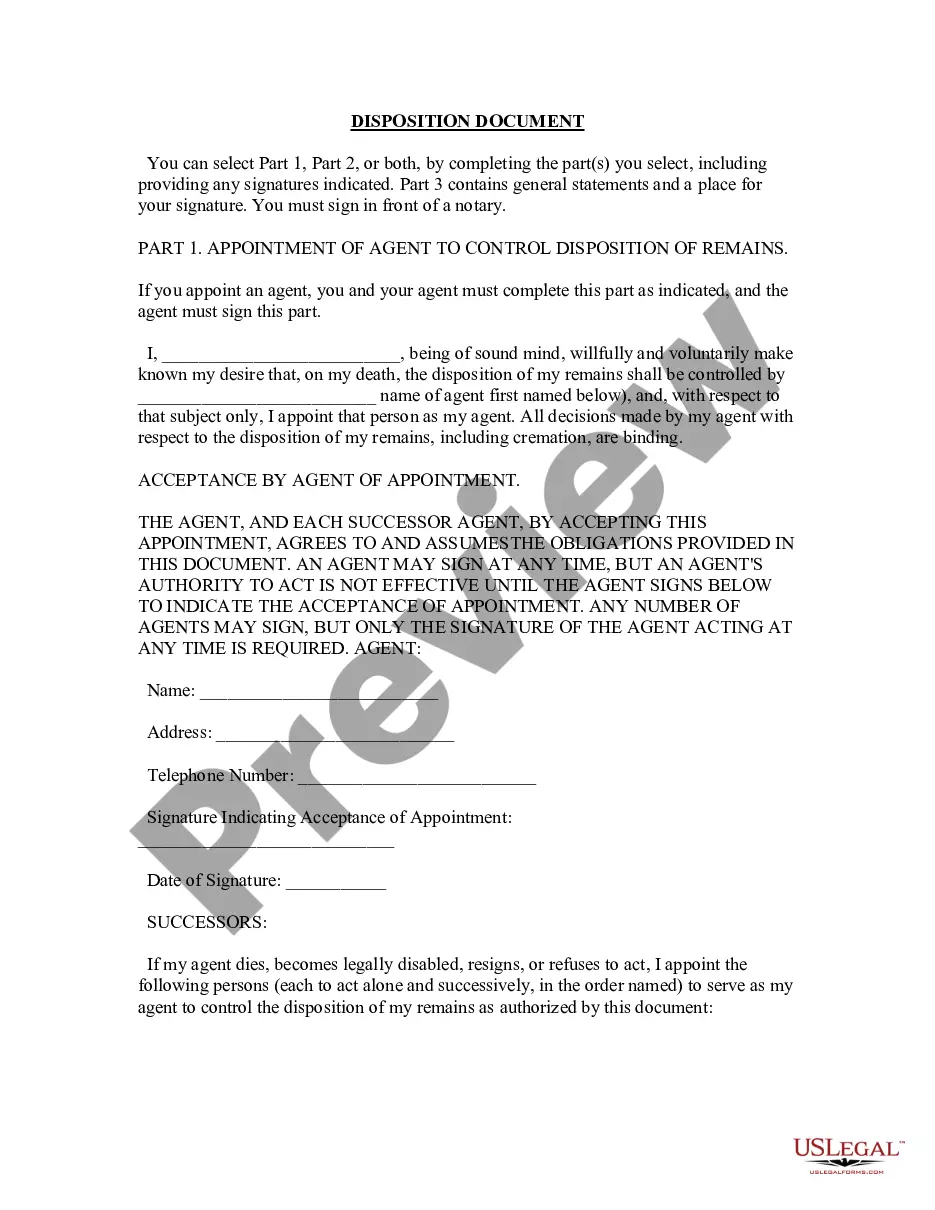

Ensure your final wishes for the disposition of your remains are honored by designating an agent and outlining your preferences.

Access essential forms for establishing your healthcare wishes and medical decisions in one package for peace of mind.

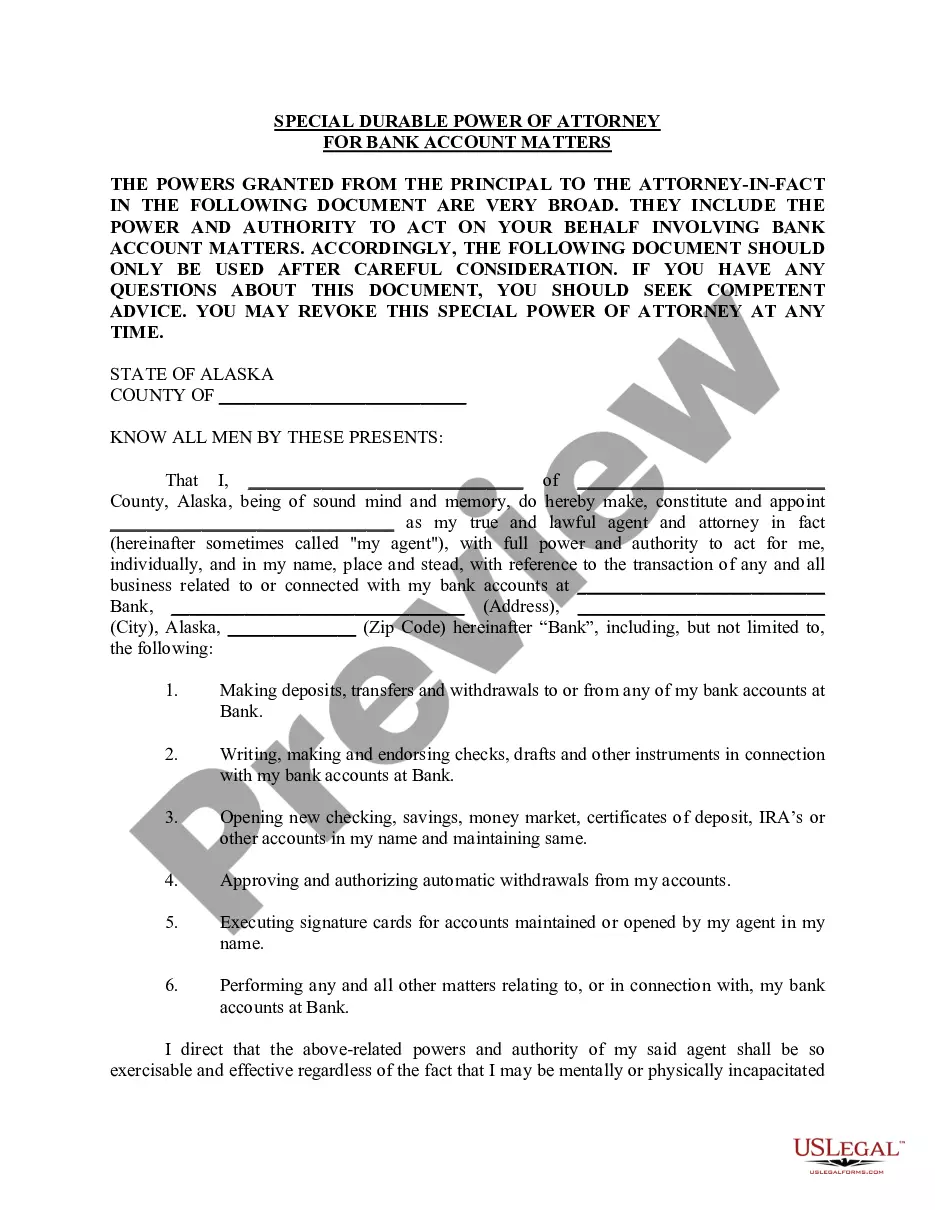

Grant someone the authority to manage your bank account matters, even during incapacity or illness.

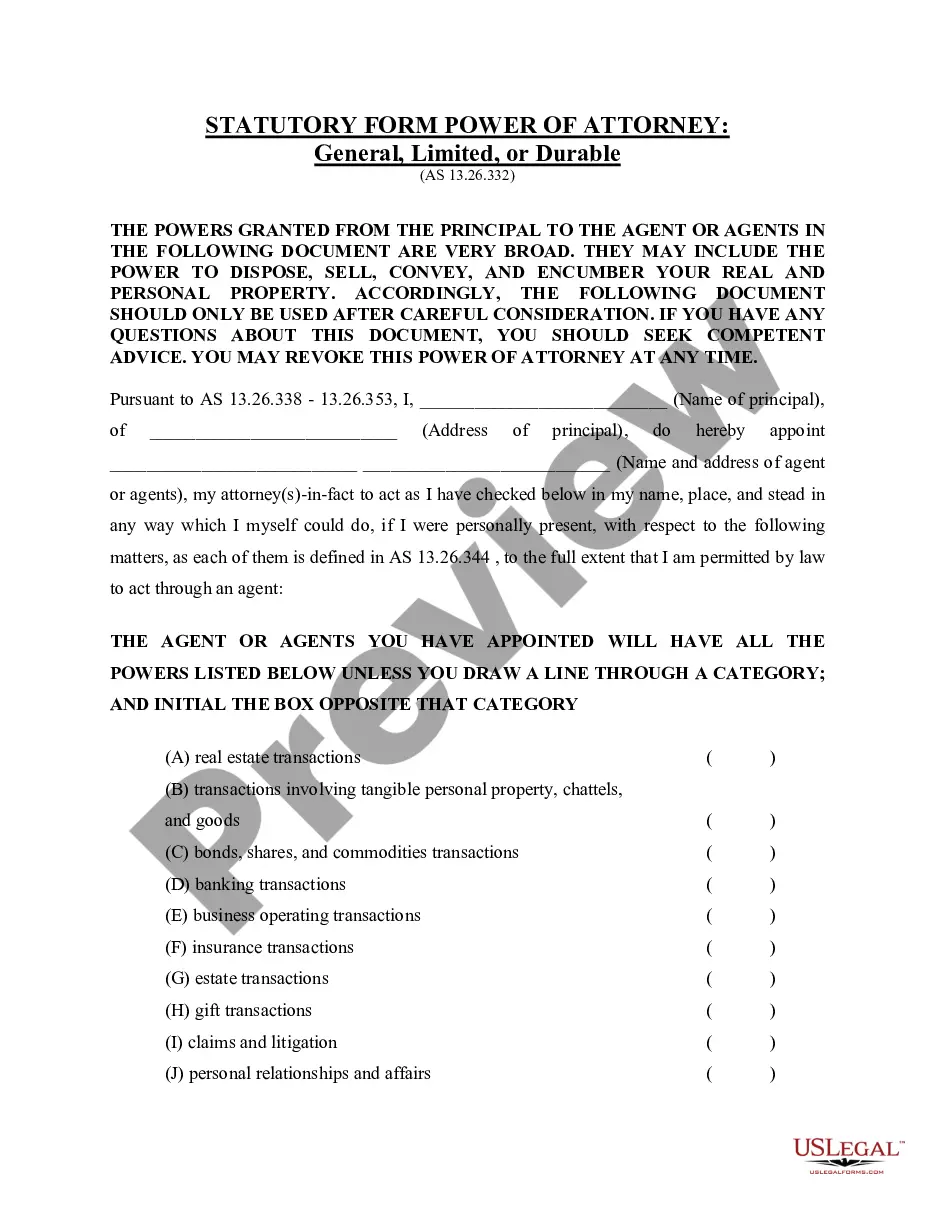

Appoint someone to manage your affairs with broad powers, including property transactions, banking, and business decisions.

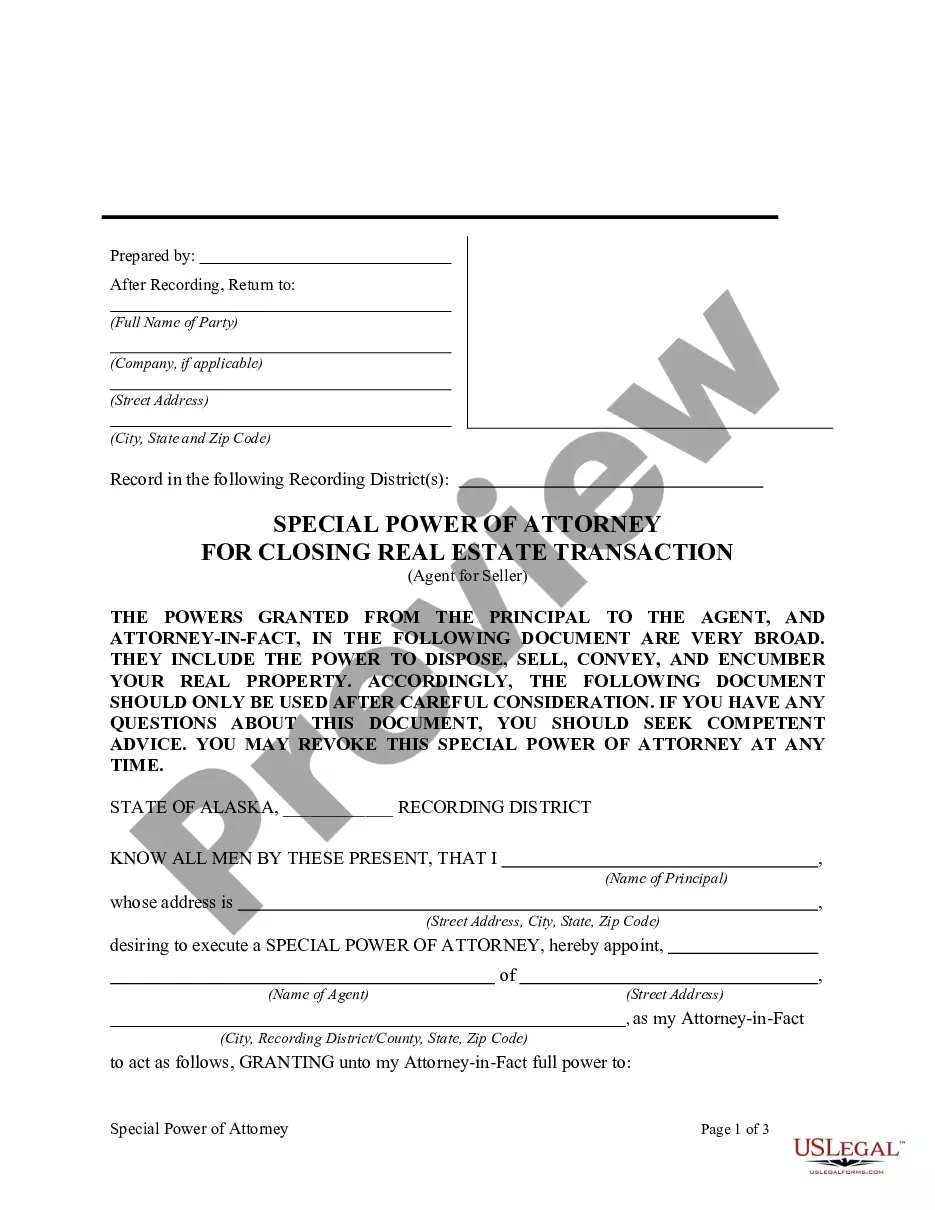

Grant authority for real estate transactions through a designated individual, making important sales decisions easier.

Power of Attorney is a legal document that grants authority to another person.

The person granting authority is the principal; the person receiving it is the agent.

Agents can make decisions regarding finances, healthcare, or both.

Different types of Power of Attorney serve varied purposes.

Notarization or witness signatures may be required for many documents.

Choosing a trustworthy agent is crucial for effective representation.

Documents should be reviewed regularly to ensure they reflect current wishes.

Begin your process in just a few steps.

A trust and a will serve different purposes; having both can be beneficial.

If no Power of Attorney is in place, decisions may default to the courts.

Review and update your plan regularly, especially after major life changes.

Beneficiary designations can override wills and trusts, so it's important to coordinate.

Yes, you can appoint separate agents for financial and healthcare decisions.