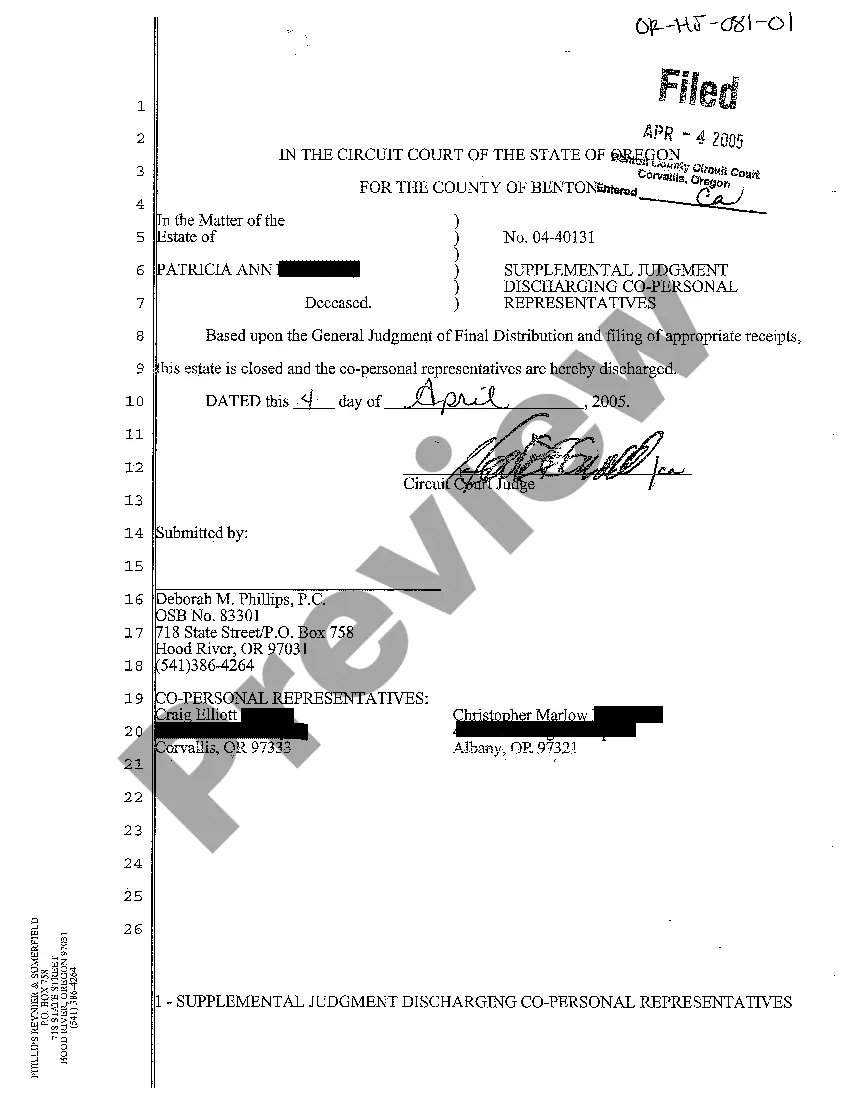

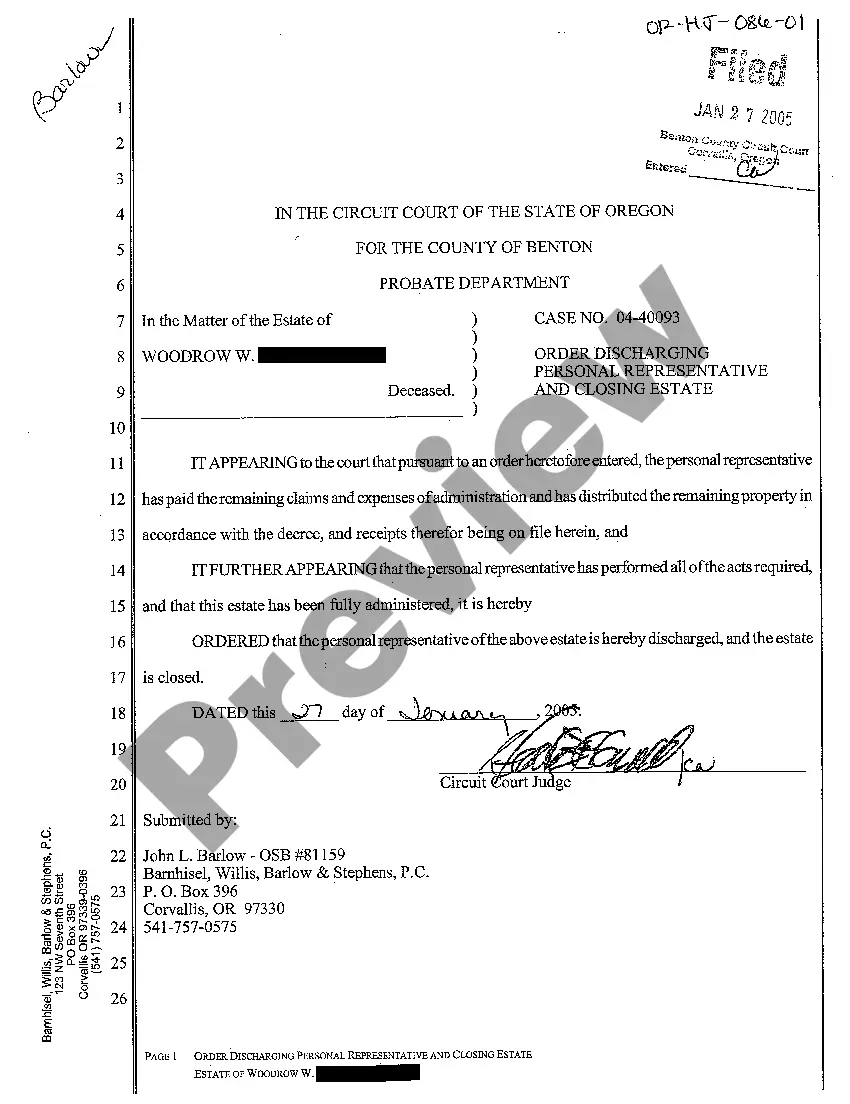

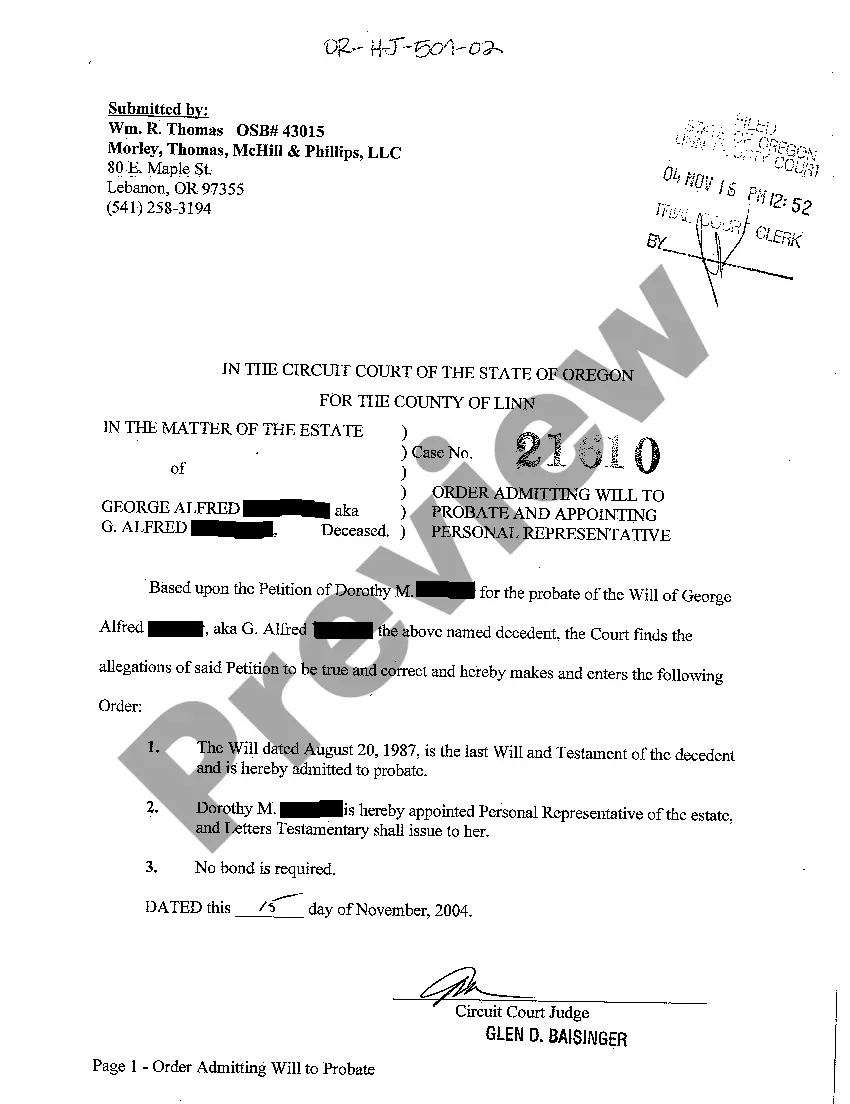

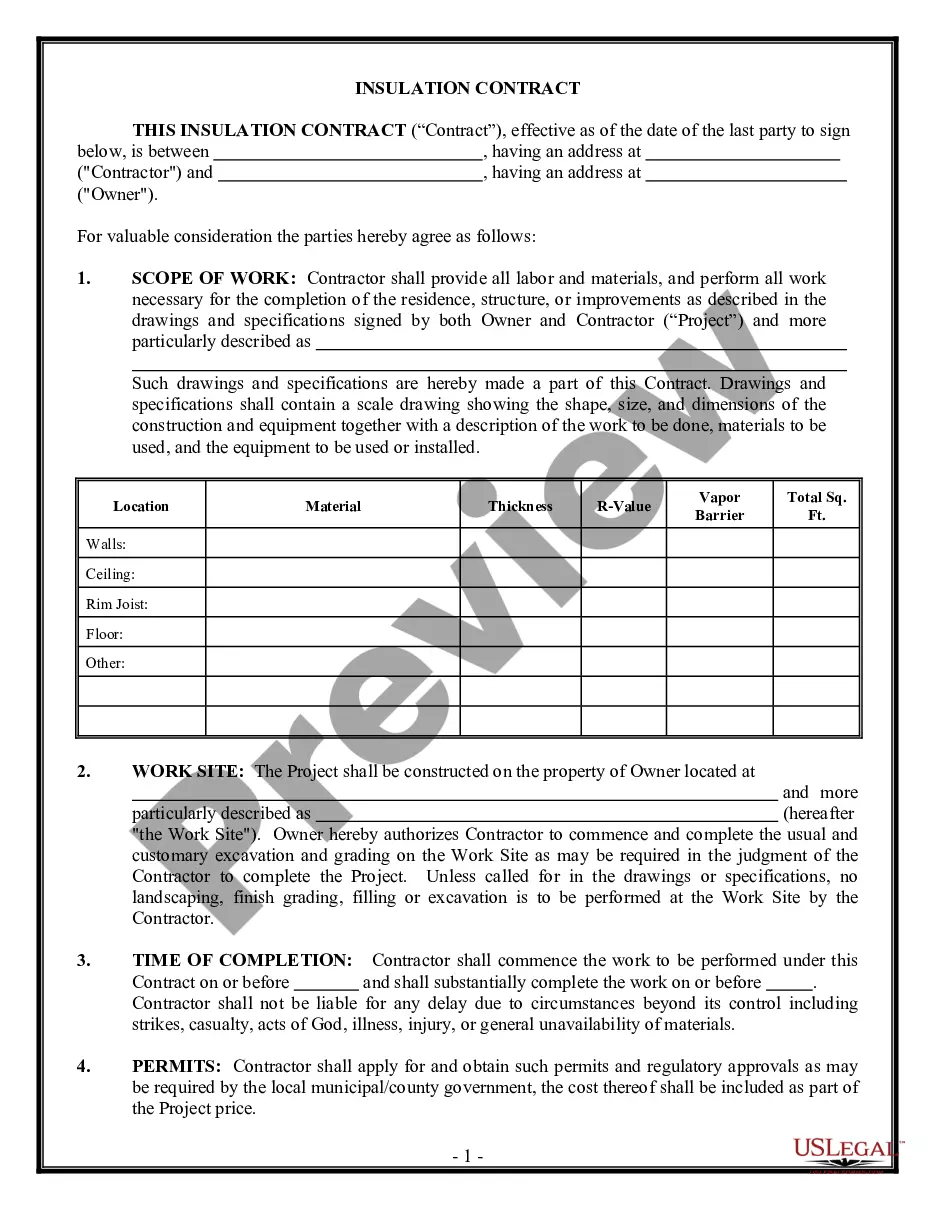

Oregon Order Closing Estate and Discharging Personal Representative

Description

How to fill out Oregon Order Closing Estate And Discharging Personal Representative?

When it comes to completing Oregon Order Closing Estate and Discharging Personal Representative, you most likely imagine an extensive process that involves choosing a ideal sample among countless similar ones and then having to pay out an attorney to fill it out for you. Generally speaking, that’s a slow and expensive choice. Use US Legal Forms and pick out the state-specific template within just clicks.

In case you have a subscription, just log in and click Download to get the Oregon Order Closing Estate and Discharging Personal Representative template.

If you don’t have an account yet but want one, stick to the point-by-point manual listed below:

- Make sure the file you’re downloading applies in your state (or the state it’s required in).

- Do this by reading the form’s description and by clicking on the Preview function (if accessible) to view the form’s information.

- Simply click Buy Now.

- Pick the suitable plan for your financial budget.

- Subscribe to an account and choose how you want to pay: by PayPal or by credit card.

- Save the file in .pdf or .docx format.

- Find the document on your device or in your My Forms folder.

Skilled attorneys draw up our samples to ensure that after saving, you don't need to bother about enhancing content outside of your individual information or your business’s information. Join US Legal Forms and get your Oregon Order Closing Estate and Discharging Personal Representative example now.

Form popularity

FAQ

Introduction. Pay the debts of the estate first. Ask each beneficiary to acknowledge receipt of the gift. Transferring company shares. Transferring real property. Draw up the accounts of the estate. Other claims on the estate. Finishing up.

Generally speaking, a Personal Representative is responsible for opening the estate, collecting the assets of the estate, protecting the estate property, preparing an inventory of the property, paying various estate expenses, valid claims (including debts and taxes) against the estate, representing the estate in claims

How Are Assets Distributed With a Will?With probate proceedings, an executor is named in the will to pay all debts, taxes, and claims against the estate. Once these are paid the executor will distribute the remaining assets to the beneficiaries named in the will.

Once probate is complete, this means that you or the solicitor have the legal right to administer the deceased's estate(property, money and possessions). If the person left a will, you'll get a grant of probate, if there was no will left then a letter of administration is what is issued.

Final Distribution and Closing the Estate: 1-3 Months During the probate process, you may distribute some assets, like tangible personal property. However, in most states you are required to wait to distribute financial assetssuch as proceeds from the property saleuntil the final probate hearing.

Yes, It's Possible for an Executor to Sell Property To Themselves Here's How. If you've been named the executor of an estate, you have a crucial job.In most cases, the executor sets about putting the house on the market and selling it so the proceeds can be distributed to any heirs.

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.

Notify all creditors. File tax returns and pay final taxes. File the final accounting with the probate court. Distribute remaining assets to beneficiaries. File a closing statement with the court.

When the executor has paid off the debts, filed the taxes and sold any property needed to pay bills, he can submit a final estate accounting to the probate court. Once the probate court approves the accounting, he can distribute assets to you and other beneficiaries according to the terms of the will.