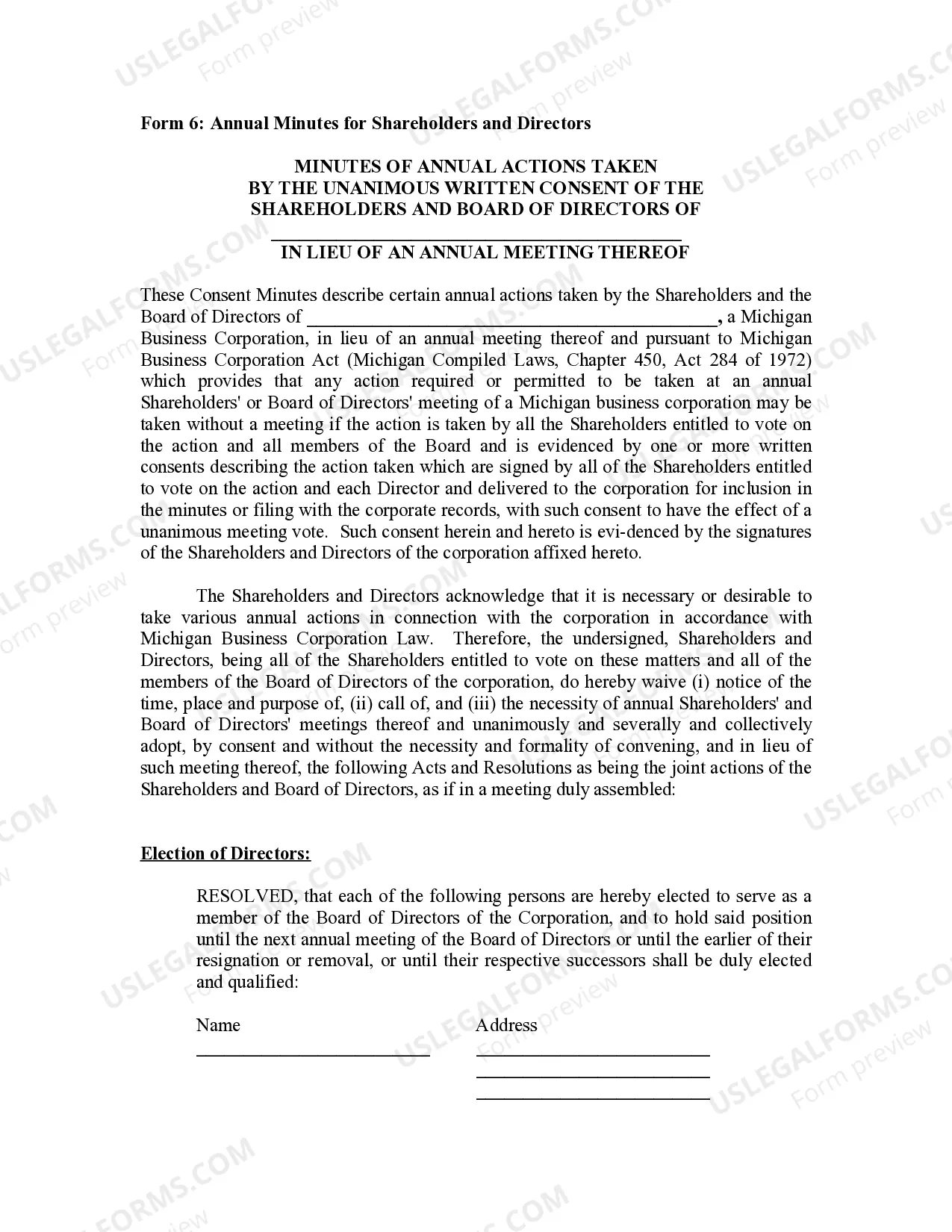

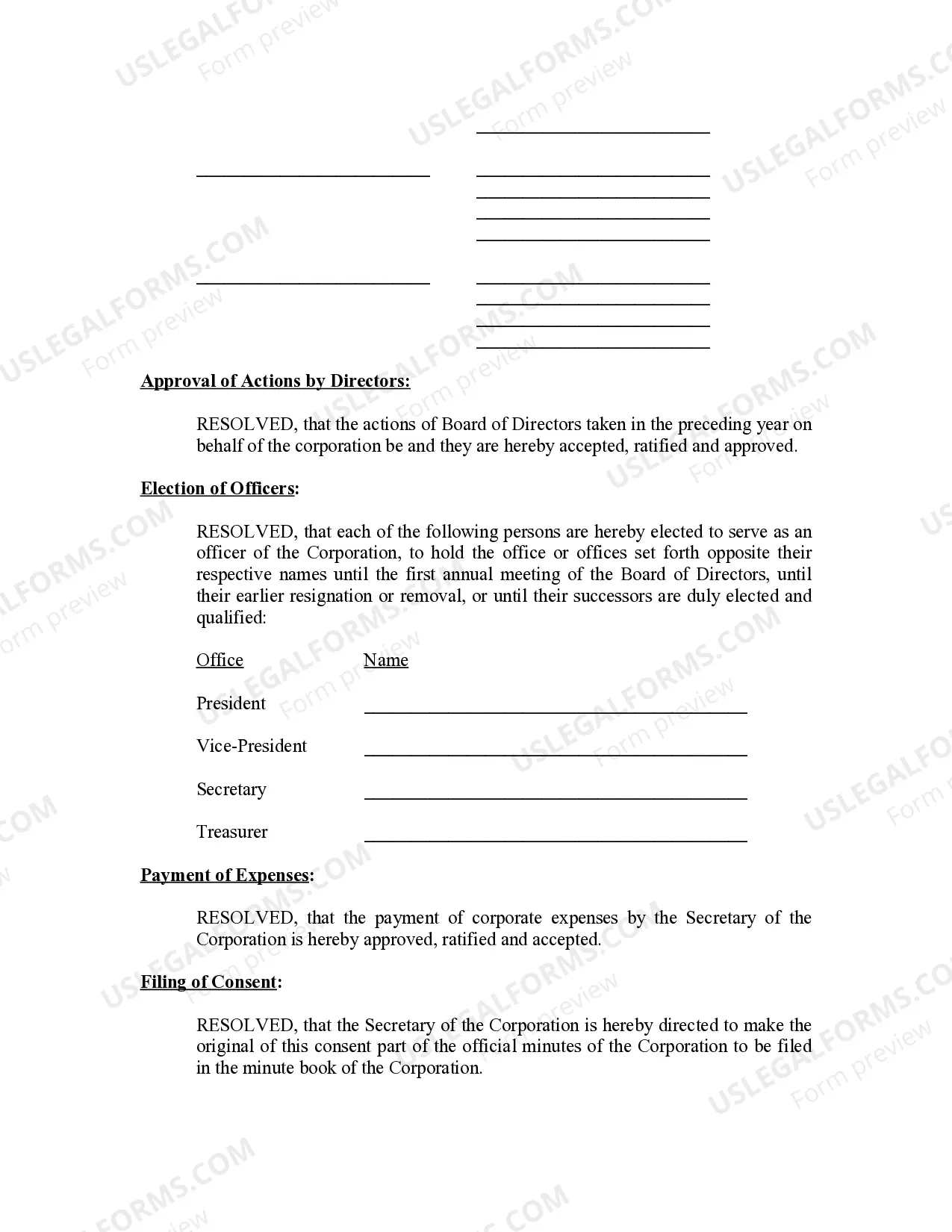

The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

Mi Annual

State:

Michigan

Control #:

MI-INC-AM

Format:

Word;

Rich Text

Instant download

Description Mi Annual File

Free preview Mi Annual Form

How to fill out Michigan Annual Minutes?

Get any template from 85,000 legal documents such as Annual Minutes - Michigan on-line with US Legal Forms. Every template is drafted and updated by state-licensed lawyers.

If you have a subscription, log in. When you are on the form’s page, click the Download button and go to My Forms to access it.

If you have not subscribed yet, follow the tips below:

- Check the state-specific requirements for the Annual Minutes - Michigan you want to use.

- Read description and preview the template.

- As soon as you’re confident the sample is what you need, just click Buy Now.

- Select a subscription plan that works well for your budget.

- Create a personal account.

- Pay out in just one of two suitable ways: by credit card or via PayPal.

- Pick a format to download the file in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- Once your reusable form is downloaded, print it out or save it to your gadget.

With US Legal Forms, you will always have instant access to the right downloadable template. The service gives you access to documents and divides them into categories to simplify your search. Use US Legal Forms to get your Annual Minutes - Michigan fast and easy.