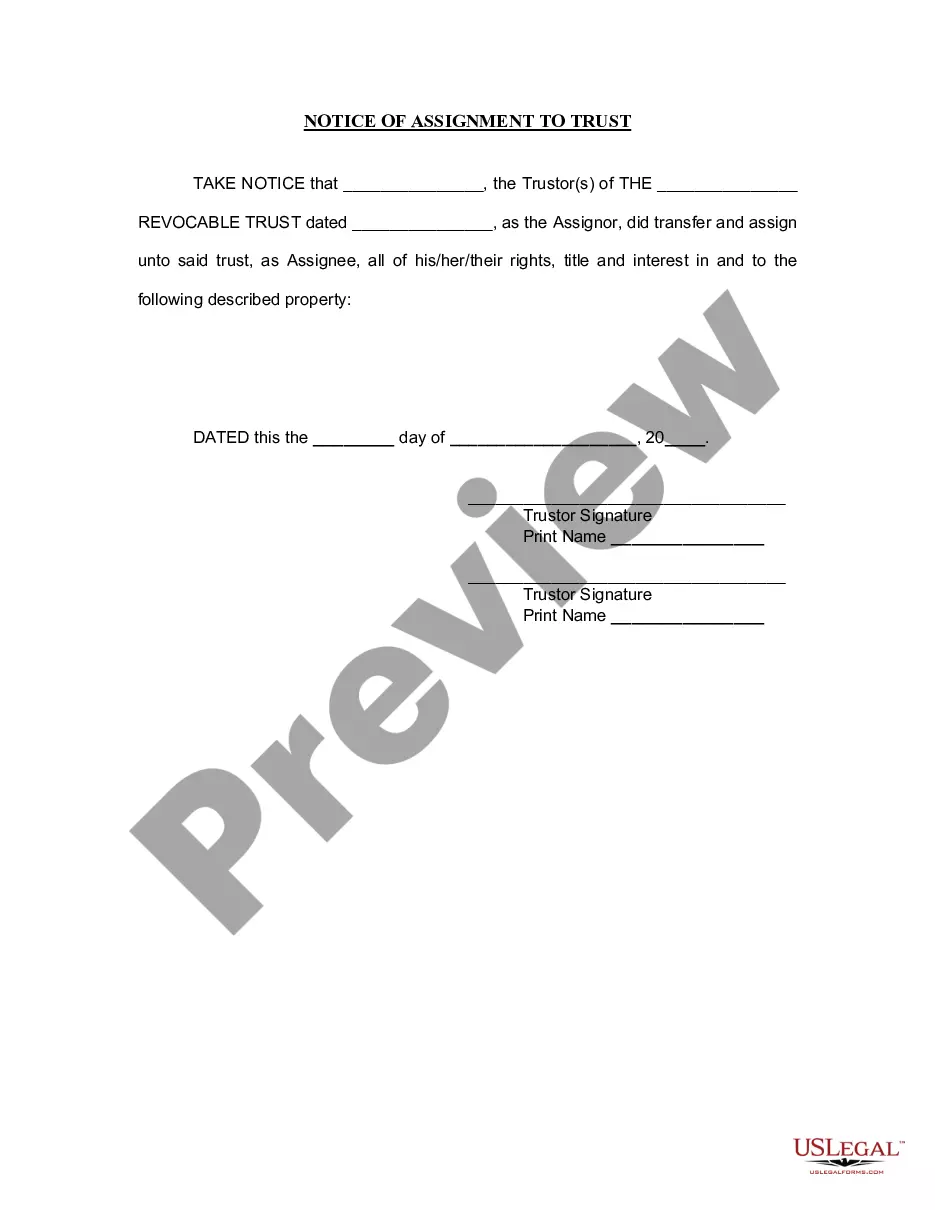

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

King Washington Notice of Assignment to Living Trust

Description

How to fill out Washington Notice Of Assignment To Living Trust?

Finding authenticated templates relevant to your local regulations can be challenging unless you access the US Legal Forms library.

This online repository comprises over 85,000 legal forms catering to both personal and professional requirements as well as various real-life scenarios.

All documents are organized by usage area and jurisdiction, making it as quick and straightforward as possible to search for the King Washington Notice of Assignment to Living Trust.

Ensuring documents are organized and comply with legal standards is crucial. Utilize the US Legal Forms library to always have crucial document templates readily available!

- Review the Preview mode and form description.

- Ensure you’ve selected the correct one that aligns with your needs and fully meets the requirements of your local jurisdiction.

- Look for another template if necessary.

- If you notice any discrepancies, use the Search tab above to find the right one.

- If it works for you, proceed to the subsequent step.

Form popularity

FAQ

The biggest mistake often involves not clearly defining the trust's terms, which can lead to misunderstandings later. It's crucial for parents to establish a clear King Washington Notice of Assignment to Living Trust that outlines their intentions. This clarity helps safeguard family harmony and ensures that assets are distributed correctly according to their wishes.

Whether your parents should place their assets in a trust depends on their specific financial situation and goals. A King Washington Notice of Assignment to Living Trust can offer advantages such as avoiding probate and simplifying asset distribution. It's often wise to consult with a legal expert to determine if a trust aligns with their needs.

Using a family trust can complicate your estate planning, especially if it is not properly set up. In some cases, the King Washington Notice of Assignment to Living Trust can create tax implications that are not initially obvious. Moreover, managing the trust requires ongoing administration, which can be burdensome for some families.

Trust funds can sometimes cause family tensions, especially if beneficiaries have differing opinions on how assets should be managed. Furthermore, a King Washington Notice of Assignment to Living Trust may require careful handling to ensure that the assets are used according to your wishes. This complexity can lead to confusion and disputes among family members.

One downside of placing assets in a trust involves the loss of control. When you create a trust, you transfer ownership of your assets to the trust, limiting your direct access to them. Additionally, setting up a King Washington Notice of Assignment to Living Trust can incur legal fees and ongoing administrative costs, which can add up over time.

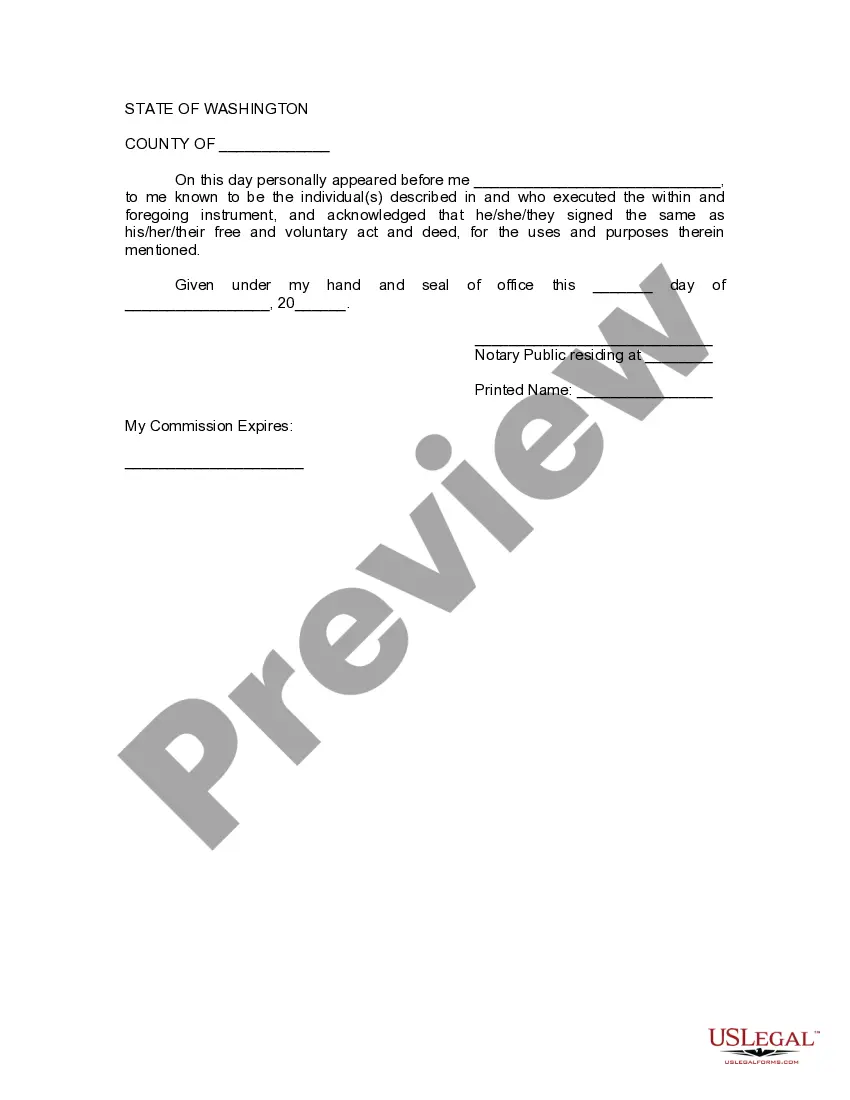

To record a deed in Washington state, you need to take a notarized deed to the county recording office where the property is located. Make sure to include any necessary forms and fees, as well as documents related to the King Washington Notice of Assignment to Living Trust if it's relevant. Once recorded, the deed will be part of public records, ensuring your ownership is officially recognized.

A deed must be recorded in the county where the property is located. This process provides public notice of ownership and is essential for enforcing rights under instruments like the King Washington Notice of Assignment to Living Trust. By recording your deed in the appropriate county office, you protect your legal interest in the property.

Transferring property to a family member in Washington state involves creating a deed that clearly states the transfer. For example, if you're using a King Washington Notice of Assignment to Living Trust, ensure it is drafted correctly to reflect your intentions. After preparing the deed, you need to sign it in front of a notary and record it with the local county office.

In Washington, to properly record a deed, it must be signed and notarized. Additionally, the deed must meet specific criteria outlined in state law, including referencing the King Washington Notice of Assignment to Living Trust, if applicable. After satisfying these requirements, the deed should be filed with the county recorder’s office to establish public notice.

In Washington state, beneficiaries generally have the right to access the trust document. This means that if you are a beneficiary of a trust, you can request to see the trust, including any King Washington Notice of Assignment to Living Trust. It's important to communicate directly with the trustee to facilitate this process and understand your rights.