The dissolution of a corporation package contains all forms to dissolve a corporation in Washington, step by step instructions, addresses, transmittal letters, and other information.

King Washington Dissolution Package to Dissolve Corporation

Description

How to fill out Washington Dissolution Package To Dissolve Corporation?

Take advantage of the US Legal Forms and gain instant access to any template sample you need.

Our user-friendly platform with a vast array of documents streamlines the process of locating and acquiring nearly any document template you may need.

You can save, complete, and sign the King Washington Dissolution Package to Dissolve Corporation in just a few minutes instead of browsing the Internet for hours in search of a suitable template.

Using our collection is an excellent method to enhance the security of your document filing.

Furthermore, you can access all your previously saved documents in the My documents section.

If you have not yet created an account, follow the instructions below.

- Our expert legal professionals frequently examine all the documents to ensure that the templates are suitable for a specific state and adhere to new laws and regulations.

- How can you obtain the King Washington Dissolution Package to Dissolve Corporation.

- If you already possess an account, simply Log In to your profile. The Download option will be available on all the samples you view.

Form popularity

FAQ

Dissolving a corporation does not automatically trigger an audit, but it can lead to one if there are unresolved tax issues or discrepancies. It's important to ensure that all financial records are in order before you utilize the King Washington Dissolution Package to Dissolve Corporation. Proper documentation and transparency will help mitigate the risk of an audit. You can also consult with professionals to guide you through the process.

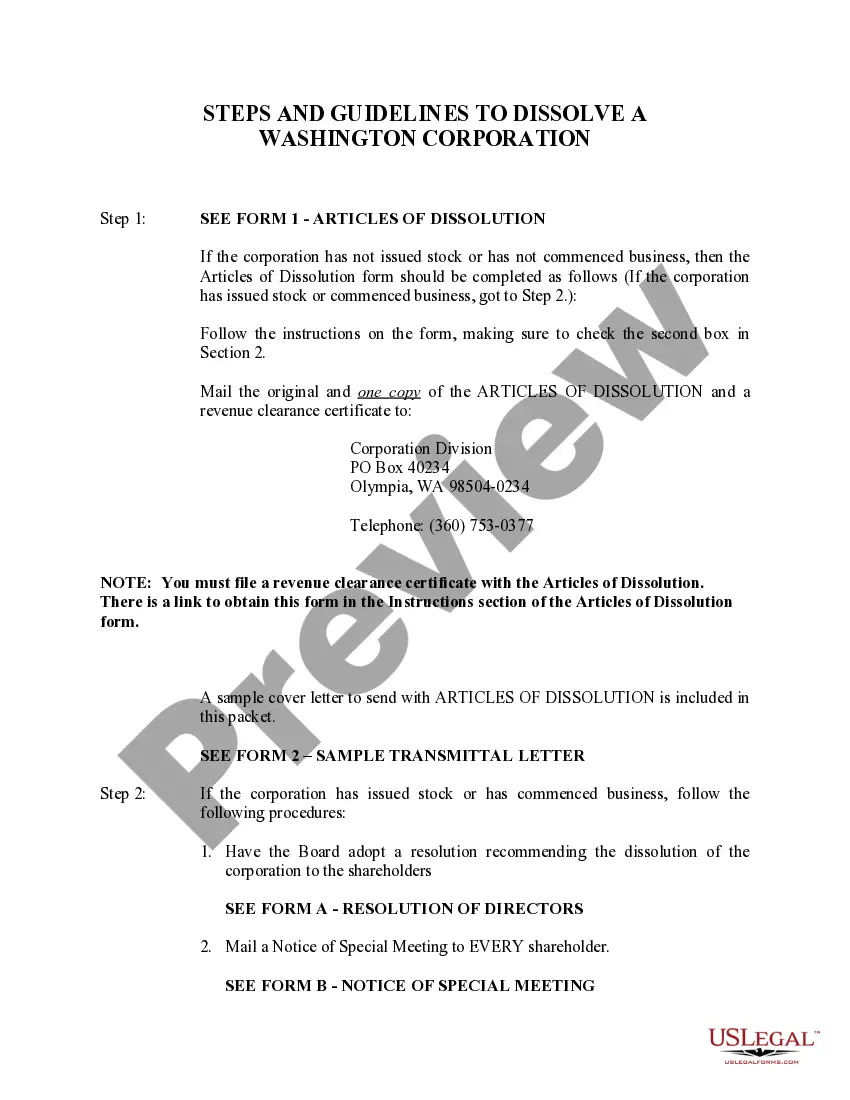

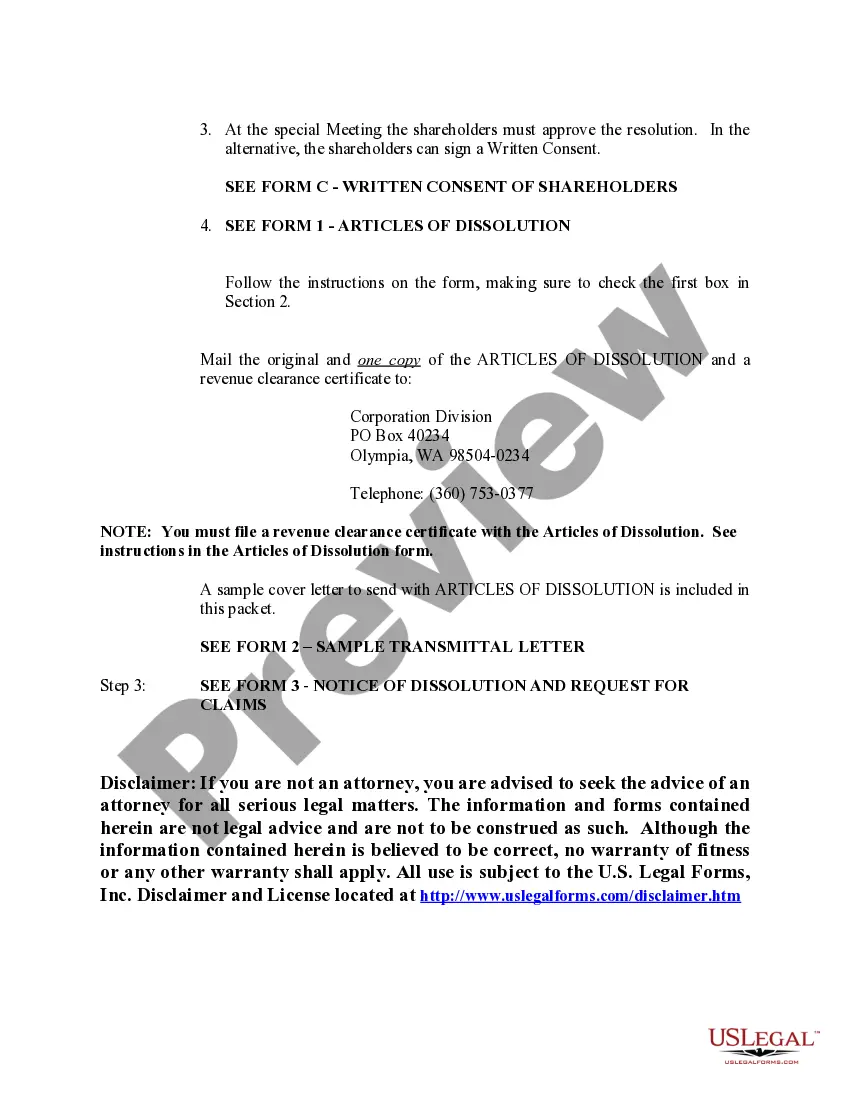

The dissolution of a company involves several key steps. First, you will need to file the necessary paperwork with your state, which may include a form specifically for the King Washington Dissolution Package to Dissolve Corporation. Next, you should notify creditors and settle any outstanding debts. Finally, after settling obligations, you can distribute any remaining assets in accordance with your company's bylaws.

To dissolve a business partnership in Washington state, begin by reviewing your partnership agreement for specific dissolution provisions. Utilizing the King Washington Dissolution Package to Dissolve Corporation can streamline the legal aspects. Notify all partners of the decision, settle any debts, and file appropriate documents with the state if necessary. This structured approach helps ensure a smooth transition and protects your legal interests.

Dissolving a corporation involves several key steps that you can manage with the King Washington Dissolution Package to Dissolve Corporation. First, you must hold a meeting with directors and shareholders to approve the dissolution. Next, file the necessary paperwork with the state, including any final tax returns and cancellation of licenses or permits. This package ensures you have everything you need for a complete and compliant dissolution process.

To dissolve your Washington Corporation, you should utilize the King Washington Dissolution Package to Dissolve Corporation. This package simplifies the process by providing you with essential forms and guidance. You'll need to obtain a Certificate of Dissolution from the Washington Secretary of State, ensuring you have settled all debts and obligations. Following these steps will help you dissolve your corporation smoothly.

Form 966 is utilized by corporations that choose to dissolve or liquidate their business entity. This form informs the IRS of the corporation's decision and must be filed appropriately. Incorporating the King Washington Dissolution Package to Dissolve Corporation into your dissolution process can help streamline the submission of Form 966, making compliance with tax obligations simpler.

To dissolve a corporation in Washington state, begin by obtaining shareholder approval for dissolution. Next, you will need to complete and file the King Washington Dissolution Package to Dissolve Corporation with the Washington Secretary of State. It is also essential to settle debts and notify relevant parties to ensure a smooth dissolution process.

Dissolving a corporation typically involves several important steps. First, shareholders must approve the dissolution in line with state laws. Next, you need to file the appropriate documents with the Secretary of State, which in Washington includes the King Washington Dissolution Package to Dissolve Corporation. Lastly, you must settle any outstanding debts, notify stakeholders, and ensure proper record-keeping during the process.

Form 966 is the official document used to report the dissolution of a corporation to the IRS. This form notifies the IRS that a corporation has decided to dissolve and helps in wrapping up tax obligations. When using the King Washington Dissolution Package to Dissolve Corporation, you will find guidance on how to properly complete and submit Form 966, ensuring a smooth transition.

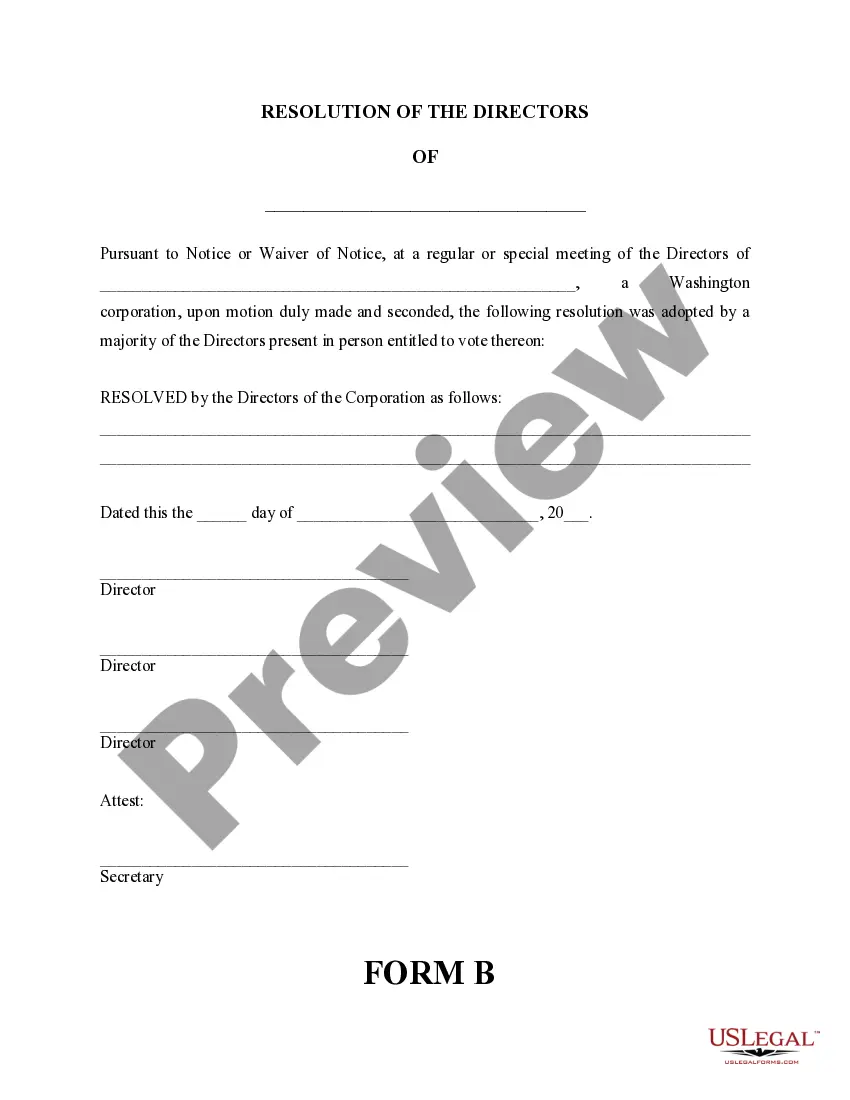

To dissolve a corporation in Washington state, you must first hold a board meeting and obtain a resolution to dissolve. Next, you will need to file the Articles of Dissolution with the Washington Secretary of State. The King Washington Dissolution Package to Dissolve Corporation provides a streamlined process, simplifying these steps and ensuring compliance with state regulations.