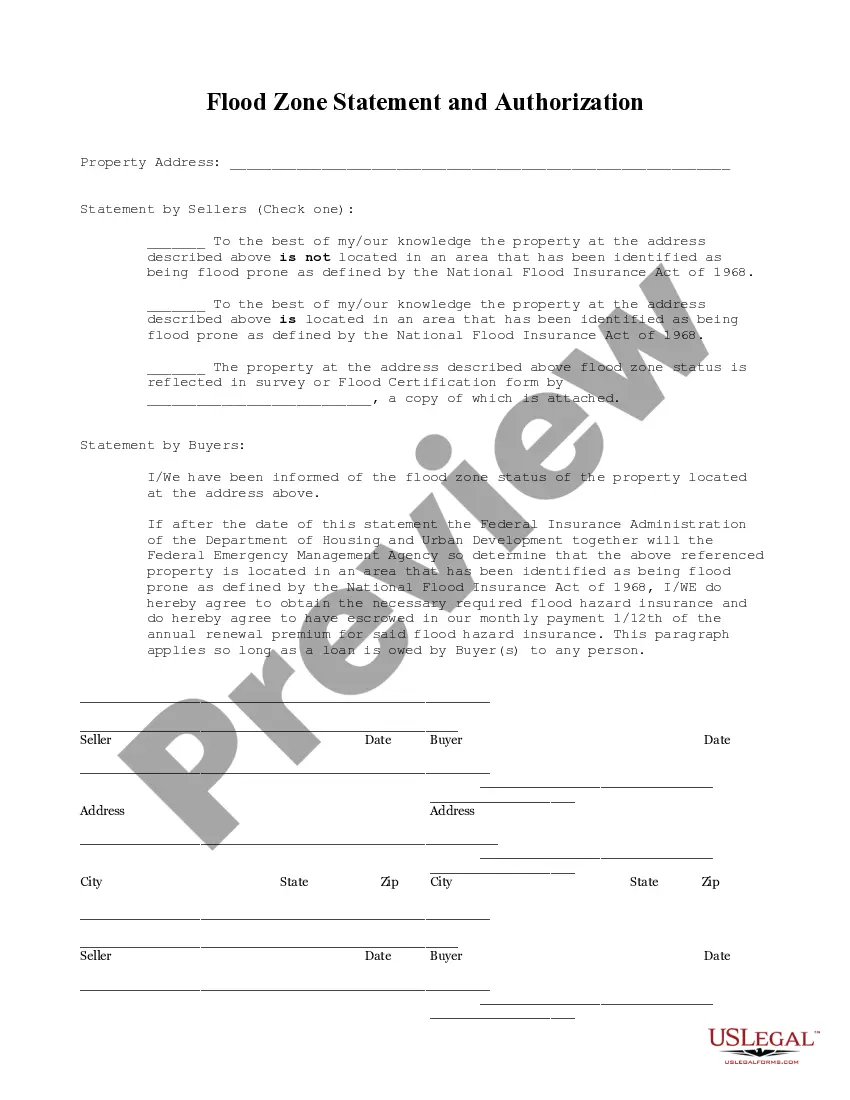

This Flood Zone Statement and Authorization form is for seller(s) to sign, stating the flood zone status of the property and for the buyers to acknowledge the same and state that should the property ever be determined to be in a flood zone, that they will obtain flood insurance.

Vancouver Washington Flood Zone Statement and Authorization is a legal document required by lenders and insurance companies to ascertain if a property is located within a designated flood zone. This statement serves as a crucial part of the loan approval process and insurance coverage determination for properties in the Vancouver, Washington area. The purpose of the Vancouver Washington Flood Zone Statement and Authorization is to determine the level of risk associated with a property, as flood zones vary in severity. By obtaining this statement and authorization, lenders and insurers can make informed decisions regarding flood insurance requirements, loan terms, and conditions. The statement typically includes information such as the property's address, legal description, and details on its proximity to rivers, streams, or other bodies of water. It also provides valuable data sourced from FEMA's Flood Insurance Rate Map (FIRM), which indicates the property's flood zone designation and identifies whether it falls into a high-risk Special Flood Hazard Area (FHA) or a moderate-to-low-risk area. Different types of Vancouver Washington Flood Zone Statement and Authorization may include: 1. Standard Flood Hazard Determination: This involves a verification process to determine whether the property is situated in a flood zone or outside the floodplain boundaries. Different flood zones are classified based on the likelihood and severity of flooding. 2. Elevation Certificate: If a property is determined to be within a flood zone, an elevation certificate may be required. This document provides detailed information on the property's elevation, including the lowest floor level, the location of mechanical systems, and other important details that assist in determining flood insurance premiums. 3. Letter of Map Amendment (COMA): In some cases, an owner or developer may dispute a property's flood zone designation due to updated topographic data or changes in the surrounding area. A COMA is a formal request submitted to FEMA to revise or remove a property from the FHA, based on scientific or technical evidence indicating that the property is situated at or above the base flood elevation. It is vital for property owners and potential buyers in Vancouver, Washington, to understand the implications of being located within a flood zone, as it can significantly impact insurance costs, property values, and even development or renovation plans. Obtaining a Vancouver Washington Flood Zone Statement and Authorization provides important information that assists in making informed decisions regarding flood insurance coverage and overall property management.