Salt Lake City Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two Individuals

Description

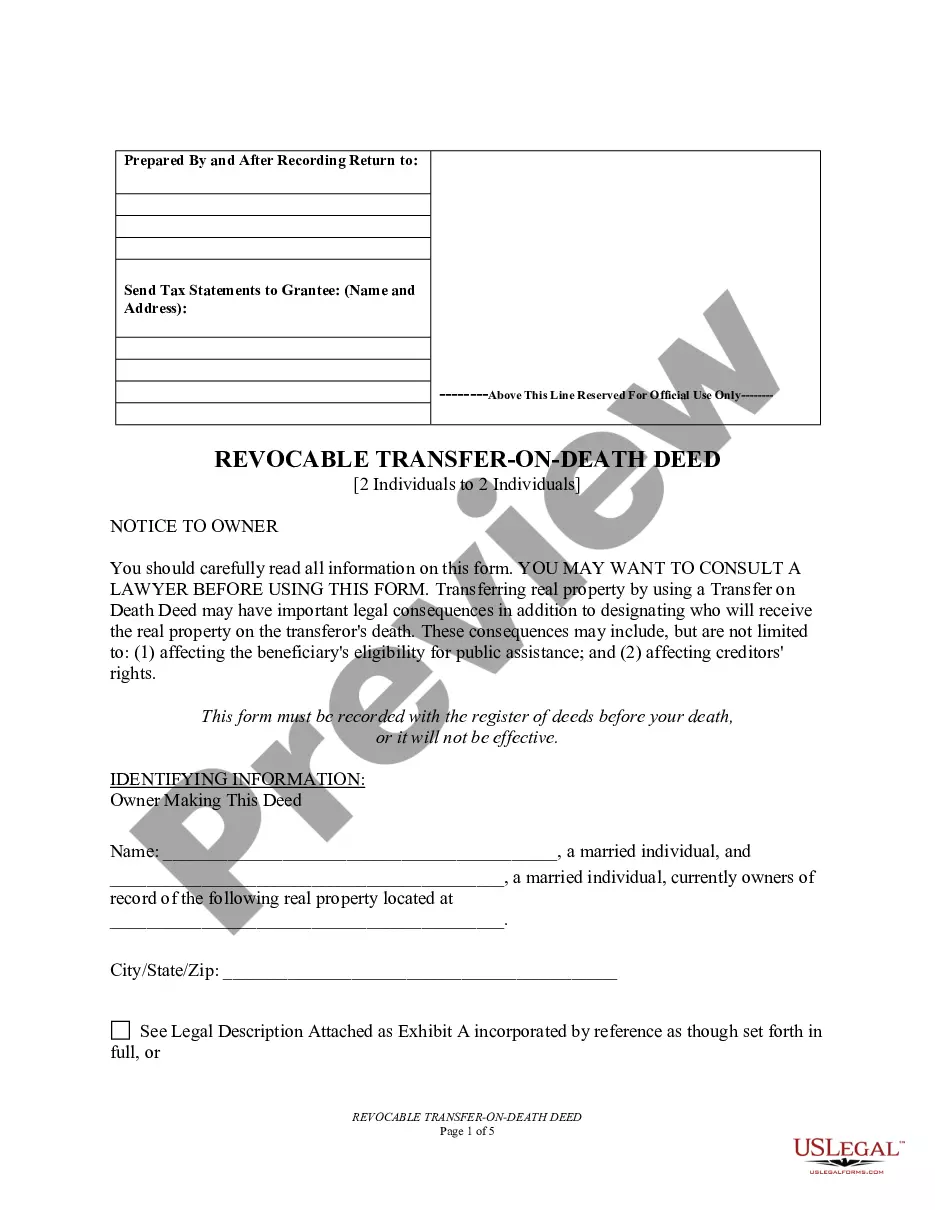

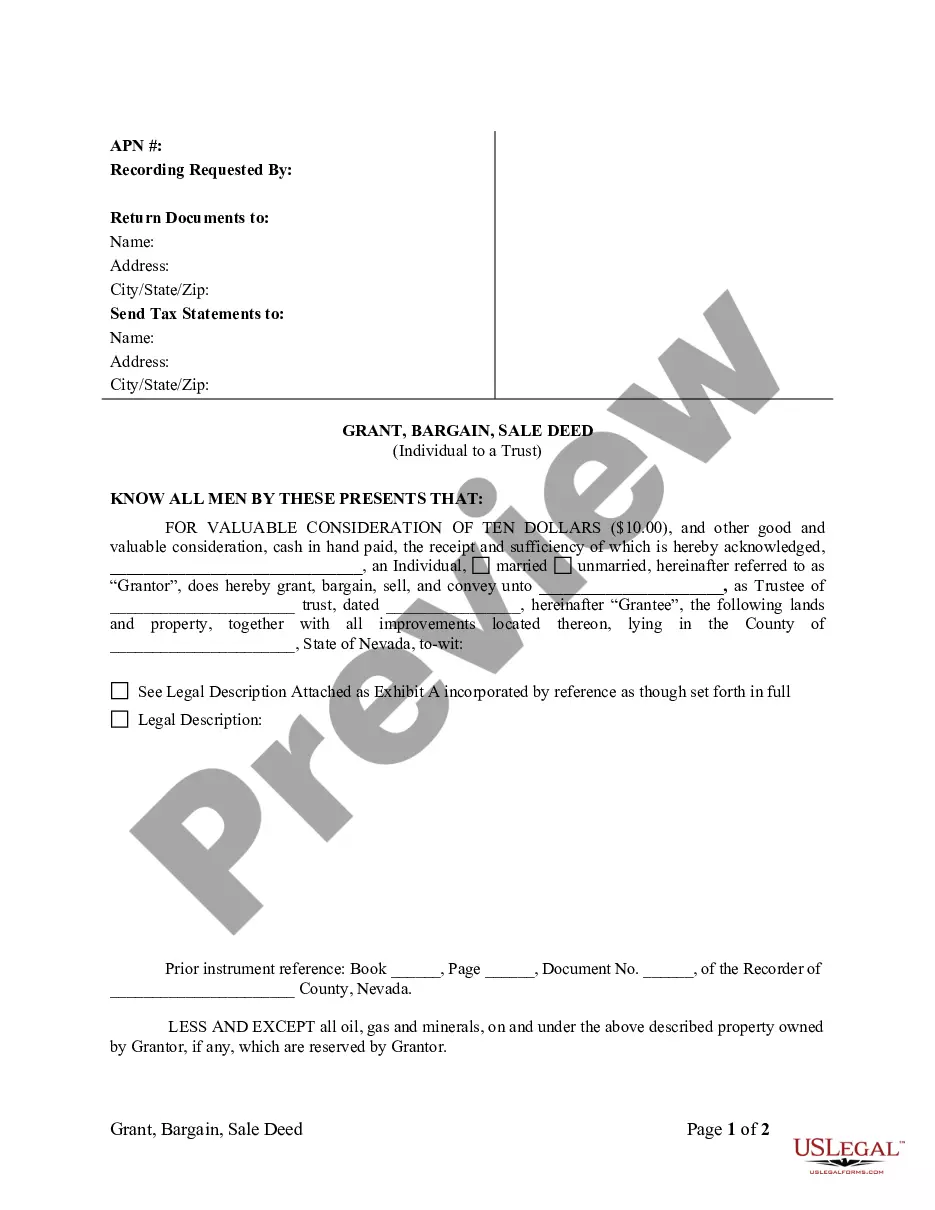

How to fill out Utah Transfer On Death Deed Or TOD - Beneficiary Deed For Two Married Individuals To Two Individuals?

We consistently aim to diminish or evade legal complications when engaging in intricate legal or financial matters.

To achieve this, we enroll in legal options that are typically very expensive.

Nevertheless, not every legal issue is particularly intricate. A majority of them can be managed independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. If you misplace the form, you can always re-download it from the My documents tab. The procedure is equally straightforward even if you're unacquainted with the website! You can create your account in just a few minutes.

- Our repository enables you to manage your affairs without needing legal counsel.

- We offer access to legal document templates that are not always publicly accessible.

- Our templates are tailored to specific states and regions, significantly easing the search process.

- Utilize US Legal Forms whenever you need to find and download the Salt Lake City Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two Individuals, or any other document swiftly and securely.

Form popularity

FAQ

To transfer stock ownership after death, you typically need to provide a copy of the deceased's death certificate and relevant ownership documents to the stockholder's company or brokerage. Each company may have specific requirements, so be sure to check their guidelines. Additionally, if you established a Salt Lake City Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two Individuals, these stocks can often transfer seamlessly to named beneficiaries, avoiding lengthy probate processes.

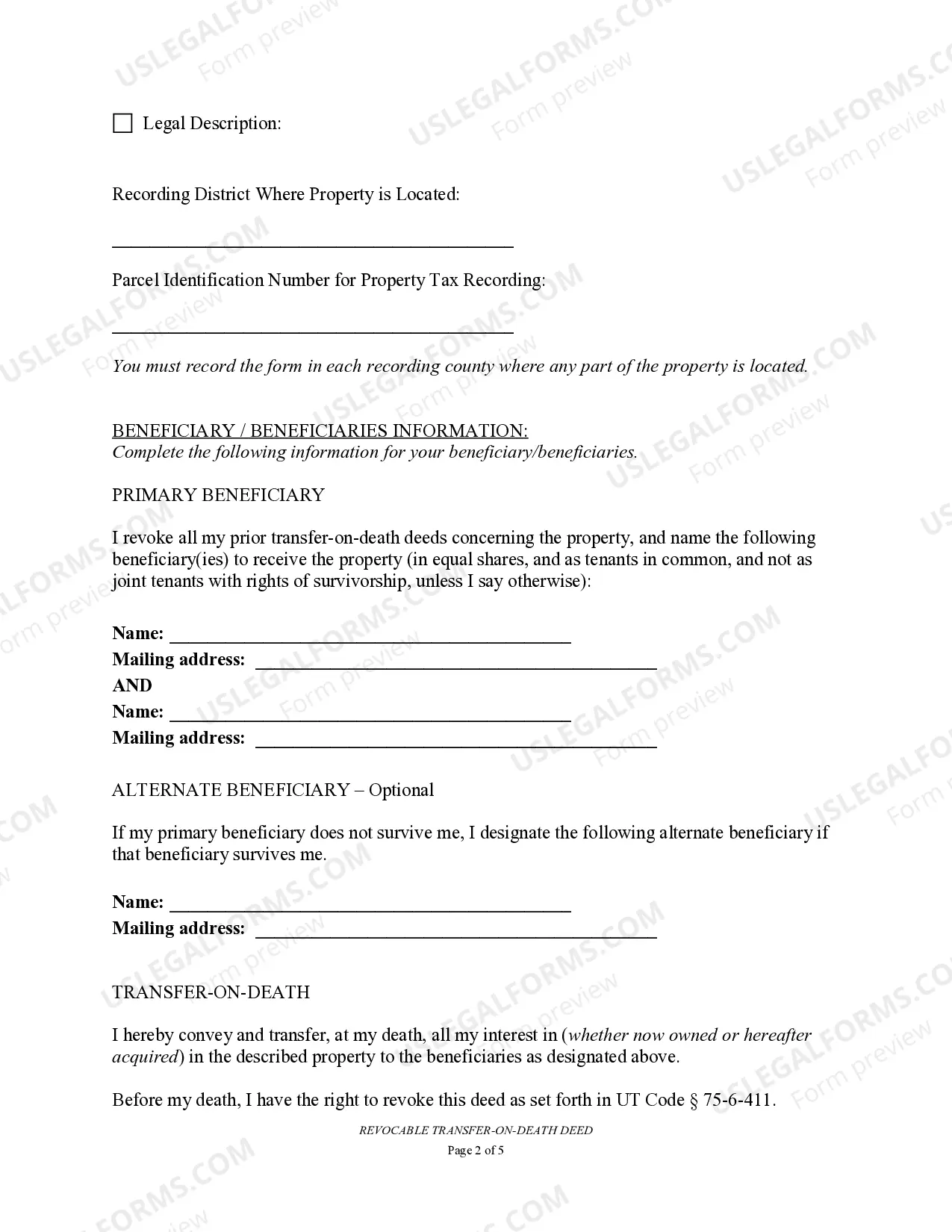

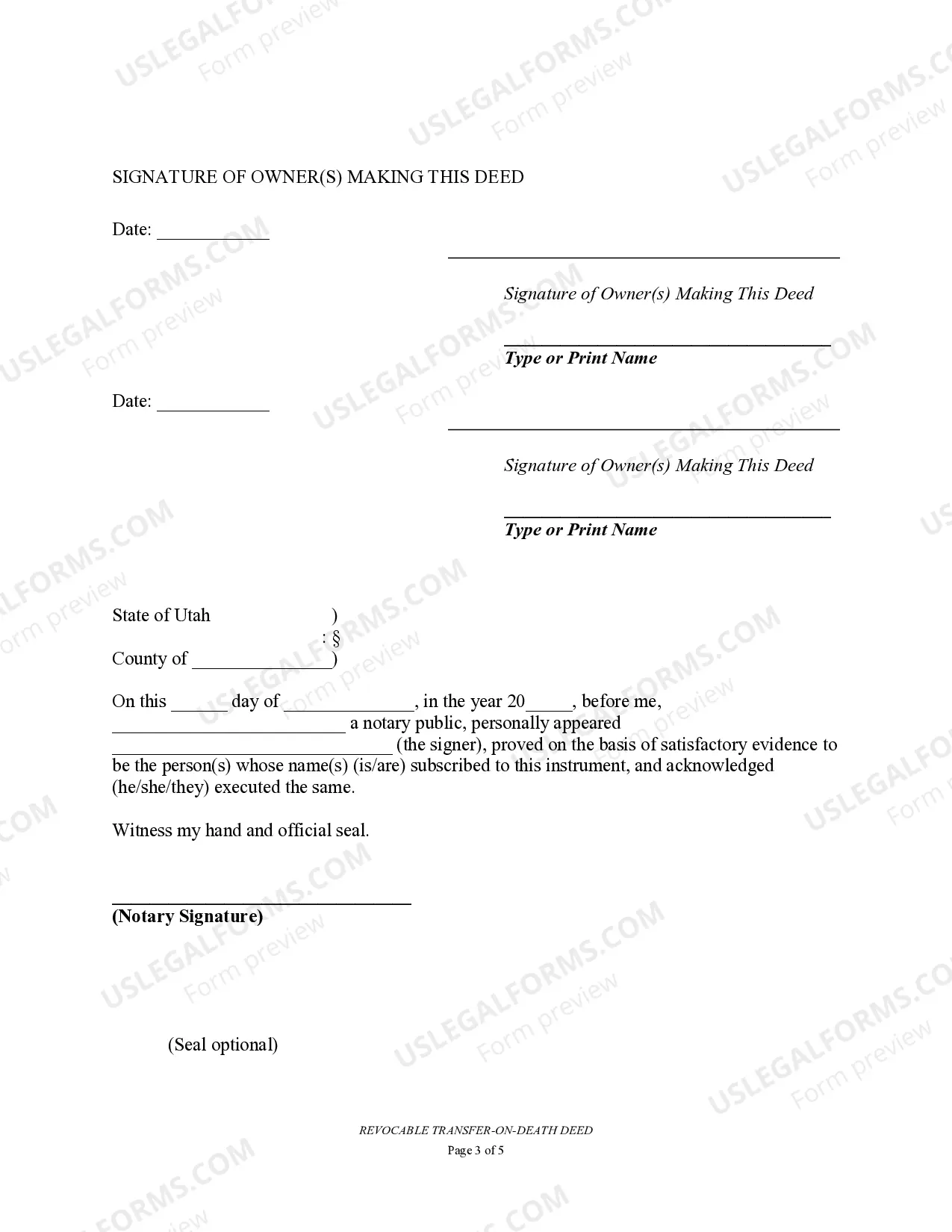

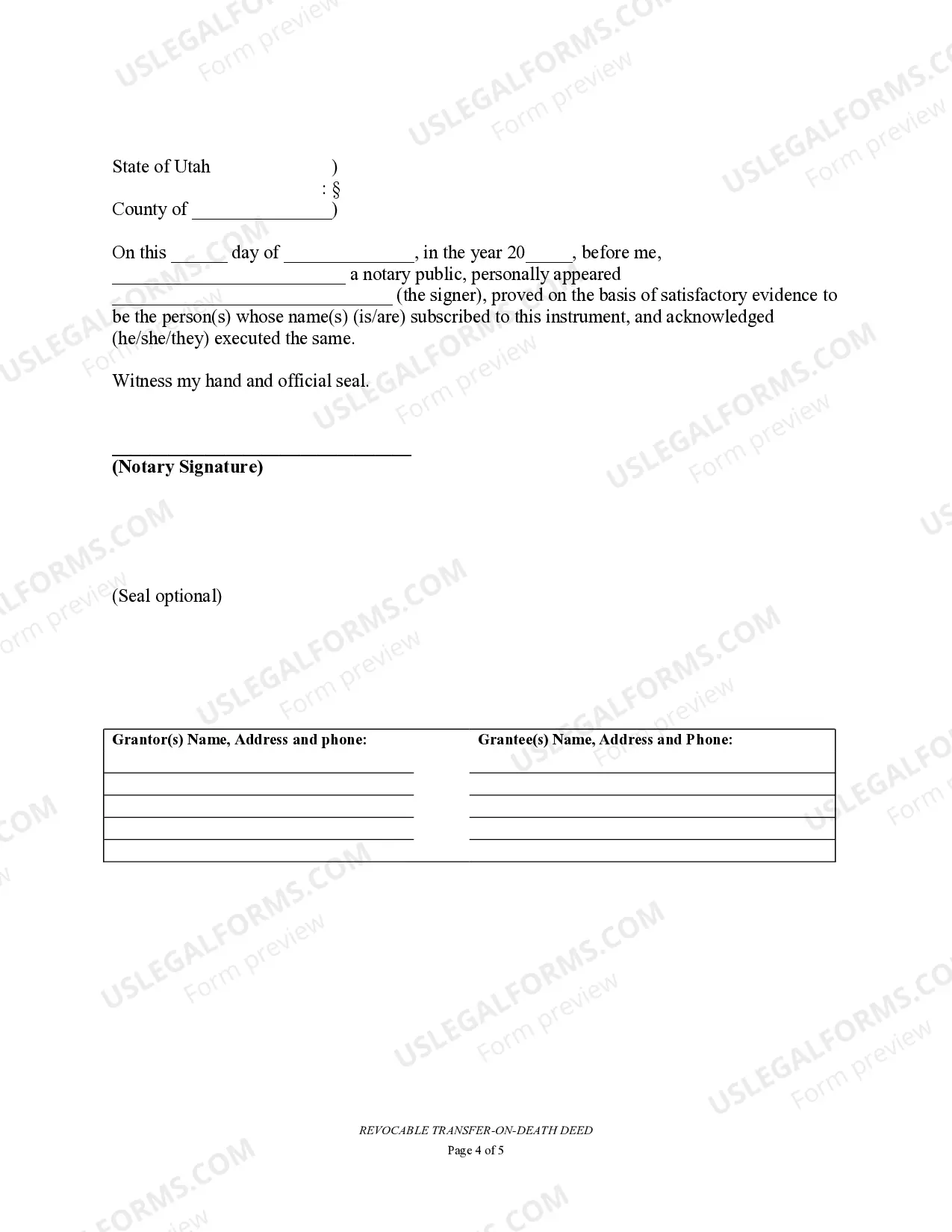

Filling out a transfer on death designation affidavit involves detailing the property description and naming your beneficiaries clearly. You should obtain the appropriate form from your local government or a trusted information source like US Legal Forms. After completing the affidavit, sign it in front of a notary public to validate it. This process parallels the steps you would take for the Salt Lake City Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two Individuals.

You do not necessarily need a lawyer to file a transfer on death deed, including the Salt Lake City Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two Individuals. Many individuals choose to handle this process independently, especially with resources available through platforms like US Legal Forms. However, if your situation is complex, consulting a lawyer may provide peace of mind and ensure everything is filed correctly.

To effectively complete a transfer on death designation affidavit in Ohio, gather essential information regarding the property and the intended beneficiaries. The affidavit must include the legal description of the property, the beneficiaries' names, and your signature. After completing it, ensure to file it with the county recorder’s office where the property is located. This process is similar to the considerations for the Salt Lake City Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two Individuals.

When considering options like the Salt Lake City Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two Individuals, many find that a TOD offers more flexibility. A TOD allows the original owner to retain control of the property during their lifetime, unlike some beneficiary deeds, which may intervene sooner. Moreover, TOD deeds typically avoid probate, making for a smoother transition. Thus, the choice really depends on your specific needs and goals.

The best way to transfer ownership largely depends on your individual circumstances, but using a deed is a common and effective method. For individuals seeking an uncomplicated way to pass on property, the Salt Lake City Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two Individuals is highly recommended. This approach not only ensures that ownership passes smoothly but also helps in avoiding the complications of probate, providing peace of mind for everyone involved.

Transferring ownership of a property in Utah involves executing a legal document, such as a warranty deed or quitclaim deed. You'll need to include details about the property and the new owner, and then file this document with the appropriate county office. For married individuals looking to transfer ownership to another couple, the Salt Lake City Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two Individuals can be a beneficial option to consider.

Yes, Utah does allow a transfer on death deed, known as a TOD. This legal document enables property owners to designate beneficiaries who will receive their property upon their passing without going through probate. If you are considering a Salt Lake City Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two Individuals, it simplifies the process and ensures that your loved ones inherit your property with ease.

One notable disadvantage of a Transfer on Death Deed (TOD) is that it does not deal with potential debts on the property. If the property holds significant liabilities, those debts might fall onto the beneficiaries. It’s also important to remember that, unlike a will, a TOD deed does not consider other aspects of your estate, so comprehensive planning is key.

In many cases, a Salt Lake City Utah Transfer on Death Deed (TOD) is considered more advantageous than a beneficiary deed. The primary benefit lies in the straightforward transfer of property without the need for probate. However, the choice ultimately depends on your individual circumstances and estate planning goals.