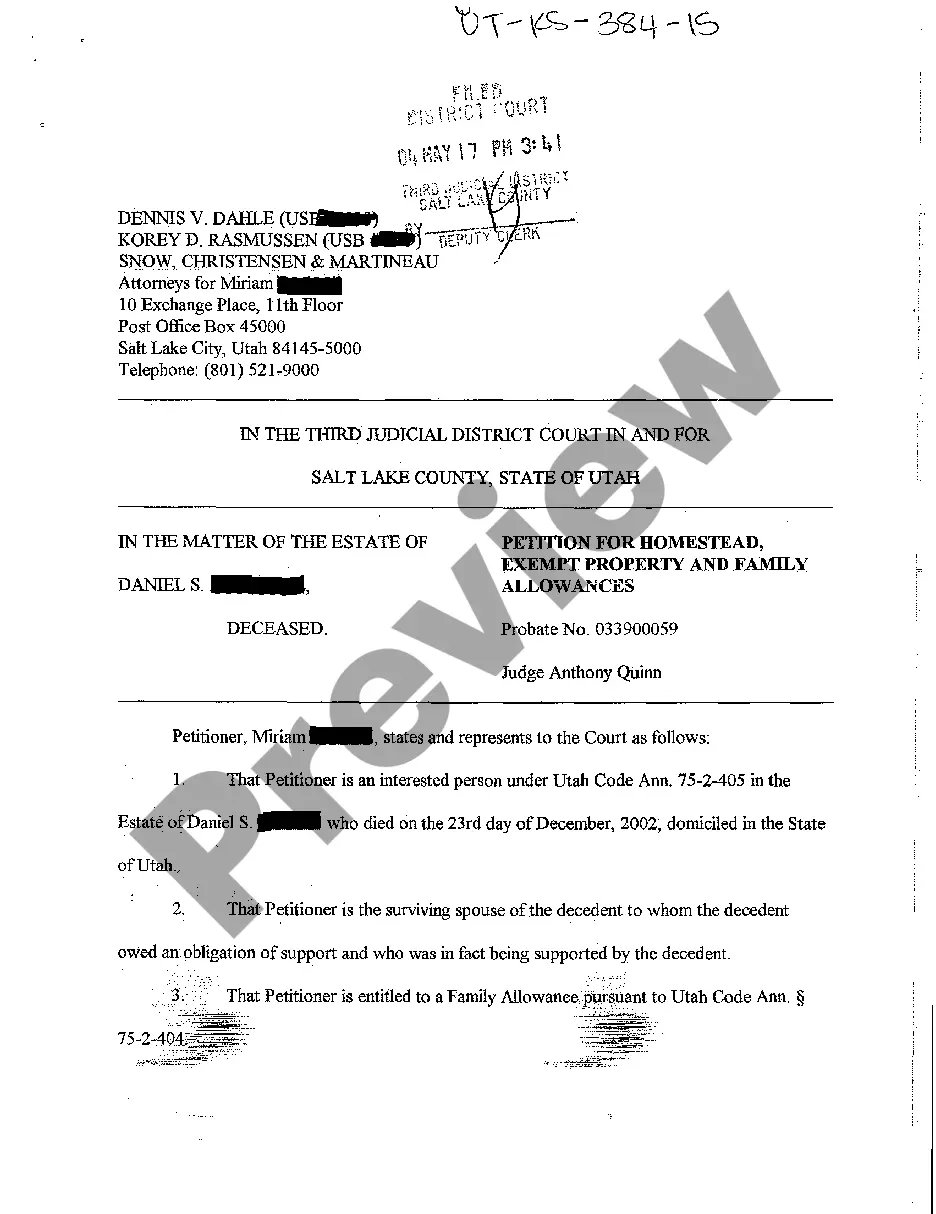

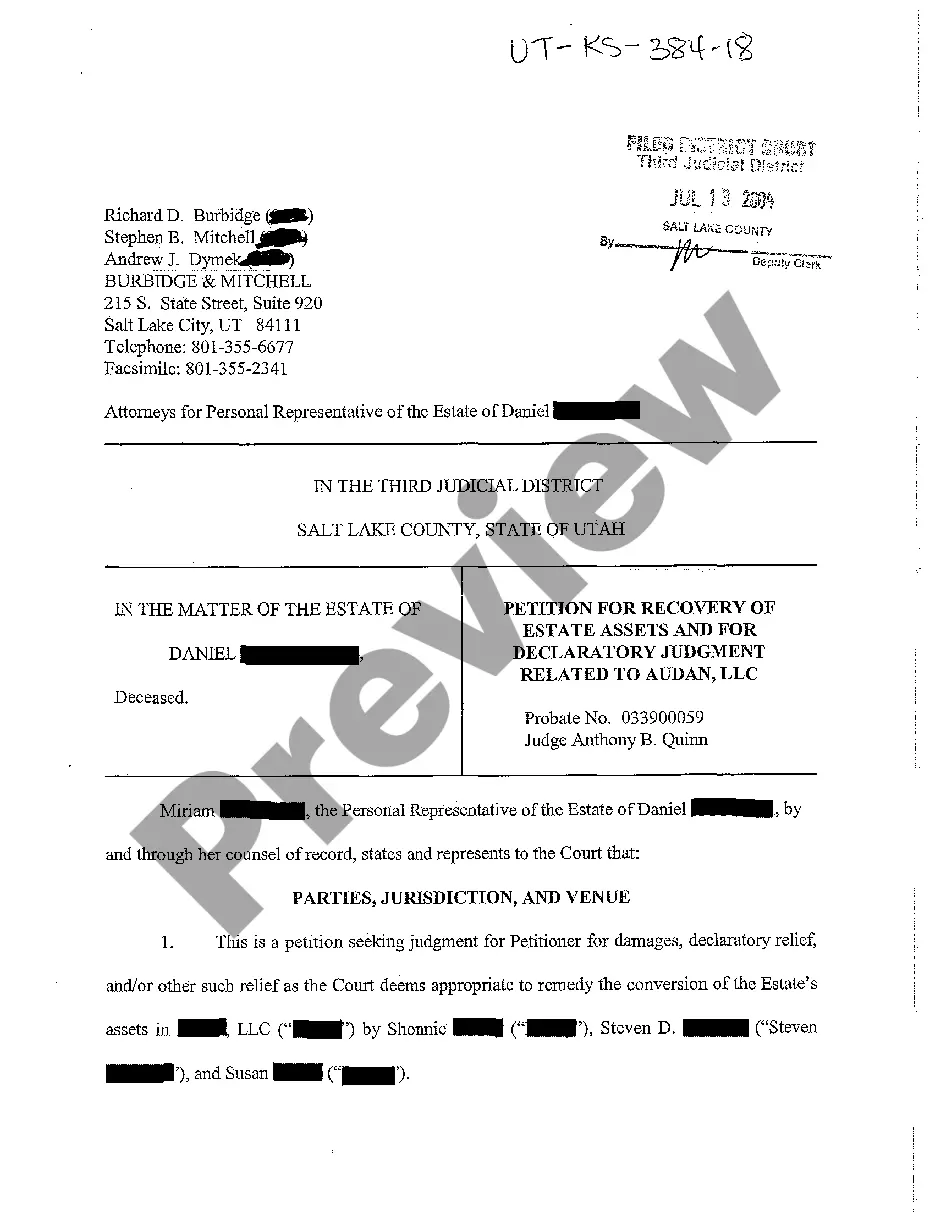

West Jordan Utah Petition for Homestead Exempt Property and Family Allowances

Description

How to fill out Utah Petition For Homestead Exempt Property And Family Allowances?

Are you seeking a dependable and cost-effective provider of legal documents to obtain the West Jordan Utah Petition for Homestead Exempt Property and Family Allowances? US Legal Forms is your preferred selection.

Whether you need a straightforward document to establish guidelines for living with your partner or a bundle of forms to facilitate your separation or divorce through the legal system, we have you covered. Our platform offers over 85,000 current legal document templates for personal and business purposes. All templates we provide access to are tailored and structured in compliance with the regulations of specific states and regions.

To acquire the document, you must Log In to your account, locate the required template, and click the Download button adjacent to it. Please keep in mind that you can retrieve your previously purchased form templates at any time in the My documents section.

Are you unfamiliar with our website? No hassle. You can easily create an account, but before doing so, ensure you take the following steps.

Now you can proceed to register your account. Then select the subscription option and continue to payment. Once the payment is finalized, you can download the West Jordan Utah Petition for Homestead Exempt Property and Family Allowances in any available format. You can revisit the website anytime to redownload the document without incurring any additional charges.

Locating current legal forms has never been simpler. Try US Legal Forms today, and stop wasting your precious time searching for legal documents online.

- Verify that the West Jordan Utah Petition for Homestead Exempt Property and Family Allowances aligns with the regulations of your state and local area.

- Review the details of the form (if provided) to understand who and what the document is designated for.

- Restart your search if the template is unsuitable for your particular situation.

Form popularity

FAQ

Homestead rights in Utah provide homeowners with certain legal protections against creditors, as well as some advantages regarding property taxes. These rights ensure that, under specific circumstances, families can retain their primary residence. Understanding these rights can be complex, but a West Jordan Utah Petition for Homestead Exempt Property and Family Allowances serves as an effective tool for navigating them.

To obtain a homestead exemption in Utah, you need to file a petition with your local county assessor's office. The process generally involves providing proof of residency and completing the necessary forms. By submitting a West Jordan Utah Petition for Homestead Exempt Property and Family Allowances, you can simplify this process and ensure your exemption is granted.

In Utah, the homestead exemption amount can vary, but it typically allows you to exempt up to $30,000 of your home's value for single individuals, and this amount can be higher for married couples. This exemption helps property owners retain more equity, which is crucial during challenging times. You can explore more about how this applies to your situation by considering a West Jordan Utah Petition for Homestead Exempt Property and Family Allowances.

A homesteading exemption allows homeowners in West Jordan, Utah, to shield a portion of their property value from property taxes. This exemption helps ensure that families maintain their homes during financial hardships. To learn about the specific requirements, a West Jordan Utah Petition for Homestead Exempt Property and Family Allowances can guide you through the process.

The homestead exemption status in West Jordan, Utah, helps protect a portion of your property value from creditors and property taxes. It serves as a legal claim that can provide financial security for your family. If you are interested in understanding this status better, consider filing a West Jordan Utah Petition for Homestead Exempt Property and Family Allowances.

Exempt property in Utah refers to assets that cannot be seized by creditors, while non-exempt property is at risk during bankruptcy or debt collection efforts. Understanding this distinction is key when filing the West Jordan Utah Petition for Homestead Exempt Property and Family Allowances. By ensuring your valuable assets are classified correctly, you protect your financial stability and maintain peace of mind.

In Utah, several assets are protected under the homestead exemption laws, including the primary residence, a certain amount of equity in that property, and personal property such as household goods. The specifics can vary, so it's crucial to understand what qualifies under the West Jordan Utah Petition for Homestead Exempt Property and Family Allowances. For a clearer picture, utilizing platforms like uslegalforms can provide necessary guidance tailored to your situation.

A homestead exemption in Utah allows homeowners to protect a portion of their property's value from creditors. This exemption is particularly beneficial for individuals facing financial hardship, as it can provide a safeguard against losing their home. Through the West Jordan Utah Petition for Homestead Exempt Property and Family Allowances, eligible homeowners can apply for this exemption, ensuring their primary residence is secure.

Qualifying for homestead exemption in Utah generally requires that you are a resident of the state, and the property must be your primary residence. Additionally, no other property should be claimed as a homestead. Filing a West Jordan Utah Petition for Homestead Exempt Property and Family Allowances simplifies the process of claiming your rightful exemption and securing your home.

In Utah, residents aged 65 and older may qualify for a property tax deferral program, allowing them to postpone property tax payments. However, this does not equate to an outright exemption, and taxes will still be due later. For accurate information and assistance, consider using the West Jordan Utah Petition for Homestead Exempt Property and Family Allowances, which can guide you through available options.