The dissolution of a corporation package contains all forms to dissolve a corporation in Utah, step by step instructions, addresses, transmittal letters, and other information.

Salt Lake Utah Dissolution Package to Dissolve Corporation

Description

How to fill out Utah Dissolution Package To Dissolve Corporation?

Regardless of social or occupational ranking, finalizing legal paperwork is a regrettable requirement in today’s work landscape.

Frequently, it’s nearly unfeasible for individuals without legal expertise to create such documents from scratch, primarily due to the intricate vocabulary and legal nuances they entail.

This is where US Legal Forms proves beneficial.

Confirm that the template you have selected corresponds to your location, as the regulations of one state may not be applicable to another.

Review the document and read through a brief description (if one is available) of situations where the paperwork is applicable.

- Our service provides an extensive assortment of over 85,000 ready-to-use documents tailored to specific states that are applicable to nearly any legal matter.

- US Legal Forms is also an invaluable tool for associates or legal advisors who wish to save time utilizing our DIY templates.

- Irrespective of whether you need the Salt Lake Utah Dissolution Package to Dissolve Corporation or any other documentation valid in your region, with US Legal Forms, you have access to everything.

- Here’s how you can swiftly acquire the Salt Lake Utah Dissolution Package to Dissolve Corporation using our trustworthy service.

- If you are already a subscriber, you can simply Log In to your account to get the right form.

- However, if you are unfamiliar with our library, ensure to follow these steps before obtaining the Salt Lake Utah Dissolution Package to Dissolve Corporation.

Form popularity

FAQ

Dissolving a corporation with the IRS requires you to notify them of the dissolution after you've filed the Salt Lake Utah Dissolution Package to Dissolve Corporation with your state. You should file a final tax return for the corporation, marking it as such on the form. Additionally, ensure that any tax obligations are settled, and provide information on the distribution of any remaining assets to shareholders. Using services like US Legal Forms can give you the clarity you need to navigate these requirements effectively.

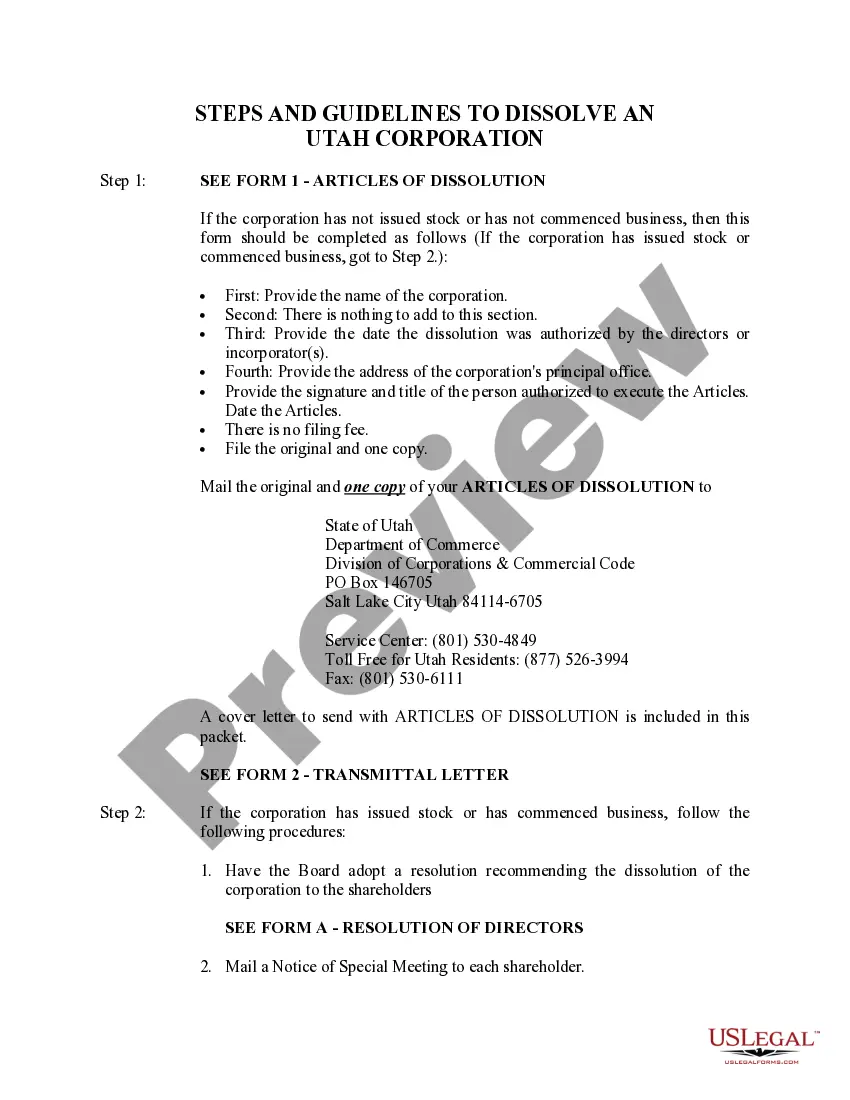

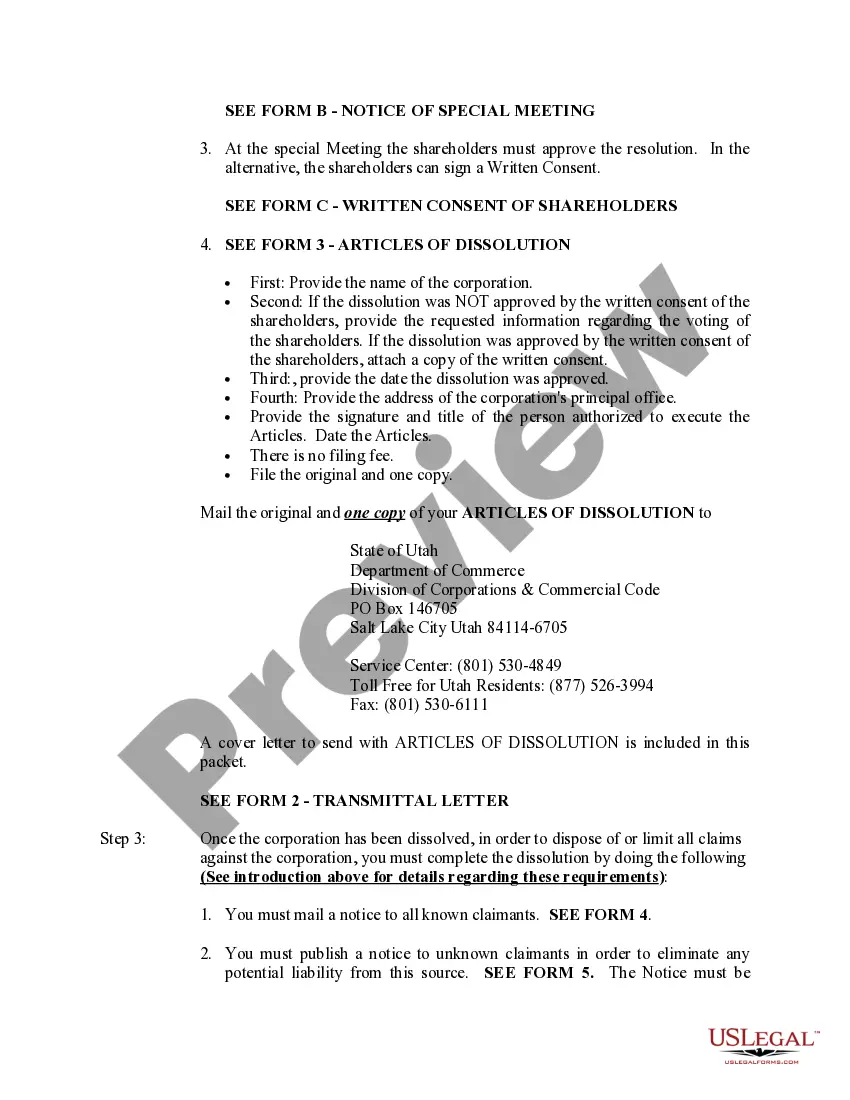

To dissolve a corporation in Utah, begin by obtaining the necessary paperwork known as the Salt Lake Utah Dissolution Package to Dissolve Corporation. This package typically includes forms that need to be completed and filed with the state. After submitting the forms, you will also need to settle any outstanding debts and obligations of the corporation. Utilizing the US Legal Forms platform can simplify this process, offering guidance and resources to ensure everything is handled efficiently.

When you dissolve AC Corp, you effectively cease all business operations and liabilities. The corporation must settle any debts, notify creditors, and distribute remaining assets to shareholders. Additionally, you must file the articles of dissolution with the state, which is where the Salt Lake Utah Dissolution Package to Dissolve Corporation can provide valuable assistance. This package guides you through all necessary steps to ensure a smooth and compliant dissolution process.

To dissolve a corporation in Utah, you need to file the articles of dissolution with the Secretary of State after resolving any outstanding debts. Using our Salt Lake Utah Dissolution Package to Dissolve Corporation, you can navigate this process with clarity and ease. This package offers all the forms and guidance required to ensure that your corporation is dissolved correctly and efficiently.

Dissolving a corporation usually includes several key steps: first, holding a board meeting to decide on dissolution, and then filing articles of dissolution with the state. Our Salt Lake Utah Dissolution Package to Dissolve Corporation outlines each step in detail, making the process easier for you. This comprehensive resource ensures you understand your legal obligations and can complete them promptly.

To obtain articles of dissolution, you typically need to file a specific form with the Utah Secretary of State. With our Salt Lake Utah Dissolution Package to Dissolve Corporation, you gain access to easy-to-follow instructions on how to complete and submit these articles. This package ensures you have everything required to finalize your business termination properly.

Dissolving an LLC can be straightforward if you follow the correct steps. Generally, it involves filing specific documents and settling any outstanding obligations. However, with our Salt Lake Utah Dissolution Package to Dissolve Corporation, you can simplify this process further. We provide clear guidance and resources to ensure you complete the dissolution without unnecessary complications.

Dissolving a corporation does not inherently trigger an audit, but it can draw attention if there are outstanding issues or concerns. To reduce any potential risks, maintain accurate records and ensure all tax obligations are met prior to dissolving. Utilizing the Salt Lake Utah Dissolution Package to Dissolve Corporation can help you manage these concerns effectively.

Dissolving a corporation involves several steps, including obtaining board approval and filing the dissolution paperwork with the state. After filing, you must settle any outstanding debts and distribute remaining assets. Consider the Salt Lake Utah Dissolution Package to Dissolve Corporation for comprehensive solutions that guide you through each phase of the dissolution process.

To notify the IRS of a corporation's dissolution, you must ensure that all tax returns are filed up to the date of dissolution. Additionally, you must mark the final return as a 'final return' on the form. The Salt Lake Utah Dissolution Package to Dissolve Corporation includes resources that guide you through the correct steps to notify the IRS effectively.