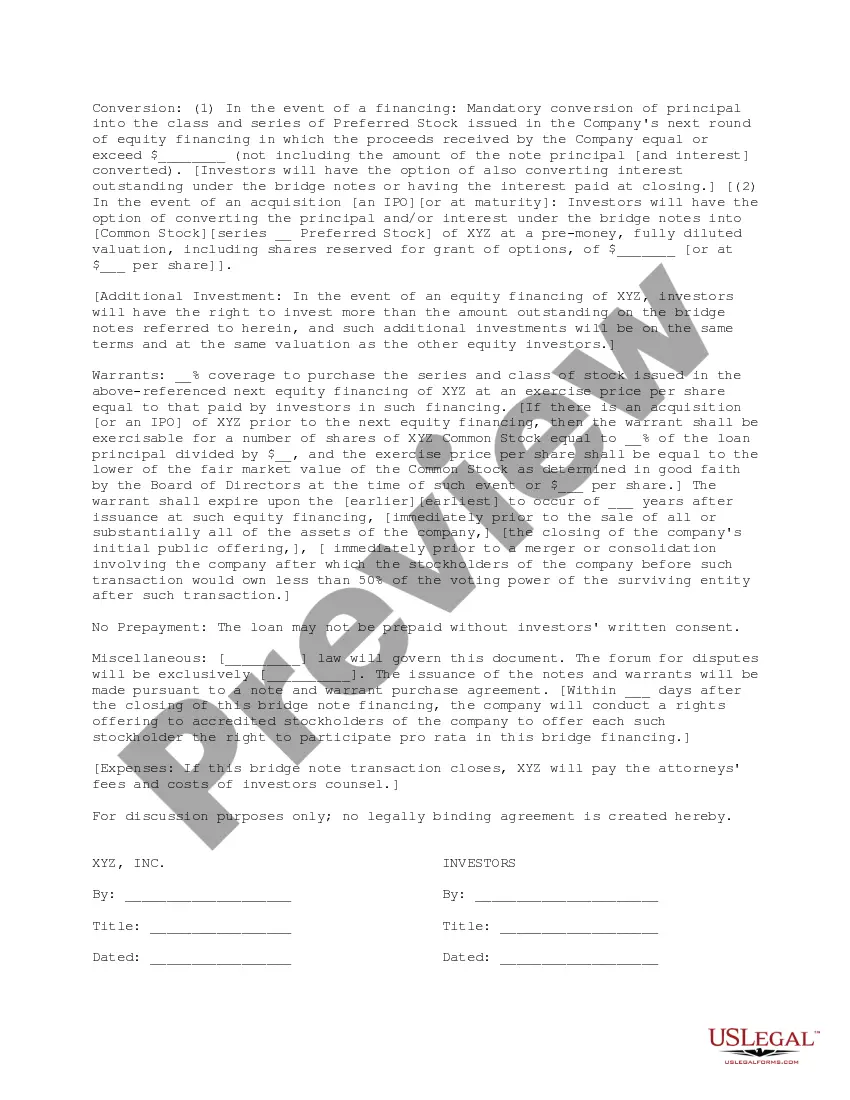

This document is for use in a proposed bridge financing in which the bridge investors are proposing loaning money to the company against delivery of bridge notes and warrants. It includes the kind of note and the conditions for its conversion, as well as the terms of the warrant.

Pima Arizona Term Sheet for Bridge Financing

Description

How to fill out Term Sheet For Bridge Financing?

What is the typical duration for you to prepare a legal document.

Considering every state has its own laws and regulations for various life situations, finding a Pima Term Sheet for Bridge Financing that fulfills all regional criteria can be tiring, and obtaining it from a qualified attorney is frequently expensive.

Several online platforms provide the most sought-after state-specific documents for download, but utilizing the US Legal Forms library proves to be the most beneficial.

Click Buy Now once you are confident in your selected file. Choose the subscription plan that best fits your needs. Register for an account on the platform or Log In to continue to payment methods. Process payment via PayPal or your credit card. Change the file format if desired. Hit Download to save the Pima Term Sheet for Bridge Financing. Print the document or utilize any preferred online editor to fill it out electronically. Regardless of how often you need the purchased template, all the files you’ve ever downloaded can be found in your profile by accessing the My documents tab. Give it a shot!

- US Legal Forms is the most extensive online collection of templates, categorized by states and areas of application.

- Along with the Pima Term Sheet for Bridge Financing, here you can access any specific document to manage your business or personal matters while adhering to your county standards.

- All samples are authenticated by professionals for their validity, ensuring you can prepare your documents correctly.

- Using the service is exceptionally straightforward.

- If you already have an account on the platform and your subscription is active, you only need to Log In, select the required form, and download it.

- You can store the file in your profile whenever needed in the future.

- If you're unfamiliar with the website, additional steps will be necessary before you can acquire your Pima Term Sheet for Bridge Financing.

- Review the content of the page you’re viewing.

- Examine the description of the template or Preview it (if available).

- Search for another document using the related option in the header.

Form popularity

FAQ

Bridge financing normally comes from an investment bank or venture capital firm in the form of a loan or equity investment. Bridge financing is also used for initial public offerings (IPO) or may include an equity-for-capital exchange instead of a loan.

A term sheet is an important document that is part of a tentative business deal. It is a summary of the terms and conditions of the tentative agreement. It is generally formatted as bullet points. It should be as detailed as possible so that the parties involved understand the information and are on the same page.

Term sheet. A term sheet is a sign your loan request is moving forward. It's usually issued after the loan officer and credit officer have reached an accord on proposed terms, and before the full underwriting of the loan request. Commercial bankers use these non-binding documents to achieve a number of goals.

A term sheet is a summary of the main business terms and possible options for a prospective financing. Term sheets are provided by lenders to prospective borrowers prior to a full underwriting of and credit approval by the lender.

Definition: Bridge loan is a type of gap financing arrangement wherein the borrower can get access to short-term loans for meeting short-term liquidity requirements. Description: Bridge loans help in bridging the gap between short-term cash requirements and long-term loans.

A term sheet is a written document that includes the important terms and conditions of a deal. The document summarizes the key points of the agreement set by both parties, before actually executing the legal agreements and starting off with time-consuming due diligence.

Bridge Loans, Defined Bridge loans (also known as swing loans) are typically short-term in nature, lasting on average from 6 months up to 1 year, and are often used in real estate transactions. They can be used as a means through which to finance the purchase of a new home before selling your existing residence.

The funds raised through Commercial Paper can be used for fulfilling seasonal and working capital need. For example, for meeting the floatation cost at the time of issue of shares and debentures i.e. Bridge Financing.

The main difference between the two is that a term sheet is simply a document that lays out the terms that both parties wish to include, and usually neither party will sign the document. The letter of intent, on the other hand, includes those terms but is singed by both parties involved.

Debt Bridge Financing If, for example, a company is already approved for a $500,000 bank loan, but the loan is broken into tranches, with the first tranche set to come in six months, the company may seek a bridge loan.