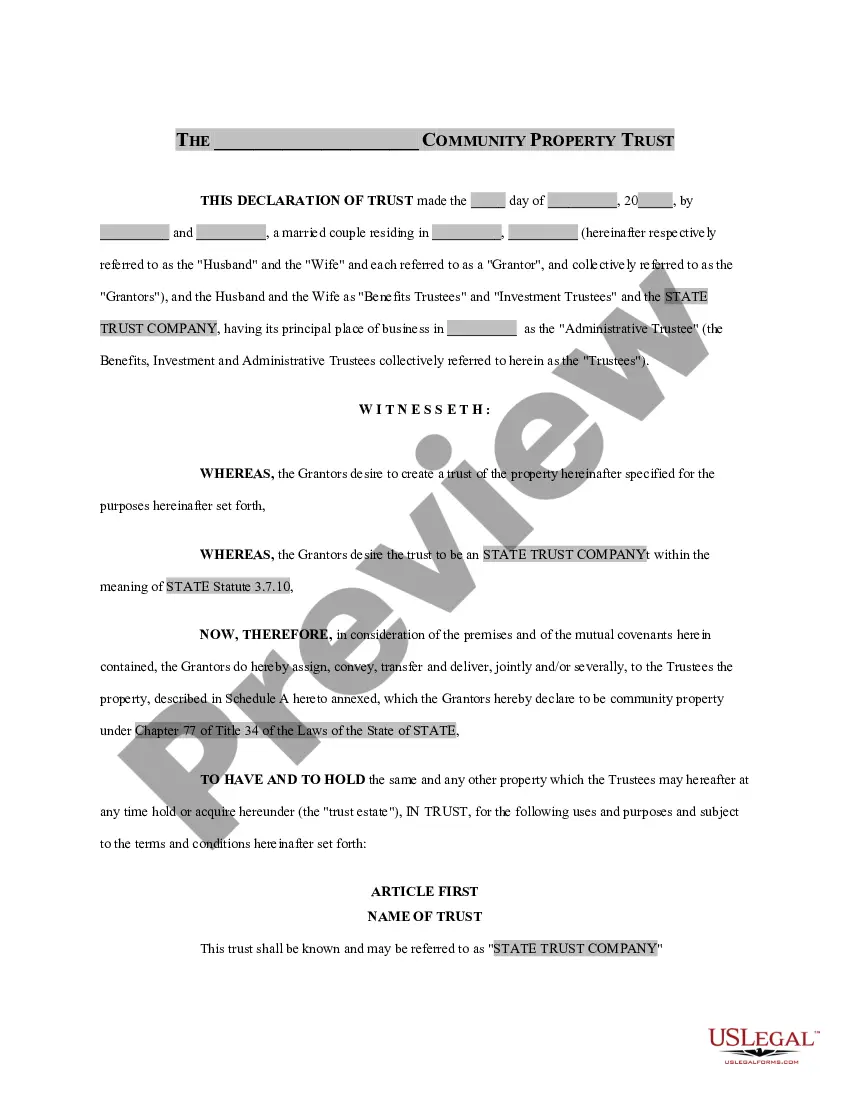

Kansas City Missouri Community Property Trust

Category:

State:

Multi-State

City:

Kansas City

Control #:

US-RE-T-1001-1

Format:

Word;

Rich Text

Instant download

Description

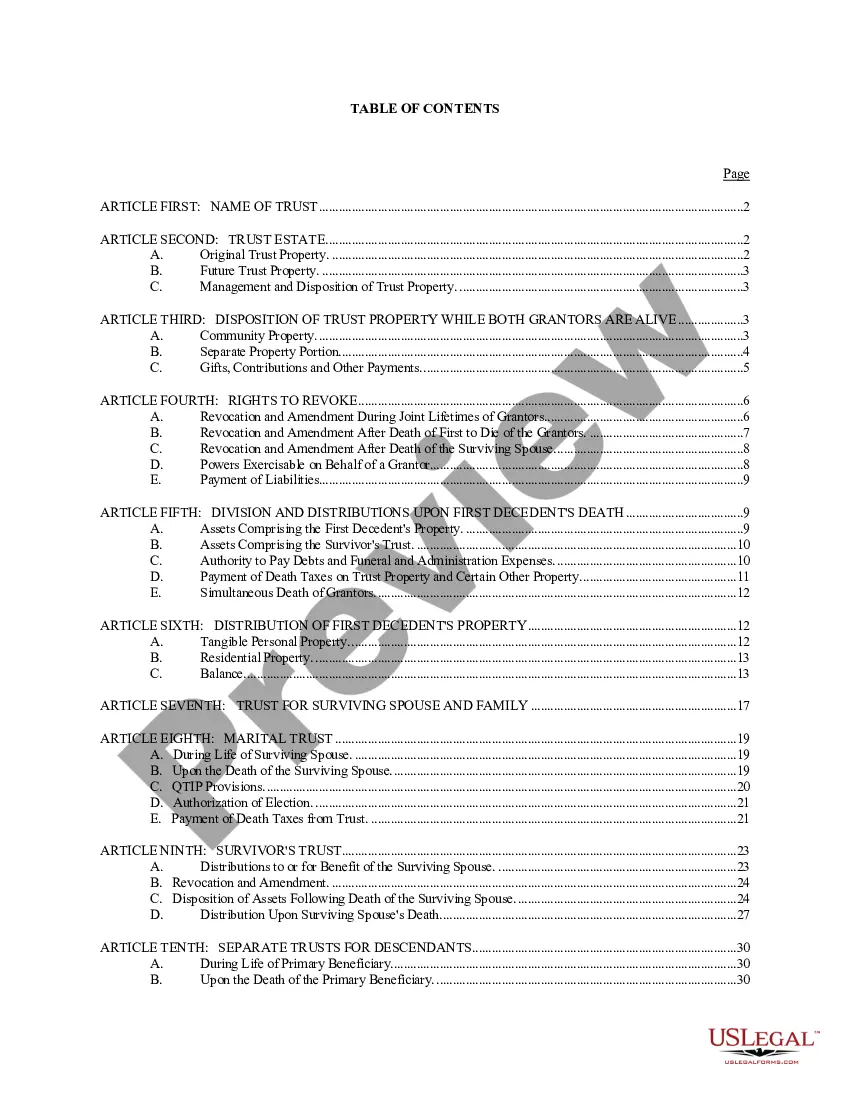

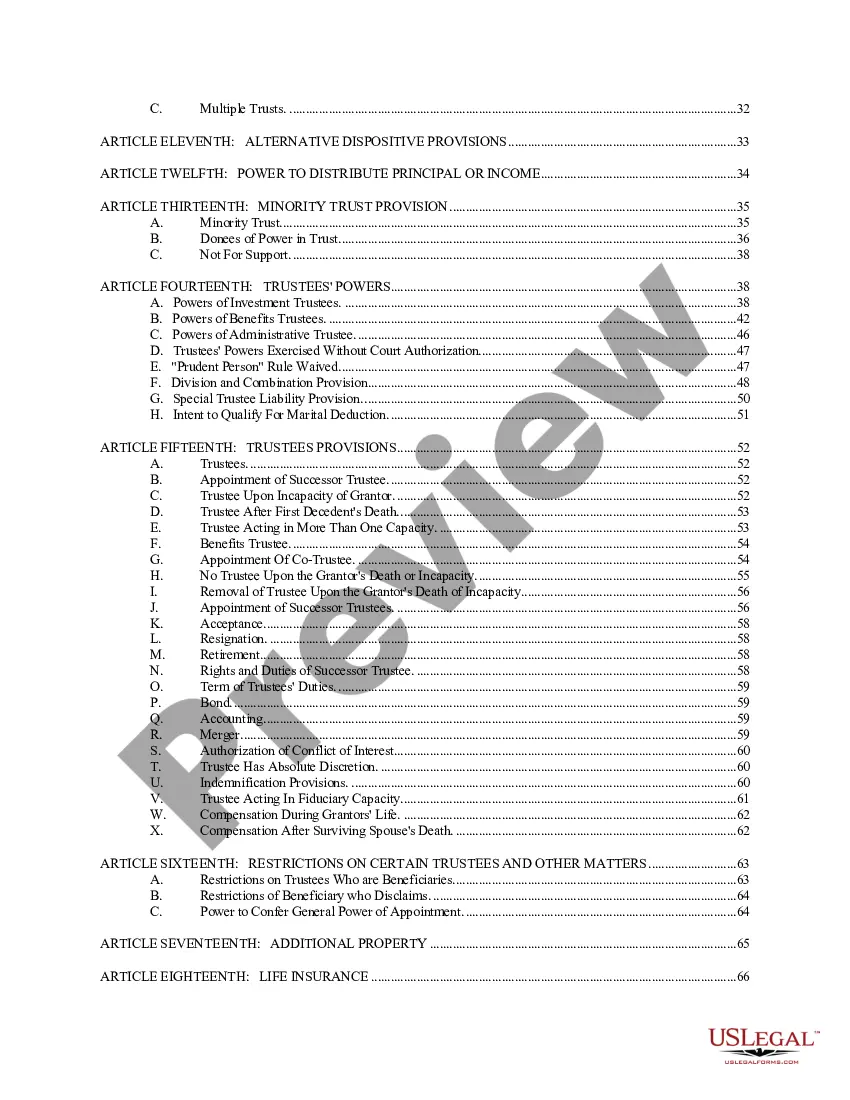

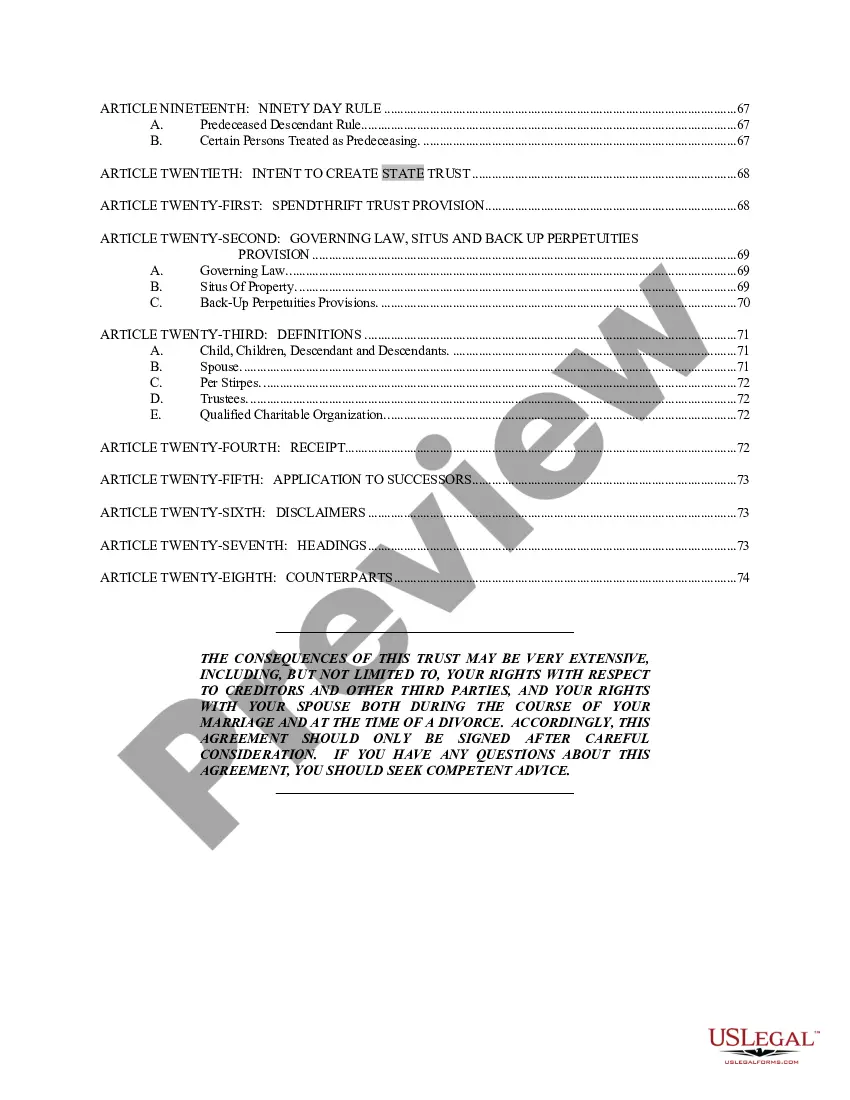

This is a sample Community Trust. Community trusts are joint trusts that are set up by married couples. They allow spouses in non-community property states to enjoy the same benefits as spouses in community property states. This type of trust holds assets that the couple deposits to the trust.

Free preview