Tarrant Texas Letter regarding Collecting Damages in Automobile Accident

Description

How to fill out Tarrant Texas Letter Regarding Collecting Damages In Automobile Accident?

How much time does it usually take you to create a legal document? Because every state has its laws and regulations for every life scenario, finding a Tarrant Letter regarding Collecting Damages in Automobile Accident meeting all regional requirements can be stressful, and ordering it from a professional attorney is often costly. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, collected by states and areas of use. In addition to the Tarrant Letter regarding Collecting Damages in Automobile Accident, here you can find any specific document to run your business or individual deeds, complying with your county requirements. Specialists check all samples for their validity, so you can be sure to prepare your documentation correctly.

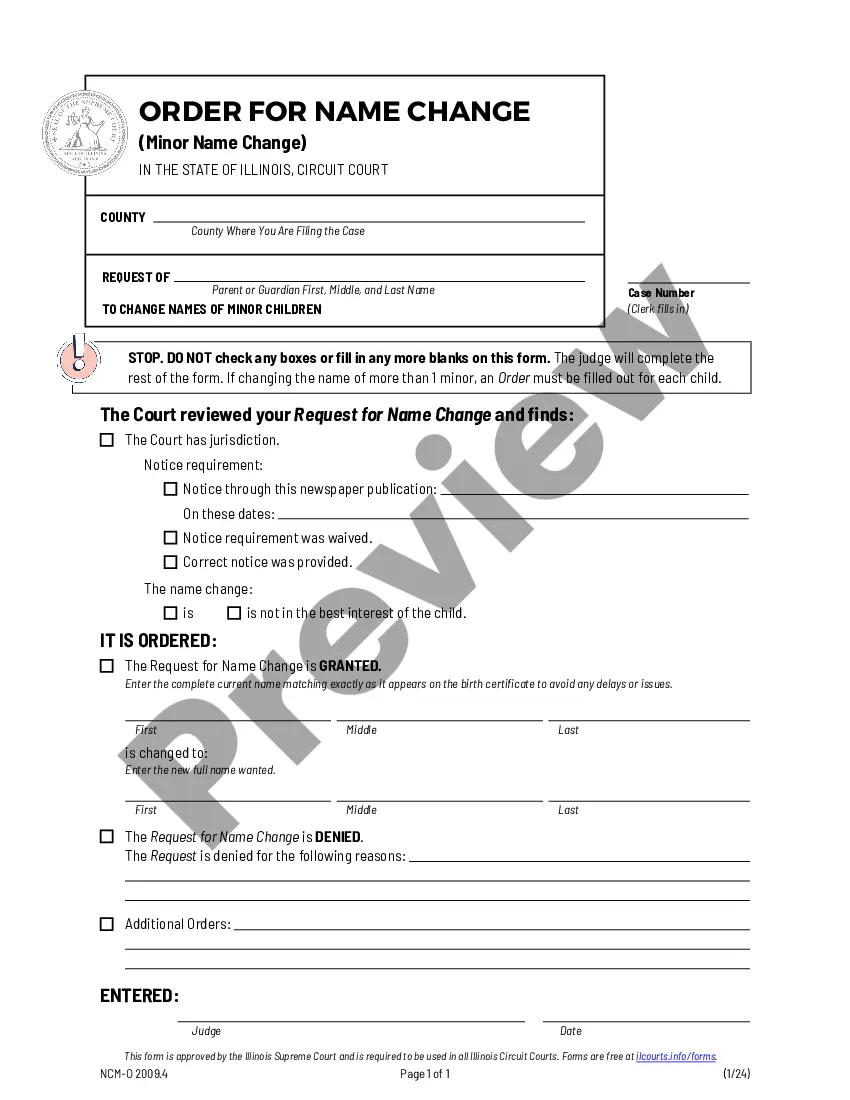

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can get the file in your profile at any time later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Tarrant Letter regarding Collecting Damages in Automobile Accident:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Tarrant Letter regarding Collecting Damages in Automobile Accident.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

7 Tips for Writing a Demand Letter To the Insurance Company Organize your expenses.Establish the facts.Share your perspective.Detail your road to recovery.Acknowledge and emphasize your pain and suffering.Request a reasonable settlement amount.Review your letter and send it!

A demand letter to an insurance company must contain; A clear description of the physical facts of the case. The right way to do that is to answer the 5 W's; Who, What, When, Where and Why? Details on what your injuries were and are. An explanation on why the other person is legally responsible for your injuries.

Here are a few tips on how to write a professional demand letter that your opponent will take seriously: Type your letter.Be polite.Keep it short, but not too short.Review the facts.Ask for what you want, but be reasonable.Set a deadline.Keep copies.Use certified mail.

Emphasize your pain, the length and difficulty of your recovery, the negative effects of your injuries on your daily life (such as "pain and suffering"), and any long-term or permanent injuryespecially if it is disabling or disfiguring, such as permanent stiffness, soreness, or scarring.

The purpose of this article is to help you maximize the effectiveness of your demand letter. Request Your Medical Records.Document Your injury.Establish the Extent of Property Damage.Document Your Expenses.Be Organized.Do Not Exaggerate and Do Not Be Greedy.Calculating "Pain and Suffering"Seek Professional Legal Advice.

Settlement letters should summarize the purpose of the claim and communicate to the insurance company a fair value for the claim. Insurance companies generally try to settle claims for as little money as possible, making it difficult to reach a satisfactory outcome.

7 Tips for Writing a Demand Letter To the Insurance Company Organize your expenses.Establish the facts.Share your perspective.Detail your road to recovery.Acknowledge and emphasize your pain and suffering.Request a reasonable settlement amount.Review your letter and send it!

Here are ten strategies for writing a settlement demand letter: Stay Focused.Do Not Threaten.Make Your Case Stand Out.Understand Policy Limits Before Writing.Support Your Claim.Include All of Your Damages.Do Not Make a Specific Demand.Do Not Offer a Recorded Statement.

Your demand letter should include: Statement of Facts: What happened before, during, and after you were injured. Liability: Why the evidence proves the store was at fault. Injuries: Describe your injuries and how they affected your life. Damages: A list of the dollar amounts of your damages.