Queens New York Clauses Relating to Powers of Venture

Description

How to fill out Clauses Relating To Powers Of Venture?

Legislation and guidelines in every domain vary across the nation.

If you're not a lawyer, it's simple to become confused by the myriad of standards when it comes to creating legal documents.

To evade expensive legal help while preparing the Queens Clauses Relating to Powers of Venture, you require an authenticated template valid for your locality.

That's the easiest and most economical way to obtain current templates for any legal purposes. Find them all with a few clicks and keep your documents organized with US Legal Forms!

- That's when utilizing the US Legal Forms platform becomes so beneficial.

- US Legal Forms is a reliable online repository of over 85,000 state-specific legal forms.

- It's an ideal solution for professionals and individuals seeking DIY templates for various life and business circumstances.

- All the documents can be reused multiple times: once you buy a sample, it stays accessible in your account for future use.

- Thus, if you possess an account with an active subscription, you can effortlessly Log In and re-download the Queens Clauses Relating to Powers of Venture from the My documents section.

- For newcomers, it’s important to follow a few additional steps to acquire the Queens Clauses Relating to Powers of Venture.

- Review the page content to confirm you have located the correct template.

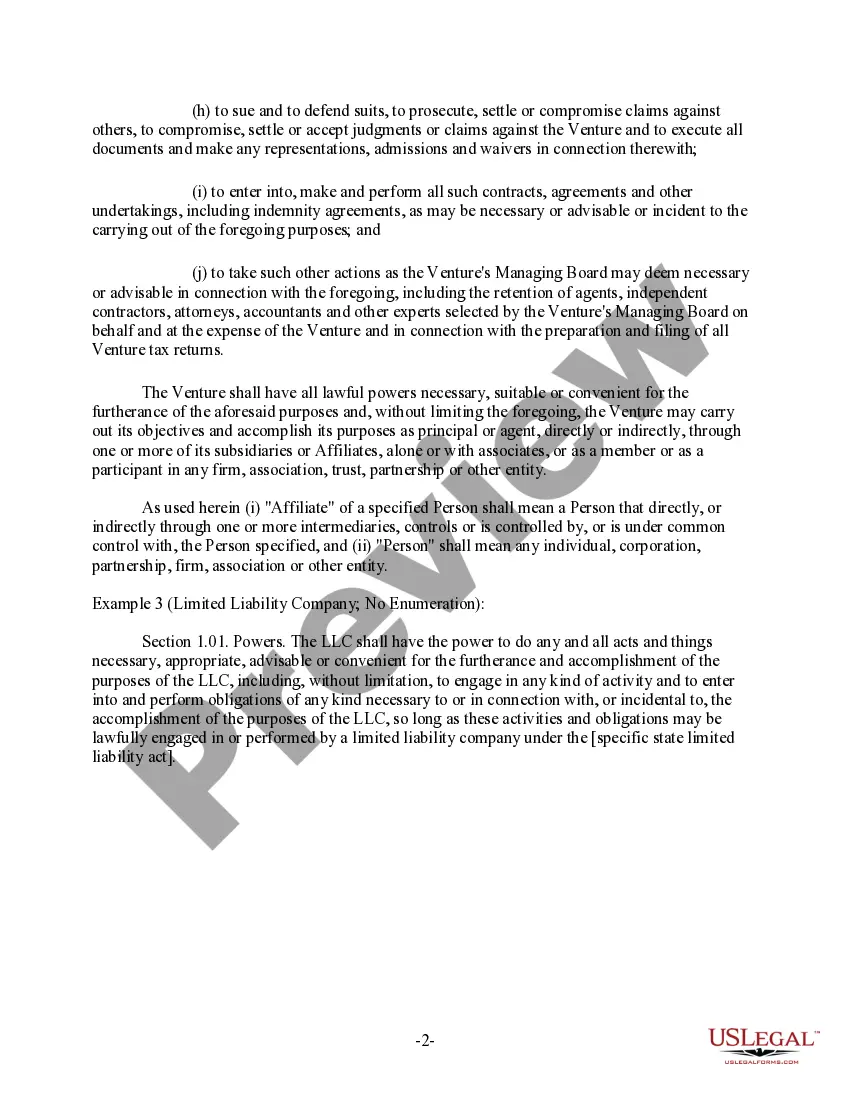

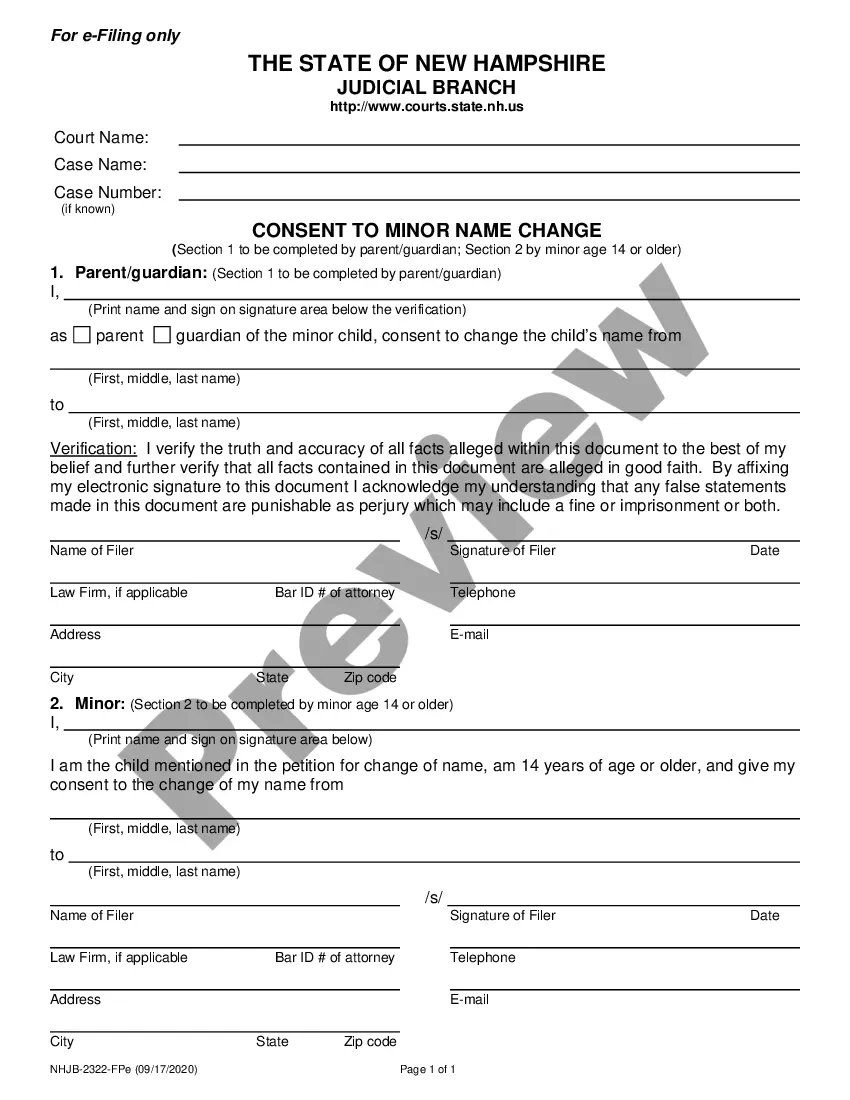

- Utilize the Preview feature or read the form description if available.

Form popularity

FAQ

Investor Rights Agreement (IRA) Right of First Refusal / Co-Sale Agreement. Certificate of Incorporation. Venture Capital Financing Documents on AngelList.

The start-ups have lack of funding. Money is invested by buying equity shares in the start-up company. Investments are generally done in innovative projects like in the fields of technology and biotechnology. Supplier of venture capital participate in the management of the company.

5 Criteria to Identify the Right Venture Capitalists for You Name and Reputation of the Venture Capitalists.Development Phase of the Company.Industry Sector of Firm and Venture Capitalists.Required Financing Volume.Location of the Venture Capitalists.

How Should I Approach a VC I Don't Know? Do2026 Research the VC, his/her firm and their investments.Do2026 Reach out to the VC in a way that makes it easy for a VC to respond to your approach.Do2026Do2026Do2026Do2026Don't2026Don't2026 Name drop, try to create a false sense of urgency, or raise a lot of hype unless you can back it up.

Eight Steps To Create An Entrepreneurial Roadmap For Your Venture Step 1: Outline your main goal.Step 2: Outline your values.Step 3: Build a product concept that works.Step 4: Find a market that appreciates your product.Step 5: Map your networks.Step 6: Outline key indicators of performance.

5 Key Components To Help Your Business Attract Venture Capital Investors Unique Idea.Show Experience.Build a Strong, Dependable Team.Growth Potential.Defensible Business Model.

Venture Capital Legal Documents: Everything You Need to Know Different Documents in Venture Capital. Agreements. Stock purchase agreement. Voting agreement. Right of first refusal/co-sale agreement. Investors' rights agreement. Subscription agreement. Other Documents.

The final way to meet venture capitalists is via email. Many VCs still list their email addresses on their websites....So, below I've included the six best places to meet VCs. Meet Them on Their Blog.Meet Them on Twitter.Meet Them on LinkedIn.Meet them at Industry Events.Meet them at Local Events.

To identify a suitable VC, you have to make up your mind about five main selection criteria. Name and Reputation of the Venture Capitalists.Development Phase of the Company.Industry Sector of Firm and Venture Capitalists.Required Financing Volume.Location of the Venture Capitalists.

What is the most important thing that a venture capitalist is looking for in a company to invest in. the most important aspect for venture capitalists are people. The purpose of a pit is convincing the VC that you are the person tp invest in.