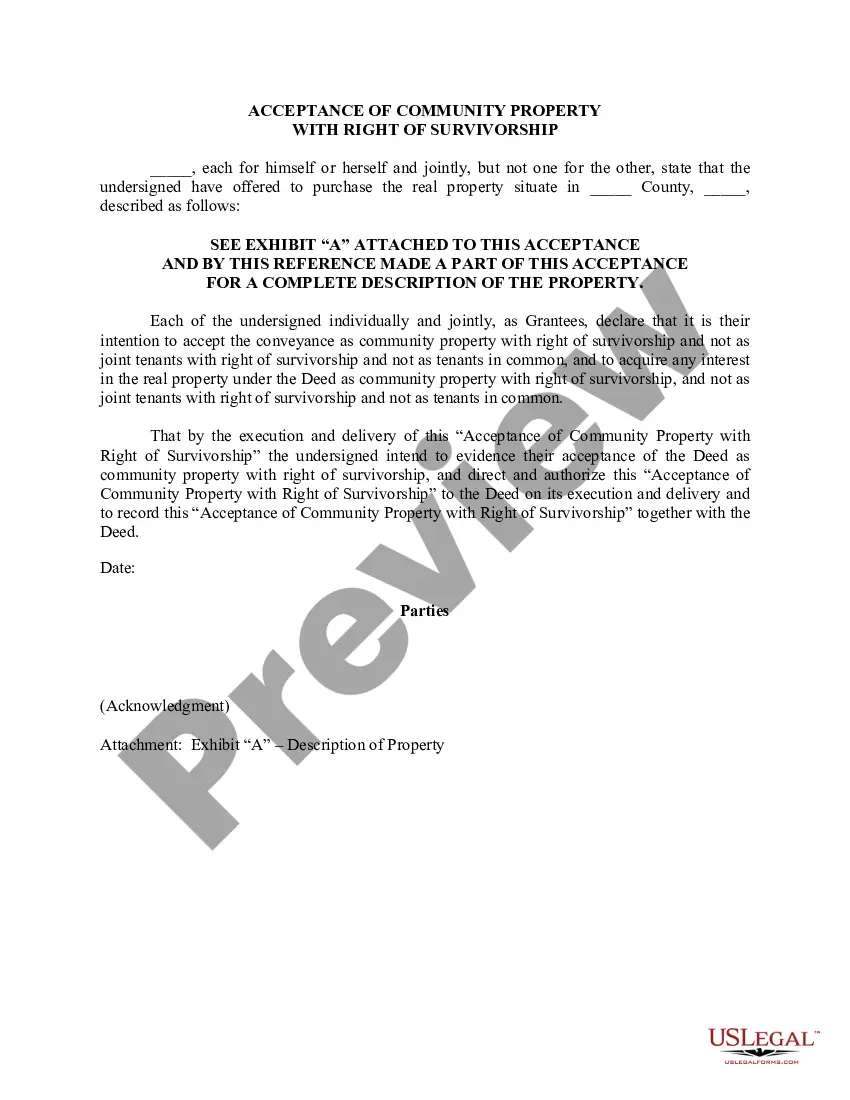

The Clark Nevada Deed (Including Acceptance of Community Property with Right of Survivorship) is a legal document used in Clark County, Nevada, to transfer ownership of real estate property while specifically acknowledging community property rights and the right of survivorship. This type of deed is commonly used by married or domestic partners who wish to hold property jointly and ensure that the surviving spouse or partner automatically inherits the property upon the death of the other. The acceptance of community property with right of survivorship is a crucial element of this deed. Under Nevada's community property laws, property acquired during a marriage or domestic partnership is generally considered community property and is owned equally by both parties. By choosing this deed, individuals acknowledge that the property being transferred is community property and that both partners have equal ownership rights. Furthermore, the right of survivorship ensures that if one partner passes away, the surviving partner automatically becomes the sole owner of the property without the need for probate. There are different types of Clark Nevada Deed (Including Acceptance of Community Property with Right of Survivorship) based on the specific needs of the parties involved: 1. General Warranty Deed with Right of Survivorship: This deed provides the highest level of protection to the buyer, as the granter guarantees the title against any past claims or legal issues. In addition, the right of survivorship ensures that the surviving partner inherits the property automatically. 2. Special Warranty Deed with Right of Survivorship: This deed guarantees that the granter has not caused any major title problems during their ownership of the property. However, it does not provide protection against previous title issues like a General Warranty Deed. The right of survivorship still applies. 3. Quitclaim Deed with Right of Survivorship: This deed transfers the granter's interest in the property without making any guarantees about the title's validity. It is often used in situations where the granter is not willing to take responsibility for any potential title issues. The right of survivorship remains intact. 4. Grant Deed with Right of Survivorship: This type of deed transfers the granter's interest in the property to the grantee without any warranties or guarantees. It offers a certain level of protection to the grantee against title defects arising from the granter's actions. The grantee will inherit the right of survivorship. In conclusion, the Clark Nevada Deed (Including Acceptance of Community Property with Right of Survivorship) is a legal tool used to facilitate the transfer of real estate property while acknowledging community property rights and ensuring the right of survivorship. Depending on the level of protection desired, individuals can choose from various types of deeds. It is recommended to seek legal advice when selecting the appropriate deed to ensure compliance with Nevada laws and protect the rights and interests of all parties involved.

Clark Nevada Deed (Including Acceptance of Community Property with Right of Survivorship)

Description

How to fill out Clark Nevada Deed (Including Acceptance Of Community Property With Right Of Survivorship)?

Are you looking to quickly draft a legally-binding Clark Deed (Including Acceptance of Community Property with Right of Survivorship) or probably any other document to take control of your own or corporate affairs? You can go with two options: hire a professional to write a valid paper for you or create it entirely on your own. Luckily, there's a third option - US Legal Forms. It will help you receive neatly written legal paperwork without paying sky-high fees for legal services.

US Legal Forms provides a huge collection of more than 85,000 state-specific document templates, including Clark Deed (Including Acceptance of Community Property with Right of Survivorship) and form packages. We provide templates for an array of use cases: from divorce papers to real estate documents. We've been out there for more than 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and get the necessary template without extra troubles.

- First and foremost, double-check if the Clark Deed (Including Acceptance of Community Property with Right of Survivorship) is adapted to your state's or county's regulations.

- In case the document comes with a desciption, make sure to verify what it's intended for.

- Start the searching process again if the form isn’t what you were hoping to find by utilizing the search box in the header.

- Select the plan that best suits your needs and move forward to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Clark Deed (Including Acceptance of Community Property with Right of Survivorship) template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Moreover, the templates we offer are reviewed by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

California is a community property state, which means that following the death of a spouse, the surviving spouse will have entitlement to one-half of the community property (i.e., property that was acquired over the course of the marriage, regardless of which spouse acquired it).

Community property with right of survivorship is a legal distinction that allows two spouses to equally share assets through marriage as well as pass on assets to the other spouse upon death without going through probate.

With community property, the step-up basis applies to the whole property; with joint tenancy, only the deceased tenant's half receives the step-up basis. This can have serious tax implications if and when the surviving tenant sells the property. Whether you want protection from creditors.

The main difference between joint tenants vs community property with right of survivorship lies in how the property is taxed after the death of a spouse. In joint tenant agreements, the proceeds from the sale of a property (after the death of a spouse) would be subject to the capital gains tax.

Community Property with Right of Survivorship is an estate planning tool that attempts to avoid probate issues by automatically transferring the deceased spouse's one-half interest in the property to the surviving spouse. This is similar to Joint Tenancy with Right of Survivorship. A.R.S.

Any joint tenant may sever the joint tenancy at any time by recording a deed.

In Nevada, each owner, called a joint tenant, must own an equal share. Community property with right of survivorship. Nevada is a community property state, which means that spouses generally own all property acquired during the marriage jointly unless they take steps to keep it separate.

Many couples own homes as joint tenants with right of survivorship, perhaps because community property with right of survivorship did not become an official option in California until July 1, 2001. To change the title, you must record a new California grant deed or quitclaim deed at your county recorder's office.

Community property with Right of Survivorship is a relatively new form of owning real property, and was created by the California legislature in 2001. It combines the security of owning property as joint tenants with the tax benefits offered by California's community property system.

Interesting Questions

More info

Passed legislation on October 7, 2011. The act will reduce the tax on the death of a nonresident widow at a rate up to 50 percent. A nonresident widow dies when she remarries and no state is the surviving spouse. The exemption is phased out for a widow in states that exempt the widow because her domicile was the same in the US as at her death. The bill also provides a child care credit if the dead person's dependent child is enrolled in childcare benefits or child care assistance program. The bill will provide a tax credit of up to 900 for expenses incurred for adoption of a disabled dog or cat. The deceased person's spouse's share of the estate is taxed at a 40 percent rate. The legislation also allows the spouse to nominate the same person to file as a beneficiary under the gift tax, allowing the other spouse the deceased's death deduction and tax rate deduction.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.