Clark Nevada Amendment to Unit Designation to include Additional Lands and Leases in A Unit

Description

How to fill out Clark Nevada Amendment To Unit Designation To Include Additional Lands And Leases In A Unit?

How much time does it typically take you to create a legal document? Because every state has its laws and regulations for every life scenario, finding a Clark Amendment to Unit Designation to include Additional Lands and Leases in A Unit suiting all local requirements can be tiring, and ordering it from a professional attorney is often expensive. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. Aside from the Clark Amendment to Unit Designation to include Additional Lands and Leases in A Unit, here you can get any specific form to run your business or individual deeds, complying with your regional requirements. Professionals check all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can pick the file in your profile at any time in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Clark Amendment to Unit Designation to include Additional Lands and Leases in A Unit:

- Examine the content of the page you’re on.

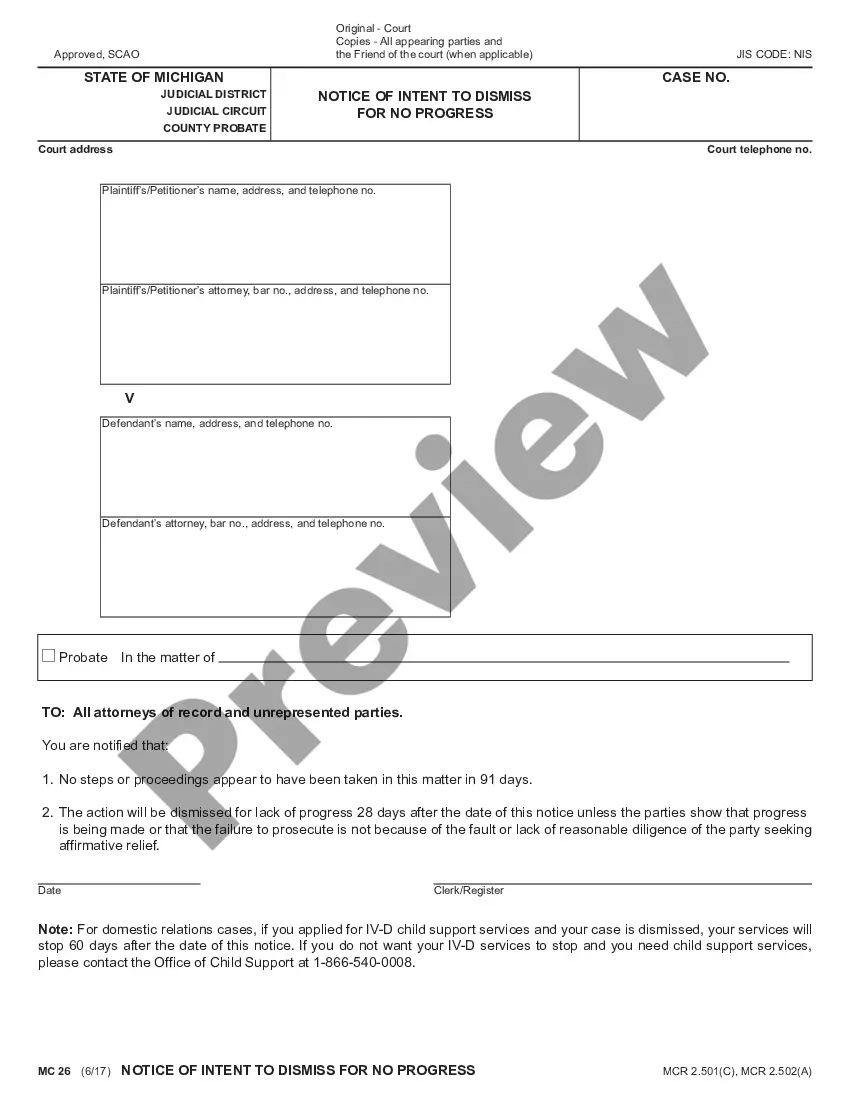

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Clark Amendment to Unit Designation to include Additional Lands and Leases in A Unit.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

No. A-11508. Supreme Court of Texas. March 22, 1967.

A state Free Royalty interest is similar to a non-participating royalty interest. An oil, gas, or other mineral lease on land in which the state reserves a mineral or royalty interest is not effective until a certified copy of the recorded lease is filed in the General Land Office.

Previous to the act, these materials were subject to mining claims under the General Mining Act of 1872....Mineral Leasing Act of 1920. Enacted bythe 66th United States CongressEffectiveFebruary 25, 1920CitationsPublic lawPub.L. 66146Statutes at Large41 Stat. 4379 more rows

In 1919 the Legislature passed what has become known as the Relinquishment Act of 1919. It purported to relinquish to the owners of the land, the State's oil and gas rights in the land, retaining a 1/16th royalty interest for the State.

The Mineral Leasing Act of 1920 (MLA) regulates the leasing of public lands for the development of several mineral resources, including coal, oil, natural gas, other hydrocarbons, and other minerals.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

A state Free Royalty interest is similar to a non-participating royalty interest. An oil, gas, or other mineral lease on land in which the state reserves a mineral or royalty interest is not effective until a certified copy of the recorded lease is filed in the General Land Office.

HISTORY. Enacted in 1919, the Relinquishment Act, as interpreted by the Courts, reserves all minerals to the State in those lands sold with a mineral classification between September 1, 1895 and June 29, 1931.

Any land on which the state retained the minerals after 1876 was called mineral classified land. Most of this land is located in the Trans-Pecos Region. As interest in development of oil and gas grew, the state began leasing more and more of the retained mineral acreage (mineral classified land) to oil companies.

Simply stated, a retained acreage clause is a clause in an oil and gas lease that sets out how much acreage a lessee may retain for each well it drills on the leased premises after the balance of the lease automatically terminates.